- Unhashed Newsletter

- Posts

- XRP finds footing after EU boost

XRP finds footing after EU boost

Reading time: 5 minutes

XRP steadies following oversold dip and EU approval

Key points:

XRP’s sharp sell-off pushed it into oversold territory, triggering capitulation-style selling before signs of stabilization emerged.

Ripple’s preliminary e-money approval in Luxembourg added a regulatory tailwind as XRP rebounded toward key resistance zones.

News - XRP went through a volatile stretch this week as a sharp pullback dragged the token into oversold conditions, prompting widespread loss-driven selling.

On-chain data showed that a large share of transfers took place below holders’ cost bases, reflecting defensive exits rather than strategic repositioning. Historically, such phases often mark selling exhaustion, especially when panic-driven moves cluster over short time frames.

Momentum began to shift as XRP stabilized near $2.05 before rebounding toward $2.14. The recovery coincided with renewed buying interest and improving volume, suggesting dip buyers were stepping in after the aggressive unwind. At the same time, market sentiment received a boost from regulatory developments tied to Ripple’s European expansion.

Regulation adds context to the bounce - Ripple confirmed it has received preliminary approval for an Electronic Money Institution license in Luxembourg, subject to final conditions.

If completed, the authorization would allow Ripple to offer regulated digital asset and stablecoin payment services across the EU through passporting rules. The move follows recent regulatory approvals in the UK and aligns with Ripple’s broader push toward compliance under the EU’s Markets in Crypto Assets framework.

While the approval directly relates to Ripple’s payments business, traders appeared to factor the news into XRP’s short-term outlook, helping support the rebound from oversold levels. XRP briefly pushed above the $2.14 resistance zone, with trading activity picking up sharply during the move.

Key levels traders are watching - XRP’s structure now hinges on whether buyers can hold the breakout area between $2.14 and $2.16. Sustained strength above this zone could open a path toward resistance near $2.26 and potentially the $2.40 region.

On the downside, failure to defend $2.14 would risk a pullback toward $2.03, where prior support has been tested.

For now, XRP’s recovery reflects a mix of technical relief and improving regulatory optics, with follow-through likely determining whether this bounce develops into something more durable.

Ethereum breakout revives $4,000 talk as on-chain strength builds

Key points:

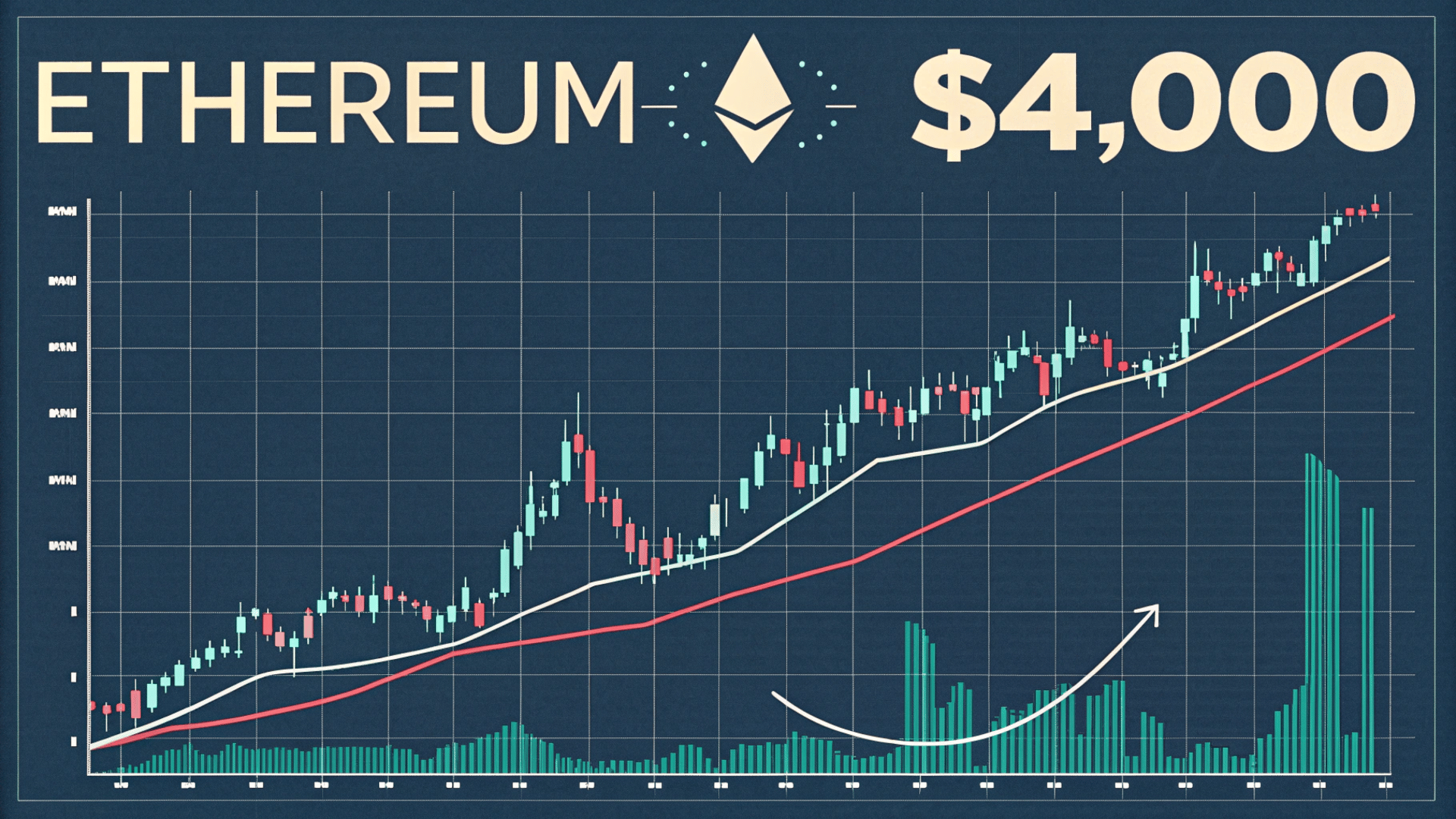

Ethereum broke out of a bullish price structure with strong volume, bringing the $4,000 level back into focus.

Network usage, staking growth, and treasury accumulation point to strengthening fundamentals despite near-term momentum risks.

News - Ethereum rallied nearly 7% over the past 24 hours, extending its recovery after breaking out of a cup-and-handle pattern on the 12-hour chart. The move was backed by expanding volume, signaling broad participation rather than a thin liquidity push.

With the breakout confirmed, the $4,000 to $4,010 zone has re-entered technical projections for the first time in weeks, marking a shift in Ethereum’s short-term technical roadmap.

While price structure has improved, momentum remains conditional. Rising short-term profits have historically increased pullback risk, even during constructive trends. However, recent data suggests holders are not rushing to sell, helping Ethereum maintain its footing above key support near $3,250.

Fundamentals add weight to the rally - Beyond price action, Ethereum’s on-chain metrics have strengthened noticeably.

Active addresses recently climbed above 790,000, overtaking major layer 2 networks, while average transaction fees dropped to around $0.15. These shifts follow a series of protocol upgrades that expanded blob capacity and reduced data costs, improving network efficiency and usability.

Staking trends are also reinforcing long-term confidence. Large treasury players continue to lock up Ether, with one major Ethereum-focused treasury staking more than 1.5 million ETH, representing about 4% of total staked supply. Validator entry queues have climbed to their highest levels since mid-2023, reflecting strong demand for staking participation.

Price levels and what comes next - For the breakout to remain intact, Ethereum needs to hold above the $3,250 to $3,270 range. A sustained move beyond $3,360 to $3,380 would reduce near-term momentum risk and open the door toward $3,580, $3,910, and eventually $4,000. Failure to defend support could shift focus back toward $3,180 and $3,050.

For now, Ethereum’s rally sits at the intersection of improving structure and strengthening fundamentals, with follow-through likely determining whether the $4,000 level becomes more than a technical reference.

Pakistan explores stablecoin payments with WLFI-linked firm

Key points:

Pakistan has signed an MOU to explore regulated cross-border payments using a dollar-backed stablecoin linked to World Liberty Financial.

The move aligns with Pakistan’s broader push to formalize digital assets and modernize remittance and settlement infrastructure.

News - Pakistan has taken another step toward integrating digital assets into its financial system by signing a memorandum of understanding with SC Financial Technologies to explore stablecoin-based cross-border payments.

The agreement focuses on assessing how a dollar-pegged stablecoin, USD1, could operate within Pakistan’s emerging regulated payments framework.

According to the country’s Virtual Assets Regulatory Authority, the MOU sets the stage for technical cooperation on compliant digital payment models.

SC Financial Technologies is described as an affiliated entity of World Liberty Financial, a crypto venture linked to the family of U.S. President Donald Trump. A person familiar with the agreement said the company will work alongside Pakistan’s central bank to examine how the USD1 stablecoin could function within existing and planned payment systems.

The exploration is intended to run in parallel with Pakistan’s own digital currency initiatives, potentially supporting remittances and other cross-border transactions. Officials emphasized that any experimentation would remain aligned with regulatory oversight and national financial stability goals.

Remittances and regulation in focus - Cross-border transfers are a key use case behind the initiative. Pakistan receives more than $36 billion annually in remittances from overseas workers, making cost efficiency and settlement speed a priority for policymakers.

Authorities have signaled that blockchain-based infrastructure could help streamline these flows if deployed within a compliant framework.

The stablecoin discussions come as Pakistan accelerates efforts to formalize its crypto ecosystem. The country has established a dedicated virtual assets regulator, is finalizing legislation for digital assets, and is preparing a central bank digital currency pilot. Officials have also positioned Pakistan as a key market for regulated crypto activity.

Political and market context - World Liberty Financial has already drawn attention after its stablecoin was used in a major international transaction involving a $2 billion equity purchase in Binance by an Abu Dhabi state-backed investor.

At the same time, the project’s links to the Trump family have prompted scrutiny in the U.S., adding a political dimension to Pakistan’s outreach.

For now, Pakistan’s agreement remains exploratory. Whether the USD1 stablecoin advances beyond technical discussions will depend on regulatory assessments and the outcome of ongoing digital currency planning.

Impersonation and AI scams drive $17B crypto losses in 2025

Key points:

Crypto scams and fraud cost users an estimated $17 billion in 2025, with impersonation emerging as the fastest-growing threat.

Chainalysis found AI-enabled scams are far more profitable than traditional methods, accelerating the shift toward social engineering attacks.

News - Cryptocurrency users lost an estimated $17 billion to scams and fraud in 2025, according to new findings from Chainalysis. The firm’s latest crypto crime research shows that impersonation schemes and AI-assisted scams are increasingly overtaking cyberattacks as the primary way criminals steal funds from individuals.

The report highlighted a sharp rise in impersonation tactics, with related scam activity jumping roughly 1,400% year over year.

Rather than relying on technical exploits, scammers are posing as trusted exchanges, support agents, government services, or trusted individuals or organizations to manipulate victims into transferring funds or sharing sensitive information. As these schemes have grown more targeted, the average payment size has increased significantly.

Chainalysis noted that artificial intelligence has played a major role in scaling these operations.

Scams linked to AI tools were found to be about 4.5 times more profitable than traditional scams, reflecting higher efficiency, greater transaction volumes, and broader victim reach. Deepfakes and automated tools have made fraud harder to detect, even for experienced users.

Trust replaces technology as the weak point - The shift toward impersonation reframes how crypto crime is evolving. While hacks and protocol breaches remain a concern, Chainalysis data shows losses from scams aimed directly at individuals are increasing and may surpass losses from cyberattacks if current trends continue.

In several high-profile cases, scammers impersonating major exchanges were able to steal millions of dollars by exploiting urgency and perceived authority rather than security flaws.

The report also found that impersonation scams rarely operate in isolation. Many pig butchering and investment fraud schemes now combine social engineering, impersonation, and technical elements, blurring traditional scam categories and making enforcement more complex.

What comes next - Chainalysis warned that there is no single fix for the problem. As scams become more industrialized, the firm urged a multi-layered response that includes better detection tools, real-time fraud monitoring, and stronger cross-border cooperation.

For users, skepticism toward unsolicited messages and requests remains one of the most effective defenses as fraud increasingly targets human trust rather than technology.

More stories from the crypto ecosystem

Did you know?

Engagement persists beyond hype cycles: Behavioral research indicates that while price spikes attract crowds, many users deepen their involvement during periods of low market excitement. This suggests that curiosity and technical experimentation contribute to sustained engagement just as much as short-term price momentum.

Crypto users are more likely to hold multiple wallets than multiple bank accounts: Surveys indicate that active crypto users commonly manage several wallets at once, separating funds by purpose (payments, savings, speculation), a behavior rarely seen in traditional banking where most users rely on one primary account.

Many people keep crypto even after losing money: Studies on investor behavior show that crypto users who experience losses often remain in the ecosystem instead of exiting entirely, driven by learning effects, sunk-cost bias, or continued utility rather than expectations of quick profits.

Top 3 coins of the day

Monero (XMR)

Key points:

XMR pushed deeper into price discovery after extending its breakout beyond the $700 mark, maintaining strong upside traction.

The MA ribbon stayed firmly bullish, while elevated volume and stretched RSI reflected sustained momentum rather than immediate exhaustion.

What you should know:

Monero continued its aggressive advance after clearing its prior consolidation range, with recent sessions showing consistent follow-through near the highs. The rally unfolded with limited downside pauses, underscoring strong conviction as price accelerated away from earlier resistance zones.

From a trend perspective, XMR traded well above the entire MA ribbon, which remained positively aligned and widely spread, reinforcing the strength of the prevailing uptrend. Momentum indicators also reflected elevated conditions, with RSI holding in overbought territory, signaling intense buying pressure rather than an early reversal.

Volume stayed elevated throughout the move, supporting the view that the breakout was driven by participation rather than thin liquidity.

Beyond technicals, demand appeared supported by a broader privacy-focused narrative, alongside geopolitical demand tied to heightened concerns around capital controls and financial surveillance. With price discovery underway, the $650–$670 area now acts as the nearest support zone to monitor for trend stability.

Jupiter (JUP)

Key points:

JUP edged higher while trading close to the upper Bollinger Band, signaling improving upside pressure without a volatility breakout.

Bullish momentum persisted on the Squeeze Momentum Indicator, though follow-through remained measured rather than aggressive.

What you should know:

Jupiter’s price action showed gradual strength, with recent candles pushing toward the upper Bollinger Band near $0.23 while remaining contained within the band structure. This reflected controlled buying interest rather than an impulsive expansion. Volume improved slightly from prior sessions, reinforcing steady participation instead of short-term chasing.

The Squeeze Momentum Indicator stayed green for several consecutive sessions, highlighting sustained bullish bias after a prolonged red phase. However, the histogram remained shallow, suggesting momentum was stabilizing rather than accelerating sharply. This kept price action orderly as JUP consolidated above its recent base.

On the catalyst front, airdrop anticipation ahead of the final Jupuary snapshot continued to support accumulation behavior. In parallel, product momentum, driven by ongoing improvements across Jupiter’s trading and DeFi offerings, helped sustain sentiment.

Holding above the middle Bollinger Band near $0.21 keeps upside attempts toward $0.23–$0.25 in focus, while a slip below $0.21 would likely invite consolidation toward the lower band around $0.19.

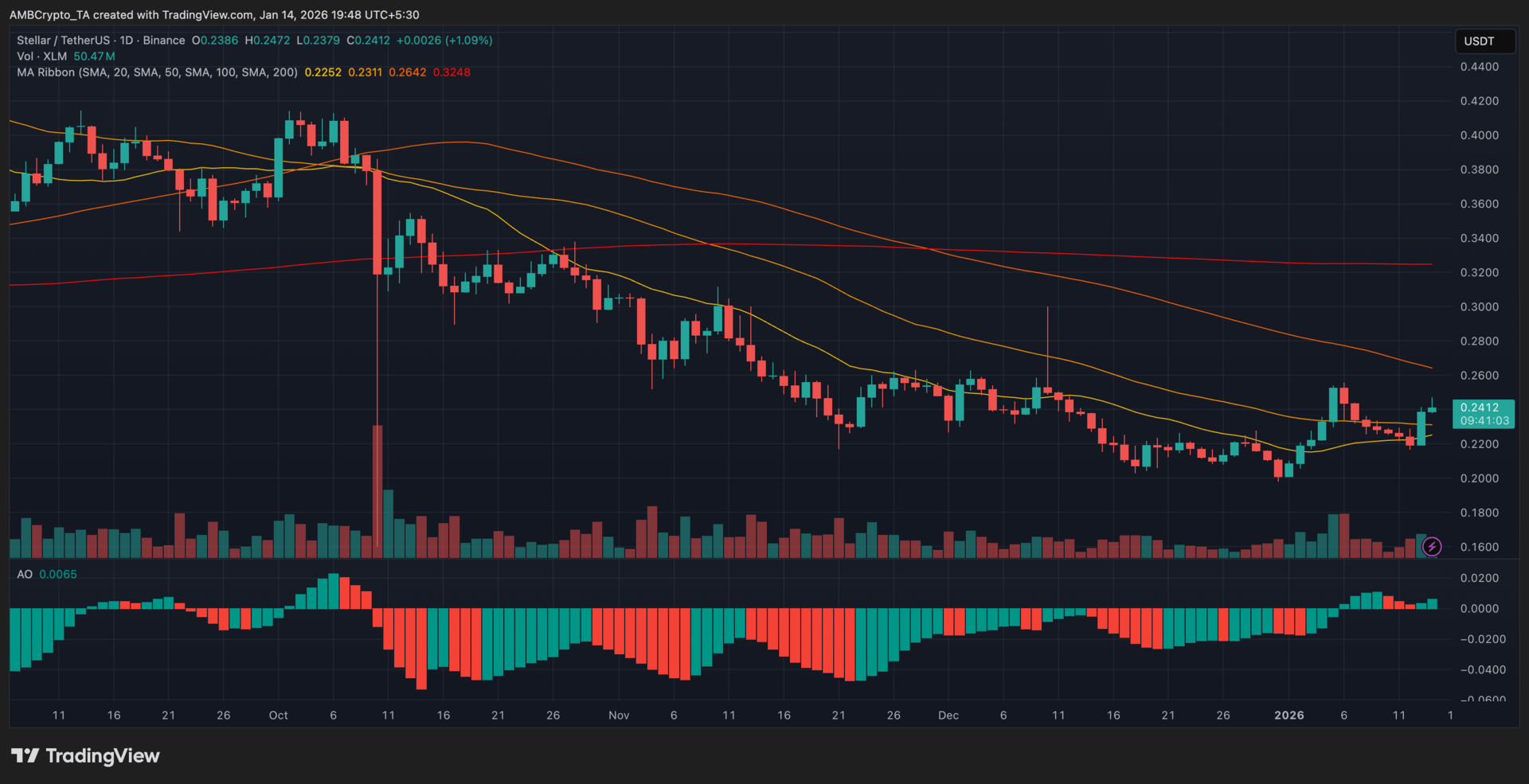

Stellar (XLM)

Key points:

XLM posted a mild recovery as short-term structure improved, though the broader trend remained constrained by long-term averages.

Momentum indicators turned constructive, pointing to stabilization rather than a decisive trend reversal.

What you should know:

Stellar traded around $0.24, extending its rebound after holding support near $0.22. Recent candles managed to stay above the shorter moving averages in the MA ribbon, indicating easing downside pressure. However, the 100-day and 200-day moving averages continued to sit overhead near $0.28–$0.32, keeping the broader structure capped.

The Awesome Oscillator flipped back into green territory, reflecting improving momentum following a prolonged bearish phase. That said, the histogram remained shallow, suggesting early recovery conditions instead of strong acceleration. Volume picked up slightly during up candles, supporting stabilization but falling short of a breakout-level surge.

Beyond technicals, market-wide strength helped lift sentiment, while institutional confidence improved after reports of U.S. Bank testing stablecoin infrastructure on Stellar. If price continues to hold above $0.22, further attempts toward $0.26 remain possible, while rejection below reclaimed short-term averages could invite renewed consolidation.

All the stories worth knowing—all in one place.

Business. Tech. Finance. Culture. If it’s worth knowing, it’s in the Brew.

Morning Brew’s free daily newsletter keeps 4+ million readers in the loop with stories that are smart, quick, and actually fun to read. You’ll learn something new every morning — and maybe even flex your brain with one of our crosswords or quizzes while you’re at it.

Get the news that makes you think, laugh, and maybe even brag about how informed you are.

How was today's newsletter? |