- Unhashed Newsletter

- Posts

- Trump hints crypto bill soon

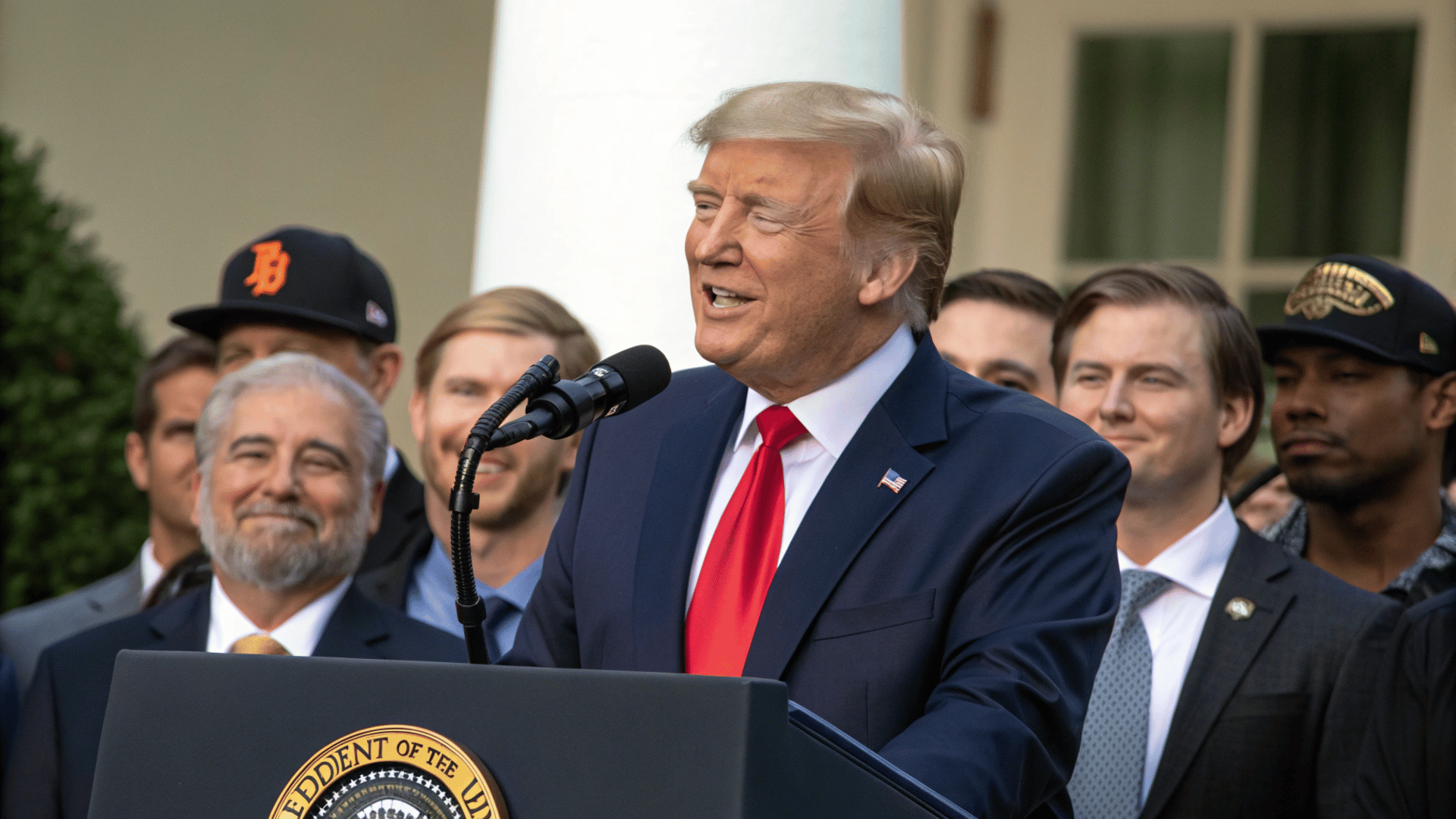

Trump hints crypto bill soon

Reading time: 5 minutes

Trump signals crypto bill as Bitcoin nears $90K

Key points:

Bitcoin rebounded toward the $89,000–$90,000 zone after U.S. President Donald Trump signaled that a major crypto market structure bill could be signed “very soon.”

While Trump’s remarks lifted risk sentiment, debates at the World Economic Forum highlighted deeper tensions between central banks and Bitcoin’s decentralized model.

News - Bitcoin recovered alongside U.S. equities during Wednesday’s Wall Street session, following Trump’s appearance at the World Economic Forum in Davos. Speaking to global political and financial leaders, Trump reiterated his ambition to keep the U.S. at the center of crypto innovation and said Congress was making progress on broader crypto market legislation that he hopes to sign shortly.

Markets reacted positively to the remarks, with Bitcoin posting modest daily gains and risk assets stabilizing after recent volatility. Trump also struck a calmer tone on geopolitical issues, including U.S. intentions toward Greenland, which helped ease broader market anxiety. At the same time, gold pulled back from record highs as investors cautiously rotated back into risk-sensitive assets.

However, enthusiasm remained measured. Rising Japanese government bond yields resurfaced as a global macro concern, reinforcing caution across crypto and equity markets despite the short-term bounce.

Crypto policy optimism meets macro reality - Trump’s comments followed his reference to the previously signed GENIUS Act, which focused on stablecoins, and his framing of crypto policy as both an economic and strategic priority. He argued that clear rules were necessary not just for innovation, but also to prevent rival nations from gaining an edge in digital assets.

Still, traders noted that Bitcoin’s recent price action has largely retraced to its early-2026 levels. Some market participants described this consolidation as constructive, pointing to strong buying interest around key support zones even as volatility persists.

Central banks push back as Bitcoin enters Davos debates - Beyond price action, Bitcoin itself became a focal point at Davos.

During a panel discussion, Banque de France Governor François Villeroy de Galhau questioned whether trust in money should rest with decentralized systems, arguing instead for independent central banks. Coinbase CEO Brian Armstrong pushed back, emphasizing that Bitcoin’s lack of a central issuer makes it more independent than any sovereign authority.

The exchange underscored a broader shift at Davos, where Bitcoin is no longer discussed only as a speculative asset or a technical experiment, but increasingly as a direct challenge to traditional monetary frameworks.

Together, Trump’s policy signals and the Davos debates suggest Bitcoin is gaining political relevance even as macro risks continue to shape its near-term trajectory.

Solana ecosystem expands while capital, products, and risk signals diverge

Key points:

Ondo Finance rolled out over 200 tokenized U.S. stocks and ETFs on Solana, widening real-world asset access even as parts of the ecosystem face price pressure.

While corporate Solana treasuries and new tokens show strain, ETF inflows, network activity, and new AI trading tools point to continued institutional and user interest.

News - The Solana ecosystem saw a wave of contrasting developments this week, blending product expansion with visible market stress.

Ondo Finance announced the launch of more than 200 tokenized U.S. equities and exchange-traded funds (ETFs) on Solana, marking the first time its Ondo Global Markets platform has deployed outside Ethereum and BNB Chain. The firm said the move aims to bring deeper liquidity and broader asset selection to onchain equities, with Ondo stating that the Solana deployment makes it the network’s largest real-world asset issuer by asset count.

At the same time, Solana-focused corporate treasuries faced mounting pressure as SOL prices declined in January. Several firms using Solana as a strategic treasury asset paused further accumulation after posting large unrealized losses, highlighting the risks of price volatility despite strong long-term conviction.

Analysts warned that a deeper breakdown below key support levels could worsen balance-sheet stress if market conditions deteriorate further.

Mixed signals from tokens and treasuries - Retail activity also showed signs of near-term strain. Solana Mobile’s newly launched SKR token saw early profit-taking following its airdrop to Seeker phone users. Onchain data pointed to sell-side dominance shortly after launch, even as staking rewards and governance features went live for participants.

Institutional flows and tooling still build - Despite these pressures, broader indicators suggested resilience. Solana-linked exchange-traded products recorded net inflows during a wider crypto market sell-off, outperforming Bitcoin and Ethereum funds as overall market capitalization fell sharply. Network activity also remained steady, with millions of new addresses added over consecutive days.

Adding to the ecosystem momentum, analytics firm Nansen launched AI-driven trading tools on Solana and Base, enabling users to execute trades via natural-language prompts. The release underscored growing interest in simplifying onchain participation through automation and AI.

Together, the developments reflect a Solana landscape where infrastructure and product growth continue, even as price volatility tests investor and corporate risk tolerance.

Galaxy plans $100M hedge fund as crypto volatility reshapes strategy

Key points:

Galaxy Digital is preparing to launch a $100 million hedge fund in the first quarter that can profit from both rising and falling crypto prices.

The move comes as Bitcoin pulls back from recent highs and macro risks push investors toward more defensive, flexible strategies.

News - Galaxy Digital, led by Mike Novogratz, is set to roll out a $100 million hedge fund designed to navigate growing volatility across crypto and financial markets. The fund is expected to launch in the first quarter and will take both long and short positions, allowing it to profit in either direction as market conditions shift.

According to multiple reports, the strategy will allocate up to 30% of capital to crypto tokens, with the remaining exposure focused on financial services stocks that Galaxy believes will be reshaped by digital asset adoption, regulation, and technological change. Commitments have already been secured from family offices, high-net-worth investors, and institutional backers, with Galaxy also making an undisclosed seed investment.

The timing reflects a notable change in market tone. Bitcoin was trading near $88,000 after sliding from its October peak, pressured by renewed trade tensions, macro uncertainty, and shifting risk appetite. Galaxy fund head Joe Armao said the market’s “up-only” phase may be fading, even as he remains constructive on Bitcoin and large-cap assets like Ethereum and Solana over the longer term.

Trading both winners and losers - Armao emphasized that the fund’s flexibility is central to its thesis. By combining crypto exposure with positions in traditional financial firms, Galaxy aims to capture both disruptive winners and businesses facing pressure from onchain innovation. He pointed to changes in payments, data, and infrastructure companies as areas where regulation, blockchain adoption, and artificial intelligence are reshaping valuations.

Macro pressure meets structural opportunity - Market analysts echoed the cautious tone. QCP Capital noted that Bitcoin is behaving more like a high-beta risk asset, reacting sharply to interest rate expectations, geopolitics, and cross-market volatility rather than acting as a hedge. Against this backdrop, Galaxy’s hedge fund launch signals a broader industry shift toward strategies built for choppier, two-way markets rather than straight-line rallies.

Gen Z trust in crypto outpaces Boomers while institutions push blockchain

Key points:

Gen Z and Millennials trust crypto platforms almost five times more than Baby Boomers, with younger users increasingly viewing digital assets as finance’s future.

Institutional adoption of blockchain is accelerating, even as everyday crypto payments remain limited.

News - A growing generational divide is shaping how Americans view crypto, according to a January 2026 survey by OKX. The study found that 40% of Gen Z and 41% of Millennials expressed high trust in crypto platforms, compared with just 9% of Baby Boomers. Confidence among younger users has also risen year over year, while sentiment among Boomers has largely remained unchanged.

This trust gap is translating into behavior. Around 40% of Gen Z and 36% of Millennials plan to increase their crypto trading activity this year, nearly four times the share of Boomers who said the same. Younger respondents tend to place less trust in traditional banks, while older generations continue to prioritize regulation and institutional oversight.

Adoption belief outpaces real-world usage - Despite strong support for crypto in principle, everyday usage remains limited. A separate survey of Bitcoin holders found that while nearly 80% back broader crypto adoption, most rarely use digital assets for daily payments. Limited merchant acceptance, high fees, and price volatility were cited as the primary barriers.

Where crypto payments do occur, activity is concentrated in digital-first environments such as gaming, digital goods, and e-commerce. Incentives including lower fees, rewards, and cashback were identified as key drivers that could encourage more frequent payment use.

Institutions push blockchain into production - While consumer behavior evolves gradually, traditional finance is moving faster behind the scenes.

Citizens Bank said blockchain adoption is shifting from pilot programs to real-world deployment, arguing that faster settlement and always-on markets could improve capital efficiency and support global economic growth. The report highlighted the New York Stock Exchange’s plan to launch a tokenized securities platform that would enable 24/7 trading of U.S. equities and ETFs, pending regulatory approval.

Looking ahead, institutional adoption could accelerate further. Ripple president Monica Long projected that by the end of 2026, roughly half of Fortune 500 companies will either hold crypto or actively use blockchain-based financial instruments. Together, the surveys and forecasts suggest a future where younger generations drive demand, while institutions build the infrastructure to support broader adoption.

More stories from the crypto ecosystem

Did you know?

Iran’s central bank has acquired at least $507 M in stablecoins: Blockchain analysis shows the Central Bank of Iran accumulated at least $507 million worth of Tether (USDT) stablecoins in 2025, indicating a strategy to bypass sanctions and traditional banking constraints using dollar-pegged crypto assets.

Stablecoin market cap hit an annual record in 2025: In 2025, the stablecoin sector’s total market capitalization surged by +48.9 %, reaching a record $311 billion, the largest stablecoin market size ever recorded, even as overall crypto prices declined.

Crypto prediction markets grew over 300 % in 2025: Prediction market trading volume expanded by +302.7 % in 2025, hitting about $63.5 billion, a sign that on-chain derivative and speculative infrastructure continues to mature despite broader market headwinds.

Top 3 coins of the day

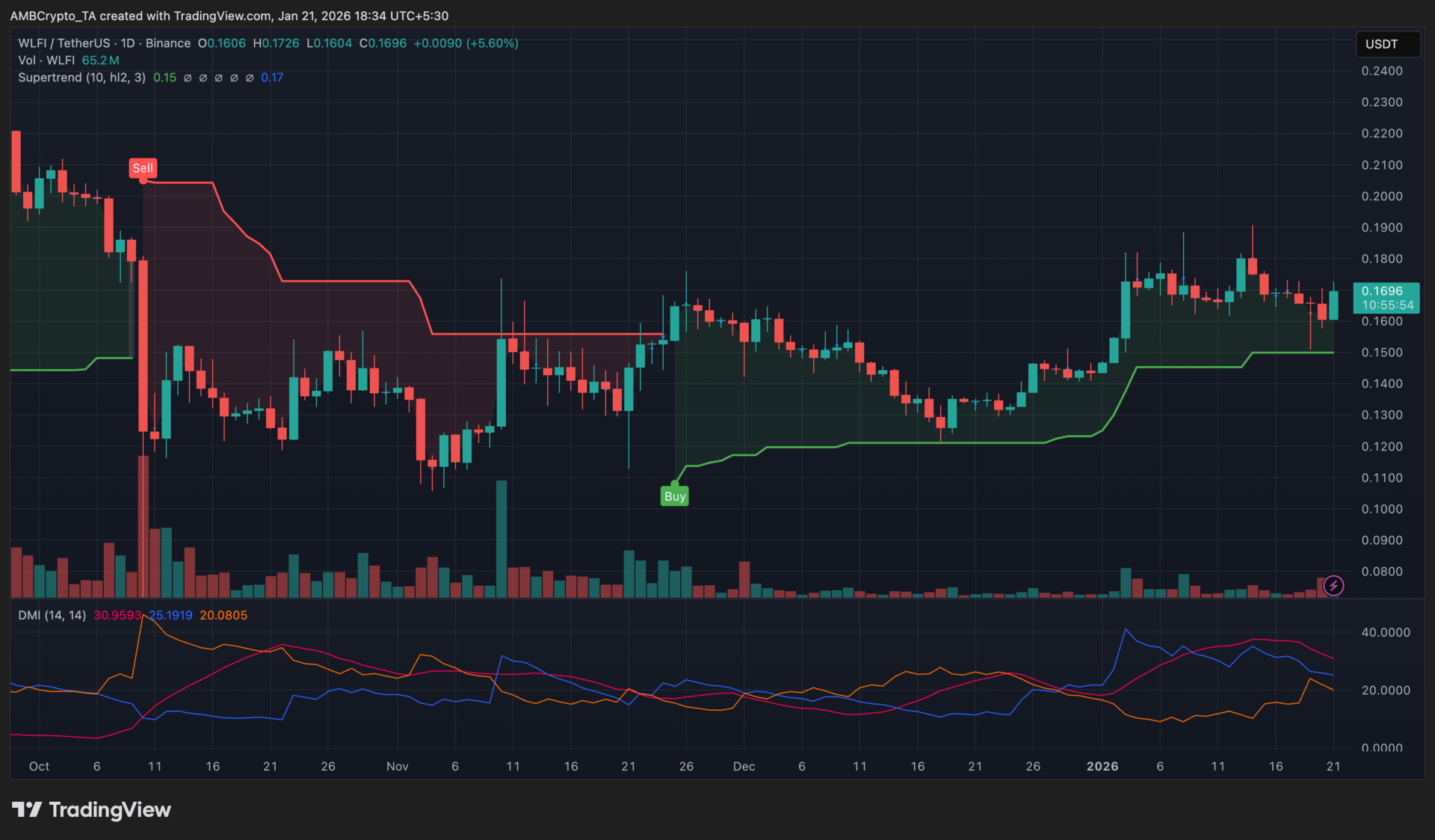

World Liberty Financial (WLFI)

Key points:

WLFI advanced toward the $0.17 region after rebounding from recent lows, with price action showing improving structure rather than a one-off spike.

The Supertrend remained supportive while DMI reflected strengthening direction, supported by a clear pickup in trading volume.

What you should know:

World Liberty Financial’s recent move marked a recovery phase after a period of pressure, with price carving out higher lows and reclaiming ground lost earlier in the month. The rebound showed follow-through across multiple sessions, suggesting buyers stepped back in with more intent than during prior failed bounces.

As things stand, the $0.155–$0.160 zone serves as the key support area to watch, while upside momentum faces its next test near the $0.175–$0.180 resistance band.

Indicator signals aligned with the price recovery. The Supertrend stayed below the candles, indicating the short-term trend remains intact as long as price holds above it. At the same time, DMI showed improving directional strength, pointing to a developing trend rather than choppy consolidation. Volume expanded during the rebound, confirming broader participation.

On the narrative side, renewed attention around WLFI’s governance activity and the expanding footprint of its USD1 stablecoin likely contributed to sentiment, helping underpin the recent advance despite broader market weakness.

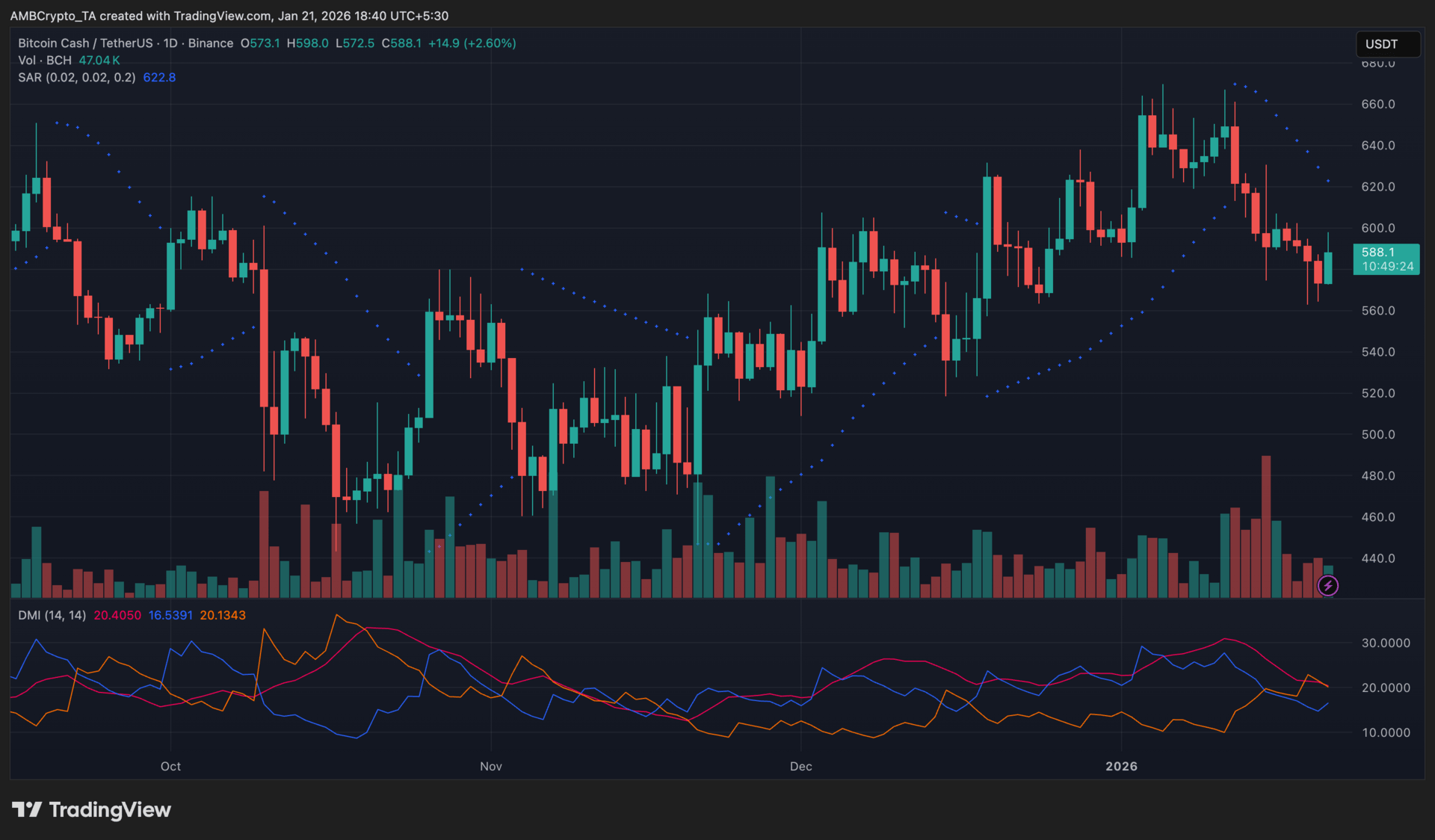

Bitcoin Cash (BCH)

Key points:

BCH rebounded from the $560–$570 zone, but bearish pressure remained visible as sellers continued to defend higher levels.

The Parabolic SAR stayed above price, while the DMI showed sellers in control with only moderate trend strength.

What you should know:

After slipping from the $650–$660 region, Bitcoin Cash found demand near the $560–$570 area, where buyers stepped in and pushed the price back toward the high-$580s. The rebound, however, unfolded under a bearish Parabolic SAR, suggesting the recovery lacked confirmation of a broader trend shift.

Momentum indicators reflected a cautious setup. The -DI remained above the +DI on the DMI, signaling that sellers still held the directional edge, while the ADX hovered near the low-20s, pointing to limited trend strength rather than aggressive continuation. Volume expanded during the bounce, highlighting reactive buying at lower levels, but it stayed below earlier distribution peaks.

Beyond technicals, sentiment was supported by reports of whale accumulation and ongoing ecosystem developments such as Cashinals activity and progress around the CashVM upgrade. For now, BCH faces immediate resistance around $595–$600, while the $560–$570 zone remains the key support to monitor.

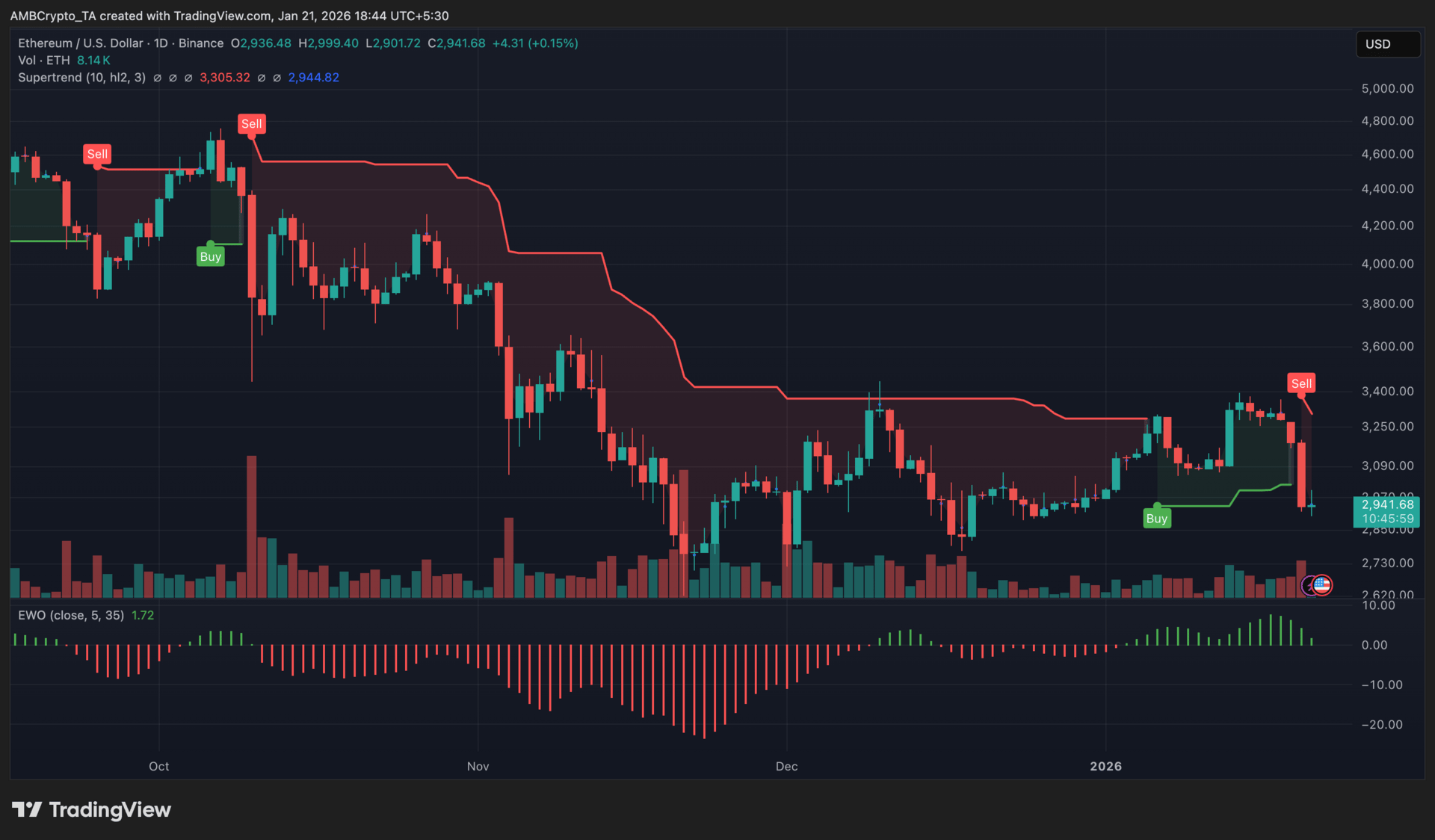

Ethereum (ETH)

Key points:

ETH remained under bearish pressure, with the Supertrend flipped overhead despite easing downside momentum.

Macro-driven selling and leverage unwinding weighed on price, even as short-term momentum stabilized.

What you should know:

Ethereum traded lower earlier in the session before finding temporary stability near the $2,940 level, as broader market sentiment turned risk-averse. Renewed macro uncertainty pushed traders away from high-beta assets, with ETH reacting more sharply than the wider market. This weakness was compounded by leverage unwinding, as long liquidations accelerated the move lower and added to near-term selling pressure.

On the technical side, the Supertrend stayed red and positioned above price, keeping the broader trend biased to the downside. However, bearish momentum began to ease. The Elliott Wave Oscillator flipped green after an extended stretch of negative readings, indicating slowing sell-side pressure rather than a trend reversal.

Volume during the bounce remained uneven and failed to expand decisively, suggesting buyers were cautious. Support sits near $2,900, while any recovery attempt needs a reclaim of the Supertrend to signal a clearer shift in structure.

How was today's newsletter? |