- Unhashed Newsletter

- Posts

- XRP’s $3 dream faces headwinds

XRP’s $3 dream faces headwinds

Reading time: 5 minutes

XRP inches toward all-time high, but $1.7B sell-off clouds the rally

Key points:

XRP surged to $3.24, just 4.7% below its $3.40 all-time high, with futures open interest climbing to nearly $10 billion.

Over $1.7 billion in XRP has been sold in the past 10 days, triggering caution as long-term holders begin profit-taking.

News - XRP is on the brink of breaking its 2018 all-time high, trading at $3.24 after a 35% weekly rally and outperforming Bitcoin by 35% in July. But just as bullish sentiment builds, a sharp wave of selling threatens to stall momentum. More than 540 million XRP, worth around $1.74 billion, has been offloaded in the past 10 days, largely by long-term holders locking in profits.

Meanwhile, open interest in XRP futures has surged to nearly $10 billion, the highest level since 2021, as traders aggressively take long positions. This spike in leveraged exposure reflects strong institutional interest, even as large holders accumulate over 2.2 billion XRP and long-term holders begin exiting. Funding rates remain positive, though overbought signals suggest short-term exhaustion could be near.

Sell pressure vs. institutional tailwinds - Market watchers are split. On one hand, XRP’s retail popularity, its role in Grayscale’s Digital Large Cap Fund, and its potential to benefit from stablecoin legislation are helping maintain positive sentiment. On the other, analysts warn that if XRP fails to break past $3.40, the price could retest support at $3.00 or even $2.65 amid continued sell-offs.

$250B market cap in sight? - If bullish momentum holds, XRP’s market cap, currently near $200B, could target $250B in the coming months, with fractals and Fibonacci extensions supporting the possibility of a rally toward $3.84 and beyond.

Corporate Bitcoin rush intensifies: Volcon, Semler, and Strategy lead treasury push

Key points:

Volcon raised $500M to buy Bitcoin, joining a surge of public firms fueling treasury strategies with aggressive equity moves.

Strategy hit a record $128.5B market cap, while Semler became the 14th-largest BTC holder with 4,846 coins.

News - The corporate Bitcoin race just kicked into high gear. Volcon, a Texas-based off-road EV maker, has announced a $500 million private stock sale, with at least 95% earmarked for Bitcoin purchases. The deal, led by Empery Asset Management and supported by firms like Pantera and FalconX, is expected to close by July 21. Volcon’s BTC will be custodied by Gemini, and its stock soared over 330% in premarket trading following the news.

Meanwhile, Semler Scientific quietly climbed the corporate BTC rankings. From July 3 to 16, the firm added 210 BTC worth $25 million, bringing its total to 4,846 coins, just above GameStop’s holdings, and pushing it to 14th place among public Bitcoin treasuries. Funded through a $175 million at-the-market (ATM) equity raise since April, Semler now reports a Bitcoin yield of 30.3% year-to-date.

Strategy’s mega surge - Michael Saylor’s Strategy continues to dominate headlines, reaching a record $128.5 billion market cap, up from just $2 billion five years ago. Now among the top 100 U.S. public companies, the firm has tripled its outstanding shares to fund a staggering 601,550 BTC war chest. Its transformation into a de facto Bitcoin ETF proxy shows no signs of slowing, with investors rewarding its high-beta BTC exposure despite a 15% drop from its all-time high.

Canada’s Matador joins the race - Canadian firm Matador Technologies also revealed plans to accumulate up to 6,000 BTC by 2027, targeting 1% of total supply. Backed by a $656 million CAD funding plan and a “compounding flywheel” strategy, the company aims to build not just a treasury but a full-stack Bitcoin business model. Though its stock dipped 4.65% post-announcement, it remains up nearly 37% YTD.

Crypto crime turns violent: 2025 on track for worst year yet

Key points:

Over $2.17B in crypto has been stolen in 2025 so far, with wrench attacks and wallet hacks accelerating.

Bitcoin price spikes and North Korean-linked heists are fueling organized crime and personal security risks.

News - With nearly half the year left, 2025 has already outpaced 2024 in total crypto thefts, recording $2.17 billion in stolen funds. According to Chainalysis, the surge is driven by both large-scale exchange breaches and a sharp rise in violent physical crimes known as "wrench attacks", where victims are assaulted or kidnapped for their crypto holdings.

One of the biggest drivers behind the spike is North Korea’s Lazarus Group, which pulled off a record $1.5 billion hack on Bybit this year, accounting for nearly 70% of service losses. But more alarming is the rapid increase in personal wallet breaches and wrench attacks, which now make up over 23% of thefts. These incidents are increasingly targeting high-value individuals, especially in Asia-Pacific regions like Japan, South Korea, and the Philippines.

Bitcoin’s surge, human toll - Chainalysis found a direct correlation between the rise in Bitcoin’s price, recently over $122K, and opportunistic attacks. In one high-profile case, Filipino-Chinese businessman Anson Que was kidnapped and murdered in a $3.5 million crypto ransom plot, with his attackers laundering funds through junket e-wallets and casinos.

Why 2025 is uniquely dangerous - Analysts warn that improved security at major exchanges is pushing attackers toward individuals perceived as easier targets. Meanwhile, the use of AI-driven scams, fake job interviews, and impersonation tactics has made it easier for hackers and organized crime syndicates to locate victims. Alarmingly, Chainalysis expects wrench attacks to double compared to any prior year on record.

Security shift ahead? - While wrench attacks remain rare compared to cyber exploits, their human impact is far greater. Chainalysis urges high-net-worth crypto holders to bolster operational security and consider ETFs or custodial services to reduce risk. Law enforcement efforts and the traceability of blockchain funds may help curb the trend, but for now, 2025 is shaping up to be the most dangerous year yet for crypto holders.

Coinbase goes super app: Base rebrand signals bold new direction

Key points:

Coinbase rebranded its Wallet into the Base App, an “everything app” combining trading, payments, messaging, mini-apps, and social features.

Flashblocks upgrade slashes Base chain’s block time to 200ms, making it the fastest EVM network; Base TVL hit $4B+ and COIN stock touched $400.

News - Coinbase has officially unveiled the Base App, a sweeping overhaul of its Coinbase Wallet and a cornerstone of its broader Base ecosystem reboot. Introduced at the "A New Day One" event, the app merges crypto trading, payments, social feeds, messaging, and mini-apps into one streamlined experience, positioning Coinbase to rival super apps like WeChat and X.

Built on its Ethereum Layer-2 network, the Base App aims to onboard the next wave of crypto users with real-time trading, tap-to-pay USDC via “Base Pay,” AI-driven chat agents, and tokenized social posts through Farcaster. Users can earn tips, explore prediction markets, and access mini-dapps, all from a single feed. Existing Coinbase Wallet users will see an automatic transition to the new Base App.

Base Chain gets a speed boost - Underpinning this push is Flashblocks, a new performance layer that cuts Base’s block time from 2 seconds to just 200 milliseconds, enabling real-time interactivity. The upgrade marks Base as the fastest EVM-compatible chain to date, with developers citing use cases like high-frequency trading and live social media transactions.

Retail & market response - While opinions on retail’s return remain split, Coinbase’s App Store rank surged from #386 to #137 in July, typically a leading indicator of rising retail interest. Meanwhile, COIN stock hit an all-time high of $400, and Base’s TVL jumped 18% to $4.02B, underlining investor excitement around the rollout.

More stories from the crypto ecosystem

Burns, adoption, and how BONK’s price might hit new price levels soon

Aptos bulls push even as sellers dominate: Can APT’s breakout hold?

Whale sends $73M XRP to Coinbase – Is a sell-off coming up soon?

Senator Lummis slams United States’ Bitcoin sell-off as a ‘strategic blunder’

How a new U.S. bill could let you use Bitcoin for home loans

Interesting facts

Bitcoin’s rally last week was triggered in part by reports of Trump considering firing Fed Chair Powell, causing a sharp dip, before the news was denied and BTC rebounded strongly.

Solana’s meme-token ecosystem has been taking off this month, led by $BONK and newcomer $LILPEPE, both gaining traction in DeFi and NFT integrations, highlighting a memecoin season that’s more utility-driven than purely speculative.

At the end of July 2025, Lightchain AI will launch its mainnet, bringing its novel Proof-of-Intelligence (PoI) consensus and Artificial Intelligence Virtual Machine (AIVM) online for the first time. If successful, it could pioneer AI-focused blockchain infrastructure—think smart AI agents running directly on-chain.

Top 3 coins of the day

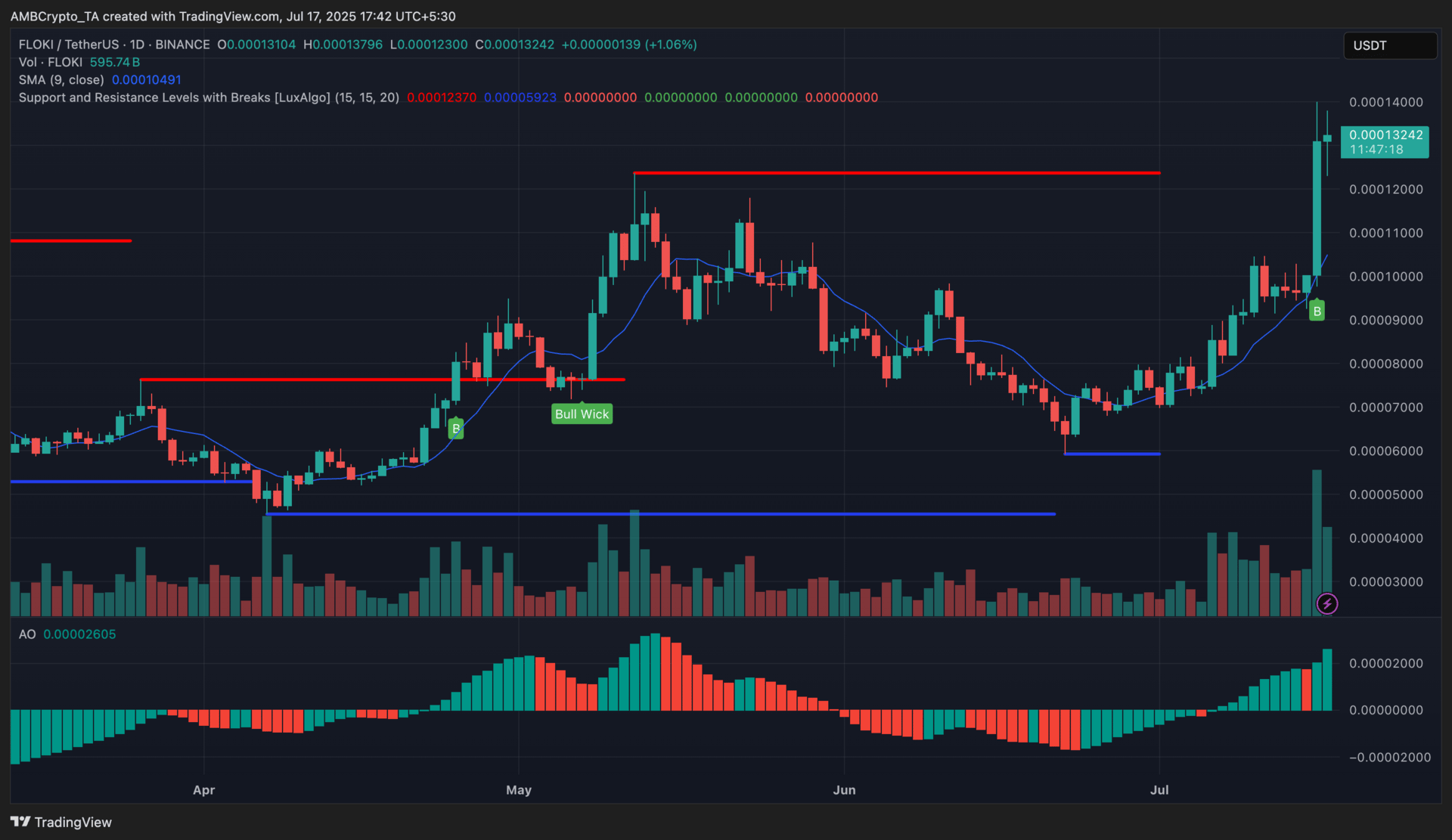

FLOKI (FLOKI)

Key points:

At press time, FLOKI was trading at $0.00013242, reflecting a 20.1% increase over the last 24 hours.

The Awesome Oscillator showed a strong bullish surge, while the 9-day SMA remained below the price, confirming sustained momentum.

What you should know:

FLOKI broke through a key resistance near $0.00011000 and quickly rallied toward its next supply zone at $0.00013700, marking its highest daily close since late May. A 338% volume spike to over $800 million underscored strong market interest. The rally followed FLOKI’s MiCAR-compliant white paper registration with the EU’s ESMA, a regulatory milestone that may attract more institutional attention across European exchanges. Technically, the Awesome Oscillator printed successive green bars, confirming rising momentum, while the 9-day SMA consistently trailed price action throughout the uptrend. A bounce from earlier support near $0.00005900 fueled the breakout. If bulls flip $0.00013700 into support, the next resistance lies near $0.00015000, though some profit-taking near this level could trigger short-term consolidation.

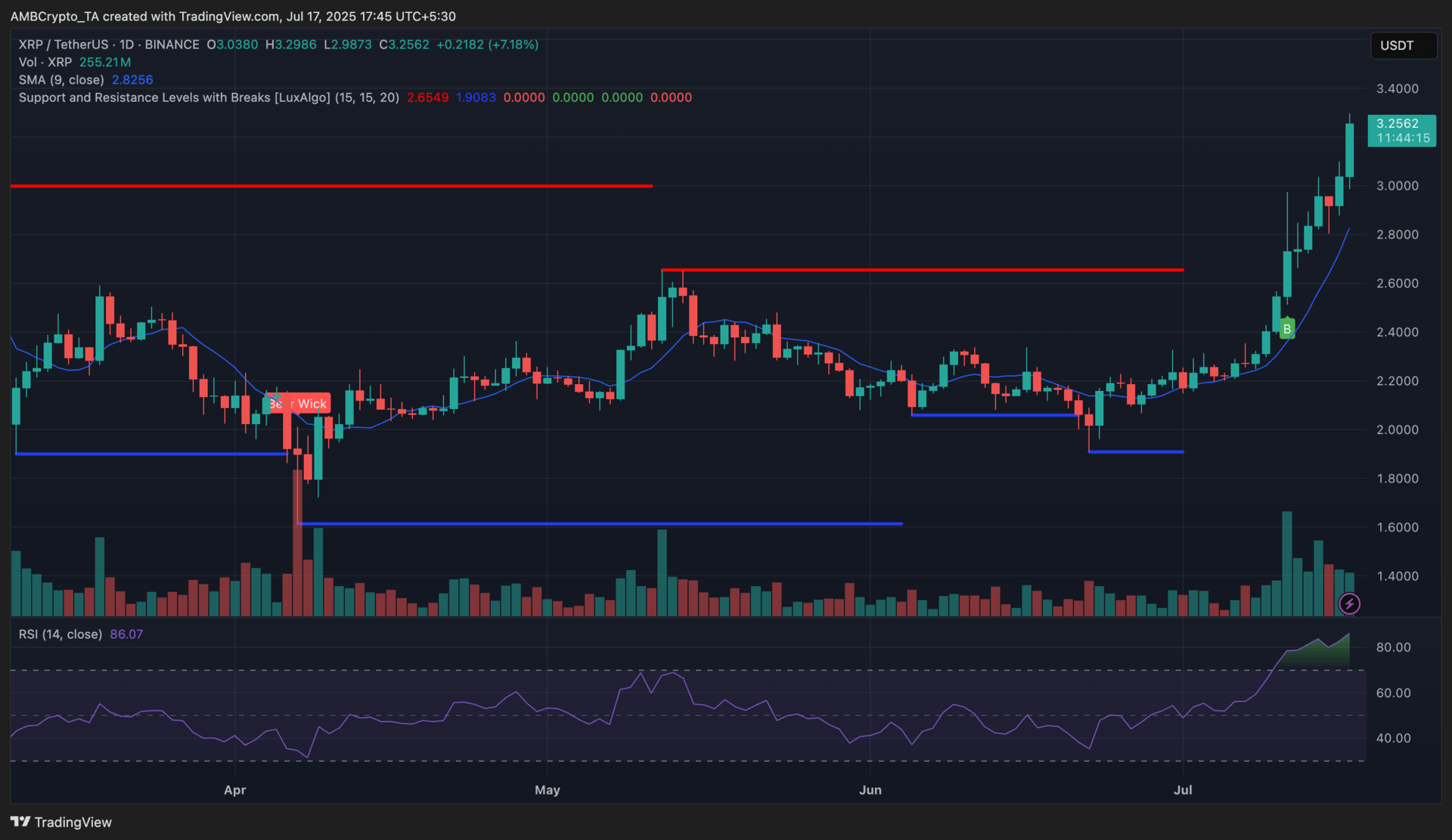

XRP (XRP)

Key points:

At press time, XRP was trading at $3.25, marking a 7.18% increase from the prior day’s close.

The 9-day SMA remained below the candles, while the RSI hovered above 86, indicating overbought territory.

What you should know:

XRP extended its bullish breakout, closing above the $3.20 level for the first time in months. The rally followed a high-volume surge that began earlier this week, which helped flip the $2.65–$2.80 zone into a firm support base. The momentum coincided with Ripple’s new Dubai partnership to tokenize real estate deeds on the XRP Ledger and growing anticipation around ProShares’ 2x leveraged XRP ETF set to launch on July 18. Daily volume remained consistently strong, reinforcing trend conviction among bulls. The RSI crossed 86, signaling overbought conditions, although the price continued to rally without immediate signs of exhaustion. Meanwhile, the 9-day SMA closely trailed the upward move, acting as dynamic support over the past 10 sessions. If buying pressure persists, the next major resistance lies near $3.50, but traders may watch for consolidation if volumes begin to taper or RSI divergence appears.

Solana (SOL)

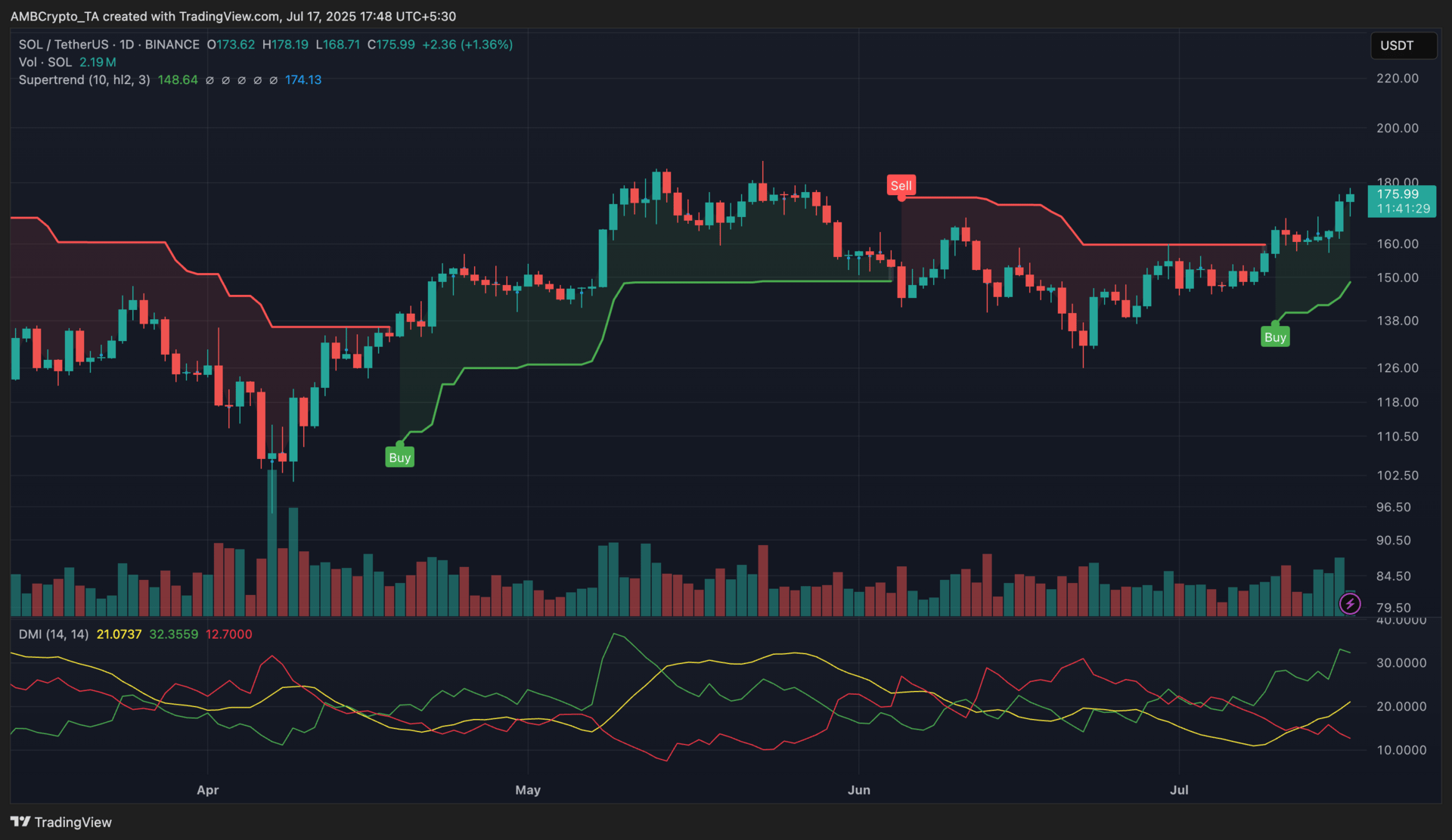

Key points:

At press time, SOL was trading at $175, up 1.36% from the previous day’s close.

The Supertrend remained in a bullish phase, while the DMI showed strong upward pressure with a wide gap between the +DI and -DI lines.

What you should know:

Solana continued its steady climb, breaching the $174 resistance level that previously triggered a short-term sell signal in early June. The Supertrend indicator maintained its bullish signal since the $138 zone, with no signs of reversal yet. The DMI reinforced the bullish momentum as the +DI (green) line climbed sharply above the -DI (red) and ADX (yellow), reflecting a robust directional trend. Volume remained consistent, suggesting growing conviction among buyers despite the broader market’s mixed signals. Institutional interest in Solana surged as CME’s futures volume crossed $5B, reinforcing bullish conviction amid growing ecosystem innovation. A sustained close above the $178 zone could open the door to testing the $190–$200 range in the short term. However, traders may watch for any weakening of the ADX or narrowing of the DI gap as potential early signs of exhaustion.

How was today's newsletter? |