- Unhashed Newsletter

- Posts

- Whales fuel Ethereum’s early rebound

Whales fuel Ethereum’s early rebound

Reading time: 5 minutes

Ethereum’s comeback begins: $3.3K flipped and whales are buying

Key points:

Ethereum moved back above the 50-week trend marker near $3,300, a level that previously preceded gains of 97% to 147%.

Whale buying, a six-week high in ETF inflows, and stronger ETH cross-pair performance supported renewed momentum in the market.

News - Ethereum’s advance toward $3,320 revived expectations that the asset may have established a floor near the $2,800 region. ETH reclaimed its 50-week moving average, a setup that historically accompanied strong follow-through.

Market data showed the ETH/USD pair rising roughly 20% from the $2,800 support to around $3,360. Analysts noted that holding above this trendline has previously increased the likelihood of pushes toward the $4,000 area.

Whale activity added further fuel to the move. Large holders accumulated about 934,240 ETH in the past three weeks while bigger institutional cohorts continued to grow their balances.

Spot Ethereum ETFs recorded $177.6 million in inflows on Tuesday, their largest daily total in six weeks and higher than Bitcoin ETF inflows that same day. Analysts described this as part of a structural rotation, with institutions broadening their exposure inside crypto.

ETH also showed strength in cross pairs. The ETH/BTC ratio touched its highest level since October 27, reinforcing the shift in market momentum. On the macro side, traders assessed upcoming Fed decisions and the pending Supreme Court ruling on reciprocal tariffs, both of which could influence near-term volatility.

ETF rotation signals institutional demand - Analysts highlighted that recent access through major U.S. wirehouses, improving ETF structures, and steady interest from institutions have contributed to stronger inflows. Spot Ethereum ETFs now hold roughly $21.40 billion in ETH, reflecting growing participation in the asset.

Rising paper profits could slow the climb - Ethereum’s Net Unrealized Profit/Loss metric has climbed to 0.296, indicating rising paper gains among holders. The last time NUPL reached a similar level, ETH saw a 5.2% pullback as traders booked profits.

A similar period of selling could briefly slow progress toward resistance at $3,390 and the broader target near $3,710, even as the breakout structure remains intact.

Bitcoin treasury firms add to reserves as market awaits Fed decision

Key points:

American Bitcoin and ProCap expanded their holdings, while Strive prepared a $500 million offering that could support future BTC purchases despite unrealized losses.

Major institutions challenged the relevance of Bitcoin’s historic four-year cycle as traders positioned ahead of the final Federal Reserve meeting of 2025.

News - American Bitcoin added 416 BTC in the week ending December 8, bringing its total to 4,783 coins. Its Satoshis Per Share metric rose to 507, up more than 17% in a little over a month. ProCap Financial also increased its holdings, adding 49 BTC to reach 5,000 coins following its recently completed SPAC merger.

Both stocks saw modest early gains on Wednesday but remain sharply lower after heavy declines earlier this month.

Strive took a different approach as it unveiled plans for an at-the-market offering of up to $500 million that could be used for general corporate purposes, including the acquisition of Bitcoin.

The firm currently holds 7,525 BTC but faces an unrealized loss of about 18% at prices below $100,000. It joined other digital asset treasury firms facing pressure from market performance and upcoming classification decisions.

Sentiment across the broader market remained mixed. Ark Invest CEO Cathie Wood argued that Bitcoin’s historic four-year cycle may be disrupted as institutional inflows help reduce volatility and limit future downside. Standard Chartered echoed this view, suggesting ETF demand has reshaped the halving cycle’s influence.

JPMorgan analysts also maintained a positive outlook, noting that while November’s pullback was meaningful, they do not expect the arrival of another crypto winter.

Bitcoin struggled to reclaim $94,000 before retreating toward $92,000 as traders focused on Wednesday’s Federal Reserve rate decision. Polymarket showed a 96.8% probability of a 25 basis point cut. Analysts highlighted resistance at $94,000, support down to $87,500, and the importance of holding above $91,500 to avoid deeper downside risk.

Treasury firms face potential index exclusion - MSCI has proposed reclassifying companies with more than half their assets in digital holdings as funds, a shift that could lead to removal from key benchmarks and potential passive outflows. Strive has urged the index provider to reconsider ahead of the final decision scheduled for January 2026.

Bitcoin’s risk profile shifts - Cathie Wood noted that Bitcoin has transitioned back into a risk-on asset as institutions increase participation. Other market observers pointed to resilient ETF ownership and continued stablecoin growth as signs of expanding maturity within the digital asset ecosystem.

BNB underperforms, Binance co-CEO Yi He hit by WeChat hack and Web2 threats escalate

Key points:

BNB trailed the broader market despite a 51% surge in trading volume and supportive ecosystem developments.

A WeChat hack targeting Binance co-CEO Yi He enabled a memecoin pump-and-dump scheme that generated $55,000 in profits for attackers.

News - BNB climbed a little over 1% to trade above $890 but continued to lag the wider crypto market’s 2.5% gain over the same period. Trading volume rose sharply, jumping 51% above the weekly average, a pattern often associated with whale activity.

However, BNB’s muted price response may indicate a rotation toward stronger-performing assets. Its chart reflected ongoing uncertainty, with the token bouncing from support near $885 but failing to maintain levels above $927, leaving a defined resistance zone intact.

Fundamentals remained broadly constructive. Binance recently secured full ADGM approval, and new infrastructure additions like Sora’s Agentic Oracle reinforced ongoing development on BNB Chain. Even so, traders stayed cautious as security concerns resurfaced within the broader ecosystem.

Days after being appointed co-CEO, Yi He’s WeChat account was hacked and used to promote Mubarakah, a little-known memecoin.

Blockchain analytics showed the attackers purchased 21.16 million Mubarakah tokens using 19,479 USDT before offloading 11.95 million tokens for 43,520 USDT as the fake endorsement circulated. The operation left the attacker with about $55,000 in realized profits while still holding additional tokens.

Binance founder Changpeng Zhao urged users to ignore memecoin promotions from compromised accounts and warned of rising risks tied to Web2 platforms.

The incident followed earlier social media compromises, including a breach of BNB Chain’s official X account in October that resulted in $8,000 in losses. Security experts noted that recycled SIM numbers, leaked credentials, and contact-based recovery flows continue to expose high-profile figures to takeover attempts.

Web2 vulnerabilities fuel crypto exploits - SlowMist analysts outlined how reclaimed mobile numbers and credential leaks can enable attackers to seize accounts with minimal friction.

Recent incidents involving Justin Sun, BNB Chain, and public figures outside crypto highlight how compromised Web2 platforms are increasingly being used to manipulate markets.

Traders wait for confirmation from BNB - Regulatory progress and new technical infrastructure offer a supportive backdrop for BNB. Still, consolidation below $927 and signs of rotation toward other assets kept traders on standby as they watched for a clearer breakout attempt.

Teachers Union warns Senate crypto bill risks pensions, with negotiators split over key provisions

Key points:

The American Federation of Teachers urged senators to abandon the Responsible Financial Innovation Act, citing risks to pension holders and weaker securities protections.

Bipartisan talks remain strained as ethics language, regulator appointments, and Supreme Court signals complicate the bill’s path forward.

News - The American Federation of Teachers urged Senate leaders to reconsider the chamber’s primary crypto market structure proposal, warning it could expose working families to unsafe digital assets and weaken investor safeguards.

In a letter to the Senate Banking Committee, AFT President Randi Weingarten said the Responsible Financial Innovation Act poses “profound risks” to the retirement security of its members. AFT represents roughly 1.7 million workers across education, healthcare, and the public sector.

The AFL-CIO and the Institute of Internal Auditors previously voiced similar concerns, arguing the bill fails to adequately protect consumers and ensure sound governance at crypto exchanges.

The legislation seeks to define oversight responsibilities for digital assets between the CFTC and SEC, create standards for exchanges and custodians, and outline how tokenized financial instruments could operate under federal rules. Still, negotiations have become increasingly contentious.

At recent policy summits, groups that once supported a unified approach are now divided over issues such as DeFi treatment, regulatory visibility, and the trade-offs needed to advance a bill. Several participants have withdrawn support, warning the current draft removes key safeguards.

Political dynamics have further complicated progress. Senator Cynthia Lummis, a lead architect of the proposal, said the White House rejected ethics language she developed with Democrats, prompting renewed negotiations.

At the same time, Democrats remain concerned about the Supreme Court’s indications that President Trump may soon gain expanded authority to fire commissioners at agencies like the SEC and CFTC.

Senator Cory Booker said that without appointed Democrats seated at both agencies, he would not support the bill, adding that assurances from the White House alone would not be sufficient.

Regulatory power concerns grow - With the Supreme Court weighing whether to overturn a long-standing precedent that limits the president’s ability to remove agency commissioners, lawmakers fear the crypto bill could grant outsized regulatory control to whichever party holds the White House.

Democrats are exploring options such as requiring bipartisan quorums at the SEC and CFTC.

Industry positions fracture - At recent policy gatherings, industry participants voiced sharply diverging views on how the bill should treat DeFi, peer-to-peer transactions, and enforcement authority. Some groups have withdrawn support, saying they prefer no bill to one that codifies concessions they view as problematic.

The Headlines Traders Need Before the Bell

Tired of missing the trades that actually move?

In under five minutes, Elite Trade Club delivers the top stories, market-moving headlines, and stocks to watch — before the open.

Join 200K+ traders who start with a plan, not a scroll.

More stories from the crypto ecosystem

Crypto market today: $311M Bitcoin short squeeze, FOMC’s rate-cut odds & more…

Ethena strengthens after $443 mln whale shift – Can ENA’s uptrend continue?

XRP market stalls – Why prices lag despite $423M crypto wipeout

SUI faces mixed market signals: Will ZenLedger’s integration help the altcoin?

Hyperliquid dips despite $4.2M whale move – Can HYPE break free?

Did you know?

From meme to mainstream - The Dogecoin community once crowdfunded a NASCAR sponsorship, turning a joke coin into a race car ad. Now, DOGE is accepted by major companies, proving that internet humor can literally drive you places.

Ethereum’s hidden art gallery - Did you know that the Ethereum blockchain isn't just for finance? It also hosts a huge number of digital art pieces and collectibles known as NFTs. In fact, some of the earliest NFT artworks are considered digital history and have sold for millions.

Satoshi’s mysterious stash - While everyone’s heard of Bitcoin’s anonymous creator Satoshi Nakamoto, did you know that Satoshi is believed to hold around one million Bitcoins that have never been touched? This treasure trove has sparked endless speculation, and if it ever moved, it could send shockwaves through the crypto world.

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

Top 3 coins of the day

Mantle (MNT)

Key points:

MNT was last seen near $1.18 after a steady intraday gain that extended its climb off November’s swing low.

MACD kept a recent bullish crossover intact as positive histogram bars held firm, while price moved closer to retesting its latest Lower High.

What you should know:

MNT held its upward bias as the latest candle closed in positive territory, preserving the recovery structure that began after the charted Low near the $0.86 region. This level now acts as the nearest support to watch. Price continued to edge higher, but the market still faced a structural barrier at the recent Lower High around $1.32, which remains the key resistance level that would need to break for a clearer trend shift. MACD stayed constructive with positive bars, although volume activity remained moderate. Catalysts such as Mantle’s TVL growth beyond $2.2B and expanding partnerships like Aave’s integration may have helped support sentiment. Broader market caution, however, kept profit-taking risks present as traders monitored whether MNT could challenge its resistance zone.

Monero (XMR)

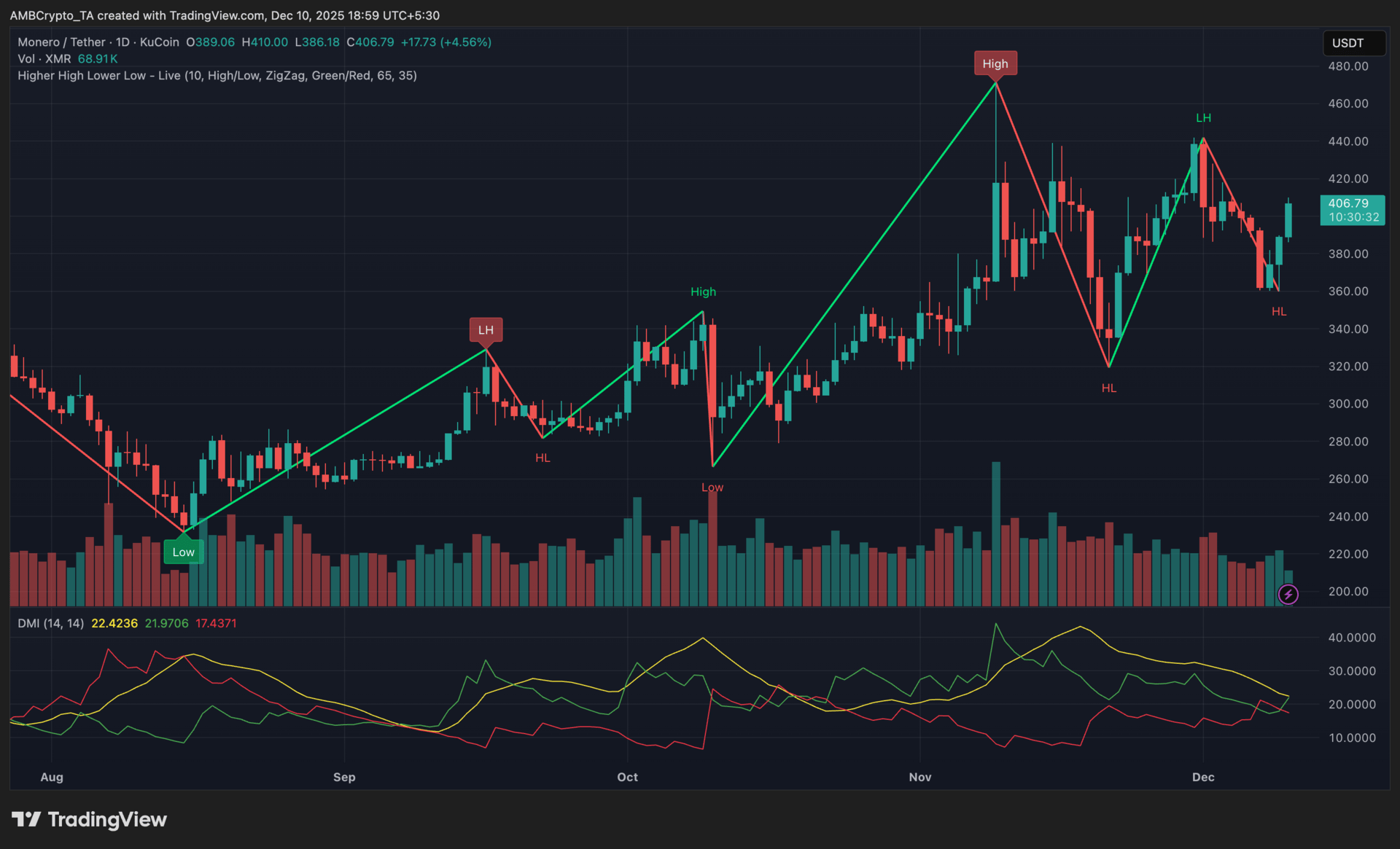

Key points:

XMR traded around $406 after a strong daily rise that carried it further away from its recent Higher Low.

DMI showed +DI holding above -DI while ADX stayed soft, hinting that buyers were regaining control even as trend strength remained subdued.

What you should know:

XMR recovered sharply after bouncing from its latest Higher Low near the $355 region, with price climbing back toward the midrange of its recent structure. The move kept the broader uptrend intact, although the chart still showed a key obstacle at the Lower High around $440, which remains the main resistance level to monitor. DMI readings pointed to improving bullish pressure, while volume stayed steady without indicating heavy accumulation. From a catalyst perspective, expectations surrounding softer Fed policy added support to risk assets, and renewed demand for privacy tools helped lift market interest in XMR. Traders will now watch whether momentum can carry price closer to the $440 barrier or if conditions shift toward another retest of nearby support.

XDC Network (XDC)

Key points:

XDC traded close to $0.050 after a mild intraday rise that followed several sessions of weakness across its broader downtrend.

The 9-day SMA hovered just above recent candles, while EWO stayed negative, showing that early relief signs had not yet shifted the wider momentum.

What you should know:

XDC attempted a gentle rebound after sliding toward the $0.047 support area, with price edging back above the 9-day SMA before settling near the $0.050 region. The move helped ease immediate selling pressure, but the broader trend still leaned bearish as the EWO remained firmly below zero. Volume stayed light, which suggested that recent gains lacked strong follow-through. On the catalyst front, the network continued to see interest tied to enterprise adoption and expanding USDC liquidity, both of which supported long-term utility discussions around XDC. Even so, traders will be watching whether price can build enough momentum to retest the $0.055 resistance or if another pullback toward support develops in the sessions ahead.

How was today's newsletter? |