- Unhashed Newsletter

- Posts

- Solana’s $200 fight gets messy

Solana’s $200 fight gets messy

Reading time: 5 minutes

Solana nears $200 again as bulls and bears clash over Upexi accumulation, Ozzy scams, and network fears

Key points:

SOL hovered around $198.33 after Upexi expanded its holdings to 1.8M SOL, while a popular analyst forecasted a surge to $500.

But concerns remain amid Ozzy Osbourne–themed rug-pulls and structural warnings that Solana may face a LUNA-style breakdown.

News - Solana (SOL) saw heightened volatility after a wave of conflicting developments tested investor conviction in the sixth-largest cryptocurrency. The token traded around $198 at press time, following a weeklong rally of over 20%.

Consumer brand firm Upexi Inc. announced it had raised $200 million to increase its SOL treasury to 1.8 million tokens, now worth more than $330 million. The firm expects up to $26 million in annual staking rewards and introduced a new valuation metric, “Basic mNAV,” positioning itself as a novel public market vehicle for altcoin exposure.

At the same time, crypto analyst "Christiaan" predicted SOL could reach $400–$500 in this bull cycle, citing bullish momentum and institutional interest. Meanwhile, another analyst, Gert van Lagen, issued a stark warning: Solana’s weakening structure versus major competitors like BTC and ETH mirrors early LUNA collapse patterns. He flagged multi-asset bearish divergences and high-timeframe breakdowns across key pairs.

Rug-pulls, upgrades, and a cultural storm - Adding to the drama, Ozzy Osbourne’s death triggered at least 15 Solana-based scam tokens. Rug-pulls drained up to $345,000 from liquidity pools within hours, underscoring memecoin culture’s dark side.

Still, structural upgrades are underway. As part of Epoch 821, Solana is increasing its block size by 20%, potentially boosting throughput beyond 60,000 TPS. However, long-standing concerns about network reliability and past outages continue to cloud investor confidence.

Conflicting signals create a tense standoff - Between bullish corporate accumulation, bearish macro-technical forecasts, and opportunistic scams, Solana is facing both its strongest tailwinds and fiercest scrutiny this year. Whether it breaks out or breaks down may come down to how well it sustains momentum above the $200 mark.

Ethereum’s institutional wave: Supply squeeze, sky-high bets, and $8K forecasts

Key points:

Ethereum ETF inflows surpassed $4B in 13 days, while public firms like Skycorp and Ether Machine are ramping up ETH treasury buys.

Bitwise projects a $10B supply-demand shock with ETH demand outpacing issuance by 7x, as analysts eye a surge toward $8,000.

News - Ethereum is entering a new era of institutional acceleration. Spot Ether ETFs pulled in $533 million in a single day this week, pushing the 13-day inflow streak above $4 billion. BlackRock’s ETHA led the charge with $426 million, followed by Fidelity’s FETH. Cumulatively, Ethereum ETFs have attracted over $8.3 billion, accounting for 4.4% of ETH’s market cap.

At the same time, public companies are going all-in. Chinese solar firm Skycorp announced ETH purchases as part of its treasury plan, triggering an 8.39% stock surge. BitMine and SharpLink now collectively hold over 700,000 ETH, while The Ether Machine plans to go public with 400,000 ETH and $1.5 billion in capital.

The demand shock is real - Bitwise CIO Matthew Hougan called this surge a “demand shock.” Since mid-May, ETPs and corporate treasuries have acquired 2.83 million ETH, which is 32 times more than what was newly issued. Hougan expects this could double to 5.33 million ETH over the next year, while Ethereum is projected to mint just 800,000 tokens.

Lookonchain also flagged a $285 million ETH withdrawal from Kraken this week, reinforcing the supply crunch narrative.

Ethereum outpaces Bitcoin - According to CryptoQuant and Derive analysts, Ethereum has outperformed Bitcoin with a 67% gain over the past month versus BTC’s 18%. The inflow gap between BTC and ETH ETFs has narrowed from 45x in April to just 1.6x now.

With institutional interest rising and U.S. regulatory clarity from the GENIUS Act supporting adoption, analysts now say Ethereum crossing $8,000 by Christmas is not far-fetched.

XRP bulls aim for $10 as legal wins and ETF flows ignite price frenzy

Key points:

XRP recently hit $3.66, and analysts now project a potential rally to $6, $8, or even $10 depending on market momentum.

Despite short-term consolidation and a breached uptrend, ETF inflows, legal clarity, and dominance signals point to long-term upside.

News - XRP is consolidating after a sharp rally to $3.66, with multiple analysts projecting ambitious price targets between $6 and $10. A mix of technical patterns, renewed institutional inflows, and regulatory clarity are fueling long-term optimism despite short-term price wobbles.

On the charts, XRP has entered a bull pennant formation, with technical breakouts targeting $4.20 initially. Analysts like Mikybull Crypto and Dom project potential extensions to $5.32, $8, or even $10 based on Fibonacci levels and dominance index signals. However, some caution persists, with XRP's July uptrend line recently breached and increased Bollinger Band spread hinting at possible near-term volatility.

Volume remains elevated, driven by the ProShares Ultra XRP ETF launch and ongoing inflows amid U.S. crypto regulatory advancements. While XRP briefly dipped below key $3.50 support, institutional buyers and ETF momentum remain strong, keeping bullish targets intact.

XRP market cap climbs past giants - XRP is now the third-largest cryptocurrency by market cap, recently overtaking PepsiCo, BlackRock, and Uber. It is on the verge of surpassing McDonald’s, needing just a 5% price gain to do so. XRP’s market capitalization, while technically different from equities, is being closely tracked by both crypto traders and traditional investors amid its rising relevance.

What to watch - Despite recent consolidation between $3.35 and $3.65, analysts view the $3.50 zone as a pivot. A breakout above $3.65 could trigger another leg up, while a sustained drop below $3.35 may invite deeper corrections. The path to $6 and beyond likely depends on XRP dominance breaking its long-standing 5.5% resistance and broader market tailwinds staying supportive.

ETF chaos: SEC halts Bitwise approval, ONDO makes surprise bid

Key points:

The SEC approved Bitwise’s 10 Crypto Index ETF, then reversed course within hours, triggering confusion and backlash.

21Shares filed for a spot Ondo ETF, marking the first such application for a non-layer-1 ERC-20 token.

News - A regulatory rollercoaster shook the ETF world this week after the SEC granted and then swiftly stayed Bitwise’s request to convert its 10 Crypto Index Fund into an ETF. While the approval was initially granted under delegated authority, it was immediately frozen pending a full Commission review. This unexpected move echoes a similar pause for Grayscale’s GDLC ETF earlier this month.

Bloomberg ETF analyst Eric Balchunas and ETF Institute co-founder Nate Geraci both called it a “bizarre situation,” pointing to growing tension between SEC staff recommendations and final Commission decisions. With no public timeline or explanation required under Rule 431, the ETF now sits in limbo, joining a growing list of crypto funds facing approval bottlenecks despite procedural green lights.

Meanwhile, 21Shares is making its own headlines. The firm filed for a spot ETF tied to ONDO, the native token of Ondo Finance: a DeFi platform focused on real-world asset tokenization. The proposed ETF would passively track ONDO’s price without leveraging or speculative tools, using Coinbase Custody and the CME CF Ondo Finance-Dollar Reference Rate.

Institutional RWA surge fuels ONDO optimism - The ONDO ETF filing is notable not just for its novelty, but for what it represents: growing institutional interest in tokenized real-world assets. ONDO’s market cap surged to $3.5 billion in July, with the token outperforming broader crypto benchmarks.

The filing comes on the heels of Ondo’s acquisition of broker-dealer Oasis Pro and its February launch of Ondo Chain, a Layer-1 blockchain designed for institutional-grade asset tokenization. Notably, the Trump-affiliated World Liberty Financial holds $383K in ONDO, though this accounts for only 0.2% of its $208M portfolio.

Crypto ETFs at a crossroads - As ETF applications pile up, with issuers like 21Shares also eyeing DOT, SUI, and XRP, the SEC’s inconsistent signals have stirred concern. Whether Bitwise’s reversal delays broader approval momentum or pushes the agency toward clearer listing standards remains to be seen.

More stories from the crypto ecosystem

Michael Saylor’s Strategy IPO could raise $500M for Bitcoin – Here’s how

Kaspa [KAS] soars 13% – But THIS resistance zone signals caution!

Bitcoin faces profit-taking, but 4 reasons why BTC’s rally isn’t over yet!

XRP prices consolidate – Will $260M in shorts spark a reversal?

BNB transactions hit 3-month high: Can rising utility fuel prices?

Did you know?

Pakistan launched a government-backed Crypto Council this year - Pakistan’s Crypto Council (PCC) was officially established in March 2025, with Binance co-founder CZ as strategic adviser, and oversees a market of ~40 million crypto users and $300 billion in annual trading volume.

Over 560 million people (≈3.9% of world population) use blockchain - By mid-2025, more than 560 million global blockchain users were counted, equating to nearly 1 in 25 people worldwide.

U.S. established a Strategic Bitcoin Reserve with ~200,000 BTC - Under a March 2025 executive order, the U.S. Treasury consolidated ~200,000 BTC (forfeited assets) into a national “Strategic Bitcoin Reserve” stored off-market, marking a historic shift toward sovereign digital-asset holdings .

Top 3 coins of the day

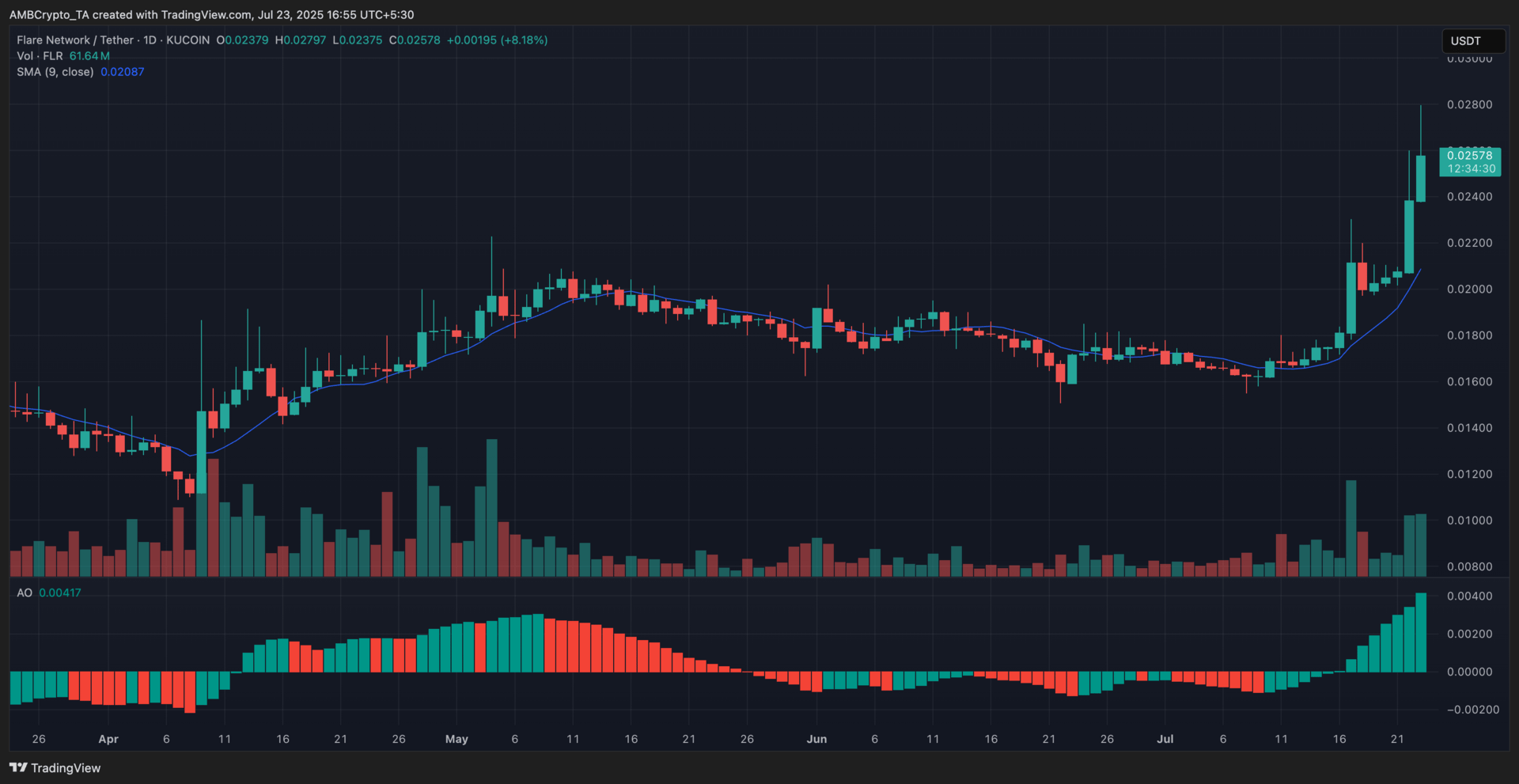

Flare (FLR)

Key points:

At press time, FLR exchanged hands at $0.025 after climbing 8.18% from its earlier daily close.

The 9-day SMA held firmly below the candles, while the Awesome Oscillator printed another consecutive green bar, signaling strong bullish momentum.

What you should know:

Flare experienced a sharp rally in recent sessions, with price climbing above the $0.024 level amid a surge in trading volume that reached 61.64 million. This bullish momentum coincided with Flare’s newly launched 2.2 billion FLR incentive program, aimed at expanding cross-chain DeFi activity by rewarding users for minting FAssets like FXRP. The program has accelerated adoption within the XRPFi ecosystem and driven fresh demand for FLR as collateral. Technically, the 9-day SMA held a steep upward trajectory and remained well below the candles, reinforcing short-term support. The Awesome Oscillator extended its bullish streak with its consecutive green bars and increasing amplitude, highlighting rising positive momentum. With momentum intact and volume trends supportive, FLR now approaches the $0.030 resistance level, with potential support seen at the $0.022–$0.023 zone on any pullback.

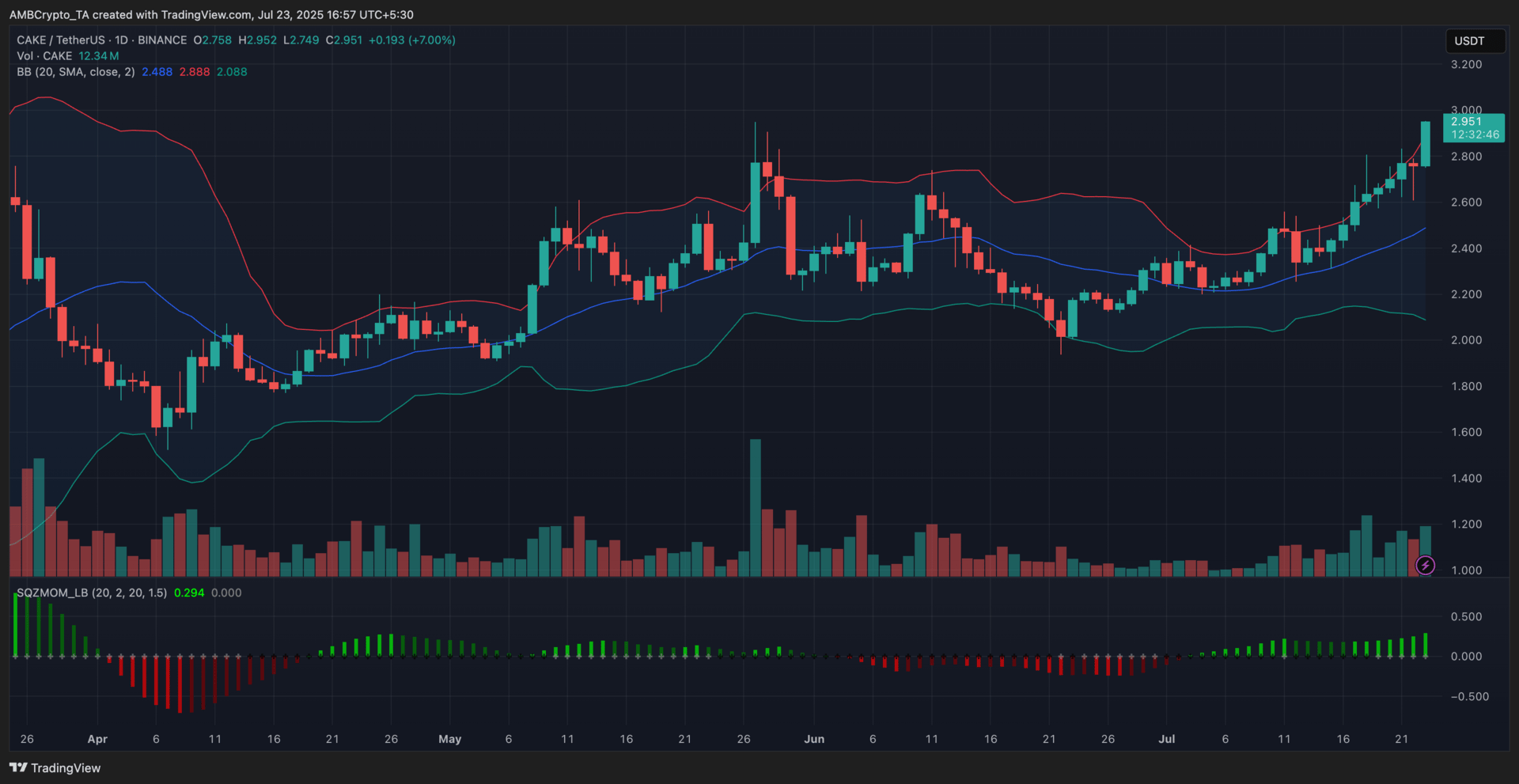

PancakeSwap (CAKE)

Key points:

CAKE traded at $2.95, climbing 7% from the previous day’s close as bulls pushed it near the psychological $3 mark.

The price expanded past the upper Bollinger Band, while the Squeeze Momentum Indicator continued its green streak, reflecting intensifying bullish momentum.

What you should know:

CAKE registered a strong rally on the charts, with price candles decisively breaking above the upper Bollinger Band. This bullish breakout coincided with PancakeSwap’s launch of its Infinity DEX on Base, offering smart contract “hooks” and multi-chain support with 50–99% gas savings, sparking renewed investor demand. Volume climbed to 12.34 million as traders reacted to the upgrade and its alignment with Base’s TVL surge. The Bollinger Bands widened sharply, reinforcing the trend’s strength as CAKE approached the $3 resistance level. Meanwhile, the Squeeze Momentum Indicator printed bright green bars, signaling continued upside momentum with no immediate signs of exhaustion. A close above $3 could open the door to the $3.28 resistance zone, while rejection may trigger a pullback to $2.70–$2.75.

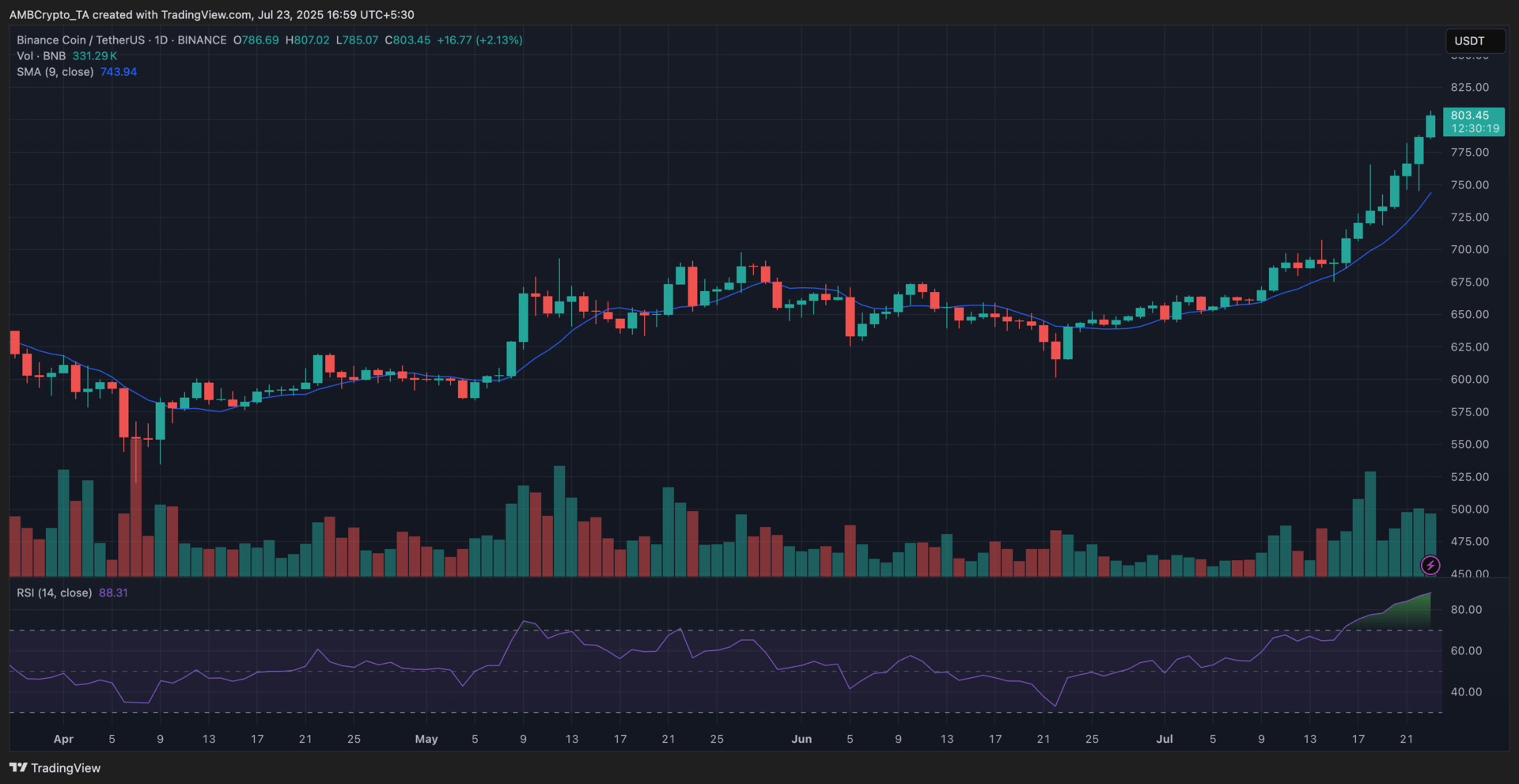

BNB (BNB)

Key points:

At press time, BNB was trading at $803, reflecting a 2.13% increase from its previous daily close.

The RSI reached 88.31, signaling overbought territory, while price action stayed well above the 9-day SMA.

What you should know:

BNB extended its sharp rally, with the price surging past $800 for the first time in weeks. The daily chart revealed strong bullish conviction as consecutive green candles pushed BNB further away from the 9-day SMA, which lagged at $743. The Relative Strength Index (RSI) spiked to 88.31, marking deeply overbought conditions: a sign that while bullish momentum dominated, a cooling-off period could be imminent. Trading volume remained elevated, confirming sustained interest from buyers across multiple sessions. A key catalyst behind the move was rising altcoin rotation, with the Altcoin Season Index climbing to 54 and Bitcoin dominance dipping. This likely fueled fresh inflows into BNB, which also benefited from increased utility demand across BNB Chain’s ecosystem. BNB faced minor intra-day resistance around the $807 level. If bulls maintain control, the next resistance lies near $825. However, any dip in momentum could lead to a retest of the $775–$780 support zone.

How was today's newsletter? |