- Unhashed Newsletter

- Posts

- XRP’s ETF buzz sparks mega cycle

XRP’s ETF buzz sparks mega cycle

Reading time: 5 minutes

XRP gains momentum as ETF launch and CME options fuel $5–$15 price targets

Key points:

XRP climbed above $3 as analysts pointed to bullish chart setups, with price targets ranging from $5 to as high as $15 depending on cycle strength.

New products, the first U.S. XRP ETF from REX-Osprey and CME’s upcoming XRP options, are reinforcing institutional demand and mainstream adoption.

News - XRP is once again drawing attention from traders and institutions, with price action and fresh product launches setting the stage for bigger moves. The token traded near $3.10 after rising almost 3% over 24 hours, and analysts now see room for a surge.

Technical indicators, including a bullish MACD crossover and multiple bull flag formations, suggest momentum could carry XRP toward $5 in the near term and potentially $15 if the larger patterns play out.

Institutional catalysts in focus - The REX-Osprey XRP ETF officially launched September 18, becoming the first U.S.-listed product to provide spot exposure to XRP. At the same time, CME Group announced plans to introduce XRP options beginning October 13, pending review.

With XRP futures already clocking over $16 billion in notional volume since May, these additions mark a new phase of institutional-grade access.

Chart signals and historical echoes - Analysts, including Steph Is Crypto and Crypto Pulse, highlight that XRP’s technical structure echoes 2017’s run, when the token more than doubled.

Current setups include retests of breakout support around $2.80–$3.00 and a confirmed bull flag, both often precursors to continuation rallies. Other fractal comparisons suggest targets in the $6–$7 range by late 2025 if momentum holds.

Beyond price action - Ripple is also expanding RLUSD’s footprint through partnerships with DBS and Franklin Templeton, reinforcing broader adoption trends. Community sentiment remains optimistic, though analysts stress volatility can cut both ways, with typical 30% swings still in play.

With technical, institutional, and adoption narratives converging, XRP’s path to $5, and beyond, has become one of the most closely watched stories in crypto this September.

Thumzup’s $2M DOGE buy fuels treasury, mining push as ETF buzz builds

Key points:

Thumzup bought 7.5 million DOGE for about $2 million at an average $0.2665, kickstarting a Dogecoin treasury and mining buildout after a $50 million equity raise.

Plans include acquiring DogeHash with 2,500 rigs and 1,000 more slated this year, plus new advisors from DogeOS; ETF anticipation and corporate treasury moves add tailwinds while on-chain signals flag near-term risk.

News - Thumzup Media disclosed an open-market purchase of roughly 7.5 million DOGE valued near $2 million, reinforcing a Dogecoin-first treasury strategy launched after its August stock offering.

Proceeds are earmarked for digital asset accumulation and high-performance DOGE mining hardware, with a proposed acquisition of DogeHash to fold in 2,500 existing miners and 1,000 additional units by year-end.

To guide execution, Thumzup added Jordan Jefferson and Alex Hoffman of DogeOS to its crypto advisory board, citing their wallets, scaling, and ecosystem expertise. DOGE traded around $0.27–$0.28 into the announcement window.

Expanding the DOGE playbook - Corporate treasury interest is rising. CleanCore Solutions disclosed about $130 million in DOGE on its path toward 1 billion tokens, while Bit Origin outlined plans to allocate a significant portion of reserves to DOGE.

On the product side, the REX-Osprey Dogecoin ETF (DOJE) is set to debut in the U.S., with some reports describing it as the first approved memecoin ETF and others noting final regulatory steps; either way, launch timing is near.

Price setup and on-chain caution - Analysts track ETF-driven upside scenarios toward $0.60–$1.40 and even higher in optimistic cases, but on-chain data show heavy profit-taking alongside the rally.

September exchange balances rose ~5.81 billion DOGE (about $1.63 billion), while coin days destroyed turned up as long-term holders moved coins. Technically, bulls want a flip of $0.287 into support to press $0.300; losing $0.273 risks a slide toward $0.241.

Global DOGE Curiosity - Google Trends data shows Dogecoin interest spiking worldwide in mid-September, with Iraq unexpectedly leading the search rankings despite a nationwide crypto ban.

Traders there cited inflation and restricted access to traditional assets as reasons for turning to DOGE, reflecting how the memecoin’s appeal has stretched into even the most regulated markets.

Why it matters - Thumzup’s treasury, mining expansion, and specialist hires signal an operator approach to DOGE exposure. Combined with ETF access and growing corporate demand, the memecoin’s narrative is broadening from speculation to strategy, even as near-term flows argue for disciplined risk management.

CZ warns crypto industry of North Korean hiring scams

Key points:

North Korean hackers are posing as job applicants and vendors to infiltrate crypto firms, with tactics tied to Lazarus.

Security Alliance profiled 60 impostors, while CZ urged tighter screening, staff training, and industry-wide intelligence sharing.

News - Binance co-founder Changpeng “CZ” Zhao has sounded a fresh alarm over North Korean cyber operations targeting crypto platforms. According to CZ, hackers have shifted from phishing to employment infiltration, disguising themselves as developers, finance staff, or IT professionals to gain insider access.

The warning comes as Security Alliance, an ethical hacker group, published a dossier identifying 60 impostor employees linked to North Korea.

Investigations revealed that fake candidates often submitted malware-laced code samples during interviews, planted malicious links in support tickets, or posed as recruiters to push fraudulent “Zoom updates.” Some even offered bribes to current employees for privileged credentials.

The Lazarus playbook evolves - For years, the Lazarus Group has been blamed for some of the largest crypto heists, including the $1.3 billion stolen in 2024. Now, reports suggest they are embedding operatives inside exchanges to bypass external defenses.

On-chain analyst ZachXBT also uncovered operatives cycling through dozens of fake identities across multiple firms.

Recent cases underline the threat: U.S. prosecutors charged North Korean citizens with infiltrating blockchain startups, while Coinbase introduced stricter in-person training after attempted bribes surfaced.

Industry response - CZ urged platforms to reinforce candidate verification, enforce least-privilege access, and adopt stricter file controls. Security experts stressed that insider compromises can be harder to detect than external hacks, making training and proactive monitoring critical.

With over $1.6 billion reportedly stolen by North Korean groups in 2025 alone, the latest warnings highlight how insider-focused infiltration now rivals phishing as a primary threat vector for the crypto industry.

DeFi TVL reclaims $170B, U.S. survey points to next wave of users

Key points:

DeFi total value locked hit $170 billion, fully retracing Terra-era losses, with Ethereum at 59% share.

U.S. polling shows 42% of Americans would try DeFi with clear rules, highlighting a demand pipeline.

News - Decentralized finance has climbed back to $170 billion in total value locked, marking a full recovery from the Terra collapse and the 2022 bear market. Ethereum still anchors the ecosystem with 59% of capital, while Base, HyperLiquid, and Sui collectively top $10 billion.

Solana is now the second largest chain with about $14.4 billion in TVL, followed by BNB Chain near $8.2 billion. The rebound has been slower and steadier than the last cycle, rising from roughly $42 billion in October 2022 to $170 billion in September 2025.

A maturing market - Headline yields have reset. Aave offers around 5.2% on stablecoins and Ether.fi about 11.1%, a far cry from Terra’s unsustainable 20% era. That reset, along with deeper institutional staking, suggests a more measured risk profile across major protocols.

Security remains the test - Even with stronger footing, risk has not vanished. Users lost about $2.5 billion to hacks and scams in the first half of 2025, keeping security and investor protection as the sector’s biggest challenge.

Americans say clarity would unlock usage - A national survey from the DeFi Education Fund and Ipsos found 42% of Americans would likely try DeFi if proposed legislation becomes law. Of those potential users, 84% would use it for online purchases, 78% for paying bills, and 77% for saving.

The research also highlights broader sentiment: nearly 18% have used or owned crypto, 22% want to learn more about nontraditional finance, 56% want full control of their money, and only 29% view today’s financial system as secure.

Recent comments from Federal Reserve Governor Christopher Waller that there is “nothing to be afraid of” in crypto payments add to the policy backdrop.

Why it matters - DeFi has repaired its balance sheet and recalibrated yields. The next leg likely hinges on security outcomes and U.S. rulemaking, with a sizable cohort of would-be users ready to participate once guardrails are clear.

More stories from the crypto ecosystem

Interesting facts

More than $4.5B in tokens are set to be unlocked in September 2025, with around $1.17B from cliff unlocks (one-time releases) and $3.36B from linear (gradual) unlocks. Projects like Sui, Arbitrum, Aptos, and Fasttoken are among the biggest contributors.

Three Swiss banks, PostFinance, Sygnum Bank, and UBS, successfully completed the first binding payment using public blockchain with bank deposits, showing real inter-bank settlement is viable on shared ledgers.

Bahrain has enacted a “comprehensive law” regulating Bitcoin and stablecoins, aiming to make cryptocurrency trade safer and more transparent. The law positions Bahrain as a rising regulatory hub in the Gulf and could attract more global crypto & fintech activity.

Top 3 coins of the day

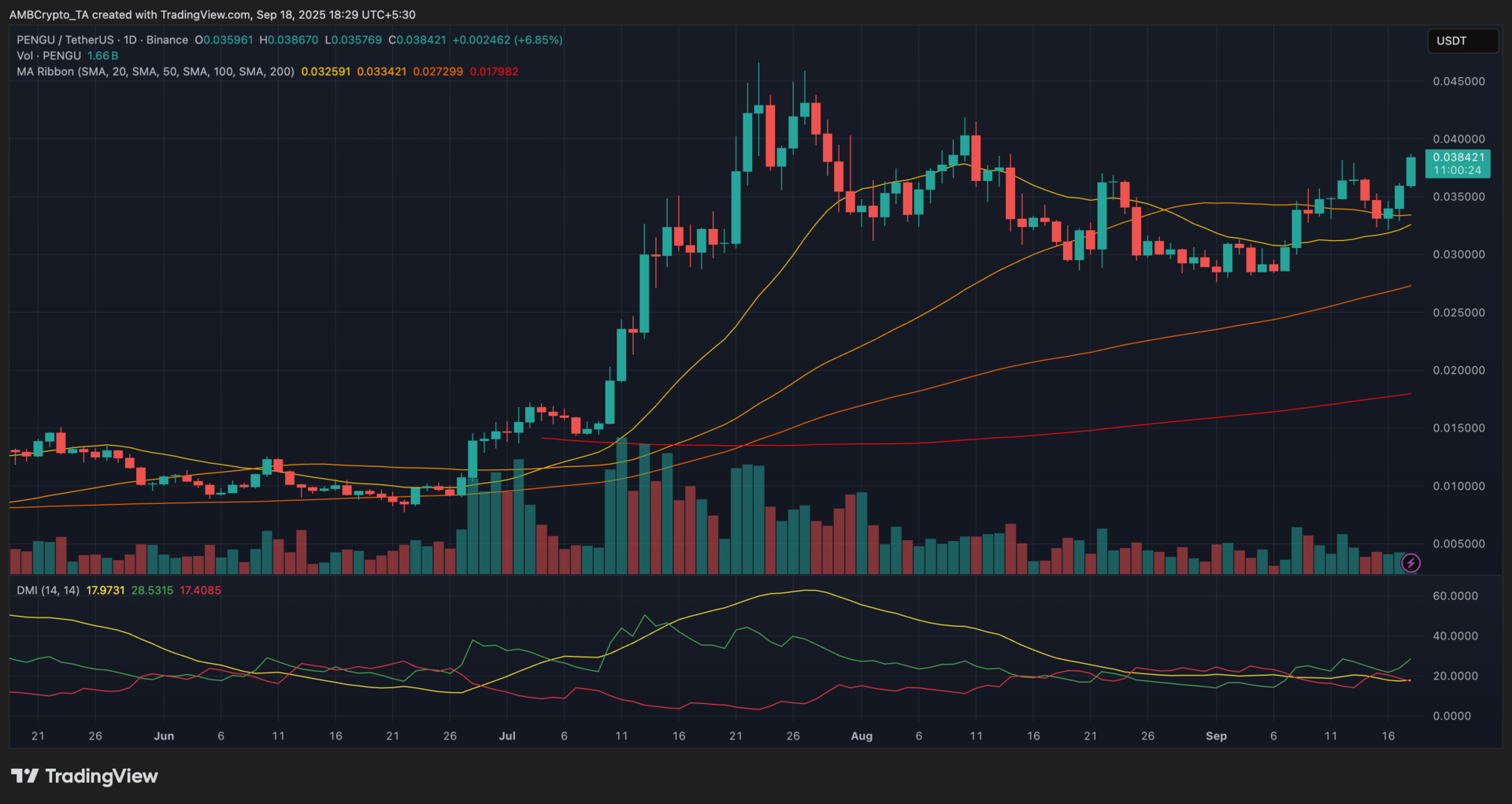

Pudgy Penguins (PENGU)

Key points:

PENGU was last spotted at $0.038, climbing 6.85% over the past 24 hours.

The token traded above short-term SMAs, while the DMI showed +DI leading -DI with a strengthening ADX, pointing to rising bullish momentum.

What you should know:

PENGU gained steadily in the latest session, supported by improving trend strength on the DMI and sustained price action above its near-term moving averages. Volume showed an uptick, though it remained moderate compared to the heavy inflows seen during July’s rallies. On the fundamentals side, Pudgy Penguins’ recent partnership with OpenSea as its official marketplace has enhanced ecosystem integration, linking token utility with one of the largest NFT platforms. This development came alongside broader retail traction through physical merchandise and brand collaborations, which have reinforced visibility. Broader altcoin momentum has also boosted demand for memecoins like PENGU. Looking ahead, the $0.040–0.041 zone is the immediate resistance to monitor, while $0.035 stands as nearby support.

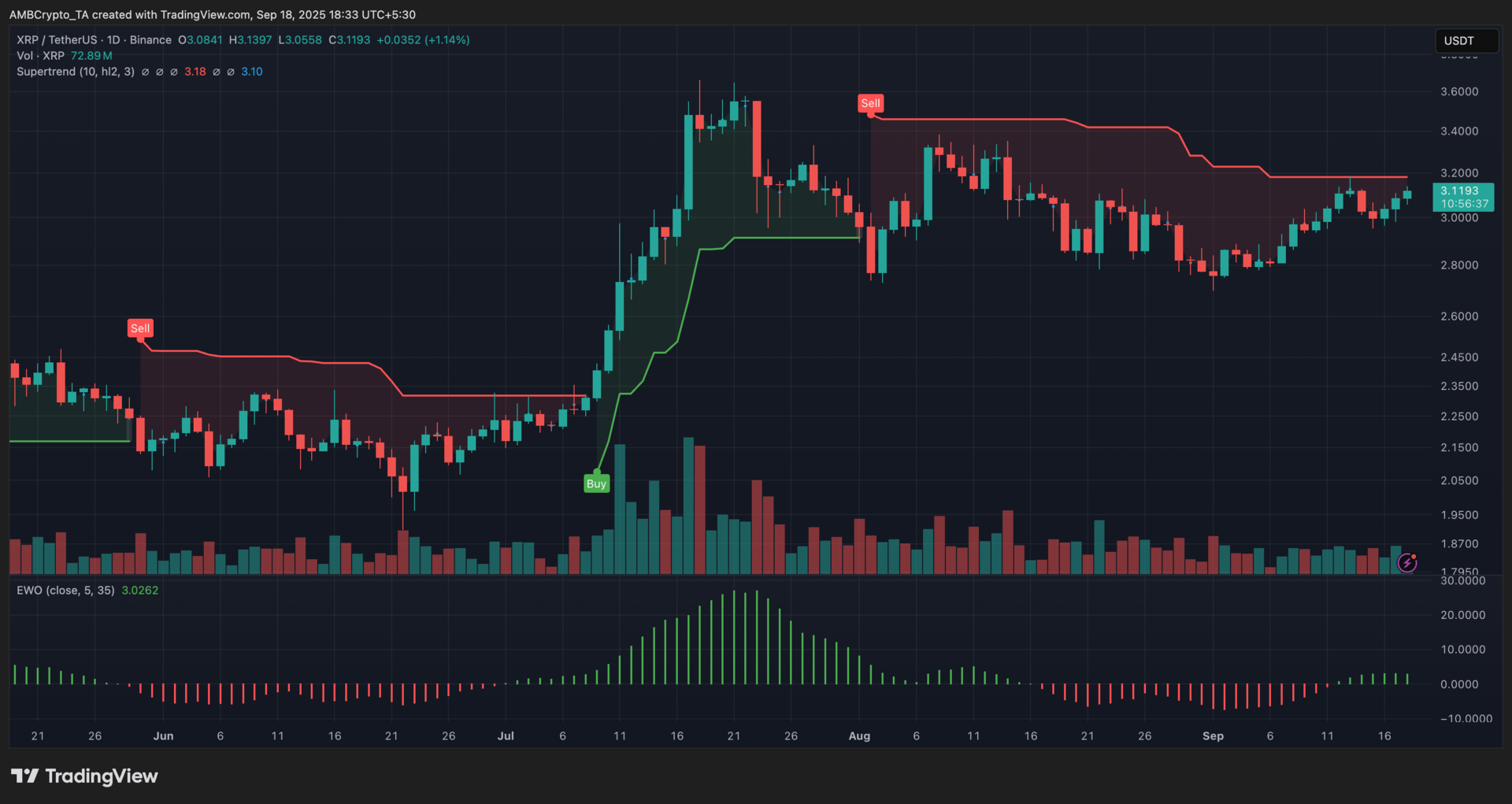

XRP (XRP)

Key points:

XRP was valued at $3.11 in the latest session, notching a 1.14% daily increase.

The Supertrend indicator stayed red above price while the EWO flipped green, hinting at early bullish momentum against steady volumes.

What you should know:

XRP managed modest gains over the past day, with trading activity showing resilience despite muted volumes compared to its July surge. The Supertrend indicator remained in a sell phase, keeping resistance near the $3.18 zone, though the Elliott Wave Oscillator’s (EWO) recent shift into green bars suggested a possible momentum revival. On a broader scale, the launch of the REX-Osprey spot XRP ETF in the U.S. has lifted sentiment, granting traditional investors direct exposure to the asset. This comes after Ripple cleared long-standing regulatory hurdles with the resolution of its SEC case earlier this year, helping restore institutional confidence. XRP needs to decisively reclaim $3.18 next to flip its Supertrend bullish, while $3.05 serves as immediate support.

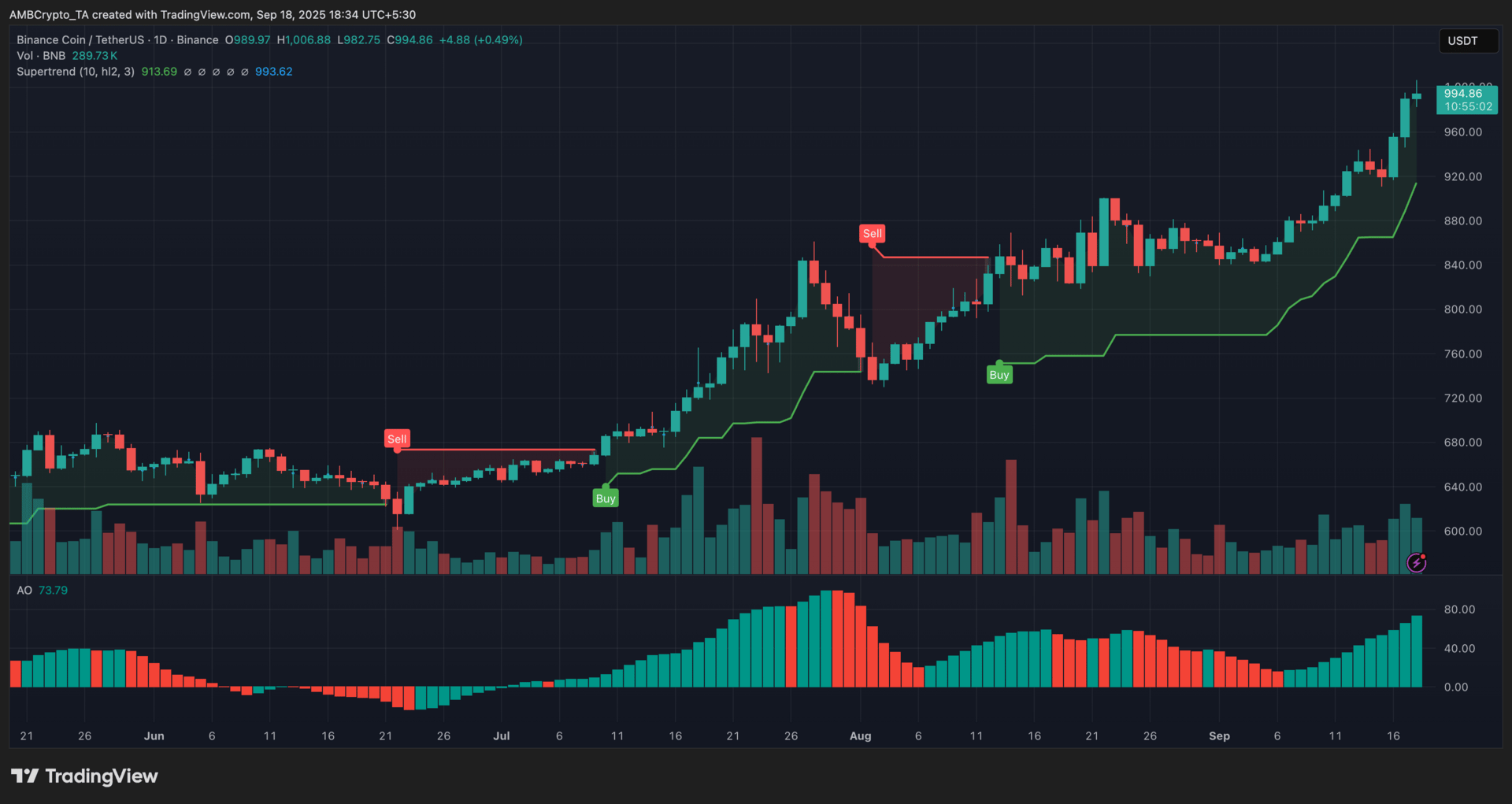

BNB (BNB)

Key points:

BNB changed hands at $994, edging 0.49% higher over the last 24 hours.

The Supertrend remained bullish below the candles, while the Awesome Oscillator stayed firmly green as volume activity picked up.

What you should know:

BNB continued its upward trajectory in the most recent session, supported by bullish chart signals. The Supertrend indicator remained positive beneath price action, while the Awesome Oscillator held strong with expanding green bars to confirm momentum. Trading volumes showed improvement but have yet to revisit the surges observed in late July. Away from technicals, sentiment was reinforced by ecosystem progress, including BNB Chain’s 5th-anniversary rewards program and scaling milestones on opBNB’s testnet. Institutional interest also played a role, with disclosures from firms such as Nano Labs and Windtree Therapeutics adding to the narrative of corporate treasury adoption. For now, traders may focus on the $1,000 mark as immediate resistance, with $913–915 serving as a nearby support zone.

How was today's newsletter? |