- Unhashed Newsletter

- Posts

- U.S shutdown sets crypto ablaze

U.S shutdown sets crypto ablaze

Reading time: 5 minutes

Bitcoin, Ethereum stay strong as U.S government shutdown sparks market jitters

Key points:

Despite the threat of government instability, Bitcoin and Ethereum prices remain relatively untouched.

Market now leaning towards traditional safe havens, as Gold surged to a record high.

News - The cryptocurrency market has been remarkable resilient as the U.S government shut down. This scenario has historically introduced significant global market uncertainty. And yet, both Bitcoin and Ethereum have remained stable, trading at approximately $116K and $4.3K, respectively.

“Buying opportunity?“ - While prediction markets are seeing heightened anxiety, some market experts are now bullish. For example - John Glover, Chief Investment Officer at Bitcoin lender Ledn, claimed that any price dips resulting from a shutdown could present a "buying opportunity." In doing so, he cited quick market recoveries after past, temporary funding disputes during the Trump administration.

Key concerns - The primary concern for analysts is not the immediate price action, but the long-term ripple effects of an extended shutdown. A lapse in funding would halt the release of crucial U.S macroeconomic data, including jobs and inflation figures. This would further complicate the Federal Reserve's policy decisions.

This decision will also affect “non-essential operations” at key regulatory agencies, specifically the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). This would likely delay decisions on crypto-related regulatory frameworks and critically, the review and potential approval of various Spot ETF applications.

Safe-haven asset - In contrast to crypto's relative stability, Gold surged to a record high of $3.8K per ounce - Up nearly 47% year-to-date. It solidified its traditional role as a safe-haven asset in times of political and economic instability.

Ripple CTO David Schwartz to step down, but XRP whales remain confident

Key points:

Long-time Ripple CTO David Schwartz to step away from daily operations.

Despite initial fears, whales continue to be confident in XRP.

News - After more than 13 years, David Schwartz, the long-standing Chief Technology Officer (CTO) of Ripple, will be stepping down from his daily operational duties at the end of the year.

However, Schwartz clarified in an X post that he isn't disappearing. Instead, he'll transition to CTO Emeritus and take a seat on Ripple's Board of Directors to continue influencing the company’s long-term strategy. He also plans to return to his roots as an independent coder, running his own XRP Ledger (XRPL) and exploring fresh use cases for the altcoin.

Whales continue to move - Schwartz's transition comes on the back of strong signals from the market's biggest players - XRP whales. They are actively betting on the token’s future.

Whales holding between 10 million and 100 million tokens aggressively accumulated over 120 million XRP in the last three days alone - Worth roughly a cool $340 million.

This accumulation means that whales now control about 8% of XRP’s total supply - A sign of solid belief in the asset's trajectory. This confidence can be echoed by market analysts, with some claiming that the altcoin may be primed for a sudden and powerful upward move.

Cardano's big bet - How new tech aims to make Bitcoin more usable

Key points:

Charles Hoskinson believes the era of Bitcoin’s extreme price swings is coming to an end.

Cardano's main goal is to unlock BTC's liquidity by building a specialized Bitcoin DeFi network.

News - Charles Hoskinson has been watching the crypto market churn since 2010. In an interview with CNBC, he revealed the drill - BTC spikes, value bleeds into altcoins, and then, the whole market crashes before slowly recovering.

However, Hoskinson, the founder of Cardano, believes this era is ending.

The arrival of institutional giants like BlackRock and Franklin Templeton has completely changed the game. According to Hoskinson, the massive influx of institutional money and complex financial products like derivatives means those wild, 90% boom-and-bust cycles are likely over.

It’s still good news - "It's a bittersweet thing, because I kinda miss the crazy days," Hoskinson admitted. However, he stressed that well-regulated markets bring in major players who focus on stability and risk management.

This structural maturity makes it much harder for the market to fall victim to the speculative, "Wild West" volatility. This shift, he argued, is the industry finally growing up.

Bitcoin DeFi underway! - Cardano's development team is not just observing this trend; they're trying to capitalize on it by making Bitcoin more functional.

Over the next year, Cardano plans to roll out features that will allow users to transact using Bitcoin, pay network fees in BTC, and earn yield back in BTC.

The team anticipates this could bring billions of dollars in Total Value Locked (TVL) from the Bitcoin network into the Cardano ecosystem.

Cardano’s upgrades continue - Not just Bitcoin, but Cardano is also preparing for its Hydra Layer-2 upgrade, designed to increase transaction capacity up to a projected one million transactions per second.

Its partnerships with FC Barcelona and Brazil's federal agency, SERPRO, will solidify its position as a reliable platform.

The new ‘credibility crisis‘ affecting EU stablecoin regulations

Key points:

Debate over multi-issuance stablecoins is exposing significant friction between major EU bodies.

If the EU cannot achieve unified clarity on this financial risk issue, it won’t be able to effectively regulate the broader digital asset market.

News - The European Union's chief financial risk regulator is pushing for a ban on stablecoins issued by multiple firms across different jurisdictions. In doing so, it is citing major fears such as "multi-issuer schemes" possibly triggering a financial crisis.

The European Systemic Risk Board (ESRB), an EU watchdog, highlighted this risk in its 2025 Non-bank Financial Intermediation Risk Monitor. While the EU's MiCA regulation has already introduced reserve and governance requirements for stablecoin issuers, the ESRB identified a critical loophole - Multi-issuer stablecoin arrangements with a third country.

Reasons behind the ban - The ESRB's concern centers on the possibility of a bank run on a stablecoin, where an EU and a non-EU country issue the same token. In such a scenario, an EU country may not hold enough reserve assets to cover a mass redemption event. There is also a contagion risk - The failure of a third-country stablecoin issuer could trigger a rush for the EU issuer.

Simply put, since the MiCA regulations lack provisions addressing solutions if this scenario arises, the failure of one branch could transmit stress across EU’s financial system. This could lead to the region’s instability.

The proposal - To close this gap, the ESRB is advocating for policymakers to take action against stablecoin schemes that involve non-EU firms. The proposed measure would effectively ban or severely restrict the issuance of tokens under such shared arrangements, ensuring that MiCA's prudential rules stay unrelenting despite ongoing international pressures.

Credibility crisis - Judith Arnal of the Bank of Spain, in a report published in early September, highlighted that internal disagreements between the European Commission, the ECB, and the European Parliament risk signaling to the world that MiCA is "fragile and subject to diverging interpretations."

She argued that regulatory infighting on such a key issue as stablecoin issuance "exposes a deeper challenge for MiCA’s credibility as a global benchmark."

More stories from the crypto ecosystem

Ethereum: Psychology or fundamentals, what really moves ETH's price?

Bitcoin becomes a problem: $10.3B dilution risk stares MicroStrategy in the face

Will FTX's $1.6B liquidity injection help the crypto market this October?

Bitcoin wipes $180mln in shorts - So why hasn’t BTC broken out yet?

'Ethereum is one of the biggest macro trades over the next 10-15 years' - Tom Lee

Did you know?

In August 2010, a major vulnerability in the Bitcoin mining protocol allowed a hacker to generate an astronomical 184.467 billion Bitcoins in a single block. Known as the "value overflow incident,” this would have made the perpetrator the wealthiest person alive by an immense margin, if successful. Fortunately, the anomaly was detected and corrected in five hours.

Changpeng “CZ” Zhao remains the undisputed king of crypto, retaining an estimated 90% stake in Binance, the world's largest exchange. As of today, his net worth stands at $79.5 billion, making him the richest individual in the crypto sector and among the top 25 richest people globally.

Crypto adoption in North America has slowed significantly since the implosion of FTX in Nov 2022 and the domino collapse of crypto-centric banks like Silvergate in March 2023. Surprisingly, adoption is booming in developing markets. India leads the way, followed by Nigeria and Vietnam.

Top 3 coins of the day

Pump.fun (PUMP)

Key points:

PUMP retains its $2B market cap as bullish sentiments continue to rise.

However, the Bollinger Bands signal overbought conditions.

What you should know:

Pump.fun (PUMP) broke into the scene with one of the most anticipated ICOs of 2025, quickly topping the $2 billion market cap. It hasn't given up the momentum from its explosive launch yet, settling into a trading volume of $810.71M in the last 24 hours.

Its bullish structure was also reflected in the price charts. Over the past day, PUMP rose over 23%, trading at $0.006640. The RSI reflected its bullish trajectory, showing a breakout after a long period of consolidation - a positive sign for traders looking to scoop up PUMP.

However, the Bollinger Bands reflected overbought conditions after a week-long consolidation trend. Thus, there is a possibility that the memecoin could reject its bullish trend in October.

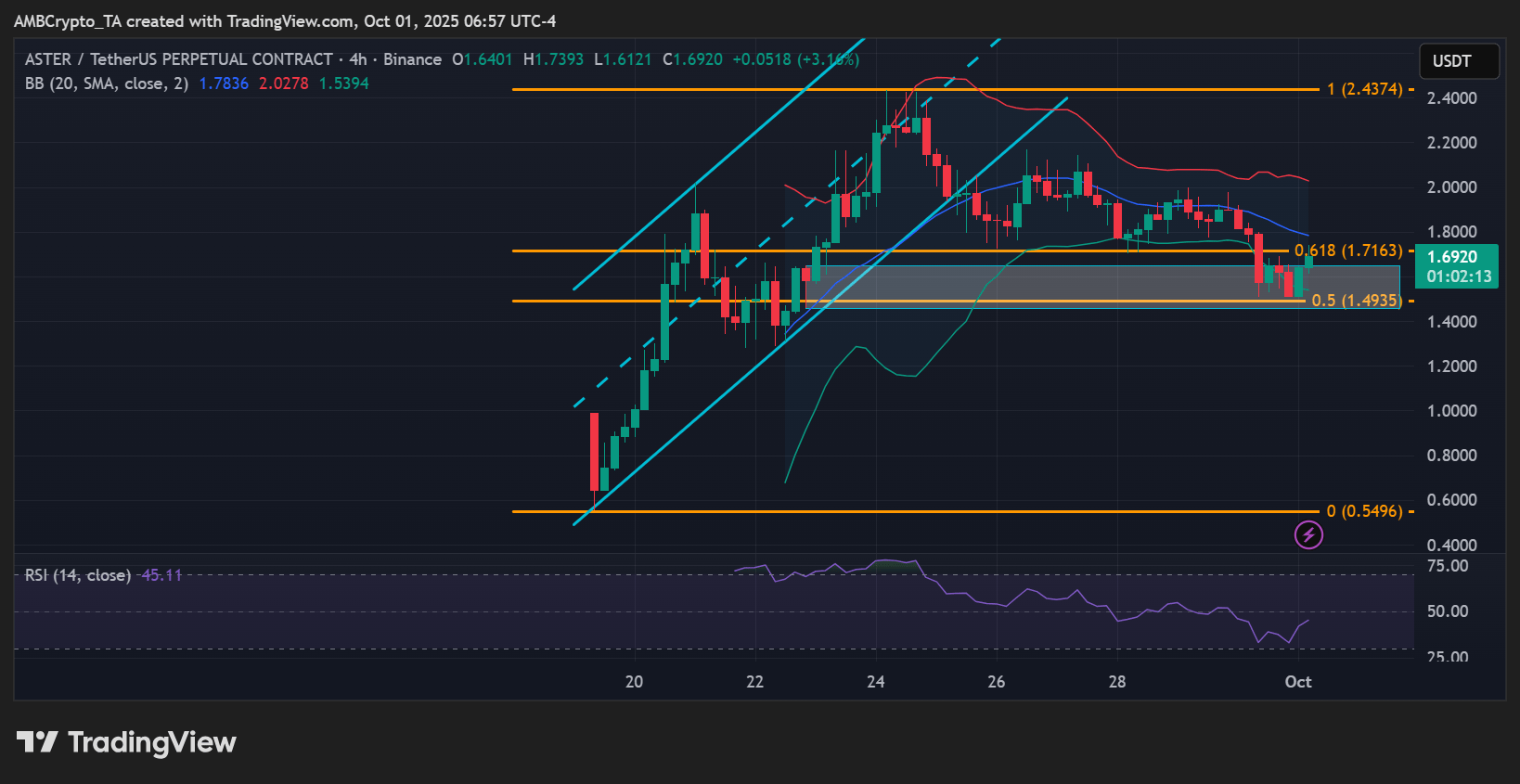

Aster (ASTER)

Key points:

ASTER’s sell pressure remains intact, with no signs of letting up.

The $1.6 support level is of crucial importance right now - failure to maintain this support will cause prices to spiral further.

What you should know:

Unlike PUMP, Aster has not had the best post-launch momentum. A star-studded debut in early September has done little to keep it afloat. In fact, ASTER has been in a downtrend over the last 7 days, dropping 28.44% this week and a 5% fall today.

The 4-hour chart does not offer much support for weary traders, too. ASTER failed to sustain its major $1.6 support level, reflecting over overbearing "sell" mood in the market. Now trading at $1.70, ASTER is testing the $1.6 support again. Failure to hold this level will translate to another major support at $1.50. The RSI remains below neutral levels as well, indicating a bleak road ahead for the coin.

However, all is not lost yet. A breakout of the current resistance at $1.70 can cause ASTER to reach $1.80 with ease, following which the price may even cross the $2 level.

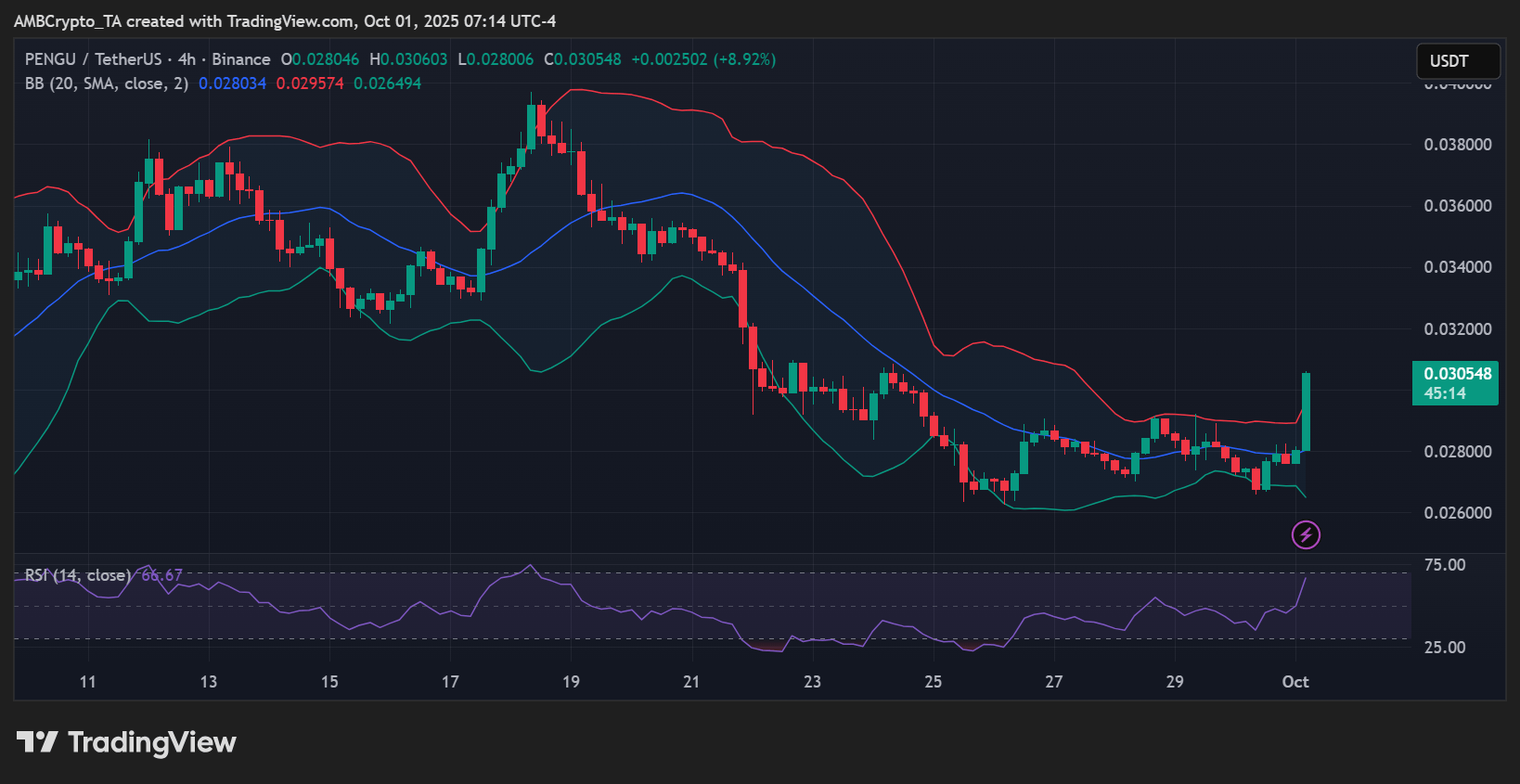

Pudgy Penguins (PENGU)

Key points:

PENGU remains in overbought territory, with the RSI and Bollinger flashing sell signals.

After two weeks of downtrend, the memecoin is up 12% in the last 24 hours.

What you should know:

PENGU's volatility this year has left sellers excited and buyers stunned. Since falling to an all-time low of $0.003715 on the 9th of April 2025, the memecoin has racked massive gains, even accumulating 12.54% gains in the last 24 hours with a market cap of $1.91B. Its 24-hour volume rose 19.03% in the last 24 hours as well, reaching an impressive $385.85M.

On the 4-hour chart, though, PENGU looks overbought. Though the memecoin gained today, it was after a steady fall over the last two weeks - not much home to write home about, in the long run. The memecoin is firmly in overbought territory right now, with its RSI and Bollinger Bands both flashing "sell" signals.

Still, it's too early to make a calculated guess. PENGU has made a name for itself this year with its multiple highs and crashes, and the memecoin could exceed expectations and fly once again.

How was today's newsletter? |