- Unhashed Newsletter

- Posts

- Trump Media’s token meets memecoin heat

Trump Media’s token meets memecoin heat

Reading time: 5 minutes

Trump Media’s token rollout coincides with Trump-branded memecoin scrutiny

Key points:

Trump Media plans to airdrop a non-transferable digital token to DJT shareholders via Crypto.com, positioning it as a rewards-based extension of its platforms.

The announcement arrives as wallets tied to the TRUMP memecoin moved about $94 million in USDC to Coinbase in December, drawing fresh attention to Trump-linked crypto activity.

News - Trump Media and Technology Group confirmed plans to distribute a new digital token to its shareholders in partnership with Crypto.com, marking the company’s most direct move yet into blockchain-enabled products.

Each ultimate beneficial owner of DJT shares is expected to receive one token per whole share, with token holders eligible for periodic rewards tied to Trump Media’s ecosystem.

The company said the token will be issued on Crypto.com’s Cronos network and will function as an access and loyalty instrument rather than a financial asset. Potential benefits may include discounts or perks linked to Truth Social, Truth+, and Truth Predict.

Trump Media emphasized that the token will not represent equity ownership, is not intended to be a security, and may be non-transferable and non-redeemable for cash.

A loyalty-first crypto model - Executives framed the initiative as a way to reward shareholders while driving engagement across Trump Media’s platforms, while maintaining regulatory clarity. The company also noted it retains the right to modify or cancel the program, with further details around timing and rewards expected in the coming year.

The token launch sits alongside Trump Media’s expanding financial footprint, including recently introduced Truth Social-branded ETFs and plans for additional equity and digital asset products.

Why the timing draws attention - The rollout comes as other Trump-linked crypto activity is under closer observation.

On-chain data cited by analysts showed wallets associated with the TRUMP project withdrawing roughly $94 million in USDC from liquidity pools in December, including a $33 million transfer on December 30 routed through Fireblocks to Coinbase-linked wallets.

While analysts cautioned that wallet labeling does not confirm ownership or intent, the flows coincided with the TRUMP token trading below $5 after a steep decline from earlier highs, keeping politically branded crypto firmly in the spotlight.

Fed liquidity surge clashes with rate uncertainty as Bitcoin stays stuck

Key points:

The Federal Reserve injected over $40 billion through repo operations in December, even as policymakers signaled no urgency to cut rates before early 2026.

Global liquidity has reached a record high, but Bitcoin remains range-bound as higher-for-longer policy expectations weigh on risk appetite.

News - The Federal Reserve injected a total of $40.32 billion into the US banking system through overnight repo operations in December, including a $16 billion operation on December 30 that was the second-largest since the COVID period.

The move underscored rising year-end funding pressures, despite official messaging that the activity reflects routine balance sheet management rather than emergency support.

At the same time, data cited by market analysts showed global liquidity reaching a record high, driven by fiscal flows, easing collateral conditions, and coordinated accommodation across major economies. Historically, such liquidity expansions have supported risk assets, including crypto.

Liquidity up, confidence still missing - Despite the surge in liquidity, Bitcoin has struggled to respond. The asset continued trading in a narrow $85,000 to $90,000 range, with thin volumes and subdued volatility.

Analysts pointed to the growing disconnect between abundant liquidity and restrictive monetary policy, with real rates still elevated and regulatory uncertainty lingering.

Federal Open Market Committee minutes released late December reinforced that tension. Policymakers signaled little appetite for near-term easing, stressing that inflation has not made sufficient progress toward the 2% target.

Several participants described December’s rate cut as finely balanced, while others argued rates should remain unchanged for some time.

2026 outlook keeps crypto in limbo - The Fed’s December dot plot revealed sharp internal divisions over the pace of rate cuts in 2026, with projections split between zero, one, or two cuts. Market pricing reflected that uncertainty, with low probabilities assigned to a January move and expectations pushed toward March or later.

Crypto analysts said sustained rate cuts remain a key catalyst for renewed retail and institutional interest. Until that path becomes clearer, Bitcoin’s stalled price action appears to reflect a market caught between rising liquidity beneath the surface and a policy stance that remains firmly cautious heading into the new year.

Ethereum stalls below $3K as network usage rises but conviction lags

Key points:

Ether remained capped below $3,000 as weak ETF flows and low leverage demand offset improving on-chain activity.

Record transactions, falling fees, and rising staking queues point to usage growth, but price momentum has yet to follow.

News - Ethereum continued trading below the $3,000 level, with repeated breakout failures keeping short-term sentiment fragile. Over the past week, ETH moved within a tight range near $2,900, reflecting a market caught between improving network fundamentals and persistent selling pressure from ETFs and derivatives traders.

Derivatives data showed muted bullish positioning, with ETH monthly futures trading at roughly a 3% annualized premium, well below neutral levels. At the same time, spot Ether ETFs recorded steady net outflows in the second half of December, weighing on confidence even as total assets under management remained large.

Activity surges while fees fall - On-chain data painted a more complex picture. Ethereum processed more than 2.2 million transactions in a single day in late December, the highest level on record, while average transaction fees fell to about $0.17.

Network fees declined sharply despite higher transaction counts, suggesting improved efficiency rather than fading usage.

Developer activity also remained strong. More than 8.7 million smart contracts were deployed in the fourth quarter, supported by real-world asset tokenization, stablecoin activity, and infrastructure development. Recent protocol upgrades aimed at scalability and validator flexibility were cited as contributors to lower fees and higher throughput.

Staking and buyers offer partial support - The staking landscape added another layer of support. The validator entry queue expanded sharply, with significantly more ETH waiting to be staked than exiting, often interpreted as confidence in long-term holding.

Separately, treasury firm BitMine Immersion Technologies accumulated nearly $98 million worth of Ether during late-December weakness, while staking additional holdings.

Why price remains stuck - Despite these signals, analysts noted that ETH’s path into 2026 remains mixed. ETF outflows, cautious leverage demand, and broader macro uncertainty continue to cap upside.

Until sustained network usage translates into stronger capital inflows, Ethereum’s improving fundamentals appear to support stabilization rather than a decisive rally.

Lighter’s LIT jumps into top DEX ranks as airdrop buzz meets early skepticism

Key points:

Lighter’s LIT token climbed into the top tier of DEX tokens by valuation following its airdrop and a Coinbase spot listing signal, overtaking Pump.fun and Jupiter.

Strong volumes and holder retention are fueling optimism, but analysts flag post-airdrop churn, falling revenue, and unclear token economics as key risks.

News - Lighter made a high-profile debut with its LIT token, quickly climbing the decentralized exchange rankings by valuation. After distributing 25% of its total supply through a community airdrop, LIT traded in the $2.7–$2.9 range, implying a fully diluted valuation near $2.7 billion.

CoinGecko data showed Lighter surpassing Pump.fun and Jupiter, placing it just behind Hyperliquid, Aster, and Uniswap in the DEX category.

Momentum was reinforced after Coinbase signaled plans to enable spot trading for LIT once liquidity conditions are met. On-chain data also pointed to early accumulation, with whale wallets depositing nearly $10 million in USDC to buy LIT shortly after launch.

Airdrop scale and early holder behavior - The launch followed one of the largest airdrops in crypto history. Bubblemaps reported that Lighter distributed about $675 million worth of LIT, ranking as the 10th-largest airdrop by dollar value.

Post-TGE data showed resilience among recipients, with roughly 75% still holding their tokens and a smaller share adding to positions.

Lighter’s visibility has also translated into activity. DefiLlama data showed 24-hour volumes rivaling Aster and trailing only Hyperliquid, while seven-day and 30-day volumes briefly outpaced both.

What traders are watching next - Post-listing sell pressure appears to be getting absorbed, with dip buyers stepping in near recent lows. LIT has defended the $2.60–$2.62 area, while resistance near $3.10–$3.12 remains the key level traders are watching. A failure to hold support could expose lower zones near $2.20–$1.95.

Optimism meets growing caution - Skeptics point to a 25% drop in open interest and declining revenue, which reportedly fell from about $1.5 million per day in November to $150,000 per day in December.

Critics also note that while Hyperliquid directs revenue to buybacks, Lighter’s value accrual model remains less defined. Whether LIT can sustain momentum may depend on user retention once airdrop incentives fade.

The Headlines Traders Need Before the Bell

Tired of missing the trades that actually move?

In under five minutes, Elite Trade Club delivers the top stories, market-moving headlines, and stocks to watch — before the open.

Join 200K+ traders who start with a plan, not a scroll.

More stories from the crypto ecosystem

‘National security’ at stake – Why U.S. stablecoin rewards face a China test

Bitcoin’s 2025 recap – 3.3% more retail buys while whales stepped back

Metaplanet boosts Bitcoin holdings to 35,102 – Risk shifts to shareholders?

Iran crisis: As the Rial collapses, can Bitcoin be the country’s lifeline?

Zcash leads Q4 privacy rally – Analyst foresees ZEC at $1,000

Did you know?

A Bitcoin transaction can outlive its sender: Bitcoin’s scripting system allows transactions to include time locks, meaning funds can be programmed to remain unspendable until a specific block height or future date, a feature that has quietly enabled use cases like inheritance planning and delayed settlements.

Ethereum upgrades don’t happen all at once: Ethereum network upgrades are executed through multiple coordinated hard forks, with changes activated at predefined block numbers rather than calendar dates, allowing developers and node operators to prepare well in advance and reducing the risk of network disruption.

Not all lost crypto is technically gone: Some cryptocurrencies include built-in recovery or reissuance mechanisms at the protocol or governance level, meaning losses from exploits or critical failures have, in rare cases, been reversed through consensus-driven changes rather than being permanently locked away.

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

Top 3 coins of the day

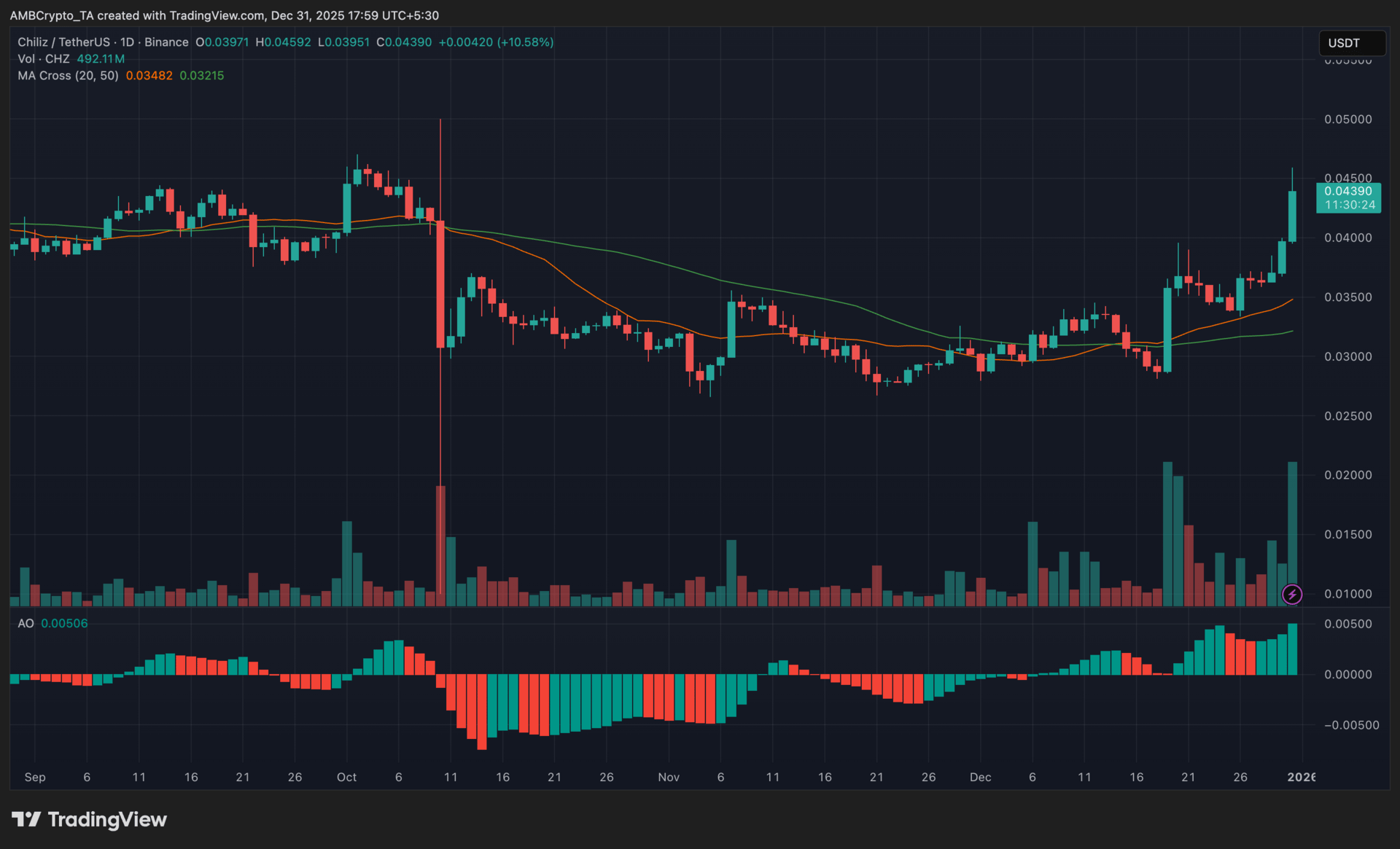

Chiliz (CHZ)

Key points:

CHZ climbed sharply and closed near $0.043 after reclaiming both the 20-day and 50-day moving averages on strong volume.

Momentum improved as the Awesome Oscillator stayed positive, while activity spikes suggested speculative interest returned.

What you should know:

Chiliz posted a decisive rebound, with the latest daily candle pushing from the $0.039 area toward a session high near $0.046 before settling higher. The move marked a clean close above both moving averages, with the faster MA holding above the slower one, signaling that the broader recovery structure remained intact.

Momentum indicators also supported the move, as the Awesome Oscillator stayed above zero and expanded further, pointing to strengthening bullish pressure rather than a brief bounce.

Volume picked up noticeably during the advance, confirming that the price expansion was backed by participation rather than thin trading.

Part of the rally aligned with renewed attention around the Decentral Protocol launch, which introduced fresh on-chain utility for CHZ within the sports-focused DeFi ecosystem. In parallel, short liquidations contributed to forced buying, amplifying the upside move.

From here, the $0.039–$0.040 zone remains a key support area to monitor, while the $0.046–$0.050 region stands as the immediate resistance to watch.

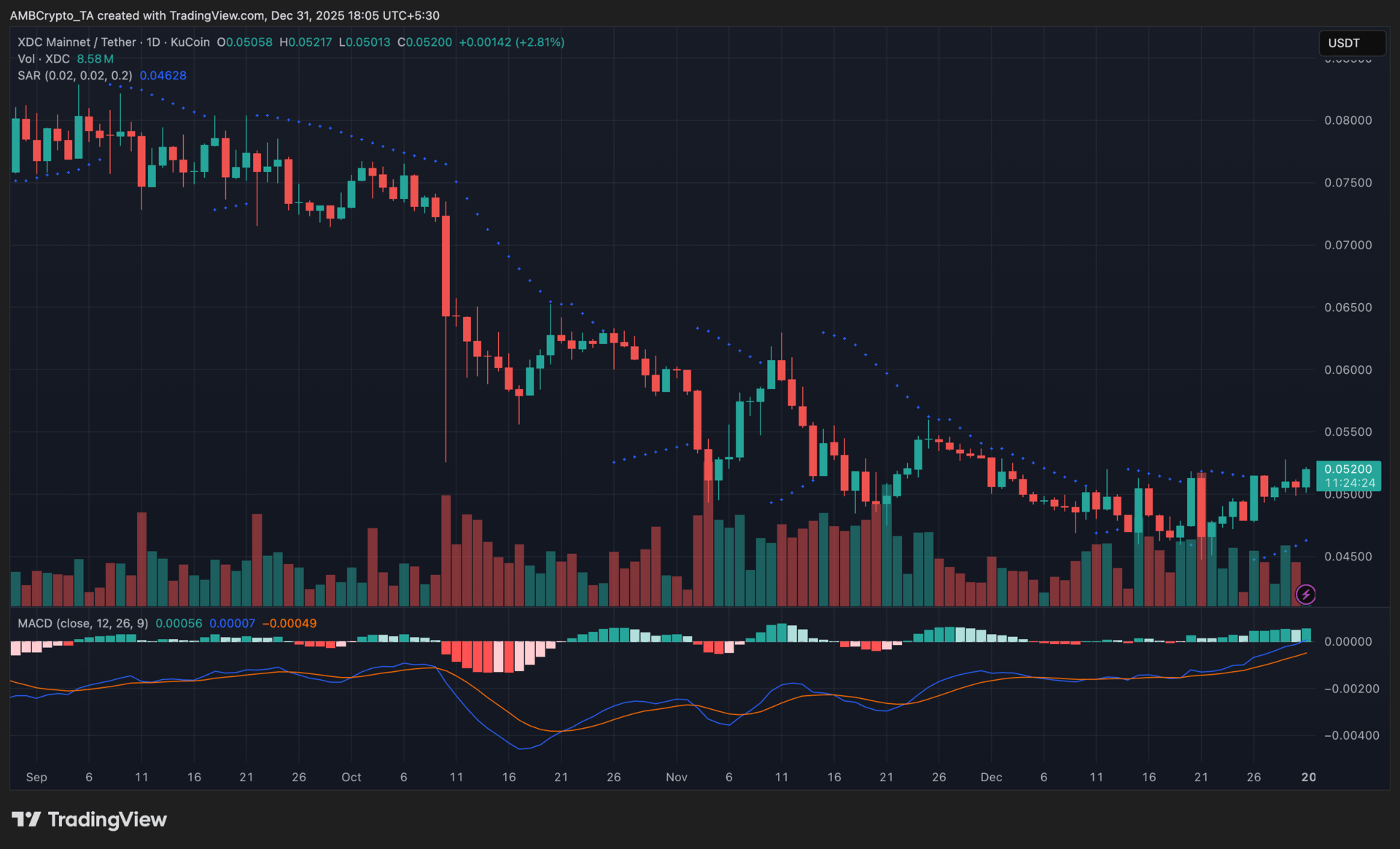

XDC Network (XDC)

Key points:

XDC was trading near $0.052 after a steady climb, with price holding firmly above the $0.05 base.

Improving momentum aligned with rising volume and ecosystem-driven interest rather than a purely technical bounce.

What you should know:

XDC’s recent upside unfolded as a measured recovery rather than a sudden breakout. Price consolidated above $0.05 and continued to edge higher, reflecting easing sell pressure after prolonged downside. The Parabolic SAR flipped below the candles, confirming that short-term trend control had shifted back toward buyers.

Momentum indicators echoed this shift. While the MACD histogram remained slightly below the zero line, consecutive green bars expanded over recent sessions, signaling strengthening bullish momentum instead of fading follow-through. The MACD line also stayed above the signal line, reinforcing the recovery structure.

This move coincided with rising spot volume, pointing to broader participation rather than thin liquidity. From a catalyst perspective, renewed attention around XDC’s trade finance narrative and recent exchange liquidity expansions supported sentiment during the rebound.

Looking ahead, $0.05 stands as immediate support, while $0.055 remains the key resistance zone to watch if momentum continues.

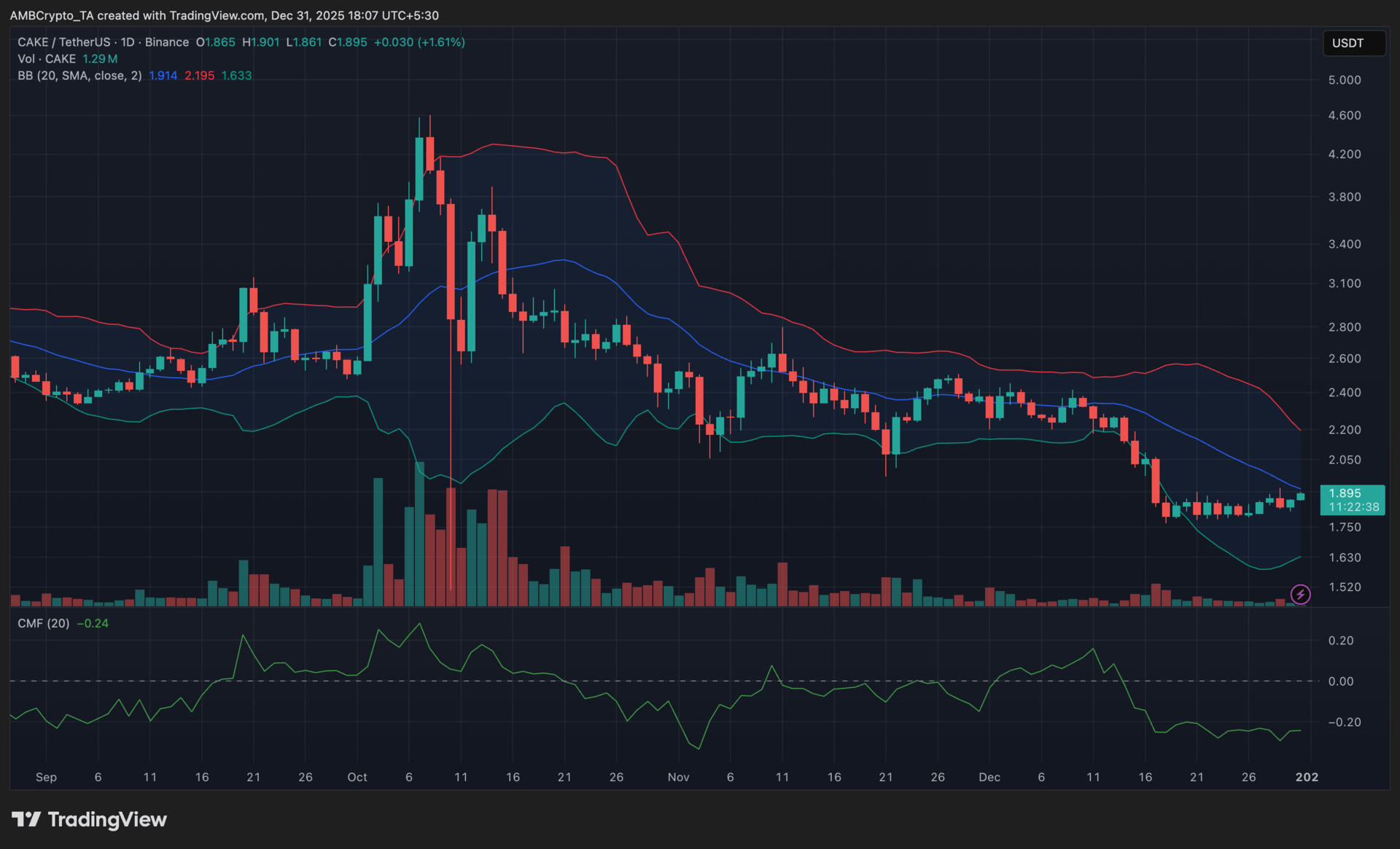

PancakeSwap (CAKE)

Key points:

CAKE traded near $1.90 after stabilizing above its recent $1.75 base, signaling a pause in downside pressure.

The rebound unfolded on lighter follow-through, keeping momentum cautious despite short-term gains.

What you should know:

CAKE’s latest move reflected stabilization rather than a decisive trend shift. After dipping below $1.80 earlier this month, price gradually recovered and held above that zone, suggesting sellers had eased control. However, the recovery stalled below the Bollinger Bands’ midline, keeping the broader structure corrective instead of bullish.

Volatility compressed as the bands narrowed, reinforcing the view that CAKE had entered a consolidation phase. While price moved away from the lower band, it failed to attract strong continuation buying. This was echoed by the Chaikin Money Flow, which remained negative near -0.24, indicating that capital outflows still outweighed inflows.

Volume behavior added context. Trading activity expanded during the prior sell-off but thinned during the rebound, pointing to short-covering rather than fresh accumulation.

On the catalyst front, continued engagement around CAKE.PAD launches and PancakeSwap’s multi-chain product expansion provided narrative support, but these developments have yet to translate into sustained spot demand. For now, $1.75 remains key support, while $2.00–$2.05 stands as immediate resistance to monitor.

How was today's newsletter? |