- Unhashed Newsletter

- Posts

- XRP jumps back, Larsen sparks panic

XRP jumps back, Larsen sparks panic

Reading time: 5 minutes

XRP recovers from sub-$3 drop as bullish signals emerge, but Larsen sell sparks debate

Key points:

XRP rebounded from a low of $2.96 to above $3.10 after a 10% intraday drop, with signs of bullish divergence and institutional buying.

Analysts view the 13–19% decline as a healthy correction, though Chris Larsen’s $175M transfer raised “dumping” concerns.

News - XRP’s price tumbled nearly 13% in a single day, breaching multiple key support levels and briefly falling to $2.96. The move followed cascading long liquidations, with over $113 million in XRP leveraged positions wiped out. The broader crypto market also saw nearly $1 billion in total liquidations, amplifying downside pressure.

However, the selloff may be nearing exhaustion. A sharp recovery to $3.11 by July 24 suggests a potential bottom, especially as higher lows continue to form. Trading volumes surged past 175 million, indicating possible institutional accumulation. On-chain metrics also point to a bullish divergence between price and On-Balance Volume (OBV), signaling spot buying activity despite the drop.

In a related development, Ripple co-founder Chris Larsen transferred 50 million XRP (worth $175M) to centralized exchanges between July 17 and July 24. The timing, near XRP’s local high of $3.66, triggered backlash from the crypto community, accusing Larsen of fueling the decline through a coordinated “dump.” While some defended the move as decentralization-oriented, critics warned of concentrated sell pressure.

Support holds, but reclaim needed - For XRP to confirm a sustained reversal, it must reclaim the $3.13 level and break above the $3.23–$3.25 resistance zone. If the $2.99 support fails, a retest of $2.78 or even $2.60 could follow.

Analysts stay cautiously bullish - Despite volatility, analysts still see upside potential, with short-term targets of $7–$10 and even $15 remaining valid if macro conditions remain favorable. XRP’s path forward now depends on broader market recovery and institutional sentiment.

Ethereum ETF frenzy: BlackRock’s ETHA hits $10B as institutions accelerate accumulation

Key points:

BlackRock’s iShares Ethereum ETF (ETHA) became the third-fastest fund ever to hit $10 billion in assets, reaching the milestone in 251 days.

Public firms now hold over $3.7 billion in ETH, with institutional inflows, ETF demand, and staking momentum fueling a long-term bullish case.

News - Ethereum’s institutional narrative just hit a new milestone. BlackRock’s iShares Ethereum ETF (ETHA) has officially surpassed $10 billion in assets under management (AUM), reaching the mark in just 251 days since launch. Bloomberg’s Eric Balchunas called the 10-day surge from $5 billion to $10 billion a “God candle,” marking ETHA as the third-fastest-growing ETF in history, behind only Bitcoin-focused counterparts.

At the same time, total ETH held by public companies crossed 1 million tokens, valued at approximately $3.7 billion. Of this, 113,000 ETH was newly disclosed this quarter alone, suggesting fresh treasury inflows. SharpLink Gaming and BitMine Immersion lead the institutional pack, together holding over 660,000 ETH. BitMine’s goal? To eventually hold 5% of all ETH in existence.

Bullish momentum gathers across markets - Spot Ether ETFs in the U.S. just celebrated their one-year anniversary with a 14-day inflow streak totaling $4.4 billion. On July 16 alone, they brought in $726.6 million, the highest since launch. While Bitcoin ETFs have recently seen net outflows, ETH ETFs are pulling ahead with stronger mid-year performance.

Meanwhile, derivative markets reflect surging demand. Open interest jumped $6 billion, CME futures hit record highs, and ETH treasury holdings ballooned following the Ether Machine-Dynamix SPAC merger.

Staking ETFs may be the next wave - With the SEC reviewing Ether staking ETF proposals, analysts expect approval could arrive as early as this quarter. The addition of 3–4% annual staking yield to ETFs could unlock another $20–30 billion in inflows, according to Bitwise.

ETH remains above $3,600 at press time, with analysts calling this a “watershed moment” for Ethereum’s role in tokenization, institutional finance, and potential Store-of-Value status.

Stablecoin boom incoming: GENIUS Act spurs $75B growth forecast, banks ready to issue

Key points:

Bank of America predicts up to $75 billion in new stablecoin supply following the passage of the GENIUS Act.

Global adoption accelerates as banks, institutions, and even PayPal expand offerings amid diverging regulatory climates.

News - Stablecoins are entering a new phase of growth, with Bank of America projecting a supply increase between $25 billion and $75 billion in the near term. This comes on the heels of the GENIUS Act being signed into law, offering long-awaited regulatory clarity for stablecoin issuance and digital asset classification in the U.S.

The GENIUS Act, alongside the CLARITY Act currently advancing through Congress, is expected to catalyze institutional adoption, infrastructure development, and tokenized finance. BofA noted that banks are preparing to launch their own stablecoins, favoring consortium-led models. CEO Brian Moynihan confirmed BofA is ready to enter the market when conditions align.

Meanwhile, wallet-level adoption of stablecoins has overtaken Solana, according to new data. Stablecoins now account for 38% of all crypto wallets: a sign that users are gravitating toward utility-focused, low-volatility digital assets. Ethereum remains dominant in transaction volume, but high gas fees are opening doors for alternatives like Solana and Tron.

Regulatory paths diverge - While the U.S. pushes forward with pro-stablecoin legislation, Hong Kong is cracking down. Beginning August 1, promoting unlicensed fiat-referenced stablecoins to retail investors in Hong Kong will carry criminal penalties, including up to six months in jail. Authorities aim to curb speculation and enforce higher standards for issuer accountability.

PayPal World joins the race - PayPal is also stepping into stablecoin-adjacent territory with the launch of “PayPal World,” a fiat-based payments platform that mirrors stablecoin functionality without using blockchain infrastructure. Though some view it as a competitive threat, others argue it validates the very need for permissionless, borderless stablecoin alternatives.

With mainstream finance, tech giants, and regulators now engaged, the global stablecoin landscape is rapidly evolving, and the stakes are higher than ever.

Crypto hack surge exposes zombie DeFi trap as scam wave hits XRP, YouTube, and Google

Key points:

Over $3.1 billion has been lost to crypto hacks in 2025, driven by access-control flaws and revived “zombie” DeFi apps draining user wallets.

Ripple warns of a spike in fake XRP giveaways via hijacked YouTube accounts, as scammers also exploit Google searches using domain spoofing.

News - The crypto industry is facing its worst year yet for security breaches, with over $3.1 billion lost to scams, protocol exploits, and phishing attacks in just the first half of 2025. A major new threat vector has emerged: hackers are hijacking expired domains from abandoned DeFi projects and turning them into wallet-draining traps.

According to Coinspect, over 100 “zombie” DeFi apps have resurfaced in malicious form, often listed on platforms like DeFiLlama and DappRadar before being delisted. These fraudulent sites lure users into connecting their wallets under false pretenses, then drain their assets using hidden onchain transactions. The security firm has identified 475 dead domains at risk and is urging defunct projects to renew domains and issue proper shutdown notices.

Scams target XRP as market rallies - Ripple CEO Brad Garlinghouse has sounded the alarm over YouTube scams targeting the XRP community. Fraudsters are using hijacked accounts with up to 176,000 subscribers to promote fake 100 million XRP giveaways. Ripple emphasized that neither the company nor its executives will ever request tokens from users, warning the community to remain vigilant. Garlinghouse noted this scam wave follows XRP’s recent price rally and mirrors tactics seen during previous bull runs.

Access controls and human-layer exploits fueling attacks - According to Hacken, access-control failures remain the top driver of crypto-related losses, accounting for nearly 60% of all funds stolen in 2025. The report also highlighted a sharp rise in blind signing attacks, social engineering tactics, and use of outdated codebases. Combined with AI-driven exploits and phishing through familiar channels like YouTube and Google, these attacks often bypass traditional security tools by exploiting user trust and habit.

AI and Google search add new risks - Security firm Hacken reported a 1,025% increase in AI-related crypto attacks this year, mostly through insecure APIs. Scam Sniffer also flagged malicious ads appearing at the top of Google search results for crypto websites, using Punycode spoofing techniques to mimic official URLs.

With attackers now leveraging everything from abandoned domains to deepfakes and search engine manipulation, experts say crypto users must stay proactive, not just reactive, as the threat landscape becomes increasingly deceptive.

More stories from the crypto ecosystem

U.S. Senate to overhaul crypto market structure? What’s coming up next

Ethereum whales make massive moves: Is this your cue to buy ETH?

ENS traders cautious as shorts outpace longs: Is a downside ahead?

Bitfarms stock jumps 26% after buyback plan: Is more to come?

Ripple CEO warns of Deepfake XRP scams as token surges to $3.10, crashes

Interesting facts

Over 100 million blockchain wallet users exist as of 2025 - Worldwide blockchain wallet usage surpassed the 100 million milestone in early 2025: a key indicator of mass adoption in DeFi and Web3.

U.S. stablecoin legislation catapulted crypto industries past a $4 trillion market cap - Following passage of the GENIUS Act in July 2025, global crypto market cap breached $4 trillion for the first time, driven by the legitimization of stablecoin frameworks.

Ethereum’s weekly spot volume overtook Bitcoin for the first time - This week, Ethereum saw $25.7 billion in spot trading volume, surpassing Bitcoin’s $24.4 billion, marking the first time ETH outpaced BTC in a weekly volume race.

Top 3 coins of the day

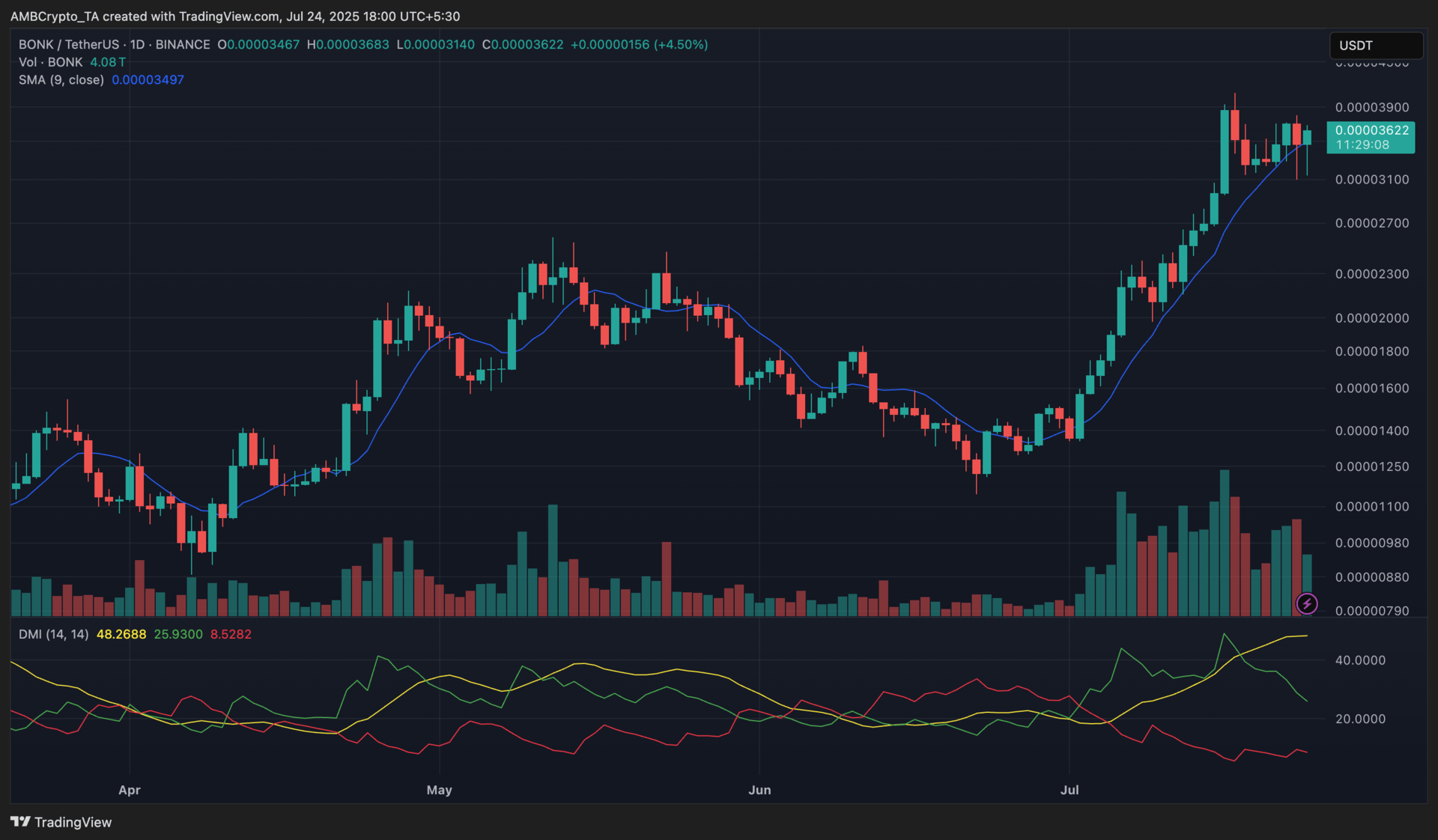

Bonk (BONK)

Key points:

At press time, BONK traded at $0.00003622, reflecting a 4.5% intraday increase from the prior session’s close.

The +DI hovered well above the -DI, while the ADX held near 48, indicating a strongly trending bullish setup.

What you should know:

BONK maintained its upward trajectory after bouncing from the $0.00002300 zone earlier this month, supported by sustained buy-side interest and recent ecosystem developments. LetsBONK, a Solana-based launchpad, announced it would allocate 1% of its revenue, roughly $15K weekly, to buy BONK tokens from high-volume pairs, reducing supply and boosting investor confidence. The 9-day Simple Moving Average (SMA) continued to act as dynamic support, with price candles holding above it throughout the rally. The Directional Movement Index (DMI) reflected a strong bullish structure, with the +DI dominant over the -DI and ADX hovering near 48. Volume, however, has begun to taper following the rally's peak last week. As long as bulls defend the $0.00003500 zone, BONK could retest the local high of $0.00003900. Traders should monitor for consolidation signs amid declining volumes.

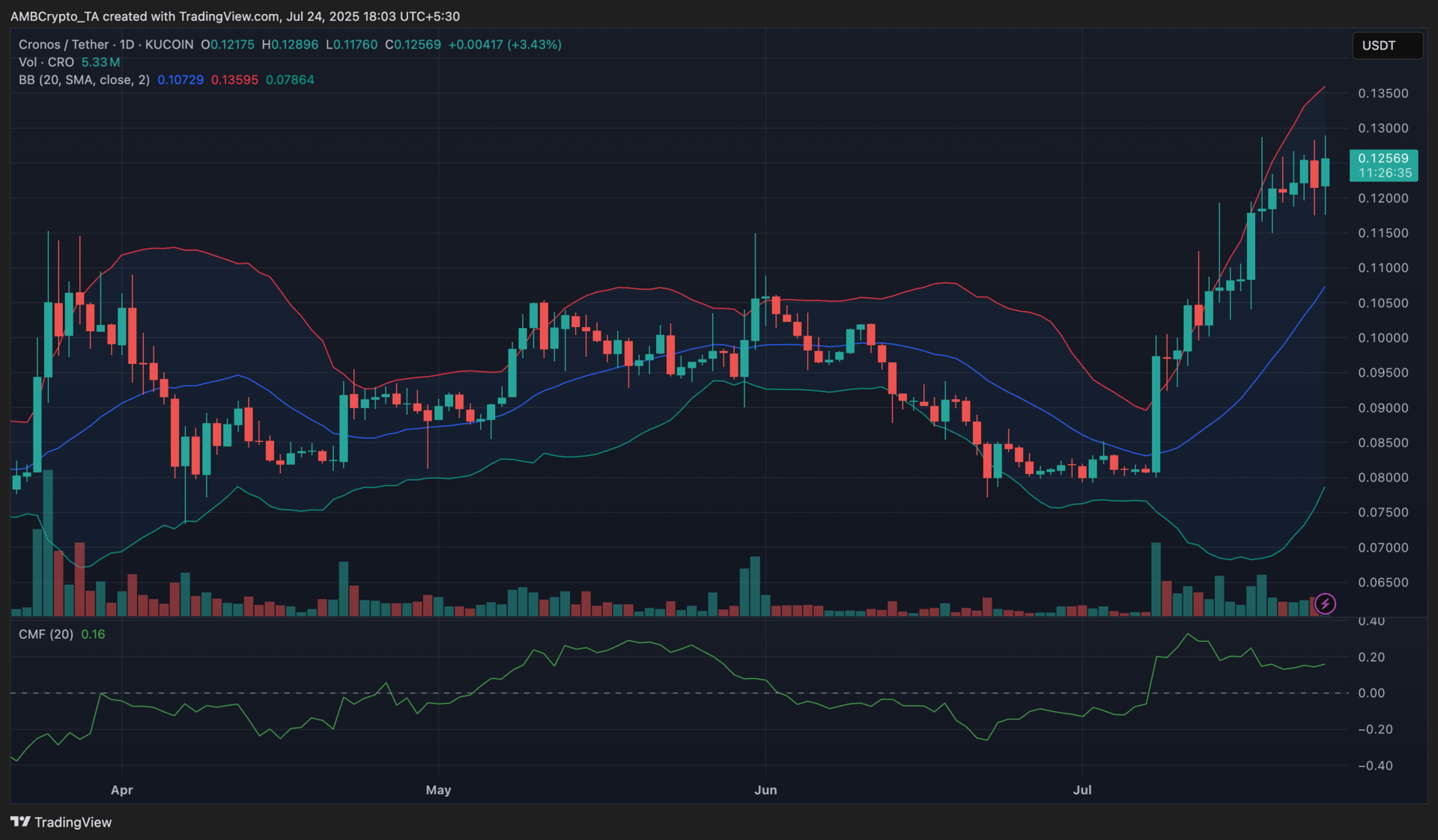

Cronos (CRO)

Key points:

At press time, CRO was trading at $0.1256, rising 3.43% from its previous daily close.

The price held near the upper Bollinger Band, while the CMF stood strong at 0.16, reflecting sustained capital inflows.

What you should know:

CRO extended its rally after reclaiming the $0.1000 mark earlier this month, with bulls driving a sharp breakout above the $0.1200 level. The daily candles consistently closed near or above the upper Bollinger Band, suggesting strong bullish momentum despite increasing volatility. The Chaikin Money Flow (CMF) remained positive at 0.16, reinforcing the bullish bias as accumulation stayed steady. However, trading volume has slowed compared to the initial breakout days, hinting at potential hesitation from new entrants. The widening Bollinger Bands signaled rising volatility, with the midline (20-day SMA) now serving as a dynamic support. Adding to the momentum, speculative demand likely surged after CRO was named in Trump Media’s proposed crypto ETF, which earmarks a 5% allocation to the token. If bullish pressure continues, CRO could attempt to flip the $0.1300 psychological mark into a support level. However, traders should remain cautious of any sharp rejections or sudden drops in volume, which could signal exhaustion in the current trend.

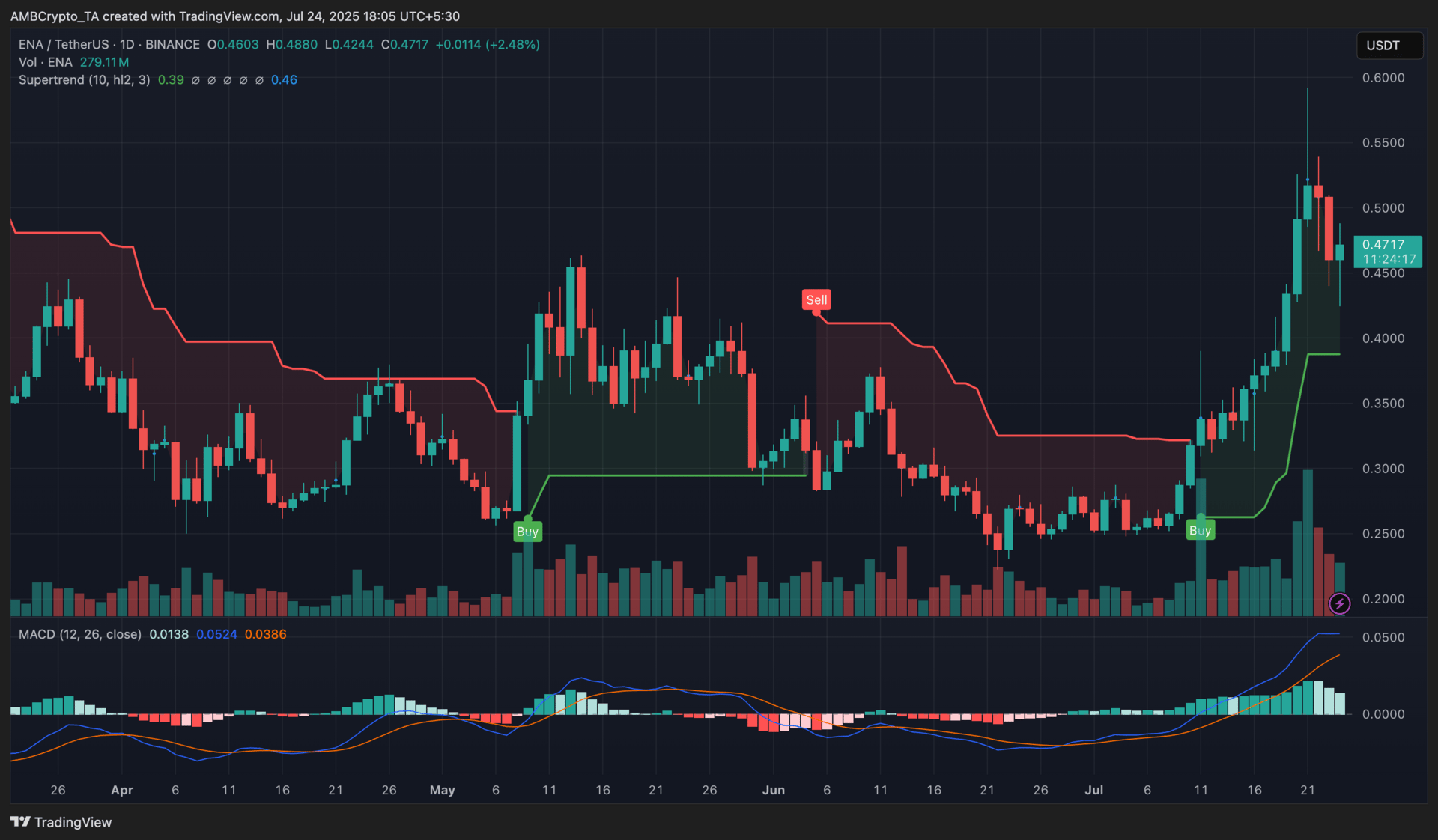

Ethena (ENA)

Key points:

At press time, ENA was trading at $0.47, up 2.48% from the prior day’s close.

The MACD histogram showed fading bullish momentum, while the Supertrend indicator remained in buy territory.

What you should know:

ENA’s steep rally earlier this week appeared to lose steam, with price pulling back from its local peak above $0.56. Despite this, it held above the Supertrend’s bullish threshold, keeping the uptrend intact, for now. The MACD histogram printed shorter green bars, and its lines showed slight convergence, signaling waning momentum. Volume also declined from the mid-July peak. However, price action has been supported by Ethena Labs’ $260M buyback program, executing $5M in daily ENA purchases since July 21, which has created structural demand and echoes treasury strategies seen with Bitcoin. This initiative, coupled with institutional buys and bullish sentiment across altcoins, added fuel to ENA’s surge. If the token holds above $0.45–$0.46, a retest of the $0.50 mark remains in play. A close below the Supertrend support near $0.39, however, could shift momentum.

How was today's newsletter? |