- Unhashed Newsletter

- Posts

- XRP ETF hopes: Dead or delayed?

XRP ETF hopes: Dead or delayed?

Reading time: 5 minutes

UN-Limited Limit Orders in DeFi

CoW Swap limit orders offer:

Unlimited order management: Limit orders on CoW Swap are completely FREE to place or cancel. Yes, really!

Unlimited order placement: Use one crypto balance to place multiple orders at once, even if you don’t have the full amount yet. That’s useful!

Unlimited order surplus: All upside captured after a price is hit goes to you and not to order takers. As it should be!

Plus everything else you know and love about CoW Swap, like gasless trading and MEV protection.

XRP’s Spot ETF dreams delayed as U.S shutdown continues

Key points:

XRP is currently under pressure as the U.S government shutdown causes a delay in the SEC’s approval for XRP Spot ETFs.

Despite falling behind BNB and USDT, the market remains optimistic.

News - XRP is currently navigating a period of significant uncertainty, with its price falling sharply to $2.85 on 07 October. The token's vulnerability has been amplified by legislative gridlock in the United States, dampening overall investor optimism.

Delays for XRP Spot ETFs - A major factor weighing on XRP's price is the ongoing U.S government shutdown, which has halted the processing of S-1 filings by the Securities and Exchange Commission (SEC).

This stalemate is causing a delay in the anticipated approval of XRP Spot Exchange-Traded Funds (ETFs). The launch of these ETFs is viewed by analysts as absolutely crucial, expected to unleash a massive surge in "Main Street demand" for XRP, given its real-world utility.

The impact of the delay has been clear, with XRP losing its coveted #3 ranking by market capitalization, being flipped by both Binance Coin (BNB) and Tether (USDT) and dropping to the #5 spot.

FUD as a “Buy” indicator - Despite the negative price action and regulatory hurdles, an interesting signal is emerging. According to Santiment,

“XRP is seeing its highest level of retail FUD since Trump's tariffs were announced 6 months ago. There have been more bearish comments than bullish for 2 of the past 3 days, which is generally a promising buy signal.”

This sentiment indicates that the high level of Fear, Uncertainty, and Doubt (FUD) could be a precursor to a market rebound, offering a potential short-term bullish outlook amidst the long-term regulatory concerns.

Strategy’s $80 billion Bitcoin Treasury eclipses tech giants

Key points:

Strategy's Bitcoin holdings briefly hit $80 billion, positioning its corporate treasury close to Microsoft and Amazon.

Institutional investment is at an all-time high, driven by Bitcoin ETF dominance.

News - The corporate Bitcoin treasury of Strategy is rapidly approaching the cash reserves of major tech firms, fueled by Bitcoin's recent record surge.

After the token briefly touched a new all-time high of $126,080 on the 6th of October, Strategy's stash of 640,031 BTC briefly topped $80 billion. This positions its treasury close to the massive cash holdings of companies like Amazon, Google, and Microsoft, which hold between $95 billion and $97 billion in cash or equivalents.

Spot ETFs dominate inflows - Institutional appetite for Bitcoin is at a fever pitch, with U.S. Spot Bitcoin ETFs recording their strongest inflows in nearly three months. Funds attracted $1.19 billion in net inflows on the 6th of October, the highest single-day total since mid-July.

BlackRock's iShares Bitcoin Trust (IBIT) led the surge, accounting for over 81% of the day's inflows with $970 million. Bloomberg ETF analyst Eric Balchunas noted that IBIT is "a hair away from $100 billion" in assets under management (AUM) just 21 months after launch, making it BlackRock’s highest-revenue-generating ETF.

This activity capped off a record week for global digital asset funds, which saw $5.95 billion in inflows, with Bitcoin accounting for $3.55 billion of that figure.

Bitcoin’s “currency debasement” theory - Bitcoin is facing increasingly bullish price forecasts. JPMorgan analysts argue Bitcoin and gold are a "debasement trade," serving as hedges against the US dollar inflation and the nation's spiraling debt.

Looking ahead, economist Timothy Peterson used simulations to state there is a “50% chance Bitcoin finishes the month above $140k.” This aggressive target is echoed by crypto analyst Jelle, who commented, “It’s definitely over for bears. Send it higher.”

This sentiment aligns with previous high-profile forecasts, such as BlackRock CEO Larry Fink's January projection that Bitcoin could hit $700,000 on currency debasement fears.

Spot ETF hopes fuel 20% SOL rally ahead of critical SEC decision

Key points:

Solana's 20% recent rally is fueled by overwhelming market optimism.

The network's fundamental strength is validated by $2.85 billion in annual revenue across its diverse ecosystem.

News - Solana is showing significant bullish momentum, trading at $230 on 07 October - A strong 20% recovery from its late September local low of $191. This uptrend is primarily driven by massive speculation surrounding the potential approval of spot Solana Exchange-Traded Funds (ETFs) in the U.S.

Market sentiment has been overwhelmingly optimistic. Bloomberg’s senior ETF analysts estimate a 100% approval probability, citing greater regulatory clarity. If the SEC gives the "green light," analysts widely believe SOL could finally break the $300-mark and enter a new phase of institutional price discovery.

Robust ecosystem revenue - Beyond the ETF catalyst, Solana's underlying financial strength provides a compelling bullish case. The network generated approximately $2.85 billion in annual revenue between October 2024 and September 2025 from a diverse ecosystem spanning DeFi, trading, memecoins, and AI applications.

Even after the peak of the memecoin mania, monthly revenues remain remarkably strong, sitting comfortably in the $150 million–$250 million range. This sustained performance proves the chain's success is not "merely a speculative flash in the pan," according to 21Shares.

Furthermore, Solana’s yield generation makes it a more dynamic treasury asset compared to Bitcoin. Kyle Samani highlighted this difference by contrasting it with Strategy's Bitcoin-heavy strategy,

“The challenge that they face is their capital structure and their coupon payments are not perfectly congruent. Bitcoin doesn’t produce any yield.”

By contrast, Solana’s staking rewards offer returns of roughly 7% or more.

End of 'Regulation by Enforcement?’ - SEC prepares defined framework for crypto

Key points:

SEC Chair Paul Atkins confirmed a move to “innovation exemption," a direct move to replace the previous "regulation by enforcement" approach.

This framework will allow crypto projects to test new models (like DeFi and tokenization) under temporary, supervised conditions.

News - The U.S. Securities and Exchange Commission (SEC) is preparing to formalize an “innovation exemption” aimed at providing a defined regulatory framework for crypto and fintech startups.

This marks the agency’s most direct effort to replace the years of "regulation by enforcement" that crypto advocates and Republicans criticized under the previous administration. SEC Chair Paul Atkins confirmed the plan, recounting how the industry had faced “four years, at least” of “repression” that resulted in “pushing things abroad, rather than having innovation being done.”

The proposal is expected to be finalized before year-end as part of a broader effort to create clearer pathways for compliant innovation, reflecting a growing sense of optimism that the SEC is shifting from enforcement to engagement.

Bridging the on-chain gap - The forthcoming framework, first directed by Chair Atkins in June, would offer "conditional exemptive relief" allowing on-chain financial projects to operate under temporary, supervised conditions while broader rulemaking is developed.

This move is seen as vital for the crypto space. Wendy Fu, CEO of Momentum Finance, highlighted the primary benefit - The exemptions would allow projects to “test their ideas without burning millions on lawyers first.” She added that the framework would also give regulators “a front-row seat to see how this stuff actually works.”

Industry experts believe the SEC's efforts “could finally bridge the gap between innovation and regulation in the U.S. market,” effectively working to bring real innovation back onshore and encourage global collaboration around financial technology standards.

More stories from the crypto ecosystem

Did you know?

The Chinese government's ban on crypto mining in May 2021 triggered the “Great Migration,” catapulting the United States as the new leader in the sector, controlling an estimated 40% of the global total. However, some estimates suggest that hidden operations still allow China to maintain a large, albeit fluctuating, share of the hashrate.

With over 300 million crypto owners worldwide, Asia — thanks to India, China, and Indonesia — leads in crypto adoption, accounting for 160 million owners. This massive figure significantly surpasses Europe, which ranks second with 38 million.

Blockchains are actively trying to go green. They are considering a shift from Proof-of-Work (PoW) — used by Bitcoin — to alternatives like Proof-of-Stake (PoS), which can reduce energy consumption by over 99%. The industry is also focusing on powering operations with renewable energy sources to handle transactions more efficiently.

Get in on the markets before tech stocks keep rising

Online stockbrokers have become the go-to way for most people to invest, especially as markets remain volatile and tech stocks keep driving headlines. With just a few taps on an app, everyday investors can trade stocks, ETFs, or even fractional shares—something that used to be limited to Wall Street pros. Check out Money’s list of top-rated online stock brokerages and start investing today!

Top 3 coins of the day

Aster (ASTER)

Key points:

Aster dipped by 2.82% over the past day amid delisting concerns.

At press time, the chart saw accumulation after a head-and-shoulder pattern over the last week.

What you should know:

Aster saw a sharp price increase between 01 and 04 October, soaring sharply from $1.5 to $2.23 during this time. However, this uptrend was brief, as ASTER dropped again amid wash trading and delisting concerns, reaching $1.79.

Currently, the altcoin is trading at $1.94 after a 2.82% dip over the last day, with a market cap of 3.29B. However, its 24-hour trading volume dropped 32.48% to 1.47B. This shows that the market remains cautious in the short term.

On the 4-hour chart, ASTER had formed a head-and-shoulders pattern from the 28th of September to the 5th of October, showing steady accumulation at its current price levels. The neckline sits at around $2.15. A breakout above this level can propel ASTER to $2.43. However, a failure to clear this level may make the altcoin retest $1.98.

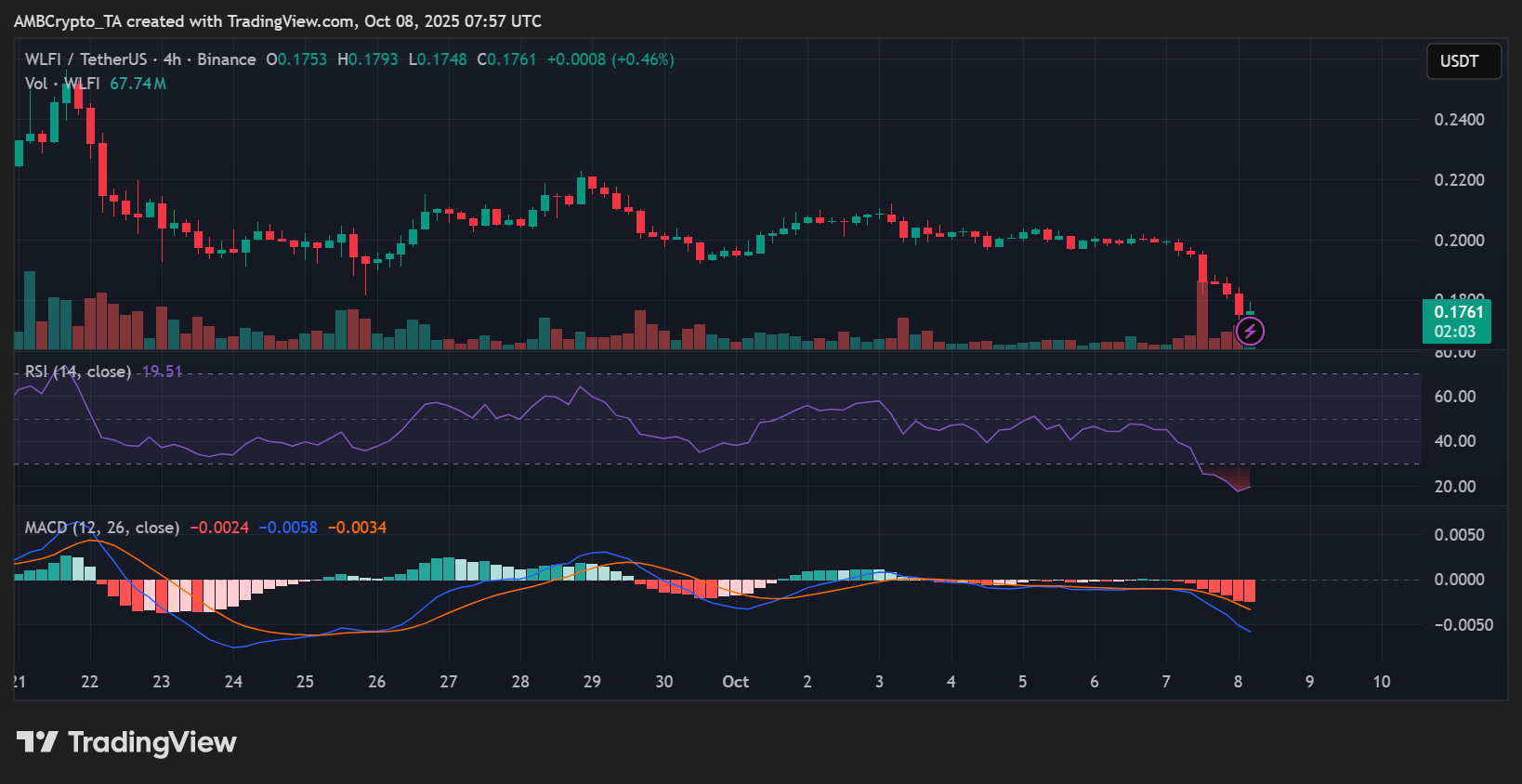

World Liberty Financial (WLFI)

Key points:

WLFI has been under massive sell pressure, dropping by over 10% in 24 hours.

The RSI and MACD slumped too, showing no respite from the bears.

What you should know:

The World Liberty Financial (WLFI) token is currently trading under pressure, at $0.1759 as panic selling grips the market. The Trump-linked token has fallen 10.36% over the last day, a surprising number, considering it fell 10.46% over the past 7 days. Despite this pullback, the project maintains a considerable presence, with a circulating supply of 24.61 billion WLFI. However, its market cap suffered, dropping down to $4.33B.

The token's all-time high of $0.33, achieved in early September 2025, now seems distant. Although the high 24-hour trading volume, which rose 16%.12% to $544.77M, indicates continued strong activity, it also highlights the significant volatility surrounding the token.

On the charts, WLFI's RSI was at a troubling 20 while its MACD continued in a freefall, showing the sellers are in no mood to stop.

The key challenge for WLFI now is to reverse its downtrend and rebuild investor confidence for sustainable, long-term growth.

Pepe (PEPE)

Key points:

PEPE saw slight bullish momentum, despite the price dropping by over 5% on the day.

If the memecoin cannot maintain an uptrend, it could fall to $0.00906.

What you should know:

PEPE (PEPE) is currently signaling strong bearish momentum. The token is trading at 0.059344 after a 5.81% drop on the day, supported by a 1.57% increase in trading volume and a market cap of $3.93B.

A look at its RSI, though, shows a slight uptick - buyers may have returned to the market, although there are not enough bulls to keep PEPE’s momentum rising and rallying.

Technically, PEPE is maintaining support at the $0.00972 level, with a key resistance point at $0.1031. A powerful breakout past this resistance, driven by strong buying volume, is anticipated to lead to a sharp rally.

However, if PEPE continues to fall, it could retest its previous support level of $0.00906. A failure to maintain this level could result in short-term consolidation.

How was today's newsletter? |