- Unhashed Newsletter

- Posts

- Trump's 401(k) shakeup: Bitcoin in play

Trump's 401(k) shakeup: Bitcoin in play

Reading time: 5 minutes

Trump’s 401(k) crypto order could reshape U.S. retirement and Bitcoin adoption

Key points:

President Trump signed an executive order allowing crypto and private equity in 401(k) retirement accounts.

Bitcoin climbed above $116K as traders eye inflows from the $12.5T retirement market and a broader shift in U.S. investment policy.

News - President Donald Trump has signed a sweeping executive order permitting cryptocurrencies, private equity, and real estate investments in 401(k) retirement plans, marking a major shift in how Americans can allocate their savings. The order directs the Department of Labor, along with the Treasury and SEC, to reassess existing restrictions and clarify fiduciary guidelines for including alternative assets in defined-contribution accounts.

With nearly $12.5 trillion held in U.S. 401(k)s, this move could open up a massive pool of capital to crypto markets. White House officials said the reform is part of a broader plan to diversify worker savings beyond traditional equities and bonds. While the order doesn’t guarantee immediate access, it offers regulatory momentum that asset managers and lawmakers could build on in the coming months.

Market reaction - Bitcoin rallied nearly 2% following the news, trading above $116,500 and approaching its late July peak. Ethereum saw a stronger surge, jumping over 7% to reclaim the $3,800 mark, while other major altcoins like Solana, XRP, and Cardano posted daily gains between 4% and 6%.

Derivatives activity also picked up, with open interest and volume increasing across major exchanges. Analysts and fund executives have described the move as “insanely bullish,” pointing to potential long-term inflows and mainstream adoption.

Why this matters for crypto - The executive order signals a significant shift in how digital assets are viewed within the broader U.S. financial system. For years, crypto access in retirement plans was largely restricted due to fiduciary concerns and regulatory ambiguity. By directing agencies to reevaluate those barriers, the administration is legitimizing crypto as a long-term investment option. Industry leaders see this as a potential game-changer that could deepen retail participation and strengthen crypto’s foothold in traditional finance.

Ripple bets $200M on stablecoin payments as XRP hits $3 milestone

Key points:

Ripple has announced a $200 million acquisition of Rail, a Canadian stablecoin payments firm, as it deepens its push into institutional finance and expands RLUSD and XRP use cases.

XRP crossed the $3 mark amid speculation of SEC case dismissal and growing institutional interest, but whale sell-offs and bearish divergence raise caution.

News - Ripple is doubling down on stablecoin infrastructure with its $200 million acquisition of Toronto-based Rail, aiming to become the global leader in B2B stablecoin payments. The deal, expected to close by Q4 2025 pending regulatory approval, will allow Ripple to integrate Rail’s virtual account technology and always-on settlement tools to streamline cross-border transactions using RLUSD and XRP.

This marks Ripple’s second major acquisition this year, following its $1.25 billion purchase of prime brokerage firm Hidden Road. CEO Brad Garlinghouse called the Rail deal a move to cement Ripple’s dominance in “the next phase of stablecoin innovation.”

The acquisition arrives just weeks after Ripple applied for a U.S. banking license and amid increased pressure from big banks to participate in stablecoin settlement flows. Rail currently services over 12 banking partners and is backed by Galaxy Ventures and Accomplice.

Legal resolution in sight? - XRP’s price surged over 4.5% to reclaim the $3 level this week, buoyed by expectations that the SEC could soon dismiss its long-running case against Ripple. The SEC and Ripple are scheduled to submit a joint status update to the court by August 15, and legal commentators suggest a pre-deadline dismissal is “more likely than not.”

Whale selling clouds rally - Despite the bullish headlines, on-chain data reveals that whales have offloaded over $1.9 billion in XRP since July 9, raising the risk of a 30% price correction if accumulation doesn’t resume. Analysts warn that unless XRP holds the $2.65 support zone, it could fall toward $2.06.

Technical breakout, ETF buzz - XRP also broke through resistance levels at $2.87, $2.92, and $2.97, briefly topping out at $3.02. High-volume trading on Korean exchanges like Upbit helped drive the rally. Meanwhile, SBI Holdings’ new Bitcoin–XRP ETF application has strengthened investor sentiment, especially among Asian institutions.

Europe’s harsh crypto rules clash with global shift

Key points:

The European Banking Authority finalized draft rules assigning a 1,250% risk weight to Bitcoin, Ether, and other “unbacked” cryptocurrencies.

The new framework may curb crypto adoption by EU banks, even as global regulators move toward greater digital asset integration.

News - The European Banking Authority (EBA) has finalized a sweeping set of capital rules requiring EU banks to hold far more capital against unbacked crypto holdings such as Bitcoin and Ether. The 1,250% risk weight under the Capital Requirements Regulation (CRR III) aims to harmonize exposure standards across the bloc and comes with strict guidelines on modeling market, credit, and counterparty risks.

The regulation prohibits offsetting crypto assets, meaning banks cannot balance Bitcoin and Ether holdings against one another when calculating capital requirements. For example, Italian bank Intesa Sanpaolo, which holds €1 million worth of Bitcoin, would be required to allocate €12.5 million in capital to meet compliance.

Global divide widens - While the EU doubles down on risk containment, the United States and Switzerland appear to be loosening the reins. U.S. regulators now permit banks to engage in crypto activities without prior approval, and Switzerland has updated its legal framework to support tokenized securities and stablecoin guarantees. This contrast in approach is raising concerns that Europe could fall behind in the global digital finance race.

MiCA alignment and industry impact - The finalized EBA guidelines align with broader MiCA regulations and Basel standards, signaling a maturation of the EU’s crypto oversight. While this may offer regulatory clarity, it also introduces hurdles for traditional institutions aiming to explore crypto services. Some banks, such as Revolut, may be insulated since their crypto services operate through off-balance-sheet entities. But for others, the capital burden could stifle innovation.

Phishing ads hijack Aave milestone as scammers exploit Google

Key points:

A day after Aave celebrated $60 billion in net deposits, fake Google Ads surfaced mimicking its platform to steal crypto wallets.

Security firm PeckShield flagged the phishing attack, which uses malicious links to drain funds from connected wallets.

News - Aave’s record-setting $60 billion in net deposits was quickly overshadowed by a sophisticated phishing scam targeting its users. Just 24 hours after the announcement, scammers used Google Ads to promote fake Aave platforms that trick unsuspecting users into linking their crypto wallets, ultimately draining their funds.

Blockchain security firm PeckShield raised the alarm on August 7, identifying a fake domain disguised to look like Aave’s official website. Once clicked, users were prompted to approve wallet transactions that silently handed control to attackers. While no specific losses have yet been confirmed, experts warned the reach of this attack was significant due to Google Ads propagation.

Familiar tactics, costly mistakes - This isn’t the first time fake Aave ads have appeared atop Google search results. Back in June, Scam Sniffer flagged similar activity. The method follows a wider phishing playbook, from fake airdrop videos featuring deepfakes to impersonated recovery services like Revoke Cash. In one extreme case this year, a U.S. investor lost $330 million in BTC through such a scheme.

Why 2025 is already the worst year for phishing - A recent report from Hacken revealed phishing and social engineering scams have already surpassed $600 million in stolen crypto in 2025, outpacing 2024’s full-year total. Tactics are becoming more polished, and even reputable search engines are being weaponized. With losses mounting, security awareness is no longer optional, it’s essential.

More stories from the crypto ecosystem

Interesting facts

The CFTC now permits spot crypto contracts on registered futures exchanges, marking a major regulatory shift toward legitimizing spot crypto trading under federal oversight via coordinated action with the SEC.

Mike Novogratz of Galaxy Digital says the crypto treasury craze has peaked, citing Strategy’s (formerly MicroStrategy) model of using debt to fund digital asset accumulation, but warning that newcomers may struggle as the trend matures.

Tornado Cash developer Roman Storm was recently convicted on one count of operating an unlicensed money-transmitting business, despite a partial jury deadlock on money-laundering and sanctions charges, spotlighting continuing legal scrutiny of crypto privacy tools.

Wall Street has Bloomberg. You have Stocks & Income.

Why spend $25K on a Bloomberg Terminal when 5 minutes reading Stocks & Income gives you institutional-quality insights?

We deliver breaking market news, key data, AI-driven stock picks, and actionable trends—for free.

Subscribe for free and take the first step towards growing your passive income streams and your net worth today.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

Top 3 coins of the day

Pendle (PENDLE)

Key points:

PENDLE rallied 9.80% in the last 24 hours to trade at $4.40, marking one of the top daily gainers amid renewed DeFi momentum.

The price broke above the Bollinger Band midline, while the Squeeze Momentum Indicator flipped red, reflecting early volatility post-surge.

What you should know:

Pendle extended its recovery as traders responded to the August 6 launch of Boros: a platform enabling on-chain funding-rate trading for perpetuals. While the price pushed toward the upper Bollinger Band, volume rose above the recent average, confirming strong buying interest. The Squeeze Momentum Indicator (SQZMOM) histogram, however, turned red after a green streak, suggesting increased short-term volatility as momentum cooled. This bullish move followed Pendle reclaiming the $4.00 level and advancing past the Bollinger basis line. Still, price action neared the $4.59 Fibonacci resistance zone, a level that may prompt consolidation or profit-taking in the coming sessions. Boros’ potential to tap into the $1T derivatives market has elevated utility-driven demand for PENDLE. With open interest caps set at $10M, early adoption could dictate whether this rally sustains. If bulls hold above $4.28, another leg up toward $4.59 remains likely. A dip below $4.00, however, could invalidate short-term momentum.

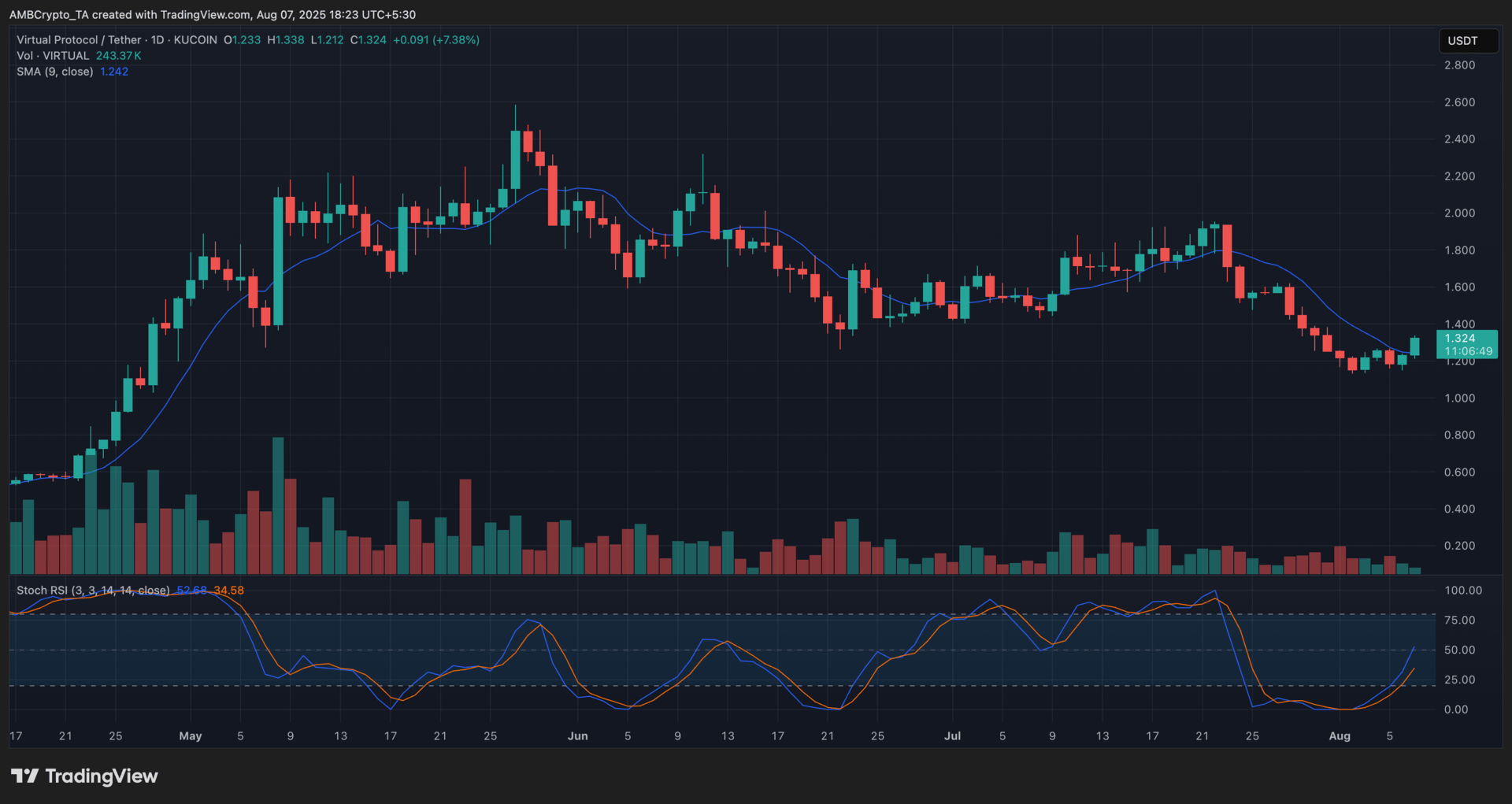

Virtuals Protocol (VIRTUAL)

Key points:

VIRTUAL jumped 7.38% over the past day to $1.32, rebounding sharply from local lows after Binance’s margin adjustment.

The price moved above the 9-day SMA for the first time in over a week, while the Stochastic RSI crossed into bullish territory near the 50 mark.

What you should know:

Virtuals Protocol staged a strong comeback after bouncing off the $1.21–$1.31 support zone. The upward move followed Binance’s August 5 decision to raise VIRTUAL’s collateral ratio, a change that reduced leverage risk and tightened circulating supply. Volume also picked up modestly, showing early buyer conviction. From a technical lens, the Stochastic RSI climbed from the oversold zone, hinting at improving momentum. VIRTUAL’s daily close above the 9-day SMA marked the first positive signal since late July, although the token still trades below major resistance near $1.56. The rally also aligned with retail buzz after VIRTUAL appeared in multiple trending altcoin lists, driving fresh demand from short-term speculators. Still, traders should be cautious of a potential rejection if $1.54 fails to flip into support. Holding above $1.31 remains critical for bulls to maintain this momentum and avoid a return to the broader downtrend.

Pudgy Penguins (PENGU)

Key points:

PENGU traded at $0.036 at press time, climbing 3.71% on the day and continuing its 144% 30-day rally.

The price hovered above the 20-day SMA, while the RSI stood at 58.14, showing healthy momentum without overbought signals.

What you should know:

PENGU resumed its uptrend after rebounding from the $0.032 support zone, a level now reinforced by the 20-day moving average. Despite a post-listing dip on August 5, the token regained strength after whales accumulated over 14B tokens, taking advantage of lower prices. Volume remained high, helping validate the recovery as traders rotated into high-beta altcoins. The meme-NFT hybrid asset also gained traction following its listing on Robinhood Advanced, which opened up exposure to U.S. retail traders. The Relative Strength Index (RSI) stayed below 60, suggesting room for further upside if sentiment holds. On-chain and trading data reflect strong speculative momentum, but any failure to hold above $0.035 could open downside toward $0.032 or $0.025. A daily close above $0.040 would mark a bullish breakout and likely attract further capital inflows. Retail accessibility and rising altcoin liquidity continue to drive PENGU’s narrative as a leading meme-sector token.

How was today's newsletter? |