- Unhashed Newsletter

- Posts

- Uptober sparks FOMO!

Uptober sparks FOMO!

Reading time: 5 minutes

Bitcoin recovers by 4% amid ‘Uptober’ hopes - Will the uptrend extend?

Key points:

BTC reclaimed $114K, lifting the broader altcoin sector amid ‘Uptober’s’ bullish expectations.

Friday’s Jobs report could determine whether the rally extends itself.

News - Bitcoin surged by 4% on Monday and reclaimed $114K amid renewed bullish sentiment ahead of historically positive ‘Uptober’ season. The bounce came after BTC slipped below $109K last week. At the time of writing though, it was valued at $113K.

Whalecoiners (holders with at least 1 BTC) also slowed down their sell-offs as exchange inflows slipped to cycle lows. This has further underscored a structurally positive outlook into Q4.

Assessing Q4 catalysts - After a series of billion-dollar liquidations and ETF outflows in late September, the crypto market appeared ready for some relief.

Similar to BTC, other large caps like ETH, SOL, and XRP recovered by 4% on average on Monday. Apart from the positive macro landscape of low interest rates and more Fed rate cut expectations, there were some crypto-specific catalysts for the rally as well.

Whale and long-term holder sell-offs have eased though. In fact, the number of coins being sent by whalecoiners to the Binance exchange dropped to a cycle low of 30K BTC.

Compared to 2024’s exchange selling pressure of 45K BTC, 2025’s reading means those with at least 1 BTC weren’t quick to sell. Additionally, long-term holders who have held BTC for more than six months also eased their dumping spree that began in July.

The low selling pressure could allow the rally to extend itself.

Bitcoin has recorded averages of 22% and 45% returns in October and November, respectively, since 2013. Hence, the positive Q4 seasonals could also set BTC for a major rally, according to LMAX Group’s Joel Kruger.

“Against the backdrop of a landmark year for crypto — marked by significant advances in adoption and regulation — these seasonal tailwinds could set the stage for bitcoin to challenge and even surpass previous record highs before year-end.”

Potential risks to the rally - According to Paul Howard, Senior Director at trading firm Wincent, the U.S Jobs report scheduled for 03 October could be delayed by the looming government shutdown.

Howard added that with no clear view of labor markets, the Fed could hold the interest rate steady at its next meeting and stall the recovery.

Solana - Is $250 target likely ahead of ETF approval?

Key points:

Over 3 million SOL has been accumulated ahead of a likely ETF approval.

SOL could face wild price swings between $202 and $217 in the near term.

News - Solana’s recent 25% discount below $200 attracted aggressive buyers that triggered a +10% recovery to $214.

However, the extent of bidding during the pullback suggested traders were front-running the likely ETF approval. The SEC is expected to make a decision by 10 October, and the recent accumulation spree means traders have been actively positioning for a positive outcome.

Healthy demand in Spot markets - During the correction, Binance retail accounts with long positions increased from 54% to 78%. That was strong bullish conviction at the peak of the recent sell-offs.

The appetite for the altcoin in the Spot markets was further reinforced by the Cumulative Volume Delta (CVD). It showed as much as $72 million in buying volume in the past few hours.

SOL’s Balance on Exchanges also supported the bullish positioning. As SOL’s correction deepened from $253 to $190 over the past few days, the overall SOL across exchanges declined from 32.7 million SOL to 30 million SOL.

In fact, the 10% recovery from $190 to $214 was marked by a further drop in SOL Balance on exchanges to 29.5 million SOL. In other words, people unstaked or bought and moved their SOL off exchanges - A bullish cue.

Based on Glassnode’s MVRV extreme deviation pricing bands, the next upside targets for SOL could be $227, $297, or a likely cycle top at $368.

On the lower side, $157 and $155 ( A realized price or average cost basis for most of the supply) could be potential support levels. Especially in the case of an extended correction in the mid-term.

Short-term volatility- In the meantime, however, leveraged SOL traders must deal with potential volatility in the short term. Especially around the key macro data release on Friday. The liquidation heatmap marked out $207 and $202 as lower liquidity pools that could attract price action.

At the same time, upside liquidity zones at $215 and $217 could also become potential price magnets. In case of wild price swings, these levels could be tagged this week.

‘It will be foolish ’ - Coinbase CEO warns Senate against stablecoin rewards ban

Key points:

Banking industry is targeting the CLARITY Act to push for a ban on stablecoin rewards.

Coinbase CEO slammed the move and warned Congress against banks’ efforts.

News - Coinbase CEO Brian Armstrong has hit out at “big banks” for their aggressive push to ban stablecoin yield.

In a recent statement, Armstrong castigated banks for pushing to “maintain their monopoly” at the expense of the common American consumer. He also warned the U.S Senate that it would be foolish to bend to banks’ demand.

Crypto defends stablecoin rewards - In mid-August, a group of bank trade associations sent a letter to the U.S Congress. It warned that the stablecoin law, GENIUS Act, had ‘loopholes’ that allow rewards via affiliates and exchanges.

The banking industry cautioned that stablecoin rewards would trigger a “$6.6 trillion banking deposit outflow” as users migrate to crypto. According to them, this would make it difficult to lend money to small and medium enterprises, with a potential negative impact on the economy.

For their part, crypto leaders clapped back at the traditional players. The Armstrong-backed advocacy group, Stand With Crypto, warned that “banks want another bailout” with their latest push.

The organization added,

“The Big Banks want to take away that right and are lobbying Congress to actually take money out of your pocket. Their action isn't pro-consumer, it's anti-competitive plain and simple.”

With the GENIUS Act now signed into law, the banking lobby is eyeing the comprehensive market structure bill, the CLARITY Act, to codify the stablecoin yield ban from exchanges.

The bill is expected to hit the Senate voting floor by the end of the year. Hence, it’s the only window for banks to keep crypto away from one of their cash cows - Interest earned from Treasury bills.

What’s next - It remains to be seen who will emerge as the winner in this billion-dollar fight between crypto and banks. However, given the well-oiled crypto lobby and a friendly Trump Administration, stablecoin issuers might be ready to challenge banks.

Stablecoins are currently a $280 billion industry, with the same projected to be worth $2 trillion by 2028.

SWIFT taps Consensys to build faster blockchain-based cross-border alternative

Key points:

Consensys plans to help SWIFT overhaul its cross-border system.

SWIFT is seeking an on-chain version of its messaging platform for faster and cheaper payments.

News - Consensys, the firm behind MetaMask wallet and Ethereum L2, Linea, has been tapped by SWIFT to help develop a model next-generation cross-border payment platform based on blockchain.

SWIFT’s plans to “extend its network with blockchain infrastructure” are expected to be a “convergence,” not a clash. So, why the sudden pivot from the world's largest network of international banks?

Stablecoin effect - Crypto now offers near-instant, transparent, and cheap transfers via stablecoins. And, everyone is pivoting. Including old players like MoneyGram as they face intense criticism of slow and expensive remittances, especially for retail.

In particular, some crypto players like Ripple have openly challenged SWIFT’s old and slow infrastructure and positioned themselves as an alternative for banks.

Amid this pressure, SWIFT responded with a pilot that incorporates a ledger and integrates 30 bank partners to explore the viability of cheaper and faster retail international payments.

There are rumours that the platform will be built on top of Linea and could take months to finalise.

Overall, it is a step in the right direction and a win for retail users on the SWIFT network. Currently, SWIFT transfers can extend to a couple of days and +10% in fees in some payment corridors.

More stories from the crypto ecosystem

Interesting facts

The tokenized market could double in 2025 and surpass stablecoin supply by 2030 as Wall Street embraces crypto. Currently, the market size is $31 billion. Bitwise expects the market to hit $50 billion by 2035 amid an intense push by the SEC and Wall Street players to offer tokenized stocks, ETFs, and other related services.

The new Aster DEX has flipped Hyperliquid's 30-day fees, becoming one of the top revenue-generating DEX and crypto platforms in September. Aster raked in $121M in fees, second only to Tether’s $652M. Hyperliquid came in seventh at $85M, with CZ linking Aster’s outperformance to ‘lower fees, higher volume.’

Public companies, led by Strategy, have doubled their BTC holdings in 2025. Their overall stash increased from 688K BTC to 1.124 million BTC on a year-to-date basis. ETFs also saw traction. However, not at the pace of public companies, with about 300K BTC acquired in 2025.

Top 3 coins of the day

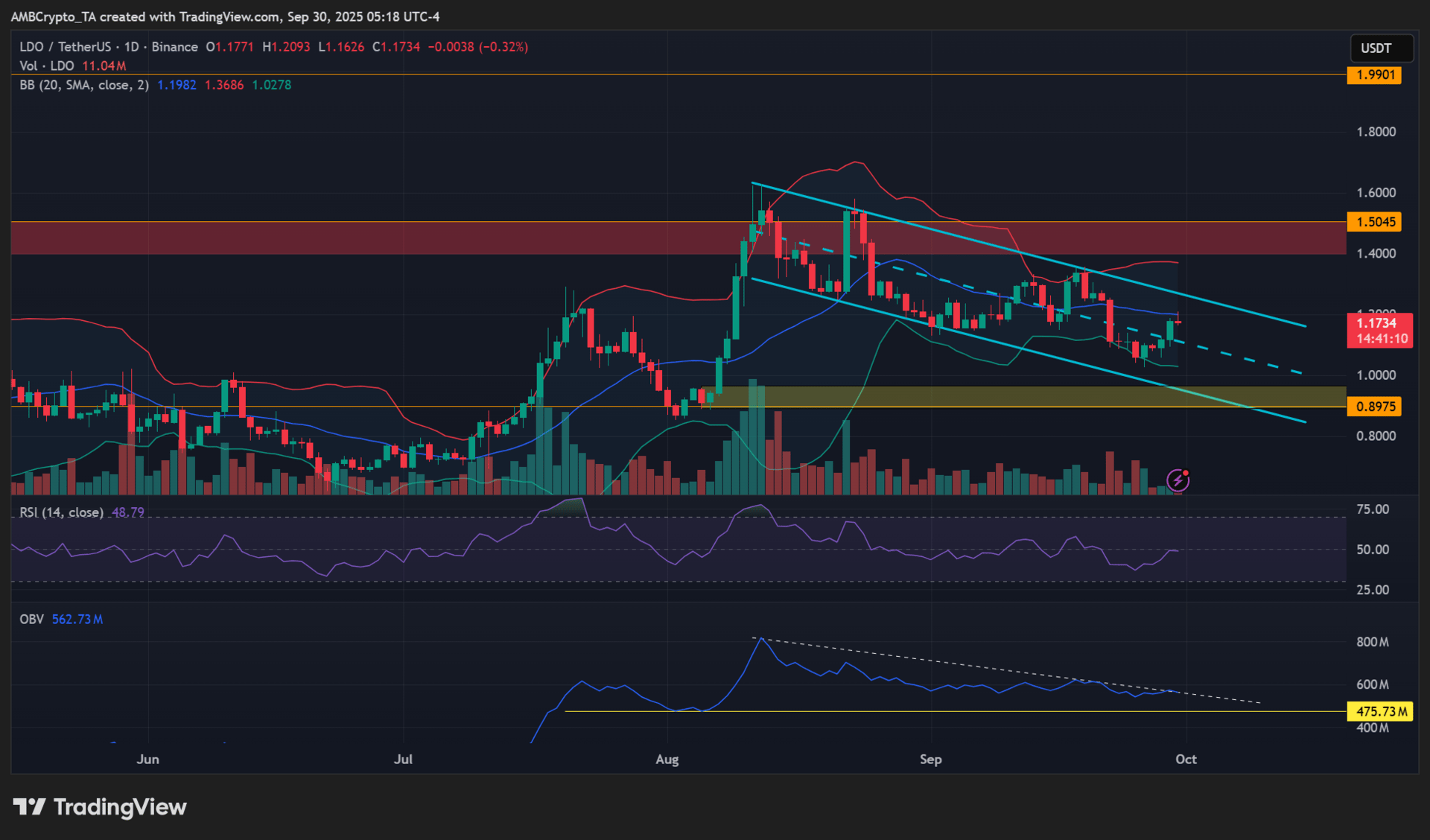

Lido (LDO)

Key points:

Lido gained on the charts, but was still on a downtrend at press time.

A decisive OBV breakout from the trendline resistance could extend the recovery.

What you should know:

Lido (LDO) topped the daily gainers list on CoinMarketCap with a nearly 8% jump on Monday. Overall, the Ethereum staking platform’s native token was up +15% in the past four days of trading. It jumped from $1.0 to over $1.20.

However, its price pattern of lower lows and lower highs meant it was still in a downtrend. But can it flip the market structure to bullish ahead of likely ETF staking in October?

Such a shift could be confirmed by a decisive OBV (On Balance Volume) break above the trendline resistance. Additionally, a daily RSI jump above the neutral level and higher could support an extended recovery scenario.

Otherwise, LDO could slip to $1 or $0.9 if the downtrend persists.

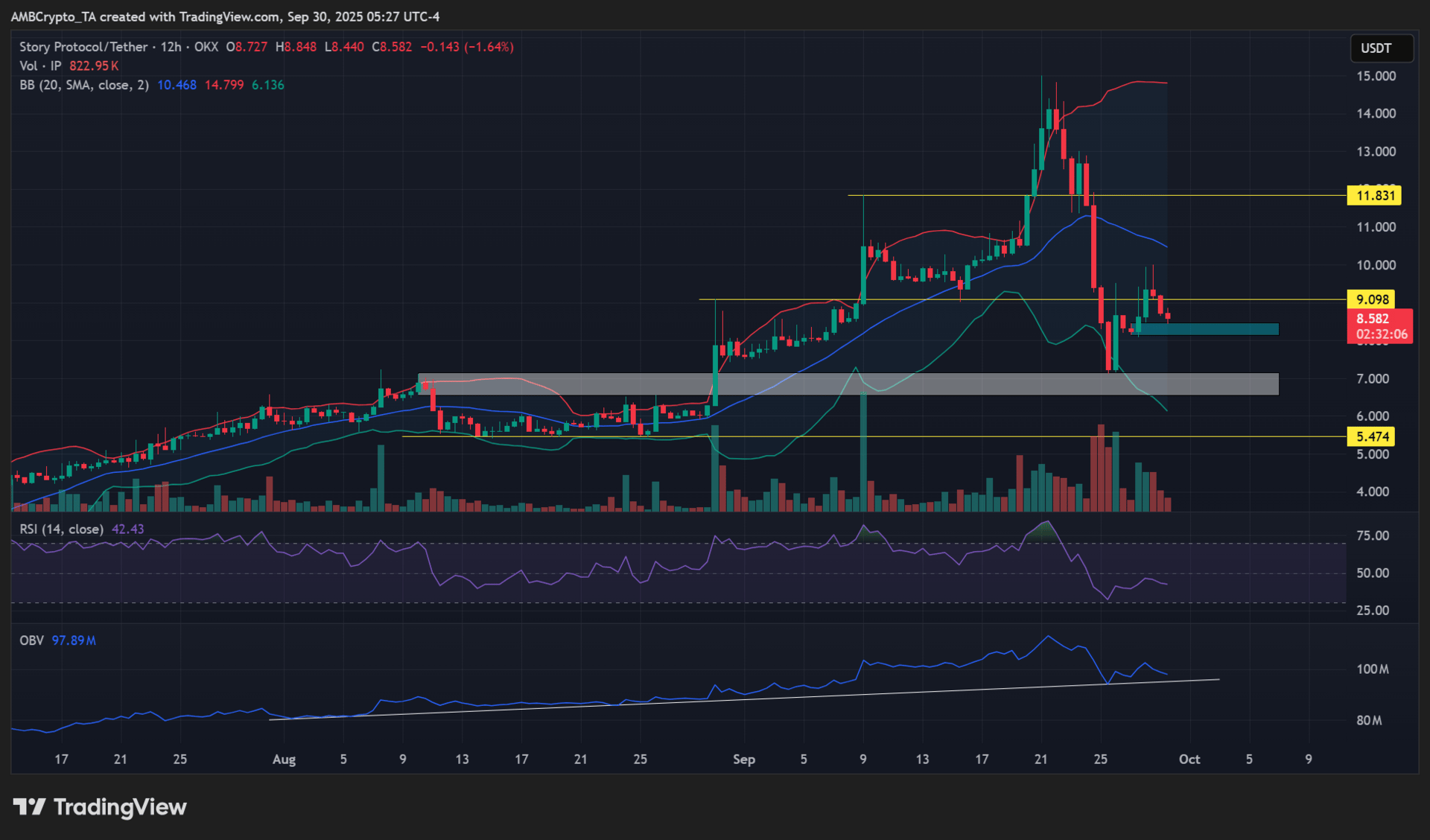

Story protocol (IP)

Key points:

Bulls have attempted to clear the $10-hurdle without success.

However, technical chart indicators suggested bulls still may have a shot at a move higher.

What you should know:

Story protocol (IP) lost half of its recent recovery gains of 40%. In the last four days, it bounced from $7 but faced rejection at $10-psychological price level. Bulls have been rebuffed at this level twice, making it a key short-term hurdle.

However, technical indicators showed that bulls could still clear the obstacle. Notably, the OBV (On Balance Volume) was above a multi-month trendline support. In short, there still seemed to be interest and volume for the altcoin.

With the slight jump in daily RSI, IP could still make it above $10. Especially if the RSI climbs higher above the neutral level.

In such a scenario, the $11.8 bullish target could be feasible. But a dip below $8 would invalidate the bullish outlook and drag IP to $7 or $5.5.

World Liberty Financial (WLFI)

Key points:

WLFI has been under selling pressure, despite recent deflationary efforts.

Technical indicators were bearish, suggesting the sell-off could extend itself.

What you should know:

WLFI dropped by 10% in the last two days. The decline erased all the gains made over the weekend after the project announced an aggressive deflationary plan. And, technical charts didn’t favor the bulls. At least at the time of writing.

The 12-hour RSI slipped below the neutral level, underscoring mounting selling pressure. If the OBV cracks the support formed in the second half of September, WLFI could drop lower on the charts.

The $0.18-$0.19 support zone and range-low could be the next level to watch out for in such a correction.

How was today's newsletter? |