- Unhashed Newsletter

- Posts

- Standard Chartered slashes Bitcoin forecasts

Standard Chartered slashes Bitcoin forecasts

Reading time: 5 minutes

Standard Chartered cuts Bitcoin targets as DAT-buying dries up

Key points:

Standard Chartered has halved its 2025 Bitcoin target to $100,000 and pushed its $500,000 projection out to 2030 as corporate treasury buying fades.

With digital asset treasury firms unable to expand and ETF inflows slowing sharply, Bitcoin’s next leg now depends almost entirely on institutional ETF demand.

News - Bitcoin’s 36% slide from its October peak has forced Standard Chartered to recalibrate one of the market’s most bullish long-term forecasts. Geoff Kendrick, the bank’s Head of Digital Asset Research, said recent price action has been difficult but remains within historical norms. He described the shift not as a crypto winter, but as a “cold breeze.”

The sharp drop in the share prices of digital asset treasury (DAT) companies has removed a major buyer from the market. Kendrick notes that many of these firms now trade below the value of the Bitcoin they hold, leaving them unable to raise capital for further accumulation. The bank now expects consolidation, not meaningful new buying, from this segment.

With corporate flows fading, Bitcoin’s trajectory rests heavily on ETF participation. Quarterly ETF inflows have fallen to roughly 50,000 BTC, the lowest level since spot ETFs launched. Standard Chartered now sees Bitcoin hitting $100,000 by the end of 2025, down from an earlier $200,000 outlook, and expects the long-promised $500,000 level only in 2030.

A fragile market driven by one buyer - Kendrick argues that halving cycle models are no longer reliable. He believes future gains will depend on slower moving but ultimately larger ETF-driven allocations.

Weak spot demand adds near-term pressure - Analysts warn that Bitcoin’s daily chart shows a bear flag pattern that could pull the price toward $67,000 if buyers fail to reclaim key levels. Spot CVD remains deeply negative and ETF outflows last week exceeded $700 million, reinforcing fragile sentiment.

Short-term holders could complicate any rebound - On-chain data shows short-term holder dominance rising from 18.3% to 18.5%, a shift that increases speculative influence on price direction. Their tendency to sell quickly when in profit has historically capped early recoveries.

Bitcoin’s percent supply in profit has climbed from 66.5% to 67.3%, still far below euphoric bull-phase conditions, reflecting patient accumulation rather than strong conviction. If the FOMC rate decision boosts market optimism, these holders will likely determine whether a rebound above $90,400 and $95,000 can gain traction or fade.

Hong Kong pushes global crypto tax alignment while HashKey IPO marks regulatory turning point

Key points:

Hong Kong opened a public consultation on adopting the OECD’s Crypto-Asset Reporting Framework, aiming to strengthen cross-border tax compliance.

HashKey’s upcoming IPO seeks about $215 million, positioning it as Hong Kong’s first listed crypto exchange amid rapid user growth and mounting losses.

News - Hong Kong has launched a public consultation on implementing the OECD’s Crypto-Asset Reporting Framework, a move intended to bring crypto tax transparency in line with global standards.

Officials say the adoption of CARF and revisions to the Common Reporting Standard would reinforce the city’s commitment to international tax cooperation and curb cross-border evasion. Hong Kong has already exchanged financial account data with partner jurisdictions since 2018.

Interest in CARF is expanding worldwide. Forty eight countries have pledged adoption by 2027, with another 27 set for 2028. The United States is evaluating adoption by 2029. A separate OECD list shows 53 governments have already signed the agreement enabling automatic exchange of account information.

At the same time, HashKey has opened subscriptions for its Hong Kong IPO, aiming to raise about $214.7 million. The listing on December 17 would make it the city’s first publicly traded crypto exchange. The prospectus shows HashKey controls approximately 75% of Hong Kong’s licensed trading market and facilitated $167 billion in cumulative spot volume as of September.

IPO strength meets financial strain - HashKey’s user base surged from fewer than 200 accounts in 2022 to more than 1.44 million by mid-2025. Yet the company recorded HK$3.0 billion in cumulative losses and burned an average of HK$40.9 million per month during the third quarter of 2025.

Institutional capital backs the bet - Despite losses, cornerstone investors such as UBS and Fidelity committed $75 million. HashKey holds HK$29 billion in staking assets and aims to reinforce its position in regulated markets through HashKey Chain and its broader tokenization strategy.

Malaysia launches ringgit stablecoin while Circle secures key UAE license

Key points:

Malaysia unveiled RMJDT, a ringgit-backed stablecoin designed to support APAC cross-border payments and attract foreign investment.

Circle received regulatory approval in Abu Dhabi, strengthening the UAE’s bid to anchor regulated stablecoin activity and institutional payments infrastructure.

News - Malaysia and the United Arab Emirates advanced two major stablecoin developments this week. In Malaysia, the king’s eldest son introduced RMJDT, a ringgit-pegged stablecoin backed by cash deposits and short-term government bonds.

The initiative arrives as stablecoin adoption accelerates across the Asia-Pacific region, where 56% of institutions already use them for payments, settlements, or treasury operations.

In the UAE, Circle secured a Financial Services Permission license from Abu Dhabi Global Market. The approval allows the USDC issuer to operate as a regulated Money Services Provider as the country intensifies oversight of fiat-referenced tokens and payment activity.

Malaysia’s stablecoin enters APAC payments arena - RMJDT will launch with a 500 million token supply, representing about $121.5 million, and will be issued on the Zetrix blockchain.

The rollout is part of Malaysia’s regulated sandbox framework under the Securities Commission and central bank, which aims to test innovations including programmable payments and ringgit-backed tokens.

Bullish Aim, the telecommunications firm behind RMJDT, will also establish a digital asset treasury with an initial 500 million ringgit allocation in Zetrix tokens. The company frames this as a strategic step to support operational stability and strengthen its alignment with Malaysia’s national blockchain ecosystem.

The move echoes the digital asset treasury model popularized by large corporate holders in recent years.

UAE strengthens its regulated stablecoin framework - Circle’s new license arrives during a surge in regional regulatory activity. Abu Dhabi’s financial center has recently granted approvals to Tether, Ripple, Binance, and Bybit, reinforcing efforts to create a tightly governed environment for payment tokens and digital asset services.

Circle also appointed Dr. Saeeda Jaffar, a former senior Visa executive, to lead its Middle East and Africa operations. The company says UAE standards place a strong emphasis on transparency, consumer protection, and risk management, making the region a strategic hub for scaling institutional stablecoin usage.

CFTC opens door to crypto collateral in derivatives as new guidance reshapes tokenization rules

Key points:

The CFTC launched a pilot program allowing approved futures commission merchants to accept Bitcoin, Ether and USDC as margin collateral for derivatives trades.

Updated guidance outlines how tokenized assets, including Treasuries and money-market funds, can be used under existing regulations as Staff Advisory 20-34 is formally withdrawn.

News - The US Commodity Futures Trading Commission has taken a major step toward integrating crypto into regulated financial markets.

Acting Chair Caroline Pham introduced a pilot program that allows futures commission merchants to accept Bitcoin, Ether, and USDC as margin collateral. The initiative begins with a three-month phase during which participating firms must submit weekly reports and notify the agency of operational issues tied to digital asset usage.

The move arrives alongside new technical guidance for tokenized collateral and the withdrawal of prior restrictions that had limited the use of digital assets in segregated accounts. Industry leaders praised the shift as overdue regulatory clarity that could redirect institutional activity from offshore venues toward supervised US markets.

A framework designed to reduce risk and improve efficiency - The CFTC said the pilot establishes clear guardrails focused on custody, reporting, and valuation practices. Firms clearing through multiple derivatives clearing organizations must apply the most conservative collateral haircut across all venues.

Updated guidance also explains how tokenized versions of real-world assets, including Treasury securities and money-market funds, can fit within current rules for segregation, enforceability, and control.

The changes reflect legal developments introduced by the GENIUS Act, which created a federal regime for non-securities digital assets and expanded the CFTC’s authority over tokenized collateral.

Industry reaction highlights market implications - Executives from Coinbase, StarkWare, and Plume Network called the pilot a major milestone for market structure. They pointed to gains in capital efficiency, greater automation through on-chain settlement, and the removal of barriers that previously hindered institutional participation.

Some exchanges are preparing to debut spot crypto trading under CFTC oversight, signaling broader market shifts ahead.

The Headlines Traders Need Before the Bell

Tired of missing the trades that actually move?

In under five minutes, Elite Trade Club delivers the top stories, market-moving headlines, and stocks to watch — before the open.

Join 200K+ traders who start with a plan, not a scroll.

More stories from the crypto ecosystem

$400M whale wave hits Ethereum – Can ETH defend the $3K line?

Can TAO’s upcoming halving event unlock Bittensor’s next big breakout?

SPX whales return after key retest – Here’s why $1 is in sight

Bitcoin, ETFs, and the ‘dual strategy’ analysts are talking about today

Bitcoin price enters ‘controlled volatility’ phase – What this means for $90K

Interesting facts

Ethiopia has quietly climbed into the top tier of global Bitcoin mining - Leveraging abundant hydropower and new pro-mining rules, Ethiopia has attracted clusters of foreign miners since 2024 and is now cited in regional industry reports as a rising global heavyweight, with policy shifts helping push it into the upper ranks of Bitcoin-mining destinations.

Gucci turned crypto wallets into luxury payment cards - In 2022, Gucci started letting customers pay with more than 10 cryptocurrencies at select US boutiques, then expanded the program across North America, turning high-end fashion checkouts into a live testbed for Bitcoin, Ethereum, Dogecoin, and even ApeCoin payments.

Tesla’s 49-day Bitcoin payments experiment is still one of crypto’s loudest corporate U-turns - In March 2021, Tesla began accepting Bitcoin for US vehicle purchases, then suspended the option less than two months later over environmental concerns, cementing the episode as one of the most dramatic on-again, off-again corporate crypto experiments to date.

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

Top 3 coins of the day

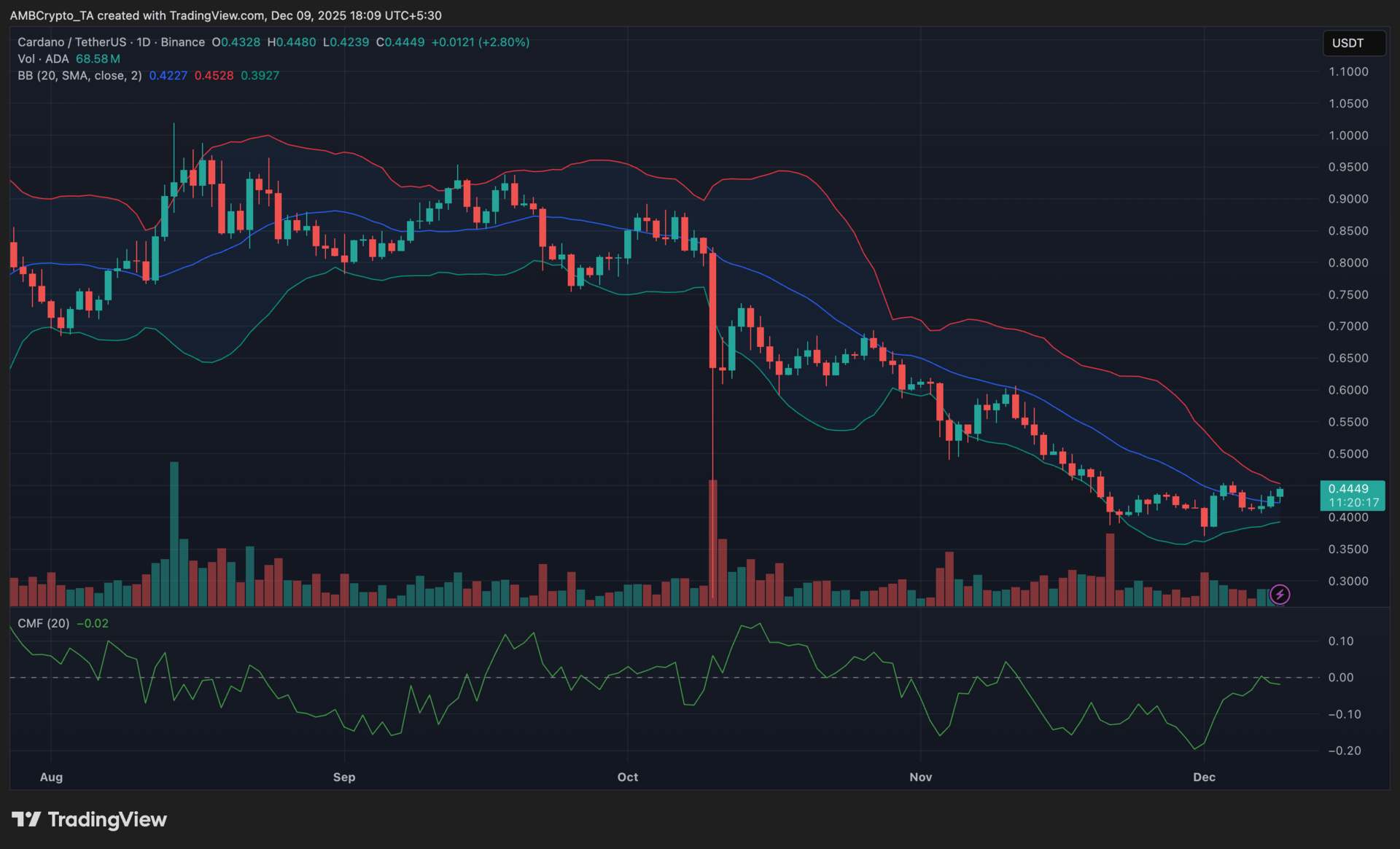

Cardano (ADA)

Key points:

ADA was last seen near $0.44 after a mild intraday climb, closing just above the Bollinger mid-band for the first time in several sessions.

The CMF held near neutral territory, while volume stayed modest, suggesting buyers were testing momentum rather than driving a decisive breakout.

What you should know:

ADA inched higher and managed to finish slightly above the Bollinger mid-band, marking a subtle shift from the lower-band drift that defined the past week. The price attempted to build a short-term base above $0.40, and today’s candle hinted at improving sentiment as it nudged through the mid-line. Volume remained moderate, while the CMF hovered near zero, indicating that capital inflows had not meaningfully strengthened yet. From a catalyst standpoint, ongoing interest around Cardano’s Midnight privacy sidechain has supported confidence in the ecosystem. For now, traders are watching whether ADA can hold above the mid-band and work toward the upper Bollinger band, with the $0.45 zone acting as the next area to monitor for continuation.

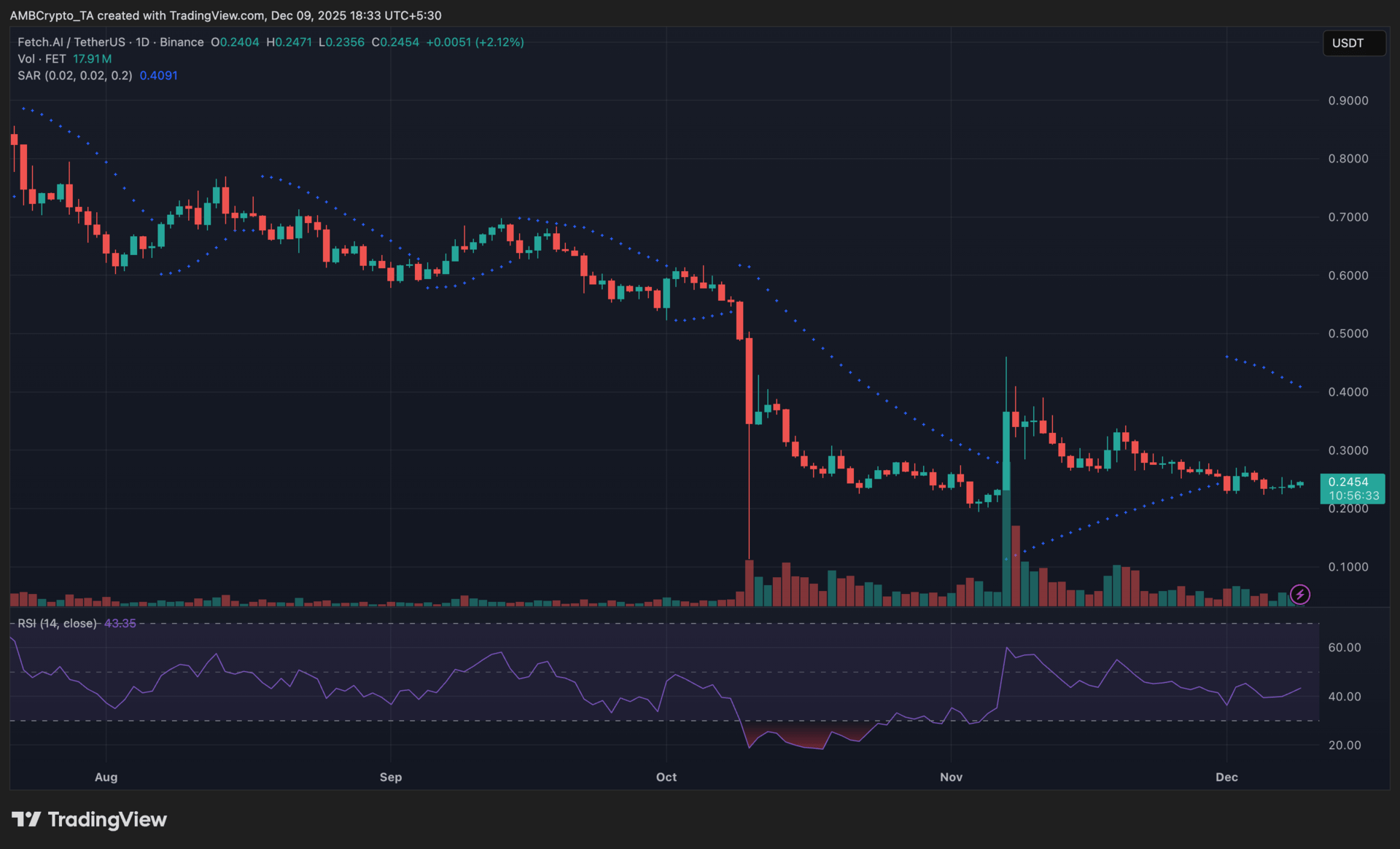

Artificial Superintelligence Alliance (FET)

Key Points

FET traded near $0.24 after a modest daily gain, with price movement staying capped under overhead SAR levels in December.

The RSI recovered from recent lows, while volume held at moderate levels, hinting at improving participation after weeks of quieter trading.

What You Should Know

FET rose over the last session, although its broader structure still reflected a slow, corrective phase. The Parabolic SAR stayed above the candles throughout December so far, signaling that sellers continued to hold a slight advantage despite fading momentum. RSI shifted to the mid-40s, showing a mild recovery from the deeper weakness seen in late October. Volume picked up slightly from the quieter stretches of November, indicating more consistent activity as the range developed. A small fundamental tailwind came from progress on the ASI Chain DevNet and the recent activation of an enterprise NVIDIA GPU cluster within the ASI ecosystem. These updates strengthened long-term interest even as near-term price behavior remained constrained. At present, traders will watch the $0.27 region as the next area of resistance, while $0.22 stays relevant as support if the range softens again.

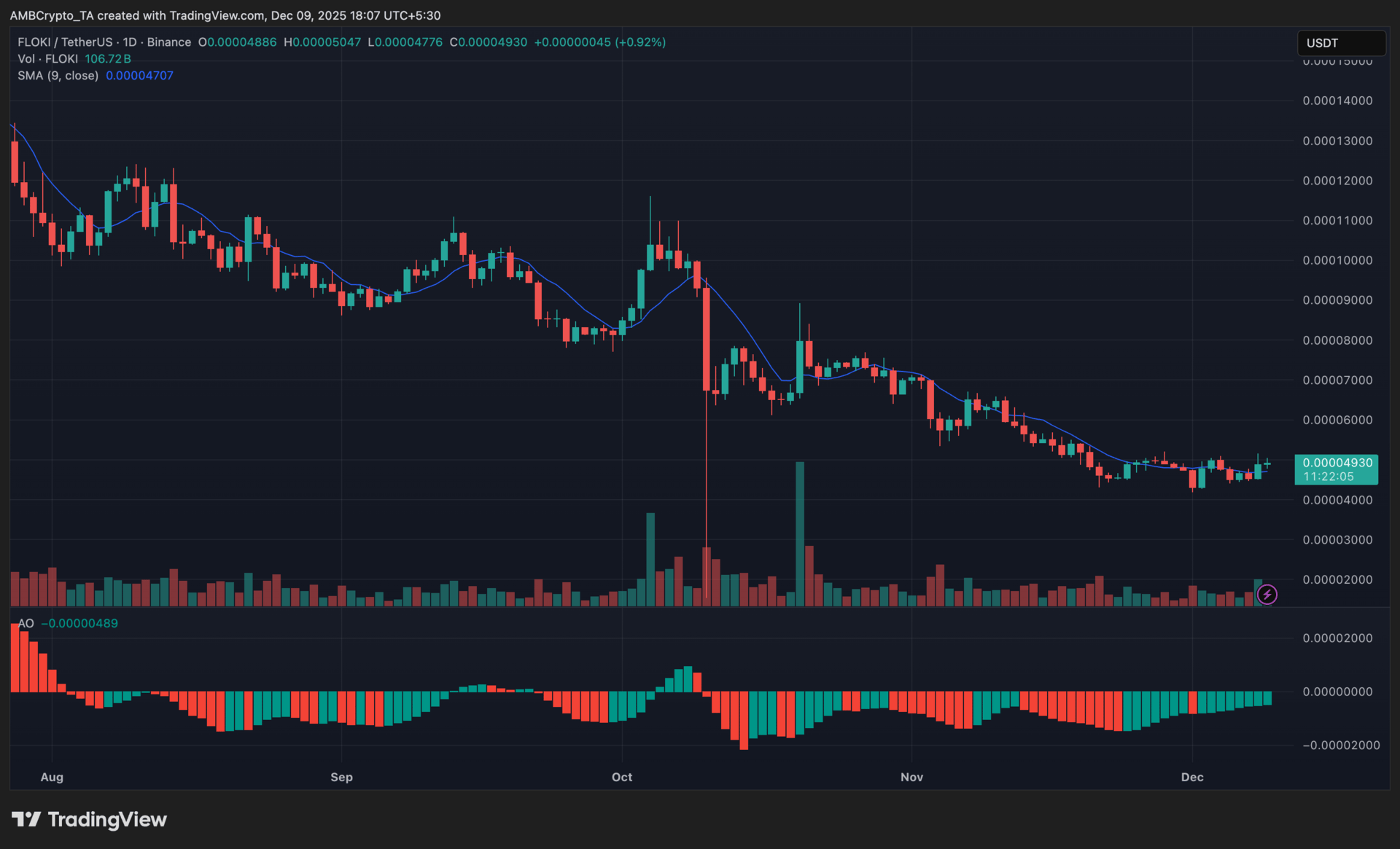

FLOKI (FLOKI)

Key points:

FLOKI traded at $0.000049, posting a mild intraday gain while reclaiming its 9-day SMA in the latest session.

The Awesome Oscillator stayed green for several sessions, reflecting a gradual shift toward positive momentum.

What you should know:

FLOKI’s price held its recent recovery path as the latest candle closed above the 9-day SMA, reinforcing short-term buyer strength after a prolonged downtrend. The Awesome Oscillator continued printing green bars, showing steadier bullish momentum building through December, though not yet signaling a strong trend reversal. Volume remained moderate but supported the slow grind higher, indicating consistent participation rather than aggressive accumulation. A nearby resistance level sits around $0.000050, while $0.000046 serves as immediate support if momentum weakens. On the catalyst front, FLOKI’s recent visibility increased after the launch of its first regulated ETP in Europe, a development that may have supported sentiment around the token despite broader market stagnation. For now, traders should watch whether FLOKI can maintain closes above the SMA and sustain green AO bars, as these conditions present the clearest signs of a potential shift away from its multi-month drift.

How was today's newsletter? |