- Unhashed Newsletter

- Posts

- XRP traders brace for big break

XRP traders brace for big break

Reading time: 5 minutes

XRP climbs toward ETF momentum as traders brace for key breakout levels

Key points:

Cboe approved 21Shares’ proposed XRP ETF for listing, while Ripple Markets seeded the fund with 100 million XRP to support creation and redemption activity.

XRP price action remains fragile near $2.00, with OBV divergence, shifting holder behavior and institutional flows shaping the next breakout attempt.

News - XRP moved closer to another spot ETF after the Cboe BZX Exchange certified approval for listing 21Shares’ proposed fund. Once live, the product will track the CME CF XRP Dollar Reference Rate and offer exposure without requiring investors to handle the asset directly.

Ripple Markets has already seeded 100 million XRP, while Coinbase Custody, Anchorage Digital Bank, and BitGo will secure the underlying holdings. The broader ETF market has gathered nearly $1 billion in cumulative inflows, with no net outflow days recorded since launch.

At the same time, price action shows a complex mix of strain and early support. XRP trades near $2.00 after slipping from $2.09, a pullback amplified by a 172.8 million volume spike at resistance. The rejection left the token underperforming broader crypto even as ETF inflows strengthened supply compression.

Signs of a possible bounce - Charts show XRP forming a symmetrical triangle, with OBV divergence at the lows suggesting hidden accumulation. Long-term holders reduced their selling by about 49% between December 3 and December 10, while short-term cohorts cut speculative supply. These shifts often provide a foundation for rebounds when ranges tighten.

Risks that could tilt the move - Transaction fees on the XRP Ledger have dropped 89% since February, touching five-year lows. Analysts note that this decline, paired with reduced open interest and weakening funding rates, could still invite a move toward $1.73 if support near $1.98 fails.

Resistance remains heavy at $2.09 to $2.10, the level that continues to cap every breakout attempt.

Do Kwon faces sentencing as Terra’s legacy returns to the spotlight

Key points:

Terraform Labs founder Do Kwon awaits sentencing today in New York after pleading guilty to fraud tied to the $40 billion TerraUSD and Luna collapse.

LUNA surged more than 55% in the past 24 hours as market interest spiked ahead of the hearing and following the network’s v2.18.0 upgrade.

News - A Manhattan courtroom is preparing to sentence Do Kwon, the former Terraform Labs chief whose TerraUSD and Luna collapse erased an estimated $40 billion in investor wealth and shook the crypto market in 2022.

Kwon, now 34, previously admitted to conspiracy to defraud and wire fraud, acknowledging that he misled investors about the mechanisms that restored TerraUSD’s dollar peg.

Prosecutors accuse him of orchestrating a scheme built on deception and are seeking at least 12 years in prison. His defense argues for a five-year cap so he can return to South Korea, where additional charges await.

Kwon’s downfall came during a chaotic period in crypto when plummeting token prices triggered failures across several firms. Charging documents detail how he secretly enlisted a trading firm to purchase millions in TerraUSD to prop up its price, contradicting his public claims that an automated algorithm stabilized the token.

A sentencing that extends beyond one man - The magnitude of the Terra collapse continues to influence markets. The SEC settlement earlier this year imposed an $80 million personal penalty on Kwon and a $4.55 billion broader settlement involving Terraform Labs.

Prosecutors argue that the harm went far beyond financial losses, citing ripple effects that contributed to wider market contagion.

Market spotlight returns to LUNA - While the industry awaits Kwon’s sentence, Terra’s LUNA token surged more than 55% over the past day after reaching a seven-month high. The rally followed the v2.18.0 upgrade and renewed attention around Kwon’s court appearance.

Analysts warn the move is driven by hype rather than fundamentals, noting that market interest remains tied to volatility rather than long-term recovery.

Solana pulls ahead as CeFi, DeFi, and sovereign tokens converge

Key points:

Coinbase and dYdX both expanded into Solana’s ecosystem, giving users access to native Solana assets through DEX rails and new spot markets.

Bhutan launched TER, a sovereign gold-backed token on Solana, reinforcing the chain’s growing role in global asset tokenization.

News - Solana’s ecosystem saw a wave of institutional and sovereign adoption today as major platforms and even a national government expanded activity on the network.

Coinbase rolled out access to all Solana tokens through a decentralized exchange integration, letting users trade assets without a traditional listing. The move gives builders and issuers new paths into Coinbase’s vast user base, provided their tokens have sufficient liquidity.

The expansion follows similar integration milestones on Base and signals a broader shift toward centralized platforms acting as front ends to onchain liquidity.

dYdX added to this momentum by launching its first ever spot trading product, opening Solana markets to users worldwide, including traders in the United States for the first time. The exchange, long known for derivatives, is waiving fees through December as part of its push to reach new jurisdictions where perpetuals remain restricted.

A sovereign token on Solana - Bhutan entered the spotlight after debuting TER, a gold-backed token issued through Gelephu Mindfulness City and custodied by DK Bank. Each token represents physical gold held in reserve, offering investors onchain transparency while maintaining the familiar structure of traditional gold purchases.

TER is the latest step in Bhutan’s multi-year blockchain strategy, which includes 5,984 BTC in national reserves, hydro-powered mining operations and recent integrations spanning payments, identity and digital asset infrastructure.

A broader trend takes shape - The arrival of Solana-native DEX access, global spot markets, and sovereign asset tokens highlights the chain’s expanding influence. From institutional-grade DeFi strategies to national tokenization programs, Solana is positioning itself at the center of onchain finance’s next phase.

Trust Wallet and Revolut target European crypto buyers with direct on-ramp access

Key points:

Trust Wallet users in Europe can now buy BTC, ETH, and SOL through Revolut with instant settlement into self-custody and, in some cases, zero fees.

The integration arrives shortly after Revolut secured MiCA approval, expanding its crypto reach across 30 European markets.

News - Trust Wallet has rolled out a new crypto purchase option for European users through a direct integration with Revolut, allowing buyers to acquire BTC, ETH, and SOL from within the wallet.

Purchases start at 10 euros and can reach 23,000 euros per transaction. While Revolut charges fees for adding money to its accounts, the actual crypto buys in Trust Wallet carry no Revolut fee. The partnership follows Revolut’s recent $75 billion valuation and regulatory approval to operate across the European Economic Area under MiCA rules.

Trust Wallet describes the integration as a simpler access point for users who want crypto delivered straight into self-custody instead of leaving funds on centralized platforms. It also reflects Trust Wallet’s broader strategy of expanding into sectors such as prediction markets and asset tokenization.

A shift toward instant, self-custodial funding - Revolut and Trust Wallet are pushing for faster on-ramps at a time when European users face varying restrictions depending on jurisdiction and payment method.

The integration supports RevolutPay, debit and credit cards, and bank transfers, providing multiple ways to fund wallets instantly. Users maintain full control of assets from the moment of purchase, with no need to transfer coins out of an exchange.

More assets and markets in view - Support will expand over time. USDC is expected to join the initial list of three assets, while separate reporting shows the broader rollout includes BTC, ETH, SOL, USDC and USDT.

Revolut continues to scale its crypto footprint after reporting $4 billion in 2024 revenue and securing banking licenses in new regions. For Trust Wallet, the partnership reinforces a simple message: make entry points smoother, while keeping ownership in the hands of users.

More stories from the crypto ecosystem

With $0.16 defended, can Terra [LUNA] extend its rally by another 50%?

‘Already seen the low?’ – Inside Cathie Wood’s bet on a new Bitcoin cycle

Bitcoin dips after Fed’s 25 bps cut – Is BTC’s 2026 rally at risk?

Twenty One Capital’s NYSE debut sees 20% fall – What scared investors?

Bitcoin – Standard Chartered’s revised projection and why THIS is ‘no longer a price driver’

Interesting facts

Centralized exchanges are becoming the world’s unofficial crypto on-ramps - Binance is closing in on 300 million users, a scale that now rivals major U.S. fintech platforms and hints at how global crypto adoption is being funneled through a handful of giants.

Asia’s regulatory battleground is shifting in real time - Hong Kong plans to relax trading rules and expand tokenization pilots, signaling a high-speed bid to outpace regional rivals as capital and developers seek clearer digital asset jurisdictions.

Stablecoins are turning into the new digital dollar rails - Stablecoins now handle nearly 64% of all on-chain activity, reflecting how millions quietly prefer tokenized dollars for real transactions over volatile tokens.

The Headlines Traders Need Before the Bell

Tired of missing the trades that actually move?

In under five minutes, Elite Trade Club delivers the top stories, market-moving headlines, and stocks to watch — before the open.

Join 200K+ traders who start with a plan, not a scroll.

Top 3 coins of the day

Zcash (ZEC)

Key points:

ZEC traded near $443 after a solid intraday advance that lifted price closer to reclaiming the short-term Supertrend support zone.

RSI hovered around the neutral 50 line while the Supertrend remained bearish, showing that recovery attempts were forming against a still weak broader signal.

What you should know:

ZEC picked up momentum after stabilising above the $424 support band, with buyers attempting to push price back toward the underside of the Supertrend resistance near $540. The latest green candle suggested renewed interest, although the trend backdrop stayed cautious as the indicator continued to print a Sell state. RSI drifted toward mid-range levels, showing that upside remained possible if follow-through strength developed. From a catalyst perspective, privacy-focused sentiment helped underpin ZEC’s rebound, aided by ecosystem upgrades such as shielded swap support and broader cross-chain usability improvements through the Zashi wallet. Traders now have their attention on whether ZEC can build enough strength to challenge the $540 resistance or if hesitation near the Supertrend line leads to another test of nearby support.

Tezos (XTZ)

Key points:

XTZ traded close to $0.51 after a steady climb that lifted price back above the 20-day MA, marking a shift from the weakness seen in late November.

EWO remained negative, while price moved gradually toward the 50-day MA, which now acts as the next dynamic resistance.

What you should know:

XTZ continued to stabilize after bouncing from the $0.46 support area, with recent candles closing above the 20-day MA for the first time in several weeks. This placed the price on a slow approach toward the 50-day MA, a level that traders will watch closely as it represents the next structural barrier for any deeper recovery attempt. EWO stayed below zero but displayed slightly easing downside pressure, aligning with the modest improvement in daily price action. On the catalyst front, Tezos benefited from real-world visibility as luxury auto dealerships in France enabled XTZ payments through Lyzi, while interest around its growing role in RWA tokenization also supported sentiment. The main question now is whether XTZ can build enough strength to push through the 50-day MA or if hesitation leads to another retest of nearby support.

TRON (TRX)

Key points:

TRX hovered near $0.28 after a mild uptick that lifted price back toward the middle Bollinger band following a brief bounce off the lower band.

MACD showed a shallow bullish crossover with small positive histogram bars, hinting at early momentum while broader conditions remained cautious.

What you should know:

TRX steadied after dipping to the $0.27 support region, with price reclaiming the middle Bollinger band around $0.28 and attempting to build short-term traction. The upper band near $0.29 now acts as the next resistance level that traders will watch as a test of whether the rebound can extend. MACD presented a modest bullish cross, although the signal stayed weak and did not yet confirm a strong trend shift. Volume activity settled at moderate levels, reflecting measured participation rather than aggressive buying. Beyond technicals, ecosystem updates from Indonesia Blockchain Week, including AI-driven enhancements and network fee reductions, helped sentiment. Tether’s regulatory approval in the UAE also boosted confidence in TRON’s role within the global USDT settlement landscape. Whether TRX can challenge the upper band or revisit $0.27 will shape near-term direction.

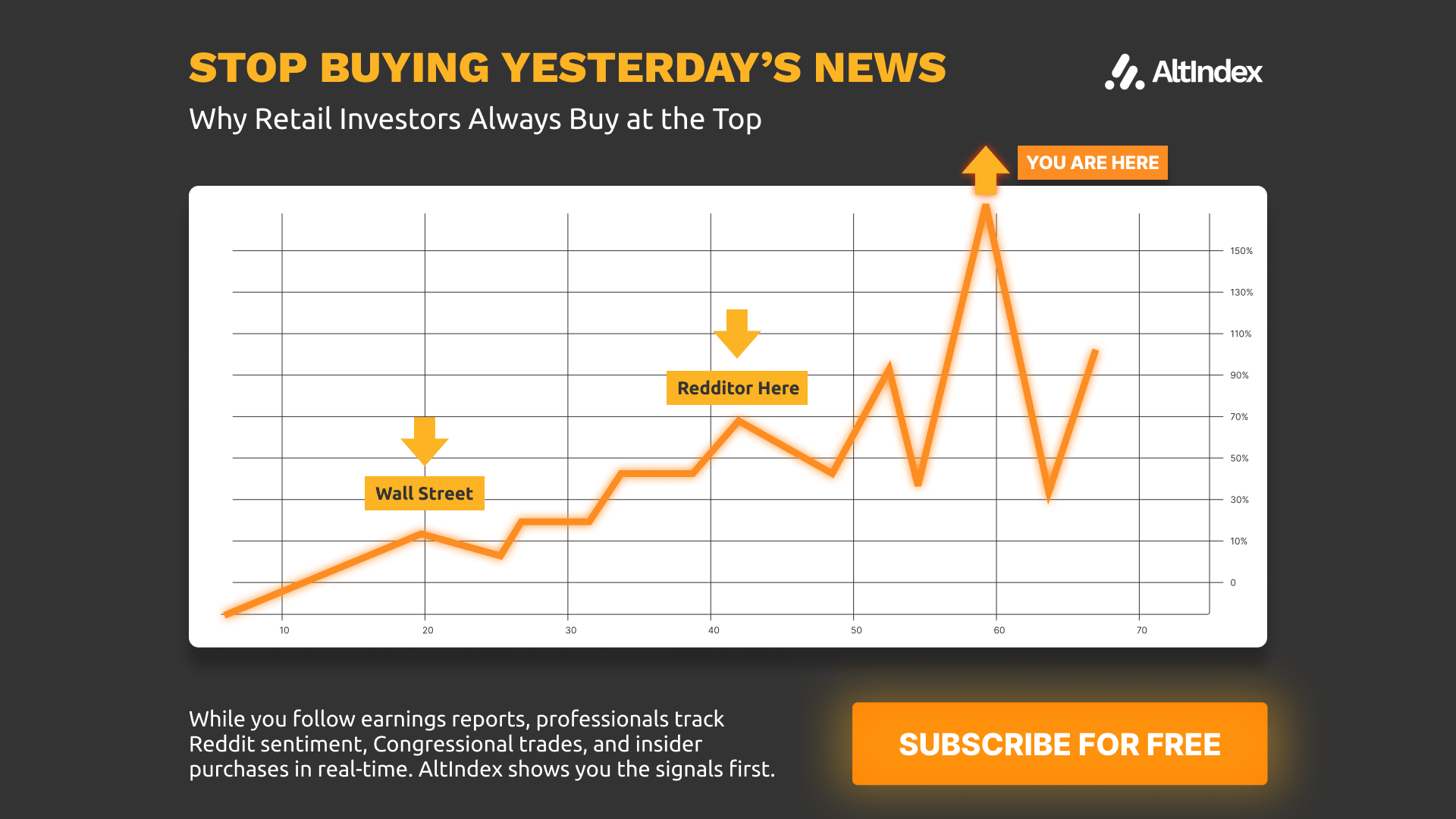

When AI Outperforms the S&P 500 by 28.5%

Did you catch these stocks?

Robinhood is up over 220% year to date.

Seagate is up 198.25% year to date.

Palantir is up 139.17% this year.

AltIndex’s AI model rated every one of these stocks as a “buy” before it took off.

The kicker? They use alternative data like reddit comments, congress trades, and hiring data.

We’ve teamed up with AltIndex to give our readers free access to their app for a limited time.

The next top performer is already taking shape. Will you be looking at the right data?

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

How was today's newsletter? |