- Unhashed Newsletter

- Posts

- Wall Street euphoria tests Bitcoin

Wall Street euphoria tests Bitcoin

Reading time: 5 minutes

Bitcoin outlook splits as Wall Street sentiment hits extremes

Key points:

Investor positioning has reached multi-year extremes, a setup that has historically preceded sharp market reversals across risk assets.

Despite near-term risks, major asset managers expect Bitcoin to break its four-year cycle and reach new all-time highs in 2026.

News - Bitcoin’s outlook is increasingly split as traditional market sentiment reaches historically stretched levels, while long-term institutional forecasts remain constructive.

Bank of America’s latest Global Fund Manager Survey shows investor cash allocations have dropped to just 3.3%, the lowest reading in the survey’s history. At the same time, exposure to equities and commodities has climbed to its highest levels since early 2022, reflecting aggressive risk-on positioning across portfolios.

Such sentiment extremes have often acted as contrarian signals. With Bitcoin still showing periods of correlation with U.S. equities, a sharp pullback in traditional markets could translate into further downside pressure for crypto in the near term.

However, institutional crypto outlooks suggest any volatility may ultimately set the stage for Bitcoin’s next expansion phase.

Why extreme optimism raises near-term risk - The survey shows investor optimism at its strongest level since mid-2021, driven by expectations of a soft economic landing and improving corporate profits. A majority of respondents expect a soft landing by 2026, while hard-landing expectations remain minimal.

Historically, periods of broad confidence combined with low cash buffers have preceded market corrections. If equities retreat, Bitcoin could initially follow, given its recent macro sensitivity.

Why institutions are looking beyond the four-year cycle - Grayscale, in its 2026 outlook, expects Bitcoin to reach a new all-time high in the first half of the year. The firm cited rising demand for alternative stores of value, improved U.S. regulatory clarity, and growing institutional participation as key drivers.

Grayscale also argued that the long-discussed four-year Bitcoin cycle is losing relevance as crypto integrates more deeply into traditional financial markets.

Bitwise echoed this structural shift, stating that halving effects are weakening, leverage has been reduced after recent liquidations, and access to Bitcoin continues to broaden through spot ETFs. The firm expects lower volatility and declining equity correlations as crypto-specific catalysts take precedence.

On-chain data from Glassnode reinforces this view. Over the past three months, Bitcoin declined about 26%, outperforming most major crypto sectors, highlighting its role as the primary capital anchor during periods of uncertainty.

Solana stays online as DDoS attack surfaces and stablecoin adoption expands

Key points:

Solana continued operating normally despite reports of an industrial-scale DDoS attack peaking near 6 Tbps, with ecosystem figures calling the resilience a positive signal.

Visa and StraitsX announced major stablecoin settlement and issuance plans on Solana, reinforcing its expanding role in institutional payments infrastructure.

News - Solana drew renewed attention this week as reports of a large-scale distributed denial-of-service attack surfaced alongside fresh announcements from major payment and stablecoin providers adopting the network.

Solana co-founder Anatoly Yakovenko said the blockchain was facing a DDoS attack estimated at around six terabits per second. Ecosystem participants described the activity as industrial in scale, noting that such traffic levels would typically cause visible network disruption.

Pipe Network said that under this level of load, one would normally expect rising latency, missed slots, or confirmation delays, yet the network was not showing significant signs of stress.

Yakovenko characterized the attack as “bullish,” suggesting the cost of sustaining such traffic rivaled Solana’s on-chain revenue, while other ecosystem figures highlighted the network’s ability to remain stable under extreme conditions.

Institutional payment use cases accelerate - At the same time, Visa confirmed it has launched USDC settlement services for U.S. financial institutions on Solana.

Initial participants include Cross River Bank and Lead Bank, which are already settling obligations with Visa using Circle’s USDC. Visa said broader access for U.S. partners is expected through 2026.

The payments giant also disclosed plans to support Circle’s upcoming Arc blockchain, operate a validator node, and expand stablecoin settlement capabilities as banks seek faster and more programmable payment rails.

Asia-Pacific stablecoins move to Solana - Separately, Singapore-based StraitsX announced plans to bring its Singapore dollar-backed XSGD and U.S. dollar-backed XUSD stablecoins to Solana by early 2026.

The rollout, developed with the Solana Foundation, aims to support payments, decentralized finance, and AI-driven applications, including instant SGD-USD swaps using Solana’s x402 payment standard.

StraitsX said its stablecoins have already processed more than $18 billion in combined on-chain volume, reinforcing Solana’s expanding role in both U.S. settlement flows and Asia-based stablecoin plans.

UK crypto ownership falls while holdings concentrate under tighter rules

Key points:

The number of crypto holders in the UK declined sharply over the past year, even as remaining investors increased the average value of assets held.

UK regulators launched a broad consultation on crypto market rules, signaling a shift toward full market structure oversight by 2027.

News - Crypto ownership in the United Kingdom declined over the past year, but investors who remain active are holding larger positions, according to new data released by the Financial Conduct Authority (FCA).

The FCA’s Cryptoassets Consumer Research 2025 report shows that the share of UK adults holding crypto fell from 12% in 2024 to 8% in 2025, reducing the estimated number of holders from about 7 million to roughly 4.5 million. Despite this decline, awareness of cryptocurrencies remained high at 91%.

While fewer people now hold digital assets, the typical value held by investors increased. About 21% of respondents reported holdings between £1,001 ($1,345) and £5,000 ($6,720), while the mean value per holder rose to just under $2,500. Bitcoin and ether continued to dominate investor portfolios, held by around 70% and 35% of crypto owners, respectively.

Regulation moves toward market structure - The findings were published alongside the FCA’s launch of three consultations on proposed crypto market rules, covering exchanges, intermediaries, staking, lending and borrowing, market abuse, and decentralized finance. Feedback on the proposals is open until February 12, 2026.

Regulators said the goal is to protect consumers while supporting innovation, with proposals designed to align crypto markets more closely with traditional financial standards rather than eliminate investment risk entirely.

Toward full oversight by 2027 - The consultations mark a step beyond earlier UK rules focused on financial promotions and anti-money laundering. The UK government has also announced plans to extend existing financial services laws to crypto assets by 2027, bringing the sector fully under FCA oversight.

Together, the data and regulatory push suggest a UK crypto market that is becoming more concentrated, more regulated, and increasingly shaped by long-term participants rather than broad retail adoption.

Trump signals Samourai review amid delays in US crypto rules

Key points:

President Donald Trump said he will review the case of convicted Samourai Wallet co-founder Keonne Rodriguez, reviving debate around developer liability and crypto privacy tools.

US crypto market structure legislation has been delayed until early 2026, extending regulatory uncertainty for exchanges, developers, and institutional investors.

News - US crypto policy delivered mixed signals this week as President Donald Trump hinted at a possible review of the Samourai Wallet case, while lawmakers postponed progress on long-awaited market structure legislation.

Trump said he would “look into” the case of Samourai Wallet co-founder Keonne Rodriguez, who was sentenced last month to five years in prison for operating an unlicensed money-transmitting business. Rodriguez and co-founder William Lonergan Hill pleaded guilty to a single charge after facing potential sentences of up to 25 years if convicted at trial.

The case has drawn sustained attention from privacy advocates and crypto users, who argue that developers should not be held criminally responsible for how third parties use open-source software. Rodriguez is set to begin serving his sentence this week, while supporters continue to push for presidential clemency.

Trump’s comments follow earlier pardons granted to Binance founder Changpeng Zhao and Silk Road founder Ross Ulbricht, reinforcing speculation around how the administration may approach crypto-related prosecutions.

Developer liability back in focus - The Samourai case has reignited broader debate over where legal responsibility should fall in decentralized systems. Prosecutors argued the founders actively promoted their mixing service for illicit use, while defenders say the prosecution risks chilling development of privacy-preserving tools across the industry.

Similar concerns have been raised in the case of Tornado Cash developer Roman Storm, whose conviction has been cited by advocates as another test of developer accountability.

Market Structure Bill pushed to 2026 - At the same time, the US Senate Banking Committee confirmed it will delay markup hearings on crypto market structure legislation until early 2026. Lawmakers cited ongoing bipartisan negotiations and unresolved disputes over regulatory jurisdiction between the SEC and CFTC.

The delay extends uncertainty for crypto firms, particularly as Congress shifts focus to funding deadlines ahead of the 2026 legislative calendar.

The Headlines Traders Need Before the Bell

Tired of missing the trades that actually move?

In under five minutes, Elite Trade Club delivers the top stories, market-moving headlines, and stocks to watch — before the open.

Join 200K+ traders who start with a plan, not a scroll.

More stories from the crypto ecosystem

$50B and counting: Why Strategy’s Bitcoin buying suddenly looks urgent

Nearly $1B in – What’s driving XRP’s unstoppable ETF streak?

Grayscale’s Bitcoin price prediction: Will BTC hit a new ATH in 2026?

Bitcoin slides 4.5% as Asia session weakness amplifies $652M liquidations

30% of Bitcoin is locked up by big players – So why is BTC’s price falling?

Interesting facts

Singapore has surged to the top of global crypto adoption rankings - According to the latest global adoption index, Singapore now leads worldwide in crypto usage thanks to a unique blend of regulatory clarity, institutional investment, and cultural engagement, outperforming older markets on both retail penetration and business activity.

Stablecoin and digital asset policy is turning into a global arms race - In 2025, more than 70% of jurisdictions tracked worldwide are actively progressing stablecoin regulations, driving clearer frameworks that are unlocking institutional initiatives in roughly 80% of major markets.

DeFi’s rebound is showing real financial muscle - Q1 2025 saw DeFi borrowing jump about 30% after a prior slump, with Aave holding a dominant ~45% share of total value locked and significant activity across lending markets, signaling renewed financial depth in decentralized finance.

Seeking impartial news? Meet 1440.

Every day, 3.5 million readers turn to 1440 for their factual news. We sift through 100+ sources to bring you a complete summary of politics, global events, business, and culture, all in a brief 5-minute email. Enjoy an impartial news experience.

Top 3 coins of the day

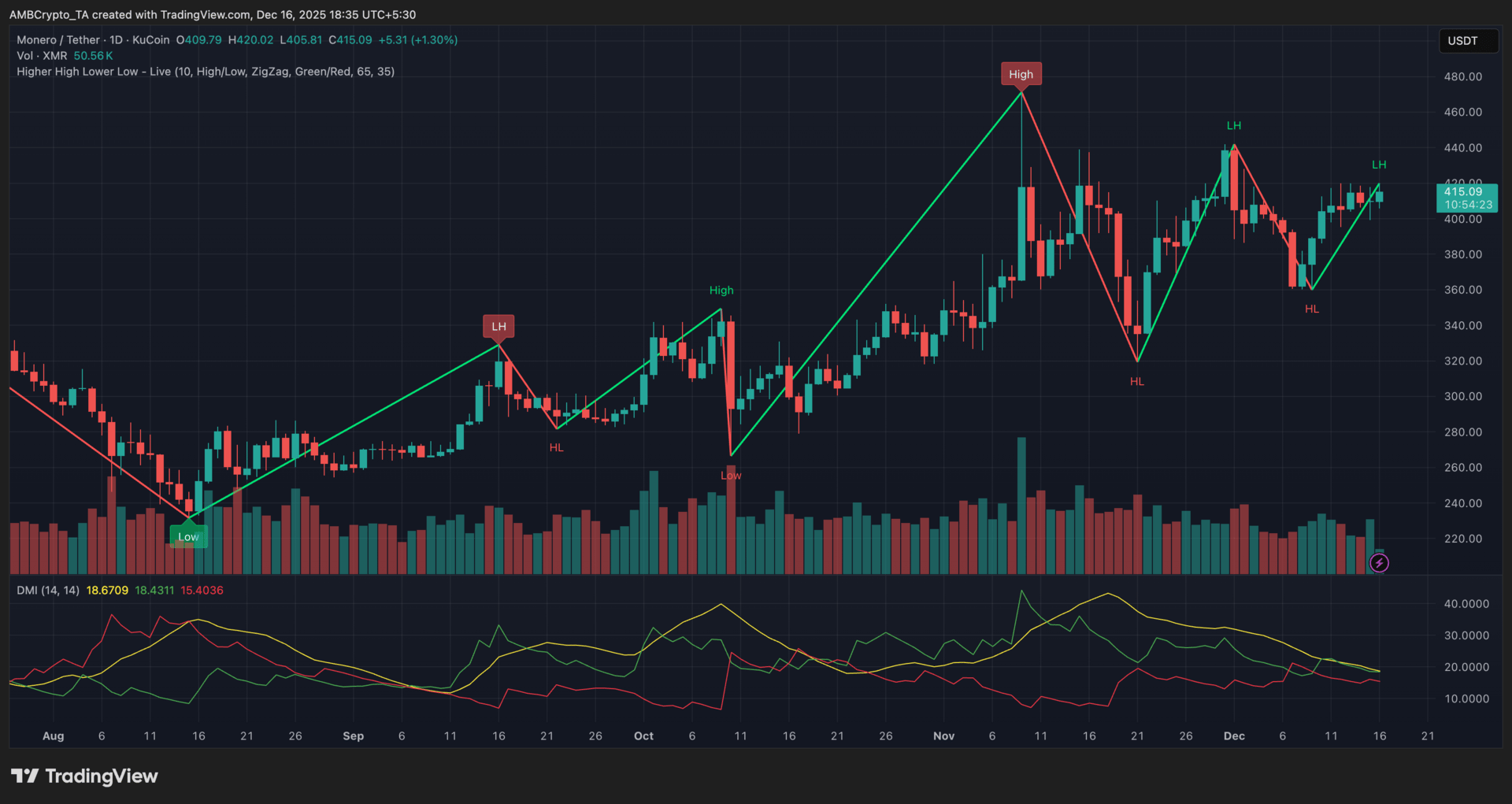

Monero (XMR)

Key points:

Monero traded around $415, posting a modest daily gain while failing to reclaim its prior swing high near $440.

Structure shifted to a higher low followed by a lower high, reflecting fading upside momentum rather than trend continuation.

What you should know:

Monero attempted to extend its recovery after defending the late-November higher low near the $360–$370 zone, but the latest rally stalled below the previous peak around $440, forming a lower high instead of confirming a higher-high continuation. This price behavior suggested that bullish momentum had slowed despite the broader recovery structure remaining intact. The Higher High Lower Low overlay reflected this hesitation clearly, while volume stayed relatively steady, indicating participation without aggressive breakout demand. On the DMI, the positive directional line previously led the move higher, but its recent flattening pointed to a loss of trend strength rather than renewed expansion. From a catalyst perspective, XMR continued to benefit from privacy-coin rotation during broader market uncertainty, alongside increased derivatives activity following the launch of XMR perpetuals, which supported short-term interest without driving a decisive breakout. At present, $400–$405 acts as near-term support, while $430–$440 remains the resistance zone to monitor for any trend confirmation.

Sky (SKY)

Key points:

SKY climbed toward $0.058 after rebounding from the $0.050–$0.052 zone, supported by improving momentum.

Buyback activity and ecosystem developments reinforced sentiment as price held above the Bollinger mid-band.

What you should know:

SKY recovered steadily after buyers stepped in near the lower Bollinger Band around the $0.050–$0.052 region, where selling pressure eased. Price then moved back above the 20-period SMA near $0.055, signaling a shift away from bearish control rather than a sharp breakout. The Squeeze Momentum indicator flipped green, indicating improving bullish momentum, though without signs of overheating. Volume expanded during the initial rebound but moderated in recent sessions, suggesting controlled participation instead of aggressive chasing. Price continued to trade within the upper half of the Bollinger Bands, while remaining capped below the upper band near $0.060–$0.061, which stands as immediate resistance. Beyond the chart, sentiment was supported by Sky’s ongoing token buyback program, which reduced circulating supply, alongside renewed attention on its ecosystem’s RWA initiatives. For now, the Bollinger mid-band near $0.055 acts as support, while a sustained move above $0.060 is needed to extend gains.

XDC Network (XDC)

Key points:

XDC slipped toward $0.049 after printing a lower high followed by a fresh lower low, keeping the broader structure bearish.

Despite the downtrend, leadership recognition helped cushion sentiment during a market-wide pullback.

What you should know:

XDC continued to trade under pressure after failing to sustain its rebound from early November. Price formed a lower high near the $0.055 region before rolling over and setting a new lower low close to $0.048, reinforcing the prevailing downtrend. Volume picked up during the breakdown phase, pointing to active distribution rather than exhaustion selling. RSI hovered near the neutral 44 level, reflecting subdued momentum with no clear oversold signal yet. While short-lived bounces emerged, they lacked follow-through, keeping sellers in control. For now, the $0.047–$0.048 zone acts as immediate support, while $0.053–$0.055 stands as overhead resistance where prior lower highs formed. On the non-technical front, sentiment found some support after XDC Network leadership received policy recognition at the UK House of Lords, highlighting its regulatory-facing narrative. Still, price action suggests traders remain cautious, awaiting stronger confirmation before reassessing downside risks.

How was today's newsletter? |