- Unhashed Newsletter

- Posts

- Whales flip as $1T crypto rout deepens

Whales flip as $1T crypto rout deepens

Reading time: 5 minutes

Crypto market faces $1T rout as whales reposition and privacy tokens rally

Key points:

Over $1 trillion in crypto value erased since October 6 as leveraged longs face mass liquidations.

Contrarian whales, Solana ETFs, and privacy coins like Monero show signs of selective resilience.

News - The crypto market has shed more than $1 trillion in value since early October, wiping out most of 2025’s gains as volatility surges across major assets. Over the past 24 hours alone, $1.38 billion in long positions were liquidated, leaving more than 440,000 traders in the red, according to Coinglass data.

Even top traders have felt the sting. Whale 0xc2a3, once up $33 million, flipped bearish after losing over $44 million on Ethereum longs, now shorting 8,562 ETH at 25x leverage.

Yet contrarians like 0x9263 and the so-called “Anti-CZ Whale” have moved in the opposite direction, opening new long positions across Bitcoin, Ethereum, and Solana. Analysts say this divergence highlights a battle between panic sellers and whales betting on renewed volatility.

Meanwhile, Solana ETFs continue to attract inflows, marking six straight days of gains even as Bitcoin and Ether ETFs saw nearly $800 million in combined outflows this week. Market observers attribute the rotation to “curious capital” seeking yield in newer altcoin ETFs amid tightening liquidity.

Privacy coins defy the downturn - Monero (XMR) emerged as an outlier, rallying over 13% this month to $377 despite the wider sell-off. Analysts link the surge to a growing privacy narrative fueled by upcoming 2026 regulations and a shift toward decentralized anonymity plays.

Crypto treasury firms may be amplifying the downturn - Columbia professor Omid Malekan argued that leveraged digital asset treasuries (DATs) have created a “mass extraction and exit event,” intensifying sell pressure.

As the market grapples with cascading liquidations, experts remain split: Is this capitulation or the start of crypto’s next major reset?

Ripple bags $500M at $40B as XRP defends $2; ETF filings accelerate

Key points:

Ripple has raised $500 million at a $40 billion valuation as payments, stablecoin, and custody bets scale.

XRP holds near the $2 floor while ETF amendments, on-chain accumulation, and mixed technicals shape the next move.

News - Ripple closed a $500 million round led by Fortress Investment Group and Citadel Securities, valuing the company at $40 billion and broadening its institutional cap table alongside Pantera, Galaxy Digital, Brevan Howard, and Marshall Wace. The raise follows a recent $1 billion tender offer at the same valuation.

Ripple says its expansion beyond cross-border payments now spans custody, stablecoins, prime brokerage, and corporate treasury, aided by six acquisitions including Metaco, Rail, and GTreasury.

Ripple Payments has processed over $95 billion in volume, and RLUSD crossed $1 billion in market cap and is used as collateral in Ripple Prime.

On the market side, XRP is stabilizing above the $2 support region after volatile swings, trading around the low-$2s in recent sessions.

Analysts point to Ripple Prime’s U.S. launch, larger OTC access, and rising liquidity as supportive near term. Some price watchers map a possible path toward the mid-$3 zone if momentum persists, while acknowledging the broader environment remains choppy.

ETF watch - Franklin Templeton removed delaying language from its XRP ETF filing, signaling readiness for a potential November launch window, while Grayscale submitted a second S-1 amendment naming executives and counsel for its proposed XRP Trust.

Other issuers have also updated paperwork, underscoring momentum behind XRP ETF efforts in the U.S.

On-chain and positioning signals - Despite price pressure, XRP’s market dominance edged up from 3.8% to 4%. Withdrawing addresses rose sharply and reserves on Binance fell, suggesting accumulation.

Holder counts increased by more than 8,000 over the past month, aided by ETF headlines and legal recognition developments in India.

Technical picture - A head-and-shoulders breakdown met its target near $2.09 before price based around $2.06. Shorts outweigh longs by nearly eight to one, raising the risk of a squeeze, while a potential 50-day and 200-day EMA bearish crossover keeps caution in play.

Key reclaim levels cited include $2.45 to $2.55, with upside pivots toward $2.77 to $3.10 if buyers regain control.

Metaplanet leverages $100M Bitcoin loan as corporate treasuries face stress test

Key points:

Tokyo-listed Metaplanet has secured a $100 million Bitcoin-backed loan to fund BTC purchases and share buybacks.

The move comes as Bitcoin treasury firms battle valuation discounts and market volatility below the $101K support.

News - Tokyo-based Metaplanet has secured a $100 million Bitcoin-backed loan, tapping just 3% of its 30,823 BTC treasury to expand reserves, fund income-generating operations, and support a $500 million share buyback.

The credit line is part of a broader $500 million facility created in late October, offering flexible, open-ended financing against Bitcoin collateral. Management emphasized that the conservative drawdown maintains ample coverage even during downturns.

The company’s Bitcoin-only treasury strategy has propelled it to become Japan’s largest corporate holder and the world’s fourth largest, trailing MicroStrategy, Hut 8, and Marathon Digital.

CEO Simon Gerovich said the move reinforces Metaplanet’s goal of acquiring 210,000 BTC by 2027 while maximizing yield through its income division, which sells cash-secured Bitcoin options.

Market context: Bitcoin’s $101K battle line - Metaplanet’s borrowing strategy unfolds as Bitcoin defends the $101,000 support, which CryptoQuant analysts say is the make-or-break level for the current bull cycle. A daily close below it could signal deeper correction risk after recent liquidations erased over $1 trillion in crypto market value.

Despite the turbulence, corporate accumulators like Strategy and Metaplanet continue expanding their holdings.

Treasury trend tightens - Metaplanet’s loan coincides with a broader treasury contraction across the sector, with one in four firms trading below their Bitcoin reserves.

Market-to-NAV ratios among corporate holders have slipped below 1.0, leading several, including Metaplanet, to initiate buybacks aimed at boosting token-backed equity value. The shift marks what analysts call a “player-vs-player” phase for corporate Bitcoin strategies, as firms compete for efficiency, liquidity, and survival.

Gemini files for CFTC-approved ‘Titan’ market as prediction-trading boom accelerates

Key points:

Gemini has applied to launch a federally regulated event-contract market called Gemini Titan to diversify revenue.

The move positions the newly public exchange against Kalshi and Polymarket amid record sector volumes.

News - Crypto exchange Gemini Space Station Inc. is stepping into prediction markets through a Commodity Futures Trading Commission (CFTC) filing to operate a designated contract market for event-based derivatives.

The platform, branded Gemini Titan, would allow traders to speculate on real-world outcomes such as elections, economic data, or entertainment results. Bloomberg first reported the plan, citing people familiar with internal discussions that began soon after Gemini’s September IPO, which raised $433 million at a $4.4 billion valuation.

The Winklevoss-led firm is seeking regulatory clearance to compete directly with Kalshi and Polymarket, the two most active U.S. prediction market venues. If approved, Gemini Titan would become only the second federally regulated exchange of its kind.

Analysts view the application as a bid to broaden Gemini’s business after reporting a $282 million first-half 2025 loss and nearly 50% share-price decline since listing on Nasdaq. Over 80% of Gemini’s current trading flow now comes from institutions, leaving limited room for retail expansion.

Sector momentum - Prediction markets are experiencing record activity: Kalshi logged $1.2 billion in weekly volume at the end of October, while Polymarket topped $1 billion and recently attracted a $2 billion investment from Intercontinental Exchange, parent of the NYSE.

Platforms like Coinbase, MetaMask, DraftKings, and Sam Altman’s World are also exploring integrations, reflecting the sector’s mainstream pull.

Regulatory outlook - Gemini’s CFTC submission must satisfy 23 core principles covering market surveillance, governance, and system safeguards. Approval could take months, but success would give the exchange a foothold in a fast-growing niche where crypto trading, derivatives, and real-world data converge.

As rivals such as Crypto.com experiment with themed entertainment contracts, Gemini’s regulated push signals that the prediction-market race has officially entered the institutional era.

The Smartest Free Crypto Event You’ll Join This Year

Curious about crypto but still feeling stuck scrolling endless threads? People who get in early aren’t just lucky—they understand the why, when, and how of crypto.

Join our free 3‑day virtual summit and meet the crypto experts who can help you build out your portfolio. You’ll walk away with smart, actionable insights from analysts, developers, and seasoned crypto investors who’ve created fortunes using smart strategies and deep research.

No hype. No FOMO. Just the clear steps you need to move from intrigued to informed about crypto.

More stories from the crypto ecosystem

All about Aster’s 3-day price swing – Can bulls reclaim $1.28?

Strategy proposes Euro STRE share offering to fund Bitcoin buys

AAVE: Will the $50mln buyback plan repeat the 50% price surge?

$1.1B in Ethereum bought in 48 hours – Is ETH breakout near?

Inside the $93M fund loss that sparked a ‘narrow-minded’ stablecoin ban

Did you know?

In 2013, a Welsh IT worker accidentally threw away a hard drive storing the private key to roughly 8,000 Bitcoins, now worth hundreds of millions. As of early 2025, the local council still refuses to allow excavation of the landfill where it lies, a refusal upheld by the High Court in January 2025.

Developer Stefan Thomas has used eight of the ten attempts to unlock his encrypted wallet holding 7,002 Bitcoins, leaving him effectively locked out of a fortune estimated at over $200 million, with only two guesses remaining before the drive permanently self-encrypts.

The biometric cryptocurrency startup Worldcoin, co-founded by Sam Altman, held a warehouse launch party in San Francisco (April 2025) where guests scanned their irises “for crypto,” signalling one of the more surreal real-world intersections of identity tech + digital assets.

Want to take advantage of the current bull run?

If you want to take advantage of the current bull market but are hesitant about investing, online stock brokers could help take the intimidation out of the process. These platforms offer a simpler, user-friendly way to buy and sell stocks, options and ETFs from the comfort of your home. Check out Money’s list of the Best Online Stock Brokers and start putting your money to work!

Top 3 coins of the day

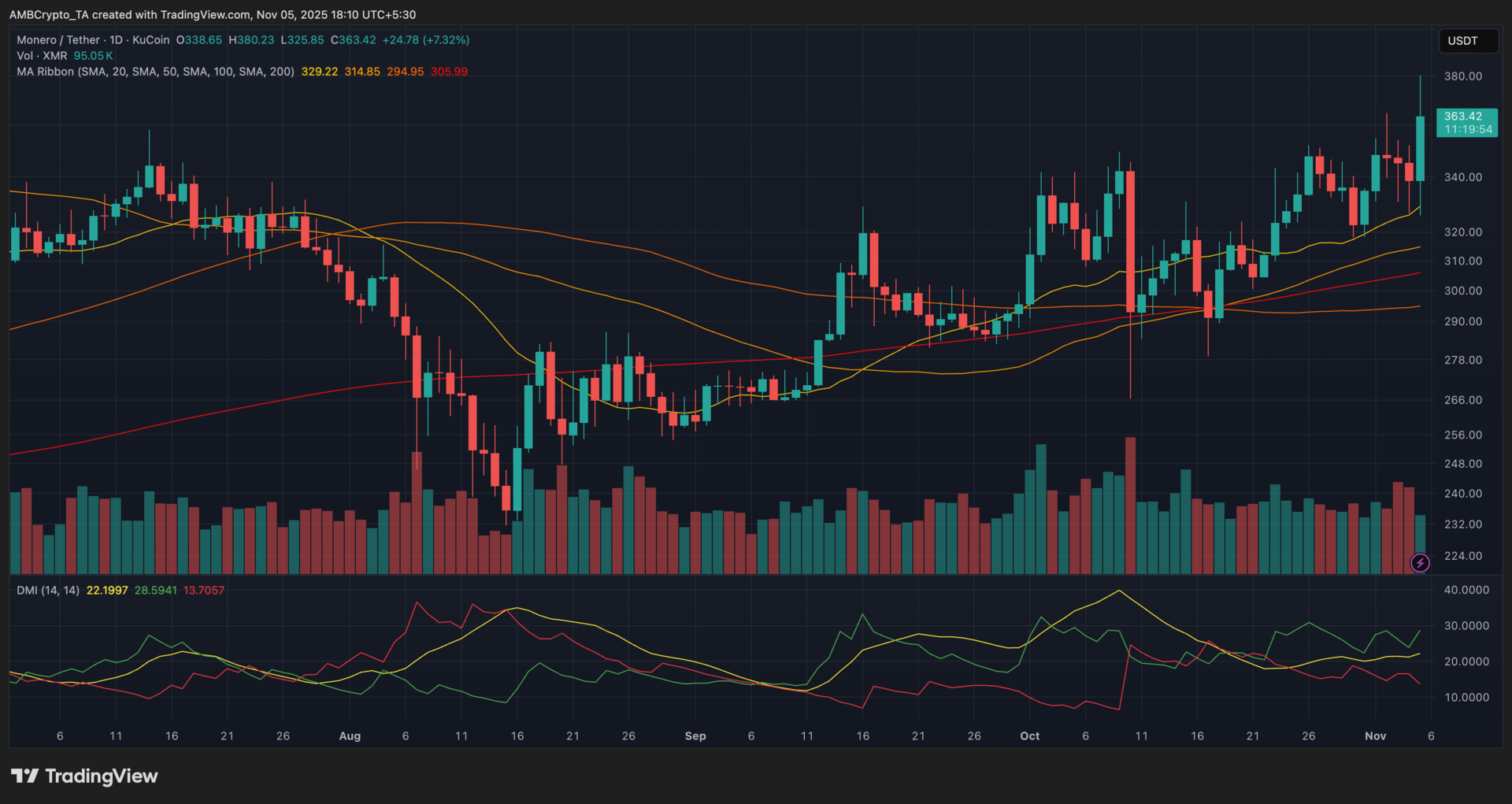

Monero (XMR)

Key points:

XMR traded near $363 after gaining over 7% in 24 hours, outperforming the wider market downturn.

The MA ribbon stayed in a bullish alignment while DMI readings confirmed buyer control on rising trade volumes.

What you should know:

Monero extended its recovery with a strong move past the $350 barrier, supported by sustained buying activity. The MA ribbon showed a bullish stack, with the 20 and 50 SMAs positioned above the 100 SMA, and price holding well above all key averages. DMI readings reinforced bullish control as +DI outpaced –DI, while ADX hovered near 22, signaling a trend still gaining strength. Volume climbed above its weekly average, confirming conviction behind the breakout. The $380 region is the resistance to monitor, with $350–$330 acting as near-term support. Beyond the chart, Monero’s rally was aided by renewed privacy-coin demand amid upcoming 2026 regulatory proposals that could restrict wallet tracking. Holding above $350 keeps momentum intact and strengthens the outlook for a continued climb toward $400.

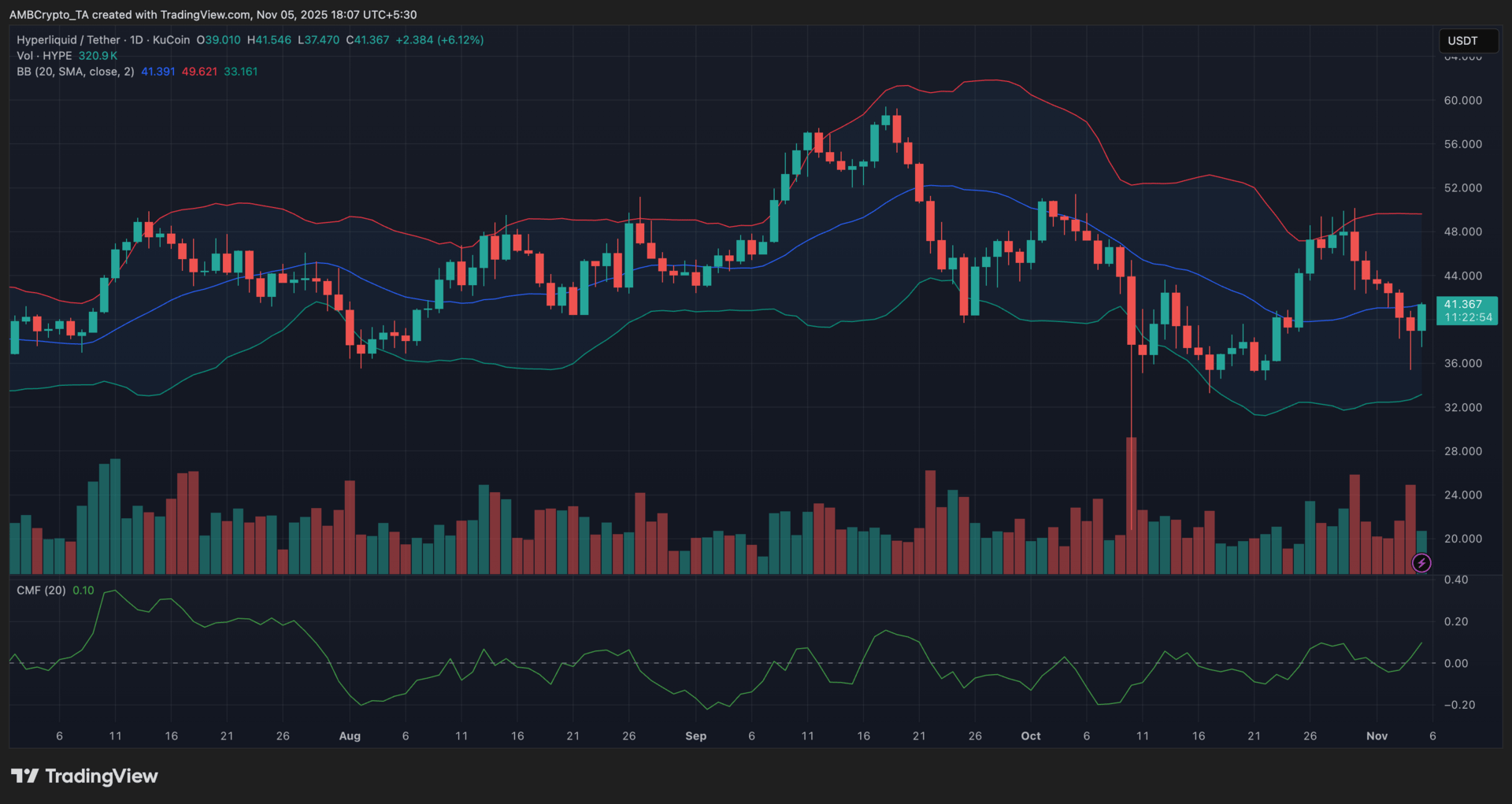

Hyperliquid (HYPE)

Key points:

HYPE rebounded over 6% in 24 hours, recovering from recent lows while volume and buying pressure ticked higher.

Bollinger Bands showed the price testing the midline, with CMF turning positive to confirm early accumulation signs.

What you should know:

Hyperliquid’s token staged a short-term recovery, climbing toward the midline of its Bollinger Bands near $41 after bouncing off the lower boundary around $33. The move was backed by a notable rise in daily trading volume and a positive shift in the Chaikin Money Flow to +0.10, signaling renewed inflows after weeks of capital outflow. The midline at $42–$43 remains the immediate resistance to watch, while $38 acts as nearby support. A breakout above the band’s median line could target the $49–$50 zone, whereas a close below $38 risks revisiting the lower band. Beyond technicals, momentum was fueled by Hyperliquid’s COIN perpetuals rollout and whale accumulation, both seen as catalysts for rising confidence in the platform’s expanding on-chain derivatives market.

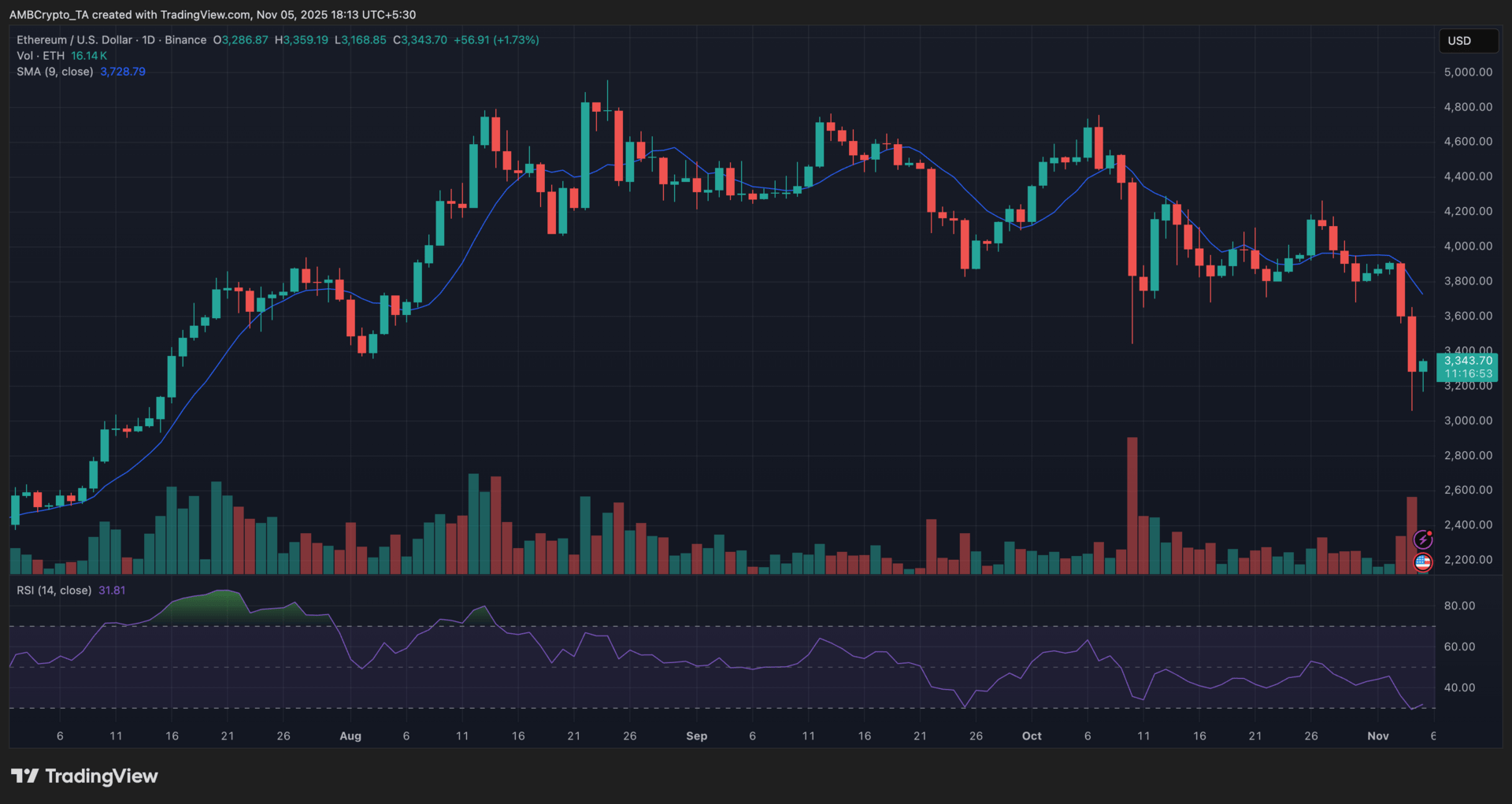

Ethereum (ETH)

Key points:

ETH hovered near $3,344 after a mild 1.7% rebound, following steep losses from earlier sessions.

Selling pressure persisted as the 9-day SMA stayed above price, while RSI approached oversold levels.

What you should know:

Ethereum attempted a short-lived recovery after sliding below $3,200 the previous day, with buyers stepping in near key support. The 9-day SMA around $3,730 continued to act as resistance, marking the prevailing bearish bias. RSI held at 31.8, signaling that selling momentum was slowing but not yet fully exhausted. Volume ticked higher than Monday’s, hinting at tentative accumulation after the liquidation-driven drop. The $3,100–$3,000 range remains crucial to defend, while a daily close above the short-term average could open a path toward $3,700–$3,800. On the fundamental side, ETF outflows and macro risk aversion have weighed on sentiment, as traders rotated to cash amid global volatility. For now, maintaining support above $3,100 is key to avoiding another cascade toward lower zones.

The best marketing ideas come from marketers who live it. That’s what The Marketing Millennials delivers: real insights, fresh takes, and no fluff. Written by Daniel Murray, a marketer who knows what works, this newsletter cuts through the noise so you can stop guessing and start winning. Subscribe and level up your marketing game.

How was today's newsletter? |