- Unhashed Newsletter

- Posts

- XRP faces pressure below $2

XRP faces pressure below $2

Reading time: 5 minutes

XRP slides below $2 as bearish signals clash with new institutional proxy bets

Key points:

XRP has slipped below the $2 support level, with technical indicators pointing to growing downside risk if key demand zones fail.

At the same time, VivoPower is expanding an XRP-linked strategy through indirect equity exposure to Ripple Labs, targeting institutional investors.

News - XRP is facing renewed downside pressure after establishing a sustained break below the $2 support level, a zone that had previously held through multiple pullbacks. Market analysts say the move signals a meaningful technical breakdown, increasing the risk of a deeper correction if buyers fail to defend lower support areas.

Technical breakdown raises downside risk - Veteran trader Peter Brandt noted that XRP’s weekly chart shows a potential double top formation, with bearish implications while price remains below $2. If the breakdown holds, analysts point to downside targets near $1.65 and, in more severe scenarios, toward the $1.20 to $1.35 range.

Onchain data adds to the caution, with realized price distribution showing a key demand zone around $1.78, where a large volume of XRP last changed hands.

Other technical signals reinforce the bearish setup. Analysts tracking moving averages and momentum indicators say selling pressure has strengthened since XRP lost its long held support, leaving bulls with limited room for error in the near term.

Institutional exposure takes a different route - The market weakness comes as VivoPower advances a new XRP-linked strategy focused on equity rather than direct token ownership. The Nasdaq listed company said it plans to originate up to $300 million in Ripple Labs shares for a South Korea focused investment vehicle managed by Lean Ventures.

Based on current prices, VivoPower estimates the structure offers indirect exposure to roughly 450 million XRP, estimated to be valued near $900 million.

The arrangement does not involve VivoPower deploying its own balance sheet capital. Instead, the company expects to earn management fees and performance-based compensation, targeting $75 million in net economic returns over three years if the mandate is fully deployed.

VivoPower said the transaction remains subject to negotiations, market conditions, and share availability.

Ethereum’s fee debate resurfaces amid market pressure and network upgrades

Key points:

Ethereum is facing market pressure alongside slowing onchain activity and renewed discussion around fees, execution speed, and protocol complexity.

Gas limit upgrades and blockspace trading models are being explored as developers and infrastructure providers address throughput and usability.

News - Ethereum is experiencing market strain as whale profitability has moved close to breakeven levels, US-based selling pressure has persisted, and network activity has weakened. Onchain data shows declining active sending addresses, while ETH price action remains caught between a possible rebound and the risk of further downside.

Market stress shapes the backdrop - At the protocol level, discussion around transaction fees and execution mechanics has returned to focus. Ethereum co-founder Vitalik Buterin recently revisited the concept of onchain gas futures, arguing that clearer fee signals and hedging mechanisms could help users better anticipate transaction costs.

In a separate statement, Buterin also said Ethereum needs to become simpler so that more people can understand the protocol from top to bottom, noting that complexity limits practical trustlessness.

Developers are simultaneously preparing further throughput changes. Discussions among Ethereum’s All Core Developers meeting indicate a possible increase in the network’s gas limit to 80 million in January 2026 following the next blob parameter-only hard fork.

Raising the gas limit would allow more transactions to fit within each block and could ease fee pressure, although developers have noted that additional client-level optimizations are required before proceeding.

Blockspace markets enter the conversation - Alongside protocol level changes, new infrastructure approaches are being tested.

Ethereum blockspace trading platform ETHGas recently raised $12 million in a seed round led by Polychain Capital and launched a market that allows participants to pre-purchase execution guarantees through pre-confirmations. The company said the market launched with $800 million in commitments from validators, builders, and other participants.

ETHGas founder Kevin Lepsoe acknowledged that the system introduces centralization tradeoffs, noting that a significant portion of Ethereum blocks already rely on specialized builders and relays. He said the platform plans to mitigate these risks through multiple nodes and leader election, though broader coordination would be required.

With ETH trading near key support levels and facing resistance from dense supply zones, price sensitivity remains elevated as infrastructure changes and market dynamics continue to unfold.

Coinbase pushes global expansion as payments, India access, and product scope broaden

Key points:

Coinbase is expanding local access across Europe and Asia through new payment integrations and regulatory clearances.

The exchange is also widening its product offering as it positions itself as a multi-asset trading platform.

News - Coinbase is accelerating its global expansion strategy, combining local payment integrations, renewed market entry efforts, and a broader product roadmap aimed at deepening user engagement across regions.

In Europe, Coinbase has integrated Poland’s widely used Blik mobile payment system through a partnership with payment processor PPro. The move allows Polish users to fund accounts using familiar local rails, even as the country continues to lag in implementing national crypto legislation.

Poland remains the only EU member state without a functioning framework to enforce MiCA, despite the regulation applying across the bloc. Coinbase holds a MiCA license secured in June, supporting its operations across the European Union as MiCA takes effect, even as Poland’s national implementation remains unresolved.

India reopens as a key growth market - At the same time, Coinbase is strengthening its footprint in India following regulatory approval to acquire a minority stake in CoinDCX. The Competition Commission of India cleared the transaction, enabling Coinbase to deepen its exposure to one of the world’s largest crypto user bases.

Coinbase has been an investor in CoinDCX since 2020 and recently resumed user registrations after a two-year hiatus. The exchange plans to introduce a rupee on-ramp in 2026, signaling a longer-term commitment despite India’s complex tax and compliance environment.

Platform expands beyond crypto - Coinbase is also expanding the range of assets available on its platform. The exchange announced plans to roll out stock trading, prediction markets, and additional derivatives, starting with integrations such as Kalshi.

Users will be able to manage crypto, stocks, and other assets within a single app, while Coinbase continues to explore tokenized real-world assets through its institutional infrastructure.

Together, these moves reflect Coinbase’s effort to combine local accessibility, regulatory alignment, and broader functionality as competition among global trading platforms intensifies.

North Korea drove record $3.4B crypto theft year with fewer but deadlier attacks

Key points:

Global crypto theft reached $3.4 billion in 2025, with North Korea-linked actors accounting for 59% of all stolen funds.

DPRK hackers relied on fewer incidents, sophisticated laundering tactics, and high-value targets to maximize impact.

News - Cryptocurrency theft surged to a record $3.4 billion in 2025, driven largely by North Korea-linked hacking groups that carried out fewer but far more damaging attacks, according to multiple analyses from Chainalysis.

DPRK-affiliated actors stole at least $2.02 billion in digital assets during the year, accounting for 59% of all funds stolen. The increase marked a 51% rise from 2024 levels, even as the number of known incidents declined sharply.

Chainalysis attributed the outsized totals to a shift toward targeting large centralized services, led by the roughly $1.4 billion Bybit hack, which was highlighted as a major driver of 2025 losses.

Big game hunting becomes the dominant strategy - Chainalysis found that North Korean hackers were responsible for 76% of all service-level compromises in 2025, underscoring a clear preference for large, high-impact targets.

While attacks on personal wallets increased in frequency, the total value stolen from individual users fell significantly, reinforcing the focus on centralized platforms and pooled funds.

Investigators also observed growing reliance on insider access and technical infiltration. DPRK-linked operatives increasingly secured roles within crypto companies or posed as trusted industry contacts, allowing them to gain privileged access before executing large-scale thefts.

A distinct 45-day laundering playbook - Post-hack activity revealed a consistent laundering pattern unfolding over roughly 45 days.

North Korean actors typically moved stolen funds in smaller tranches, relied heavily on bridges, mixers, and Chinese-language over-the-counter services, and gradually routed assets toward potential off-ramps. This behavior contrasts with other threat actors, who tend to move funds in larger batches and interact more broadly with DeFi platforms.

Chainalysis warned that as North Korea continues using crypto theft to fund state priorities and evade sanctions, identifying and disrupting these high-impact operations quickly will remain a central challenge for the industry heading into 2026.

If You Could Be Earlier Than 85% of the Market?

Most read the move after it runs. The top 250K start before the bell.

Elite Trade Club turns noise into a five-minute plan—what’s moving, why it matters, and the stocks to watch now. Miss it and you chase.

Catch it and you decide.

By joining, you’ll receive Elite Trade Club emails and select partner insights. See Privacy Policy.

More stories from the crypto ecosystem

Interesting facts

China’s rare trees and tea are becoming blockchain assets: In late 2025, Chinese firms are tokenizing prized Huanghuali trees and fine tea into digital assets to raise capital and trade collectibles on blockchain platforms, blending traditional culture with modern finance in ways regulators are still wrestling with.

Wall Street is using blockchain for money market funds: JPMorgan launched a tokenized money market fund on the Ethereum blockchain in 2025, letting qualified investors hold fund shares as digital tokens with daily interest and 24/7 settlement, a notable move by a major bank into on-chain finance.

Bitcoin’s payment network is quietly scaling beyond store-of-value use: In 2025, the Bitcoin Lightning Network has grown into a real payments layer, with major exchanges and wallets routing roughly 15–16 % of Bitcoin withdrawals and payments through Lightning, enabled by ongoing upgrades like reusable Lightning addresses and stablecoin support.

Seeking impartial news? Meet 1440.

Every day, 3.5 million readers turn to 1440 for their factual news. We sift through 100+ sources to bring you a complete summary of politics, global events, business, and culture, all in a brief 5-minute email. Enjoy an impartial news experience.

Top 3 coins of the day

Uniswap (UNI)

Key points:

UNI rebounded toward $5.26 after defending the lower Bollinger Band near $4.85, supported by a clear pickup in volume.

Bearish momentum weakened as the MACD histogram contracted, even though the signal line remained slightly above the MACD line.

What you should know:

UNI staged a relief bounce after dipping into the lower Bollinger Band zone around $4.85, a level that previously acted as a demand area. Price action then pushed back above the mid-band, suggesting short-term mean reversion rather than a confirmed trend shift. Volume expanded during the rebound, indicating active participation instead of a thin liquidity move. Momentum indicators, however, remained mixed. The MACD signal line stayed marginally above the MACD line, confirming that bearish control had not fully flipped. Still, shrinking negative histogram bars showed selling pressure had eased compared to earlier sessions. Beyond the chart, traders tracked governance-related optimism, with a major UNI token burn proposal entering its final voting phase. This narrative appeared to support short-term sentiment, even as broader crypto markets stayed cautious. Holding above $4.85 remains key, while $5.45–$5.55 now acts as the immediate resistance zone to monitor.

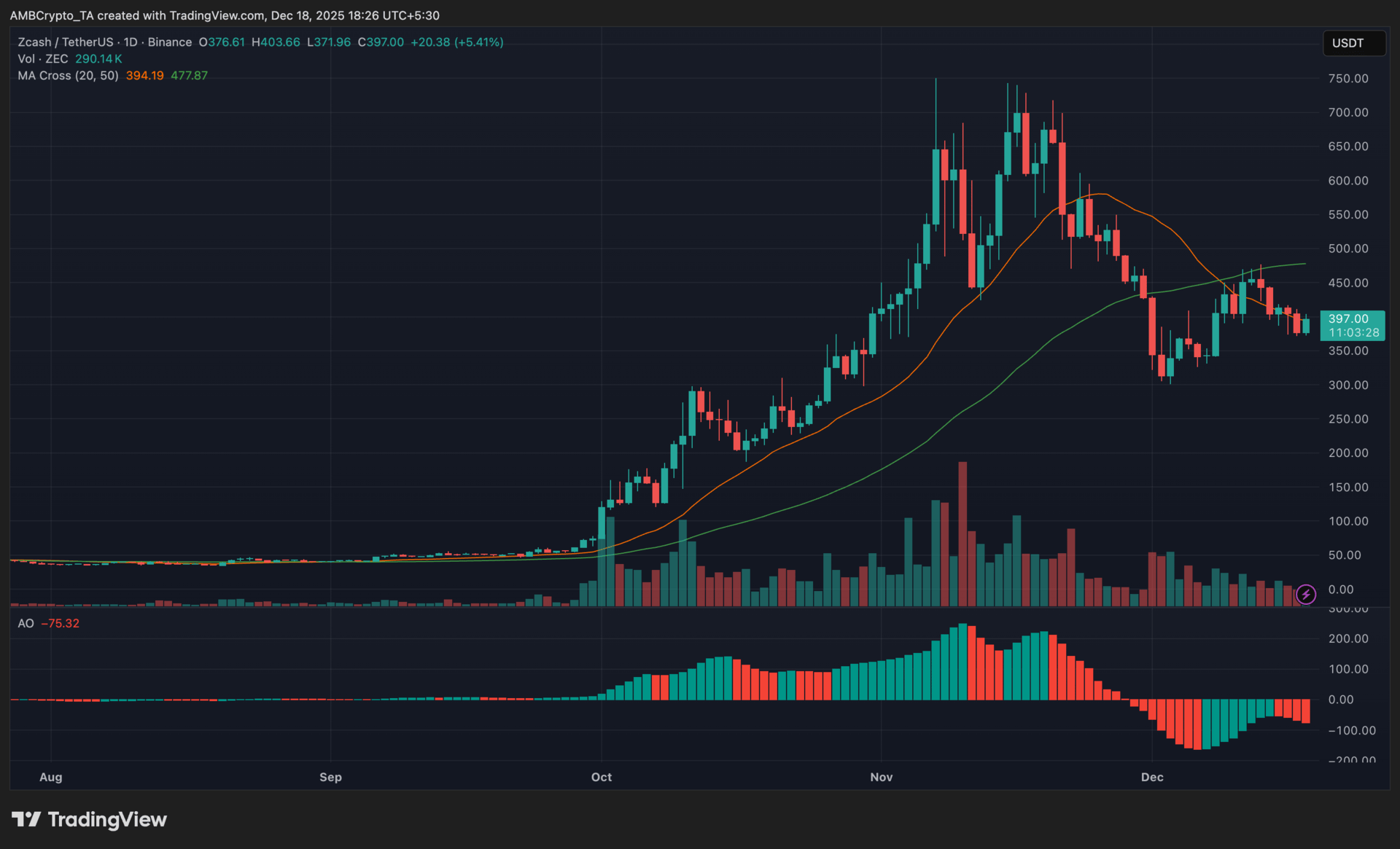

Zcash (ZEC)

Key points:

ZEC was trading near $397 at press time, reflecting a modest rebound after its recent pullback from multi-week highs.

The 50-day MA stayed above the 20-day MA, while the AO showed strengthening negative momentum, signaling a cooling phase within a broader uptrend.

What you should know:

Zcash’s price action cooled after an extended rally, with recent candles forming lower highs as the asset consolidated near the 50-day moving average. Despite slipping below the 20-day MA, the 50-day MA continued to hold above it, indicating that the medium-term trend structure remained intact rather than flipping bearish outright. Momentum indicators echoed this slowdown. The Awesome Oscillator (AO) shifted deeper into negative territory, showing increasing bearish momentum rather than contraction, which aligned with ongoing profit-taking. However, sell pressure lacked aggressive follow-through. Volume expanded during the prior rally and eased during the pullback, suggesting distribution remained controlled. Beyond technicals, ZEC drew support from broader privacy coin interest after DTCC’s move toward blockchain-based tokenization, reinforcing demand for compliance-friendly privacy infrastructure. Zcash’s selective disclosure design positioned it favorably amid regulatory scrutiny, while whale accumulation helped cushion downside risks. For now, the 50-day MA remains the key level to defend, while a recovery above the 20-day MA would be needed to restore upside momentum.

Monero (XMR)

Key points:

XMR was trading around $440 at press time, extending its recent advance as buyers maintained control.

RSI stayed elevated near the low-60s, while price pushed toward the upper Bollinger Band, signaling sustained bullish pressure.

What you should know:

Monero continued to trend higher after building a series of higher lows, with recent candles pressing into the upper Bollinger Band. This move reflected expanding volatility rather than a short-lived spike, as price held firmly above its mid-range consolidation. Momentum remained constructive, with RSI hovering below overbought territory, suggesting buyers retained room to stay active without immediate exhaustion. Volume supported the move, rising alongside bullish candles and confirming participation rather than thin liquidity-driven gains. From a structure standpoint, the $440–$450 zone now stands as the key resistance area to monitor, while the $400–$410 region remains the primary support buyers are defending. Beyond the chart, Monero benefited from renewed interest across the privacy coin segment following institutional discussions around privacy-enabled blockchain infrastructure. That broader narrative helped sustain demand, even as regulatory uncertainty continued to cap aggressive upside.

How was today's newsletter? |