- Unhashed Newsletter

- Posts

- Tariffs rattle markets, crypto draws $2B

Tariffs rattle markets, crypto draws $2B

Reading time: 5 minutes

Crypto funds pull in $2B as tariff fears rattle markets

Key points:

Crypto investment products recorded $2.17 billion in weekly inflows, their strongest showing since October, as geopolitical and trade risks intensified.

Bitcoin dominated early-week allocations, even as late-week tariff headlines triggered sharp reversals across broader crypto markets.

News - Crypto investment funds saw a surge in capital last week, with inflows topping $2.17 billion as investors repositioned amid escalating global macro uncertainty.

Data from CoinShares showed that most allocations arrived earlier in the week, before sentiment flipped sharply on Friday following renewed tariff threats and geopolitical escalation tied to Greenland.

Bitcoin accounted for roughly $1.55 billion of total inflows, reinforcing its positioning as the primary macro hedge highlighted in the CoinShares report. Ethereum also attracted notable demand, pulling in nearly $500 million, while Solana, XRP, and select mid-cap tokens posted more modest gains.

Risk appetite deteriorated rapidly as markets digested reports of potential US tariffs on multiple European countries. President Donald Trump’s renewed tariff rhetoric coincided with a broader risk-off move across equities and crypto, triggering $378 million in single-day outflows from digital asset products by week’s end.

Macro shock tests Bitcoin’s “hedge” narrative - Despite strong fund inflows, Bitcoin’s price action painted a more conflicted picture. The asset slipped toward the $92,000–$93,000 range as tariff fears weighed on global markets, while traditional safe havens such as gold and silver climbed to record highs.

Derivatives data reflected the shift in positioning. Nearly $815 million in leveraged positions were liquidated across crypto markets, while open interest declined across most major altcoins, pointing to widespread de-risking.

Betting markets also pared expectations of a near-term Bitcoin rally, underscoring how closely the asset remains tied to broader macro risk sentiment.

Inflows persist despite regulatory noise - Allocations into Ethereum and Solana held up despite regulatory uncertainty linked to proposed restrictions on stablecoin yield offerings.

Inflows were also recorded across blockchain-related equities and major crypto fund issuers, highlighting continued capital deployment across the wider digital asset investment landscape.

Last week’s fund flows underscored how quickly sentiment can shift, with geopolitical developments and trade policy uncertainty continuing to steer short-term market direction.

Vitalik Buterin pushes for a DAO reset amid Ethereum’s network surge

Key points:

Vitalik Buterin said most DAOs rely too heavily on token-based voting and should be redesigned to handle core governance functions like disputes and data coordination.

The comments arrive as Ethereum sees record on-chain activity, steady staking behavior, and Ether holding above the $3,000 level despite recent volatility.

News - Ethereum co-founder Vitalik Buterin has renewed his criticism of decentralized autonomous organizations, arguing that many have drifted far from their original purpose.

In recent posts, Buterin said the dominant DAO model, one centered on token-holder voting and treasury control, has become inefficient, vulnerable to capture, and poorly suited to meaningful governance.

Instead, he called for a new generation of DAOs designed to support critical infrastructure. These include maintaining shared data, resolving on-chain disputes, managing oracles, and overseeing long-term projects that may outlive their founding teams. According to Buterin, these roles require governance systems that balance decentralization with resilience and decisiveness.

Where DAOs actually work - To explain this shift, Buterin revisited his distinction between convex and concave decision-making. Convex decisions, such as leadership or strategic bets, often break down under forced consensus. Concave decisions benefit from aggregating many inputs, making them a better fit for decentralized coordination.

Dispute resolution, pricing judgments, and safety assessments fall into this category. Buterin said making such systems viable requires solving two persistent problems: lack of privacy and decision fatigue. He pointed to zero-knowledge cryptography and limited use of artificial intelligence as tools that can support human judgment without replacing it.

Ethereum’s market backdrop - This governance debate is unfolding alongside signs of strength across the Ethereum network.

Daily transactions have reached record highs, average fees remain near recent lows, and staking activity appears stable, with validator exit queues at zero. At the same time, Ether has held above the $3,000 support zone, backed by rising staking demand and renewed ETF inflows highlighted in recent market data.

Hyperliquid regains perp DEX lead as rivals face pressure

Key points:

Hyperliquid reclaimed the top spot among perpetual DEXs, posting $40.7 billion in weekly trading volume and the highest open interest across the sector.

Lighter and Trove-linked activity came under pressure, with post-airdrop volume fading, sharp token declines, and growing scrutiny around token handling and project decisions.

News - The decentralized perpetual exchange landscape saw another reshuffle this week, with Hyperliquid reasserting its dominance as rival platforms struggled to sustain momentum. Data from CryptoRank showed Hyperliquid processing roughly $40.7 billion in weekly trading volume, ahead of Aster at $31.7 billion and Lighter at $25.3 billion.

The gap was even more pronounced in open interest, a key measure of where traders hold leveraged risk. Hyperliquid led with about $9.57 billion in open interest, exceeding the combined total of several major competitors, including Aster, Lighter, Variational, edgeX, and Paradex.

The divergence suggests traders are increasingly parking risk on Hyperliquid rather than rotating activity around short-term incentives.

Post-airdrop hangover hits lighter - Lighter’s slowdown has been particularly sharp following its recent airdrop. Weekly trading volume has fallen nearly threefold from its peak, while its LIT token slid to a new all-time low near $1.70.

Market data showed the token down more than 37% over the past month, pressured by heavy selling from early airdrop recipients and broader market weakness. Aster’s native token also fell to record lows, underscoring stress across incentive-driven perp platforms.

Trove pivot sparks backlash inside Hyperliquid ecosystem - The turbulence extended beyond trading metrics.

Trove Markets, which had raised funds to build on Hyperliquid, sparked backlash after abruptly pivoting its planned perp DEX to Solana. The move triggered refund demands from backers and intensified attention on how HYPE tokens originally acquired for staking requirements were handled.

On-chain activity later flagged large HYPE transfers linked to Trove, prompting allegations of a $10 million token dump and leading the Hyperliquid Foundation to engage blockchain investigator ZachXBT.

While investigations continue, the episode highlights how project decisions and token mechanics can quickly ripple across the on-chain derivatives ecosystem.

Paradex outage triggers chain rollback, open orders cancelled

Key points:

Paradex suffered a platform-wide outage after a database maintenance failure, prompting a rollback to an earlier block on Starknet.

The incident led to mass liquidations, forced order cancellations, and renewed debate around trust and operational risk on Layer-2 DeFi platforms.

News - Decentralized perpetuals exchange Paradex experienced a major service disruption this week after internal database maintenance caused widespread failures across its trading interface, APIs, blockchain components, bridge, and block explorer. As prices on the platform briefly collapsed to zero, users reported thousands of forced liquidations within seconds.

To stabilize the system, Paradex confirmed it rolled back the chain to block 1,604,710, restoring balances to their pre-incident state. As part of the recovery process, the exchange force-cancelled all open orders except take-profit and stop-loss orders. Trading later resumed after roughly eight hours of downtime.

Paradex said the rollback was intended to protect user funds, adding that all assets were safe. However, the move erased every trade and position change that occurred after the affected block, leaving some traders frustrated as positions and transaction history were reset.

What went wrong - According to the team, the disruption followed a faulty database migration that injected incorrect pricing data into the system. Bitcoin was briefly priced at zero on the exchange, triggering cascading liquidations before services were taken offline. Some users also reported unusual funding behavior during the disruption window.

While rollbacks are rare in on-chain systems, Paradex described the move as the best available recourse under the circumstances. The exchange has not provided a confirmed timeline for full service restoration and said updates would continue via its official status page.

Trust questions for Layer-2 DeFi - The incident has reignited debate around decentralization and control in Layer-2 DeFi. Some community members praised Paradex for communicating quickly, while others questioned what the rollback means for immutability and user autonomy.

Built on Starknet, Paradex ranked eighth in 30-day trading volume across on-chain derivatives venues, with more than $37 billion in reported activity over the past month. Following the outage, users have called for clearer incident response policies, compensation frameworks, and safeguards against similar failures going forward.

More stories from the crypto ecosystem

Did you know?

Crypto funding networks are under scrutiny in India: Indian security agencies have flagged a sophisticated “crypto hawala” network allegedly used to move untraceable foreign funds into the Jammu and Kashmir region, highlighting how cross-border crypto activity can raise national security concerns.

Bitcoin above $97K isn’t just price action: Bitcoin recently jumped above $97,000, marking a multi-day rally influenced by the Senate Banking Committee’s progress on the “Digital Asset Market Clarity Act.” This uptick reflects investor sensitivity to emerging legislative markups rather than just speculative momentum.

Countries are sharing crypto data under new standards: Switzerland will adopt the OECD’s Crypto-Asset Reporting Framework (CARF) in 2026, though the first formal data exchanges with partner countries are now scheduled for 2027, signaling a phased push toward international transparency and cooperation in tracking digital asset flows.

Top 3 coins of the day

Monero (XMR)

Key points:

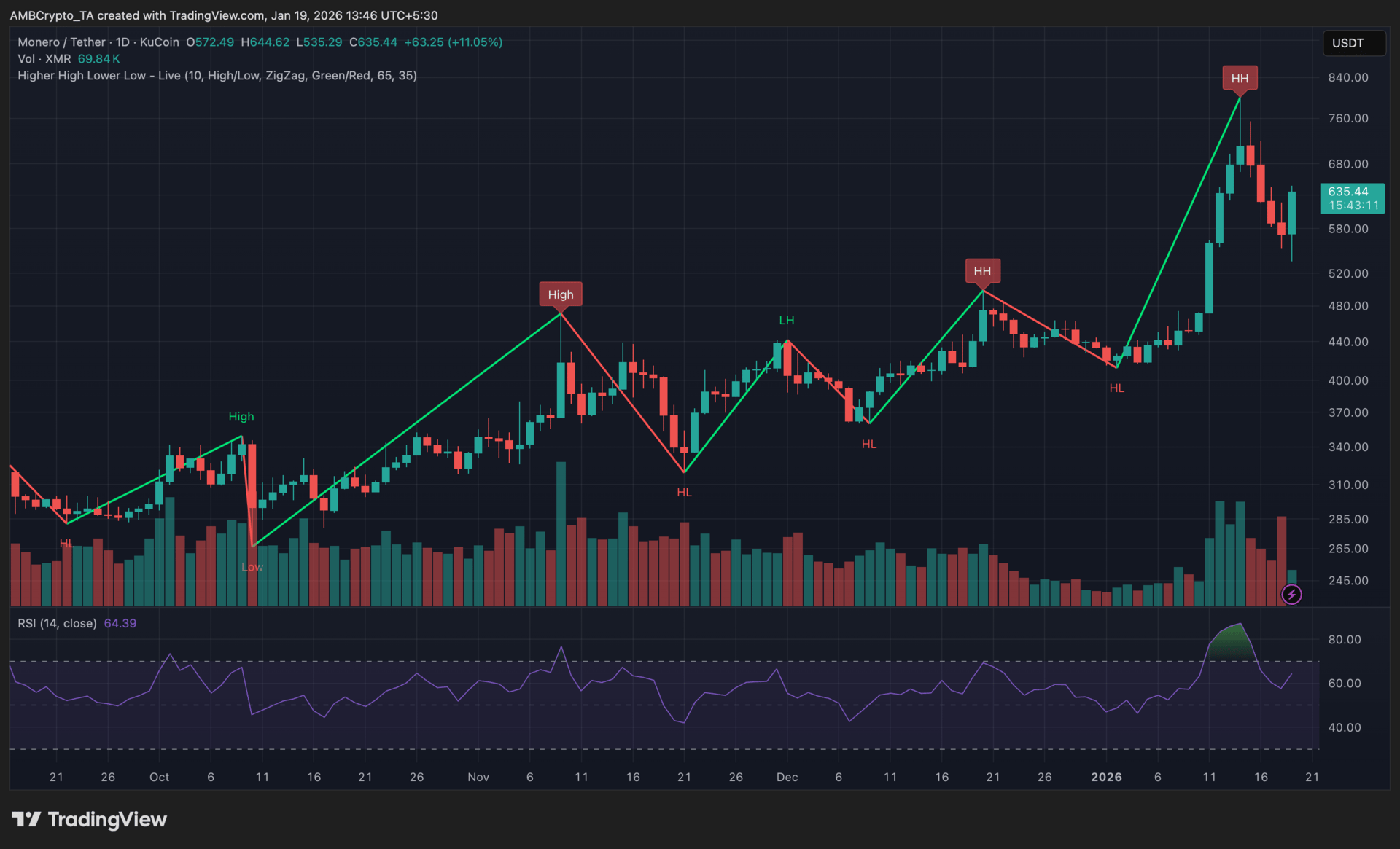

XMR rebounded to around $635 after cooling off from its recent spike toward the $780 zone, reflecting a short-term pullback rather than a breakdown in structure.

The RSI held above neutral while volume tapered from its peak, suggesting momentum cooled but the broader bullish trend remained intact.

What you should know:

Monero’s latest daily candles showed a controlled retracement after an explosive rally earlier this month.

Price had surged sharply before facing profit-taking near the recent swing high, leading to a pullback that stabilized above the $580–$600 support zone, which remains the key area to watch. Importantly, the broader higher high and higher low structure stayed intact, indicating that the move was corrective rather than trend-ending.

The RSI hovered near the mid-60s, pointing to easing momentum but still favoring buyers on a higher timeframe. Volume expanded during the rally and cooled during the retracement, aligning with consolidation instead of aggressive selling pressure.

On the catalyst front, renewed attention on Monero’s privacy utility following a high-profile fund conversion into XMR, alongside the launch of XMR perpetual swaps on Hyperliquid, likely supported both volume and speculative interest during the recent move.

Internet Computer (ICP)

Key points:

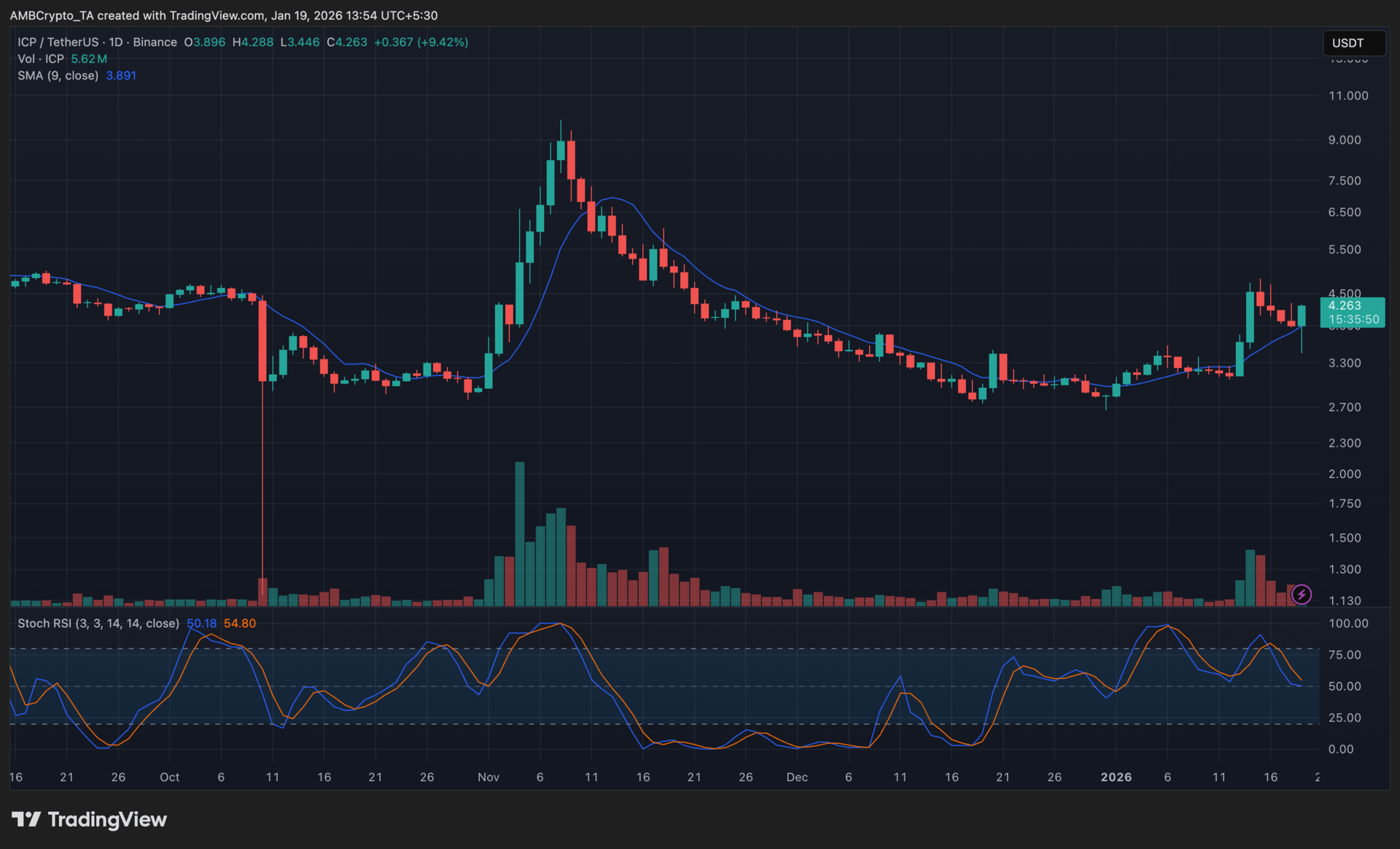

ICP climbed toward the $4.26 region after pushing higher from its recent base, signaling a momentum-driven recovery rather than a short-lived bounce.

Price stayed above the rising 9-day SMA as volume picked up and the Stochastic RSI cooled from elevated levels, pointing to steadier follow-through instead of exhaustion.

What you should know:

Internet Computer’s recent candles reflected a clear shift in pace, with buyers stepping in decisively after a prolonged period of softer price action.

The advance allowed ICP to reclaim the 9-day SMA and hold above it, which now acts as near-term support around the $3.90–$4.00 zone. This reclaim marked a departure from the earlier downtrend and pointed to improving short-term structure.

Momentum indicators supported this view. The Stochastic RSI eased from overbought territory but remained elevated, suggesting upside pressure cooled without fully fading. Volume expanded alongside the move, reinforcing stronger participation during the recovery.

Beyond the chart, anticipation around DFINITY’s proposed “Mission70” tokenomics update likely supported sentiment, aligning with the surge in trading activity. On the upside, the $4.45–$4.60 region is the next resistance zone to monitor, as prior selling activity emerged there.

Dash (DASH)

Key points:

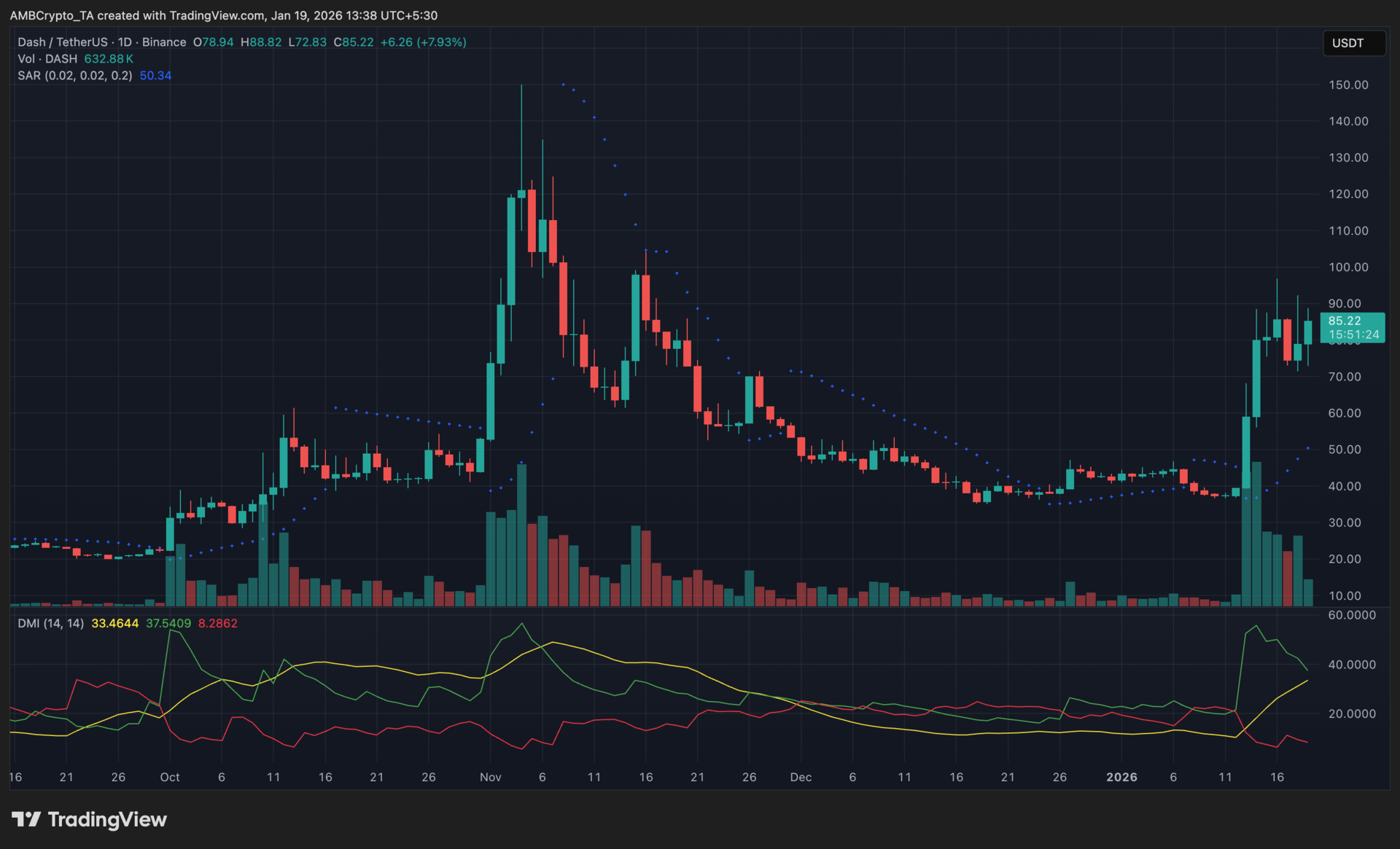

DASH surged toward the $85 area after breaking out from a prolonged base, marking one of its strongest daily advances in recent months.

The Parabolic SAR stayed below price while DMI showed +DI firmly above −DI, confirming trend strength alongside a sharp pickup in volume.

What you should know:

Dash entered a high-momentum phase after erupting from a long period of compression, with price rapidly reclaiming levels not seen for months.

The breakout carried DASH well above its prior range, with follow-through buying keeping the move intact rather than fading quickly. As a result, the $75–$80 zone now stands as the key support area to monitor, representing the former breakout base.

Trend indicators reinforced the move. The Parabolic SAR remained positioned beneath the candles, signaling that bullish control persisted unless a flip occurs. At the same time, DMI reflected a strong directional push, with trend strength building as the rally unfolded.

Volume expanded aggressively during the advance, confirming broad participation instead of a thin liquidity spike.

Beyond technicals, renewed rotation into privacy-focused coins and recent ecosystem efforts to expand merchant and fiat access likely added to momentum. The $90–$95 region is the next resistance zone to watch if upside pressure continues.

All the stories worth knowing—all in one place.

Business. Tech. Finance. Culture. If it’s worth knowing, it’s in the Brew.

Morning Brew’s free daily newsletter keeps 4+ million readers in the loop with stories that are smart, quick, and actually fun to read. You’ll learn something new every morning — and maybe even flex your brain with one of our crosswords or quizzes while you’re at it.

Get the news that makes you think, laugh, and maybe even brag about how informed you are.

How was today's newsletter? |