- Unhashed Newsletter

- Posts

- USD1 proposal sparks WLFI backlash

USD1 proposal sparks WLFI backlash

Reading time: 5 minutes

WLFI governance vote sparks backlash over USD1 push

Key points:

A WLFI governance vote approving a USD1 growth proposal has drawn criticism after voting power was concentrated among a small number of wallets.

Locked WLFI holders were unable to participate in the vote, even as treasury tokens were approved for USD1 incentives and partnerships.

News - World Liberty Financial (WLFI) has come under scrutiny following a governance vote that approved measures aimed at supporting the growth of its USD1 stablecoin. The decision has triggered backlash from parts of the community, particularly from investors whose tokens remain locked and could not be used in the vote.

Onchain voting data shows that the top nine wallets controlled roughly 59% of total voting power, with the largest single wallet accounting for nearly 18.8%. Researchers tracking the vote flagged these decisive “FOR” votes as originating from wallets linked to the team or strategic partners. As a result, a large share of WLFI holders holding locked tokens were excluded from participating in the outcome.

Locked holders and governance concerns - Community criticism has focused on the project’s decision to prioritize USD1-related incentives while long-standing questions around token unlocks remain unresolved. Around 80% of WLFI tokens sold to investors are still locked, preventing holders from selling their positions or submitting governance proposals of their own.

Some tokenholders who opposed the measure argued that allocating treasury tokens toward USD1 partnerships could dilute investor value without offering direct economic benefits. Project documentation states that WLFI holders are not entitled to protocol revenue, with net income instead allocated to entities associated with the Trump and Witkoff families.

Treasury spending draws mixed reactions - The approved proposal allows the use of up to 5% of unlocked treasury tokens to support USD1 adoption programs and strategic partnerships. While some governance participants described the move as a long-term effort to build utility across the ecosystem, others criticized the lack of clarity around vesting schedules for the remaining locked supply.

Market pressure adds to unease - The governance dispute has unfolded alongside renewed pressure on WLFI’s token price. After a recent pullback from prior highs, the token has traded near key support levels, reflecting cooling momentum. This comes as locked holders have voiced frustration over eroding paper gains while governance decisions continue to move forward without their participation.

Coinbase seeks to revive stalled U.S. crypto bill at Davos

Key points:

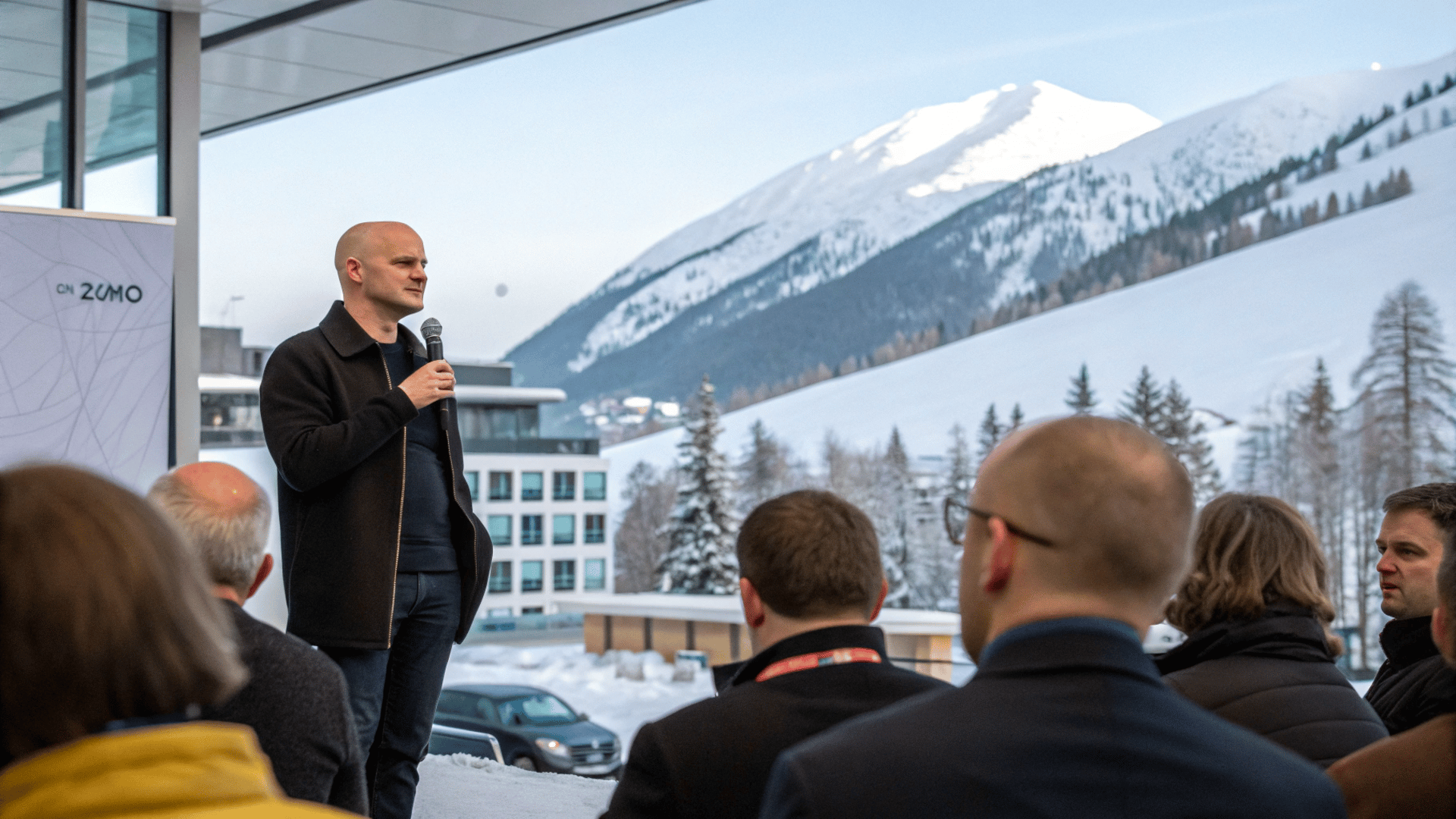

Coinbase CEO Brian Armstrong is using the World Economic Forum in Davos to restart talks around the stalled U.S. crypto market structure bill.

Disagreements over stablecoin yield rules remain the core obstacle after Coinbase withdrew its support from the Senate draft.

News - Coinbase CEO Brian Armstrong arrived in Davos, Switzerland, this week with a renewed push to revive momentum around the U.S. crypto market structure bill. The outreach follows Coinbase’s abrupt withdrawal of support from the Senate draft, a move that led to the cancellation of a planned markup and strained relations across the industry and Capitol Hill.

Armstrong has outlined three priorities for his Davos meetings: discussing economic freedom with global leaders, promoting tokenization, and advancing market structure legislation. He has argued that tokenization can broaden access to capital markets and that stablecoins should operate under rules that allow both banks and crypto companies to compete on equal terms.

Stablecoin yield remains the sticking point - Coinbase stepped back from the bill after objecting to provisions that would restrict yield on stablecoin holdings. The draft language would have barred platforms from offering yield simply for holding stablecoins, a policy backed by banks concerned about deposit outflows.

Following Coinbase’s withdrawal, the Senate Banking Committee canceled its scheduled markup, exposing deep fractures within the crypto industry’s lobbying effort.

Since then, Armstrong has acknowledged the fallout and has sought to reengage policymakers while holding parallel discussions with bank leaders. Those talks have focused on whether compromise is possible on stablecoin yield mechanisms without sidelining crypto firms.

Banks and politics shape the next phase - Meetings in Davos have also highlighted the growing role of banks in shaping crypto legislation. Armstrong has said clearer rules could help move the industry forward, while some critics warn that heavier bank involvement could tilt policy outcomes toward traditional finance interests.

The effort unfolds against a complex political backdrop. White House support for the bill has been linked to whether crypto firms and banks can reach agreement on yield. Meanwhile, Senate committees have yet to reschedule key hearings, and lawmakers have raised additional concerns about jurisdiction and enforcement provisions within the draft.

For now, Armstrong’s Davos outreach signals an attempt to reset negotiations, even as the path to U.S. crypto legislation remains uncertain.

Strategy tops 700,000 BTC as BlackRock adds credit exposure

Key points:

Strategy added 22,305 BTC for $2.13 billion, lifting total holdings to 709,715 BTC.

BlackRock’s iShares PFF ETF holds significant exposure to Strategy-linked preferred equity, reinforcing institutional interest.

News - Strategy has pushed its Bitcoin holdings beyond the 700,000 mark after completing another large-scale purchase, even as broader crypto markets showed signs of strain. The company disclosed that it acquired 22,305 BTC at an average price of $95,284 per coin, bringing its total holdings to 709,715 BTC as of January 19.

Executive chairman Michael Saylor confirmed the purchase, noting that Strategy has now spent approximately $53.92 billion on Bitcoin at an average acquisition price of $75,979 per coin. While the latest buy was made at a premium to spot prices at the time, the company’s blended cost basis remains below current market levels.

Capital markets fuel continued accumulation - The acquisition was funded through Strategy’s ongoing capital markets activity.

Regulatory filings show the firm raised roughly $2.125 billion in net proceeds during the week through at-the-market programs, driven primarily by the sale of common stock and its perpetual preferred equity Stretch (STRC). Smaller amounts were raised through other preferred offerings, while additional issuance capacity remains available.

Strategy’s approach continues to rely on converting equity and credit instruments into Bitcoin exposure, reinforcing its position as the largest publicly traded corporate holder of BTC. The firm now controls more than 3% of Bitcoin’s circulating supply, underscoring the scale of its accumulation strategy.

BlackRock ETF exposure adds institutional signal - Alongside the purchase, market attention has turned to BlackRock. Its iShares Preferred and Income Securities ETF (PFF) holds substantial allocations to Strategy-linked securities, including STRC, STRF, and STRD. STRC alone represents one of the ETF’s largest positions, highlighting demand for Strategy’s income-focused credit products.

Market response remains mixed - Despite the headline accumulation, Strategy’s shares showed volatility around the announcement, tracking broader Bitcoin price swings. The contrast between aggressive long-term accumulation and short-term market pressure has become a recurring theme as Strategy continues to expand its Bitcoin treasury.

Polymarket faces fresh European blocks as scrutiny intensifies

Key points:

Hungary and Portugal have moved to restrict access to Polymarket, citing illegal gambling and unlicensed activity.

Election-related betting and insider trading concerns are accelerating regulatory pressure across Europe.

News - Polymarket is facing renewed regulatory action in Europe after authorities in both Hungary and Portugal moved to restrict or wind down access to the crypto-based prediction market. The actions highlight growing uncertainty over whether prediction markets should be regulated as financial instruments or treated as gambling.

Hungary’s gambling regulator, the Szabályozott Tevékenységek Felügyeleti Hatósága, has temporarily blocked Polymarket’s domain and subdomains, citing the forbidden organization of gambling activities. The restriction will remain in place while the regulator completes its review. Users in Hungary reported seeing official warning notices when attempting to access the platform.

In Portugal, the Serviço de Regulação e Inspeção de Jogos ordered Polymarket to cease operations within 48 hours, stating that the platform lacks authorization to offer betting services. Betting on political events is illegal under Portuguese law, and regulators said Polymarket’s election-related markets violate national rules. While enforcement appears ongoing, the platform remained accessible to users as of Monday.

Election betting raises alarm - Regulatory attention in Portugal intensified after unusually large volumes were placed on the country’s presidential election. Reports indicate that more than €4 million was wagered in the hours before results were announced, while total volume on the main presidential market exceeded €103 million ($120 million). Sharp shifts in odds ahead of the outcome fueled speculation about potential insider trading.

Similar concerns have surfaced elsewhere. On January 3, a Polymarket user reportedly earned about $400,000 after betting on the removal of Venezuela’s president just hours before U.S. forces captured Nicolás Maduro in a military operation.

Widening global pressure - The latest moves add to a growing list of jurisdictions restricting Polymarket. The platform has already been blocked or limited in more than 30 countries, including France, Belgium, Poland, Singapore, Switzerland, and Ukraine. Despite mounting enforcement actions, prediction markets continue to attract heavy trading activity, keeping regulators focused on the sector’s rapid expansion.

More stories from the crypto ecosystem

How USDD’s $1.1B stablecoin supply taps Chainlink for cross-chain pricing

Celestia price analysis: Inside TIA’s 13% sell-off and what comes next

Avalanche defends KEY support: Why AVAX traders watch $18 next

Inside the $282mln ZachXBT investigation – How stolen Bitcoin hit Tornado Cash

Solana metrics turn bullish – But is cooling volume a red flag?

Interesting facts

Pakistan partners on a dollar-linked stablecoin project: Pakistan has signed an agreement with a U.S. firm affiliated with World Liberty Financial to explore collaboration on a dollar-pegged stablecoin called USD1, aiming to integrate it into the country’s digital payments framework as part of its broader virtual asset legislation push.

U.S. crypto market regulation could reshape the industry in 2026: A long-awaited draft bill in the U.S. Senate seeks to establish a federal framework for cryptocurrencies by clarifying when tokens qualify as securities or commodities and expanding the Commodity Futures Trading Commission’s authority over spot crypto markets, potentially reshaping how digital assets are regulated.

Polygon is pursuing stablecoin payments with major acquisitions: Polygon Labs agreed to acquire crypto payments provider Coinme and infrastructure firm Sequence in deals totaling more than $250 million, aiming to expand stablecoin-based transactions and position itself as a regulated U.S. payments entity.

Top 3 coins of the day

MYX Finance (MYX)

Key points:

MYX held firm above the $5 mark after its recent advance, signaling consolidation rather than a loss of momentum.

The MA crossover stayed bullish while the RSI remained above neutral, indicating trend support even as volume cooled.

What you should know:

MYX’s recent candles pointed to stabilization after a recovery move earlier this month, with price hovering around the $5.30–$5.40 region. Instead of extending sharply higher, MYX entered a tight consolidation phase, suggesting buyers continued to defend gains rather than rush for exits. This behavior kept the short-term structure constructive, especially as price stayed above the rising moving averages.

The $5.00–$5.10 zone now stands as the immediate support area to watch, while the $5.90–$6.20 range remains the next resistance band if upside momentum rebuilds.

Momentum indicators aligned with this view. The RSI hovered in the low-to-mid 60s, reflecting steady strength without flashing overheated conditions. Meanwhile, volume faded from its earlier spike, pointing to absorption rather than distribution.

On the catalyst side, renewed interest around MYX’s V2 rollout and associated airdrop incentives likely supported participation, contributing to the recent price resilience despite broader market weakness.

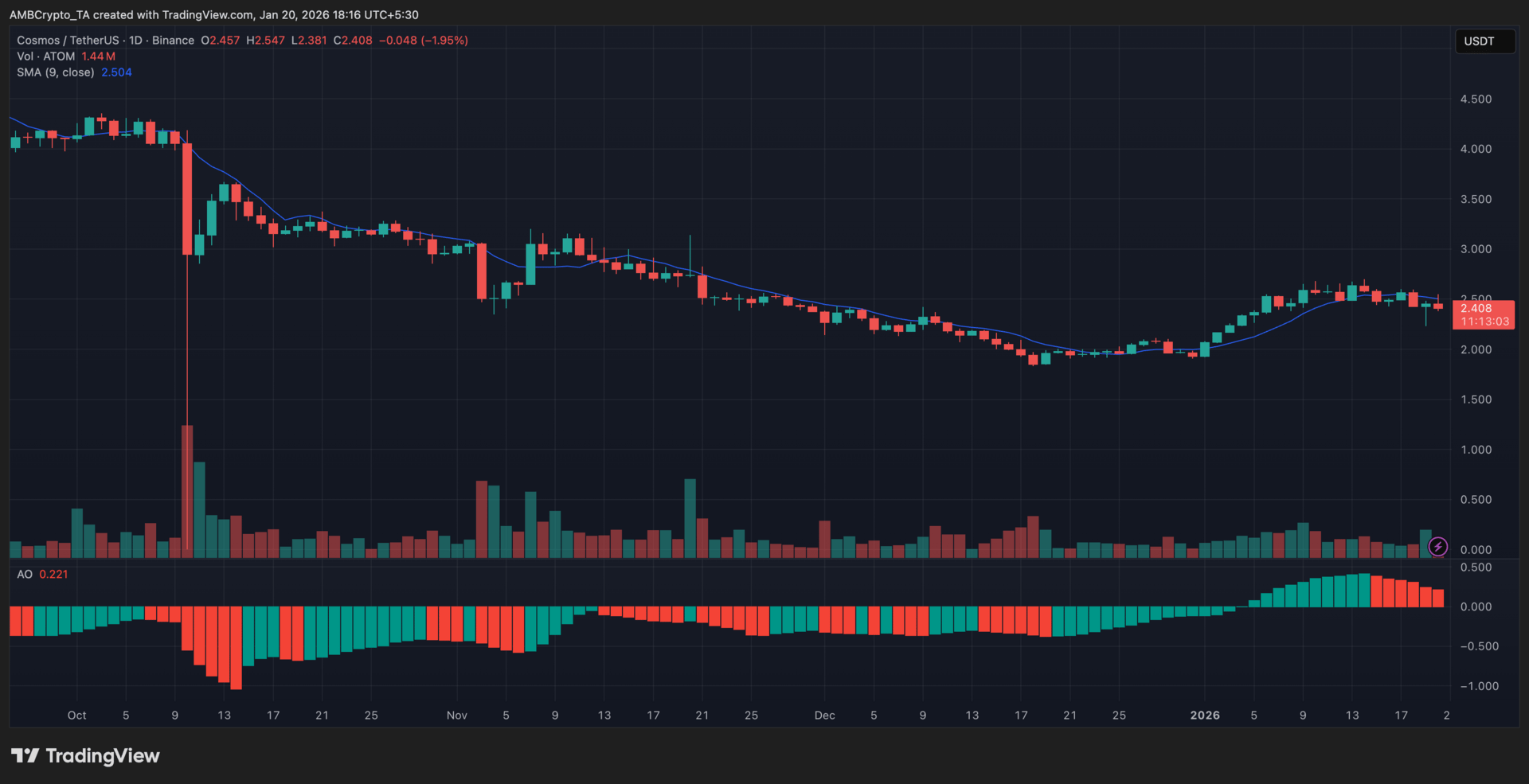

Cosmos (ATOM)

Key points:

ATOM hovered near the $2.40 area after giving up part of its recent rebound, reflecting hesitation rather than a decisive breakdown.

Price slipped below the 9-day SMA while the Awesome Oscillator printed red bars near the zero line, signaling fading upside momentum alongside muted volume.

What you should know:

Cosmos’ latest daily sessions suggested a pause in recovery, with ATOM struggling to extend gains after rebounding from late-December lows.

Price drifted lower toward the $2.35–$2.40 support zone, an area that continues to absorb repeated tests but has yet to spark a strong follow-through bounce. The failure to hold above the 9-day SMA highlighted weakening short-term control from buyers and reinforced the range-like behavior seen over the past several weeks.

Momentum indicators echoed this slowdown. The Awesome Oscillator turned red near the zero line, pointing to a loss of bullish pressure rather than an aggressive bearish shift. Volume also remained subdued, underscoring the lack of conviction on both sides of the market.

From a broader perspective, ongoing discussion around Cosmos’ tokenomics redesign likely offered some sentiment support, even as price action stayed cautious. On the upside, the $2.55–$2.60 region remains the key resistance zone to watch if momentum rebuilds.

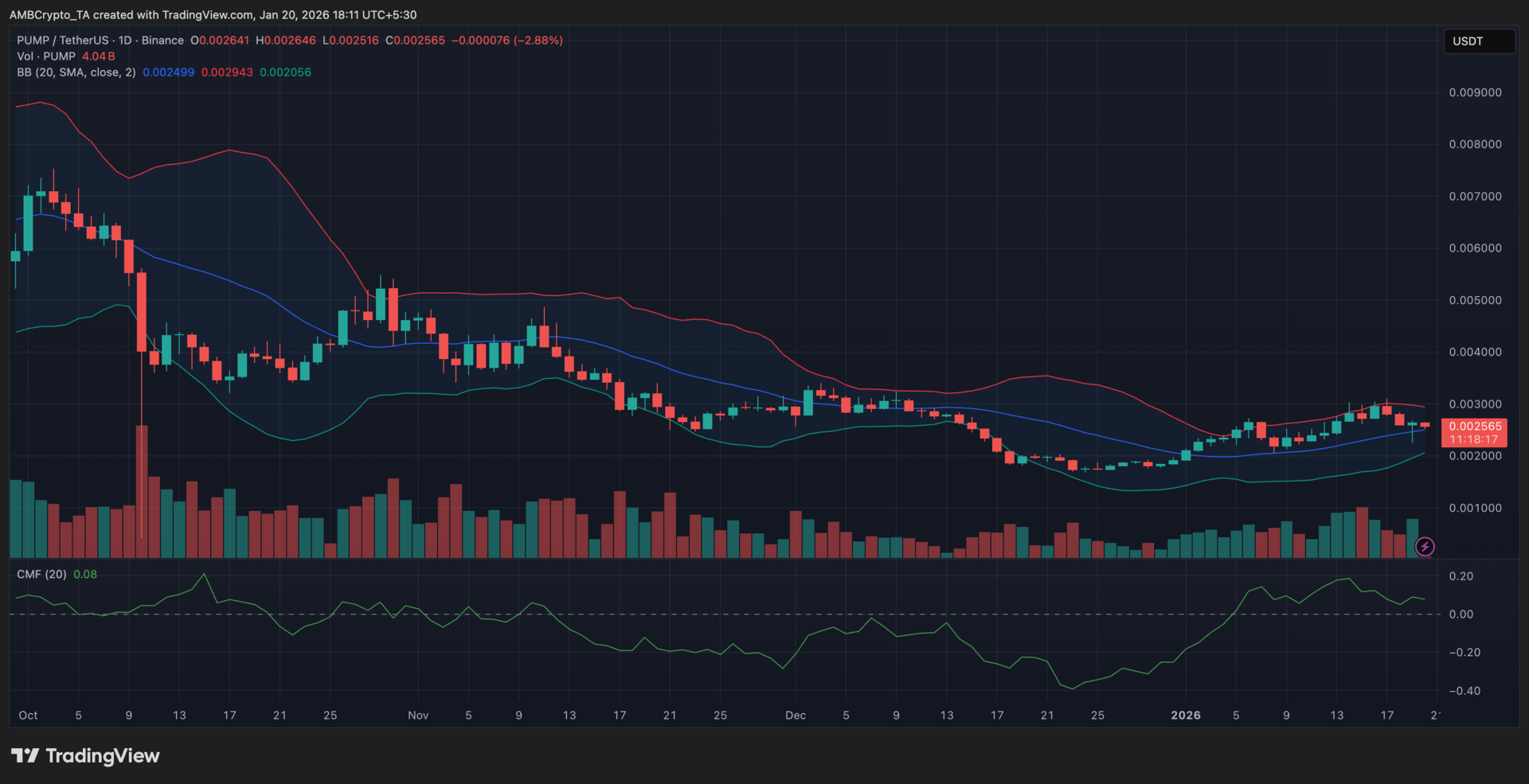

Pump.fun (PUMP)

Key points:

PUMP traded near $0.00256 as selling pressure eased, with price holding a tight range instead of extending lower.

Volatility compressed as Bollinger Bands narrowed, while CMF hovered just above zero, reflecting weak but positive capital flows.

What you should know:

After a stretch of downside pressure, PUMP moved into a consolidation phase rather than attempting an immediate rebound.

Price action remained confined to a narrow band, signaling hesitation from both buyers and sellers. The $0.00245–$0.00250 area continues to act as near-term support, while recovery attempts remain capped below the $0.00270–$0.00275 resistance zone close to the upper Bollinger Band.

Indicator behavior reinforced this neutral setup. Bollinger Bands tightened, pointing to reduced volatility and a lack of directional expansion. Meanwhile, the Chaikin Money Flow stayed marginally positive, suggesting mild inflows but without the strength typically seen during accumulation phases. Volume also remained subdued, underscoring the absence of urgency across the market.

On the narrative front, the launch of Pump.fun’s ecosystem-focused fund likely helped stabilize sentiment, even as price action stayed cautious and range-bound.

How was today's newsletter? |