- Unhashed Newsletter

- Posts

- XRP rebounds: Treasury power vs risk

XRP rebounds: Treasury power vs risk

Reading time: 5 minutes

XRP’s turning point: $1B treasury plan and CME demand rise as $3M hack highlights custody risks

Key points:

Evernorth Holdings, supported by Ripple, has signed a SPAC deal with Armada Acquisition Corp II to raise over $1 billion and list on Nasdaq under the ticker XRPN by early 2026.

XRP’s whale wallet count climbed to an all-time high of 317,500, as long-term holders eased selling by 82%, setting the stage for a potential breakout above $2.59 amid growing institutional demand.

News - Ripple’s ecosystem could soon welcome a new market powerhouse. Evernorth Holdings, a Ripple-backed firm, has announced plans to go public through a SPAC merger with Armada Acquisition Corp II, aiming to list on Nasdaq as XRPN.

The company seeks to raise over $1 billion in gross proceeds, including a $200 million commitment from SBI Holdings, and counts Ripple, Rippleworks, Pantera, Kraken, GSR, and Chris Larsen among its investors.

Unlike a traditional ETF, Evernorth will act as an active XRP treasury, purchasing XRP on the open market and deploying it through lending, liquidity provision, and DeFi yield strategies.

CEO Asheesh Birla said the firm’s mission is to “create returns for shareholders while reinforcing XRP’s utility.” Ripple executives Brad Garlinghouse, Stuart Alderoty, and David Schwartz will serve as advisers, while Evernorth maintains independent governance.

Institutional demand for XRP grows - The timing of Evernorth’s move coincides with a surge in institutional interest for regulated XRP products. CME data shows record growth in XRP futures trading, with over 476,000 contracts exchanged since May, totaling $23.7 billion in volume and $1.4 billion in open interest.

With 29 large institutional holders now active, XRP has firmly entered the regulated market’s spotlight alongside Bitcoin and Ethereum.

Whale activity and price outlook - On-chain data supports this momentum. The number of XRP whale addresses recently hit an all-time high of 317,500, while supply on exchanges dropped to 3.9%, signaling reduced sell pressure.

Long-term holders have cut selling by over 80%, and short-term traders are re-entering the market, boosting near-term liquidity. Analysts say clearing $2.59 could open a path toward $3.10 if momentum holds.

Security concerns resurface - Still, not all news around XRP is bullish. On-chain investigator ZachXBT uncovered a $3 million XRP theft from a U.S. wallet, where funds were laundered through 120 cross-chain swaps to OTC desks linked to Huione, a network recently sanctioned by the U.S. Treasury.

He warned that over 95% of recovery firms exploit victims with fake promises, reviving debate around wallet safety and self-custody confusion.

Bitcoin’s institutional wave grows: BlackRock expands UK access as Saylor’s Strategy nears 700K BTC

Key points:

BlackRock’s new iShares Bitcoin ETP has begun trading on the London Stock Exchange, following the UK’s decision to lift its retail crypto investment ban.

Michael Saylor’s Strategy purchased another 168 BTC for $18.8 million, lifting total holdings to 640,418 BTC as the firm edges toward its 700K target.

News - Institutional adoption of Bitcoin is accelerating on both sides of the Atlantic. In the UK, BlackRock’s iShares Bitcoin ETP launched on the London Stock Exchange after regulators lifted a four-year ban on retail crypto products.

The move marks the first time British retail investors can directly access a Bitcoin-backed product under FCA oversight, with coins custodied by Coinbase. The launch follows the success of BlackRock’s U.S. spot ETF, which now manages over $85 billion in assets and became the firm’s most profitable fund within 21 months of launch.

At the same time, Michael Saylor’s Strategy added another 168 BTC for $18.8 million, bringing total holdings to 640,418 BTC valued around $71 billion. The firm financed the buy through preferred share and common stock issuances.

Saylor said Strategy can deploy up to $100 million in Bitcoin purchases within hours, highlighting how corporate treasuries are reshaping capital markets by converting raised funds directly into BTC.

Institutional momentum and market signals - BlackRock’s UK expansion joins listings from 21Shares, WisdomTree, and Bitwise, signaling a broader convergence between traditional finance and crypto exposure. The FCA’s softened stance and rapid market uptake indicate rising confidence in Bitcoin as an investable asset class.

Corporate treasuries double down - Despite Strategy’s stock (MSTR) falling over 20% since early October, its Bitcoin accumulation strategy continues to influence corporate treasury trends worldwide. Saylor’s firm, holding nearly 2.5% of all Bitcoin in circulation, remains the largest public BTC holder.

Analysts note that as both Wall Street asset managers and corporate treasuries expand their Bitcoin footprints, institutional demand may offset recent volatility from the October market crash.

Musk’s “Floki is CEO” joke jolts memecoins as FLOKI jumps on renewed hype

Key points:

Elon Musk posted that his Shiba Inu, Floki, is “back on the job as X CEO,” sharing an AI video; FLOKI’s price surged roughly 24–29% within hours.

Traders flagged rising flows and improving momentum signals, with net inflows near $4.07 million and price testing short-term resistances on the daily and 4-hour charts.

News - Elon Musk revived his long-running “dog CEO” gag on X, writing that “Flōki is back on the job as X CEO” and sharing an AI-generated clip of his Shiba Inu behind a desk. Within minutes, the FLOKI memecoin spiked.

Across price feeds, the token rallied from roughly $0.000065–$0.000066 to intraday prints near $0.000082–$0.000085, a move in the 24–29% range captured by CoinGecko, Kraken, and multiple market trackers.

The jump underscores Musk’s outsized influence on meme assets, a pattern seen before with DOGE and SHIB. Sources also noted that X chatter among the “Floki Vikings” community accelerated, with CoinMarketCap polling showing about 83% bullish votes during the move.

Beyond the headline, liquidity picked up. Coinglass data showed about $4.07 million in net inflows on October 20, the strongest daily total of the month for FLOKI. Market cap and volumes rose in tandem as the token briefly reversed weeks of lethargic trading within a broader downturn.

What traders are watching - Technical reads cited in the sources point to FLOKI reclaiming the 20-day EMA near $0.0000786 and pushing toward resistance around $0.0000918–$0.0000984.

Analysts added that a close above $0.0001006 would confirm a full break from the recent bearish structure, with upside scenarios eyeing $0.00010 first and, on sustained momentum, possible follow-through toward $0.00013. On the downside, initial supports sit near $0.0000780 and $0.0000650 if profit-taking accelerates.

Sector context - The move came after a rough stretch for memes. Following the October 10 market shock, the memecoin sector’s value fell by nearly 40% from $72 billion to $44 billion, then saw another slide on Friday as fear dominated and roughly $230 billion in broader crypto value was erased in a day.

FLOKI’s bounce shows that personality-driven catalysts can still overpower fundamentals, but the setup remains sensitive to sentiment and liquidity.

Coinbase and Gemini push crypto cards mainstream with BTC cash-back and SOL auto-staking

Key points:

Coinbase ended the waitlist for its American Express-powered Coinbase One Card, letting U.S. Coinbase One subscribers earn up to 4% back in Bitcoin on every purchase, with higher tiers tied to assets held on Coinbase.

Gemini launched a Solana edition of its credit card that pays up to 4% back in SOL and can auto-stake rewards for up to 6.77% yield, expanding a suite that also includes Bitcoin and XRP cards.

News - The competition between exchanges is heating up as both Coinbase and Gemini roll out new crypto credit cards to drive adoption and strengthen user engagement. Coinbase has ended the waitlist for its Coinbase One Card, opening access to hundreds of thousands of American users.

The American Express-backed card offers 2–4% Bitcoin rewards, with rates tied to assets held on the platform. Early users have spent over $100 million, about $3,000 monthly per user, and added more than $200 million in deposits to maximize their reward tiers.

The card is limited to Coinbase One subscribers, while a lower-cost Coinbase One Basic tier at $5 a month or $49.99 a year offers limited benefits.

Meanwhile, Gemini launched its Solana-branded credit card, which provides up to 4% back in SOL on purchases and introduces auto-staking for yields up to 6.77% APY.

The card has no annual or foreign transaction fees, features Mastercard World Elite perks, and is issued by WebBank. The product aims to deepen Solana’s retail footprint, with Gemini noting that users who held Solana rewards for at least a year historically saw strong appreciation.

A new phase in crypto consumer finance - The two launches highlight how exchanges are broadening their ecosystems beyond trading, blending crypto rewards with traditional card benefits.

While Coinbase leverages Bitcoin rewards to boost subscriptions and platform deposits, Gemini’s staking-enabled model bridges passive yield with everyday spending.

Market outlook - Analysts say these launches signal a growing convergence between spending, earning, and staking, turning daily payments into on-chain accumulation.

Solana traded near $191 after Gemini’s announcement, while Coinbase’s card is expected to bolster recurring revenue in its $655 million subscription and services segment. Both moves reflect the next stage of crypto’s integration into mainstream financial life.

Reddit’s Top Stocks Beat the S&P by 40%

Buffett-era investing was all about company performance. The new era is about investor behavior.

Sure, you can still make good returns investing in solid businesses over 10-20 years.

But in the meantime, you might miss out on 224.29% gainers like Robinhood (the #6 most-mentioned stock on Reddit over the past 6 months).

Reddit's top 15 stocks gained 60% in six months. The S&P 500? 18.7%.

AltIndex's AI processes 100,000s of Reddit comments and factors them into its stock ratings.

We've teamed up with AltIndex to get our readers free access to their app for a limited time.

The market constantly signals which stocks might pop off next. Will you look in the right places this time?

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

More stories from the crypto ecosystem

Will Japan’s banks soon invest in Bitcoin? FSA weighs major reform

Gold fatigue sets in – Is it finally Bitcoin’s turn to shine?

Why XRP faces its most critical week yet as ETF decision looms

PUMP price prediction – Should traders bet on a rally this week?

Bittensor [TAO] gains 12% as $28 mln hack mystery clears – More gains?

Did you know?

In case you missed it, the U.S. SEC has introduced new listing standards for crypto ETFs, cutting approval times from as long as 270 days to just 75, a move expected to accelerate ETF launches in late 2025.

Few realize that the global crypto-asset market has doubled in size over the past year, reaching nearly $4 trillion, prompting the Financial Stability Board (FSB) to warn of major regulatory gaps worldwide.

And here’s one more: despite new frameworks like the GENIUS Act in the U.S., the FSB says most jurisdictions still lack consistent stablecoin regulations, calling oversight “incomplete and uneven.”

Best Price, Every Trade.

Want the best price on every swap? CoW Swap evaluates routes across DEXs in real time and settles the most efficient path. Tighter pricing, higher success rates, fewer reverts. Find your best price.

Top 3 coins of the day

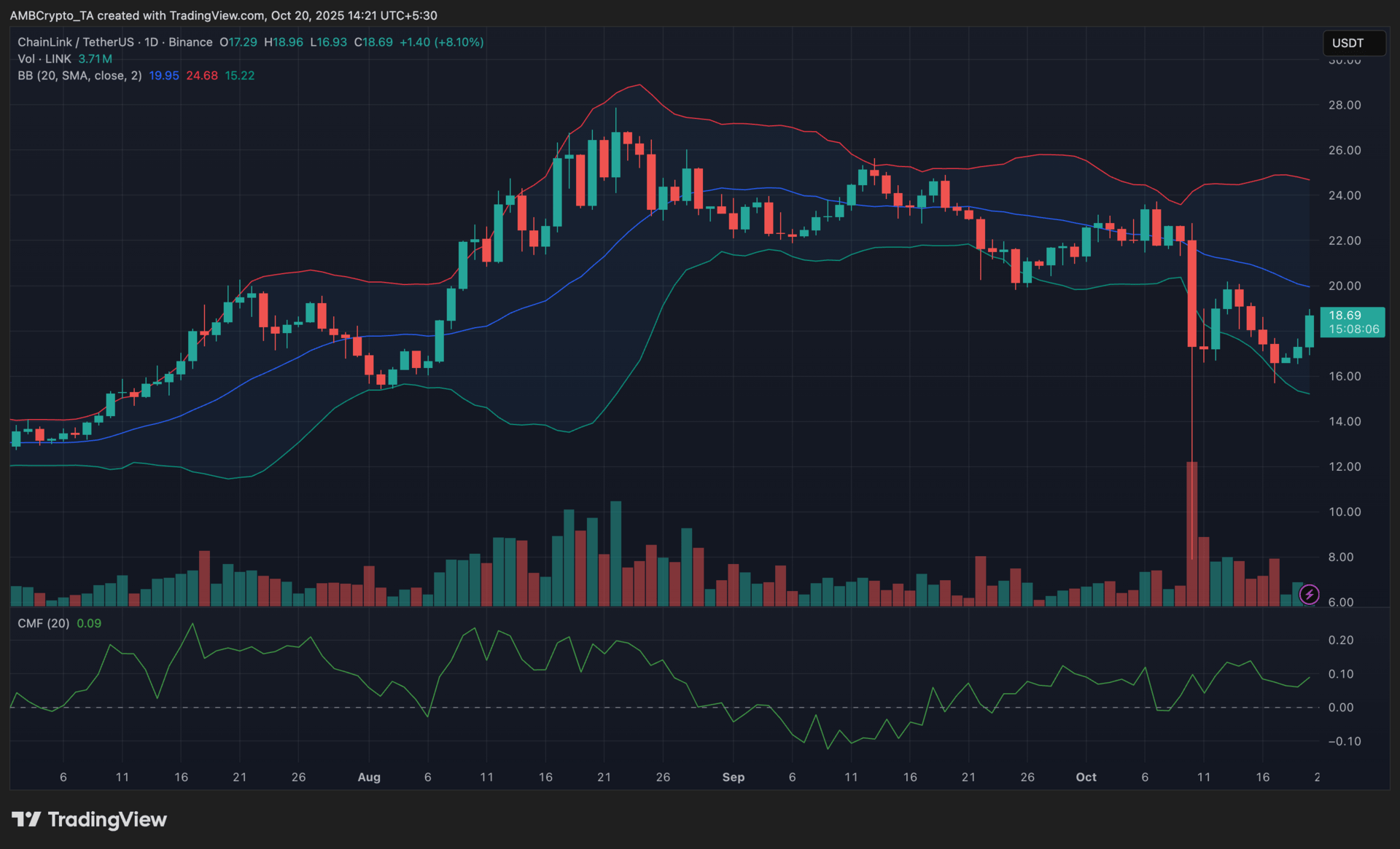

Chainlink (LINK)

Key points:

At press time, LINK was trading at $18.69, reflecting an 8.1% daily increase as the token rebounded from the $16 region following a week of heavy selling.

The CMF hovered at +0.09, signaling renewed inflows, while the price moved toward the Bollinger Band midline near $19.9, indicating early signs of recovering momentum.

What you should know:

LINK gained strength after whales reportedly withdrew over $40 million worth of tokens from exchanges, hinting at long-term accumulation. The rebound coincided with an uptick in trading volume to 3.71 million, suggesting buyers are reentering the market. On the chart, the lower Bollinger Band around $15.2 serves as key support, while the $19.9 midline acts as near-term resistance to monitor. Broader optimism also stemmed from Chainlink’s Q3 milestones, including its expanded partnerships for real-world asset tokenization and cross-chain interoperability. If momentum continues, LINK may retest the upper Bollinger Band near $24.6, supported by steady institutional traction and improving market sentiment.

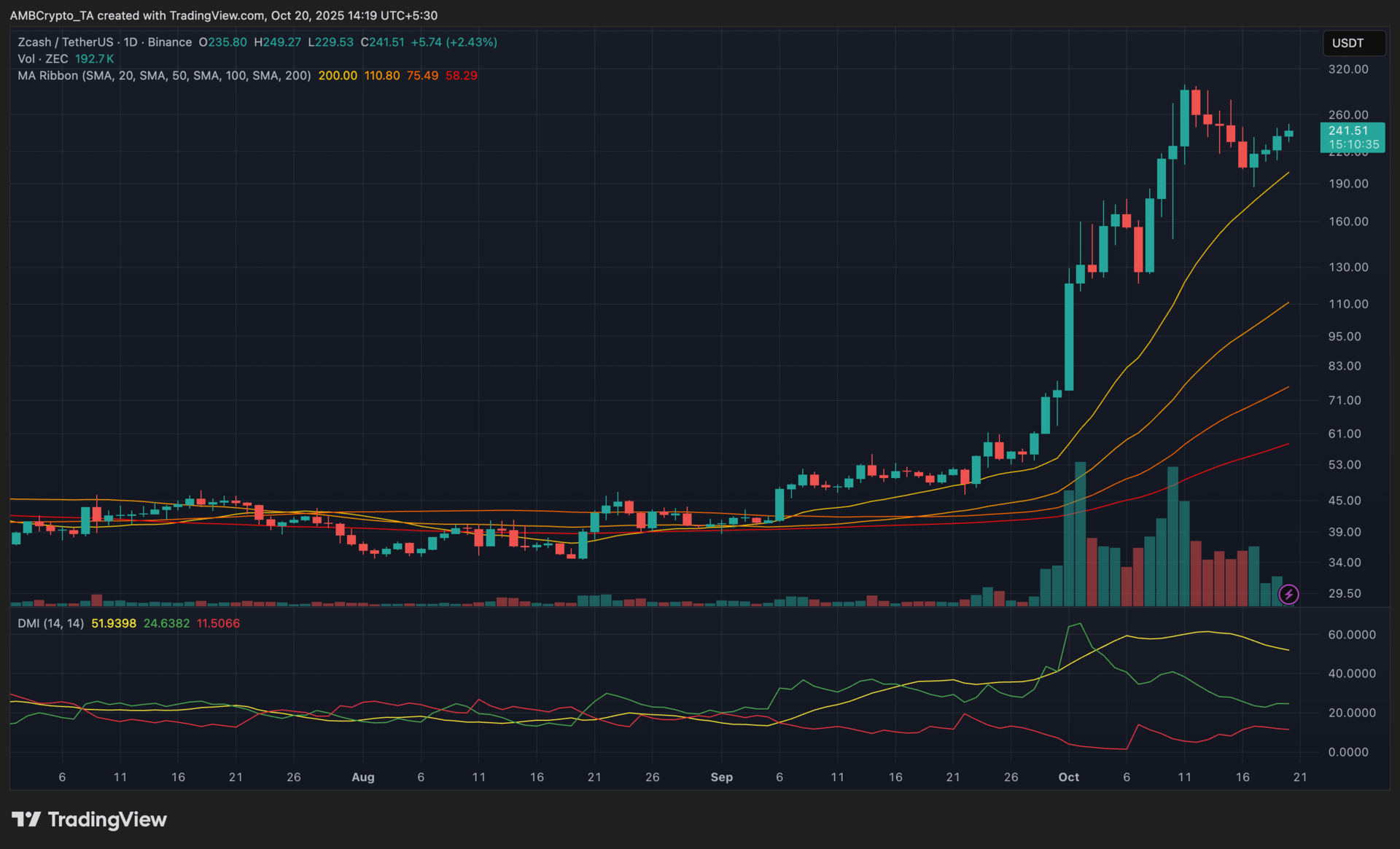

Zcash (ZEC)

Key points:

ZEC was last seen trading at $241, marking a 2.4% daily gain as buyers gradually stepped back in after a sharp pullback from early October highs.

The +DI held well above the –DI, while the ADX near 52 signaled that ZEC’s uptrend remained strong but slightly cooling, hinting at short-term consolidation.

What You Should Know:

Zcash steadied after a volatile week in which it lost 20% from its recent peak near $300, viewed by traders as a “healthy reset” following its 350% rally this month. The price hovered well above the 20 SMA at $200, reinforcing a bullish structure, while $260 remains the key resistance to watch. Renewed interest in privacy coins, driven by CBDC surveillance debates and upcoming halving narratives, added further momentum to ZEC’s rebound. With shielded transactions continuing to rise and institutional trust in privacy assets holding firm, traders now monitor whether ZEC can sustain its strength toward another $260–$300 retest in the near term.

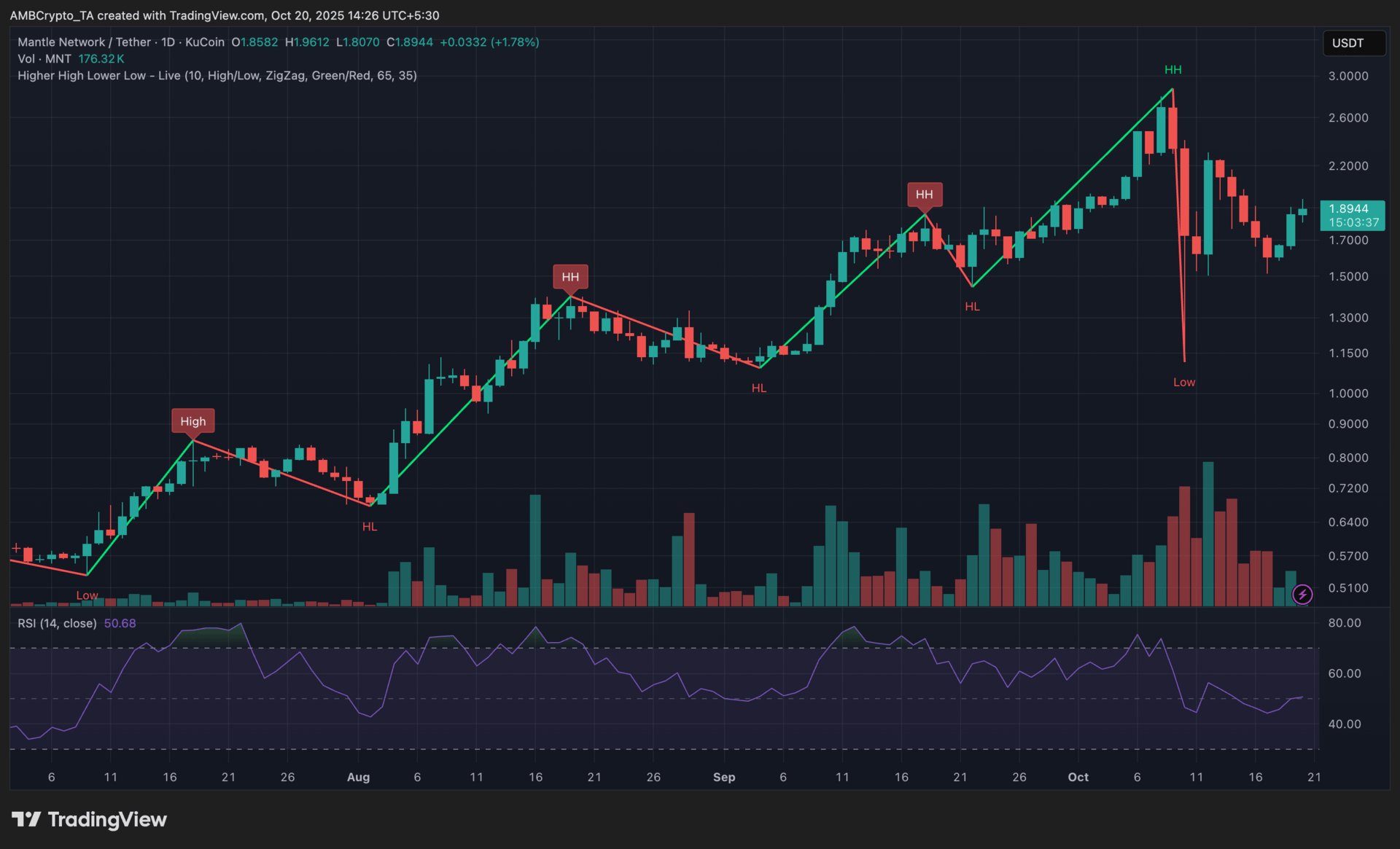

Mantle (MNT)

Key points:

MNT changed hands at $1.89, marking a 1.7% daily uptick after a volatile weekend that saw steep sell-offs followed by quick recovery buying.

The RSI hovered near 50, showing neutral momentum, while the structure of higher highs and higher lows suggested a tentative continuation of its broader uptrend.

What you should know:

Mantle stabilized after swinging between losses and gains over the past two days, with traders defending support near $1.45. The pattern of higher lows signaled that buyers were attempting to reestablish control, though $2.00–$2.10 remains a near-term resistance zone to monitor. A surge in on-chain activity followed the token’s RWA tokenization launch, which expanded its institutional focus, while its Bybit integration continued to drive exchange-based demand. With trading volume easing to 176K, MNT’s short-term moves may stay range-bound unless renewed liquidity or staking momentum reignites bullish pressure toward the $2 mark.

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

How was today's newsletter? |