- Unhashed Newsletter

- Posts

- XRP trapped between buyers and sellers

XRP trapped between buyers and sellers

Reading time: 5 minutes

XRP caught between holder conviction and selling pressure

Key points:

XRP traded near $1.90 after repeated failures to reclaim the $1.97 to $2.00 zone, keeping downside risks toward $1.80 in focus.

Long-term holders continued accumulating, but short-term selling and weak capital flows limited recovery attempts.

News - XRP’s recent price action reflected a market caught between long-term conviction and short-term pressure. After a brief rebound earlier this week, the token failed to hold gains near $1.97 to $2.00 and slipped back toward the $1.90 area. With no fresh headline catalyst, price movement remained driven by positioning, capital flows, and clearly defined technical levels.

On-chain data showed a split among holders. Long-term wallets continued to add exposure, helping stabilize price during pullbacks. In contrast, short-term holders repeatedly sold into rebounds, keeping XRP locked in a fragile consolidation range.

Selling pressure keeps rallies in check - Wallets holding XRP for one week to one month reduced their supply sharply over the past two weeks, selling into every bounce near $1.98. This behavior aligned with exchange flow data, which flipped from net outflows earlier in the month to modest inflows by January 23, signaling profit-taking rather than accumulation.

Capital flows reinforced the caution. Chaikin Money Flow trended lower alongside price, pointing to sustained outflows. XRP exchange-traded funds also recorded a large single-day net outflow around January 20, which outweighed smaller inflows that followed.

Crowded shorts add latent tension - Derivatives positioning painted a different picture. Funding rates on Binance remained mostly negative, showing that leveraged traders continued to lean bearish. Similar conditions in late 2024 and early 2025 preceded sharp rebounds as short positions were forced to unwind. For now, that latent buying pressure has not translated into sustained upside.

Executive optimism vs market reality - Ripple CEO Brad Garlinghouse recently reiterated a bullish long-term outlook for the crypto market, stating he expects new all-time highs in 2026. While he declined to comment directly on XRP’s near-term price, he pointed to continued positive momentum across the ecosystem.

He linked his long-term optimism to expectations that the CLARITY Act will advance in 2026, arguing that clearer U.S. market structure rules could support broader crypto adoption over time.

That optimism stands in contrast to XRP’s current structure. Support near $1.90 to $1.80 remains critical, while resistance between $1.97 and $2.00 continues to cap rallies. Unless capital flows improve and selling pressure fades, long-term conviction may slow the decline, but it has yet to reverse it.

Binance files MiCA application in Greece ahead of deadline

Key points:

Binance has applied for a MiCA license in Greece as the July 1 EU compliance deadline approaches, with its application reportedly under fast-track review.

The move comes amid mounting regulatory pressure across Europe, including warnings from France and wider debates over MiCA passporting and centralized oversight.

News - Binance has filed for authorization under the European Union’s Markets in Crypto-Assets Regulation, selecting Greece as its regulatory base ahead of the July 1 deadline that will require crypto firms to hold a valid MiCA license to continue operating in the bloc.

The exchange confirmed it is working with Greece’s Hellenic Capital Market Commission (HCMC) after establishing a local holding company, Binary Greece, in December.

Greece has yet to issue its first MiCA license, placing Binance among the earliest large exchanges to enter the country’s approval process. Regulators are reportedly fast-tracking the review, with the HCMC engaging multiple global advisory firms to support the assessment.

Why Greece, and why now - Binance’s Greek filing follows growing scrutiny across Europe as national regulators push firms to finalize compliance plans before the MiCA transition period ends. France’s markets regulator recently flagged Binance among dozens of crypto firms still operating without a MiCA license, warning that non-compliant providers would be forced to halt services from July.

The exchange’s decision to anchor its application in Greece reflects both timing and structure. Binary Greece was incorporated as a single shareholder public company with a stated focus on financial advisory services and regional investments. The setup indicates a longer-term operational presence rather than a short-term licensing arrangement.

MiCA tensions across the EU - Binance’s application lands amid broader disagreements within the EU over how MiCA should be enforced. French regulators have raised concerns about license passporting across member states, while the European Commission has pushed for greater centralized oversight through the European Securities and Markets Authority, a proposal that has faced resistance from smaller jurisdictions.

With MiCA shifting from framework to enforcement, the move highlights how compliance outcomes may increasingly depend on national regulators alongside EU-level oversight.

Ledger explores $4B US IPO after BitGo listing

Key points:

Ledger is reportedly preparing a potential US IPO that could value the hardware wallet maker at more than $4 billion, according to multiple media reports.

The move follows BitGo’s recent New York listing and comes amid rising demand for crypto custody tools alongside renewed scrutiny of security practices.

News - French hardware wallet manufacturer Ledger is exploring a potential initial public offering (IPO) in the United States that could value the company at over $4 billion. Reports state that Ledger is working with Goldman Sachs, Jefferies, and Barclays on a possible New York Stock Exchange (NYSE) listing, with plans that could materialize as soon as this year.

The reported valuation would mark a sharp increase from Ledger’s $1.5 billion valuation in a 2023 funding round. The company has previously signaled interest in tapping US capital markets, with CEO Pascal Gauthier indicating in late 2025 that future fundraising could include a New York listing.

Custody demand meets public markets - Ledger’s IPO discussions come at a time when crypto custody has gained renewed attention. Rising crypto hacks and fraud have pushed more users and institutions toward self-custody solutions, supporting Ledger’s revenue growth, which management has described as reaching triple-digit millions.

The timing also follows BitGo’s NYSE debut, where the crypto custody firm priced its shares at $18 and closed its first trading session higher, valuing the company at over $2 billion. The listing came amid renewed attention on crypto infrastructure firms, even as recent public listings have delivered mixed post-IPO performance.

Security history adds context - While custody demand has strengthened, Ledger’s track record has drawn scrutiny. The company has faced multiple security-related incidents, including a recent breach involving a third-party payment processor that exposed customer data, as well as earlier data leaks and a smaller hack affecting decentralized finance applications.

Commentary cited in the reports suggested that while custody-focused firms may face different risks than trading platforms, IPO outcomes could still depend on broader crypto market conditions and investor risk appetite. Ledger is yet to confirm details of the IPO plans, underscoring that discussions remain subject to change.

Seized Bitcoin goes missing under South Korean custody

Key points:

South Korean prosecutors are investigating the seized Bitcoin that has gone missing after an internal audit flagged a likely phishing attack during official custody.

The incident highlights growing risks around how authorities store and manage confiscated crypto assets.

News - Prosecutors in South Korea’s Gwangju District are investigating the loss of a large amount of Bitcoin that had been seized in a criminal case, following the discovery during a routine inspection of confiscated assets. Local media reports said an internal audit concluded the funds were likely lost through a phishing attack while the Bitcoin was under official storage.

Officials have declined to confirm the exact timing or amount involved, citing the ongoing investigation. However, multiple reports indicated that the missing Bitcoin could be worth around 70 billion won, or roughly $48 million. A prosecution official told Yonhap News that authorities are working to determine the circumstances of the loss and track the whereabouts of the assets.

Phishing suspected during custody checks - According to local reporting, the loss may have occurred when an agency employee accessed a fraudulent website while checking the custody status of seized digital assets. Investigators believe this exposure may have resulted in sensitive access information being leaked, enabling the Bitcoin to be transferred out of official control.

Phishing remains one of the most common attack vectors in crypto, relying on impersonation tactics to trick victims into revealing passwords or other sensitive details. Chainalysis estimates that crypto scams and fraud drained about $17 billion from victims in 2025, driven largely by a sharp rise in impersonation schemes.

Custody risks extend beyond private firms - The incident underscores broader challenges facing law enforcement agencies as they increasingly confiscate and hold large volumes of cryptocurrency. While exchanges and individual users have long faced custody risks, the Gwangju case shows that public institutions are also vulnerable if security procedures fail.

Prosecutors have not disclosed what custody methods were used or whether the seized Bitcoin was moved to a separate custody wallet. As the investigation continues, the case has raised questions about how digital assets are safeguarded once they enter official possession, particularly as crypto-related seizures grow in scale.

More stories from the crypto ecosystem

Is Ethereum the ‘one common blockchain’? BlackRock CEO weighs in

Here’s why Bitcoin’s bull market case shouldn’t be dismissed just yet!

Tokenized assets hit $21B, but are new chains starting to matter?

Ethereum fundamentals diverge from its price – Is this a bottom signal?

XRP shorts feel the heat – Why THIS is turning into a squeeze zone

Crypto scams uncovered

Senior-targeting “tech support” scam hit $27 million: A Chinese national pleaded guilty in a $27 million fraud and money laundering scheme that targeted about 2,000 elderly victims across the U.S., using fake tech support and impersonation tactics before laundering proceeds through crypto.

Fake “crypto trading platforms” stole $14 million via social media: The SEC charged three purported crypto trading platforms and four “investment clubs,” alleging they lured retail investors through social media ads and WhatsApp groups, then routed deposits into fake platforms where no real trading occurred and withdrawals were blocked unless victims paid extra fees.

A crypto company founder was indicted for laundering scam proceeds: Federal prosecutors indicted the founder of a Chicago cryptocurrency company, alleging a roughly $10 million money laundering conspiracy that converted funds tied to fraud into crypto and moved them through wallets to obscure the source.

Top 3 coins of the day

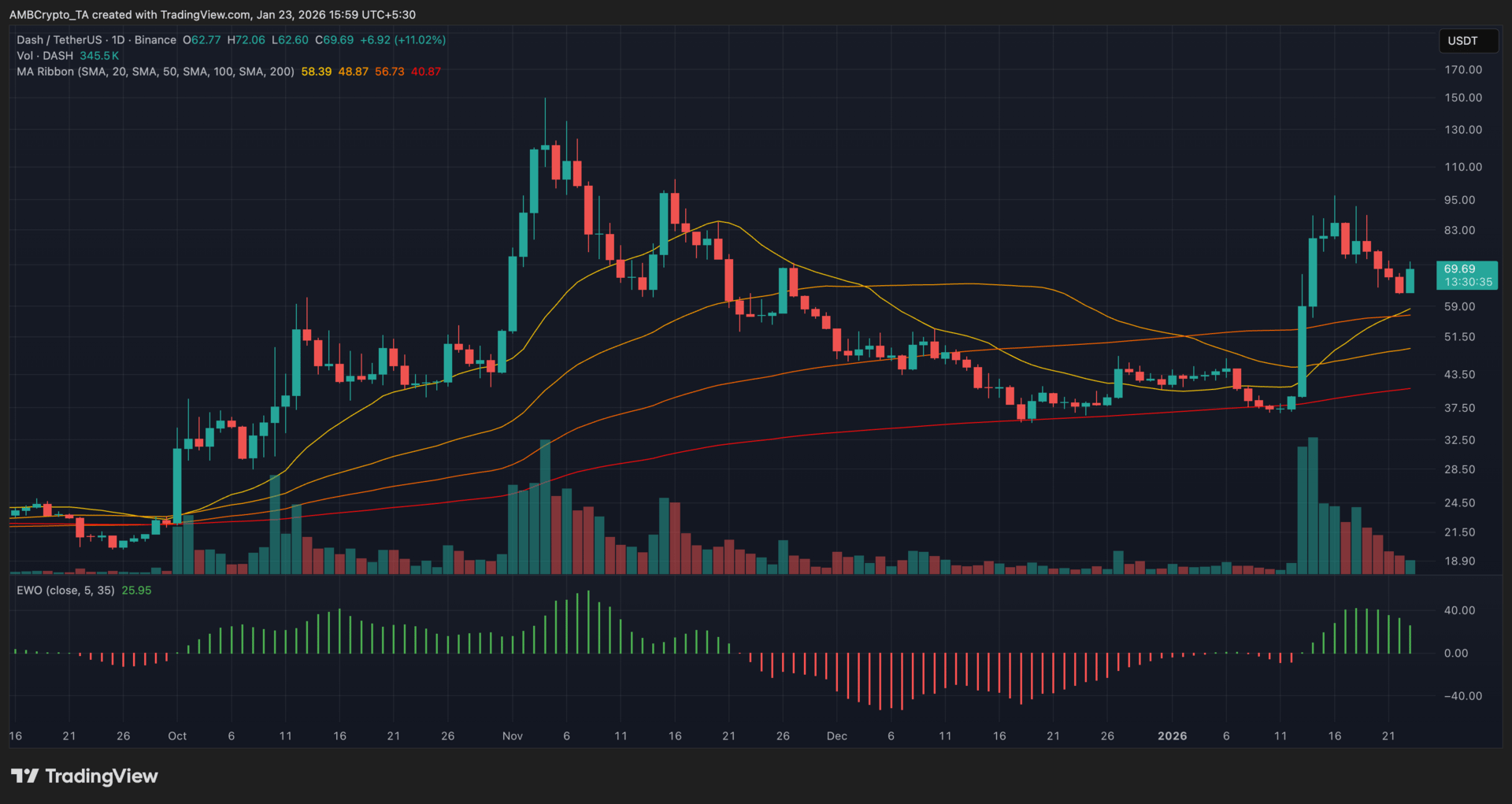

Dash (DASH)

Key points:

DASH rebounded sharply from recent lows, reclaiming all major moving averages as buyers stepped in after a steep weekly drawdown.

Momentum and participation improved together, with EWO flipping positive and volume expanding during the recovery move.

What you should know:

Dash staged a strong rebound after a heavy weekly sell-off, with price climbing back above its full MA ribbon. The recovery unfolded with a decisive bullish candle, signaling a shift from persistent downside pressure to short-term stabilization. The move was supported by expanding volume, suggesting the bounce attracted fresh participation rather than thin liquidity.

Momentum conditions also improved. The EWO turned positive and continued printing green bars, reflecting strengthening upside force after a prolonged negative phase. While this pointed to a relief-driven push, the rebound still occurred within a broader corrective structure, keeping follow-through strength in focus.

From a positioning standpoint, attention remained on a large whale short opened earlier this week, which likely added a contrarian element to the rebound. In parallel, Dash benefited from renewed visibility around ecosystem progress, including the recent AEON Pay integration and anticipation around the Evolution upgrade.

Support is at $65–$66, while resistance stands near $72–$74, where prior selling pressure and MA congestion remain active.

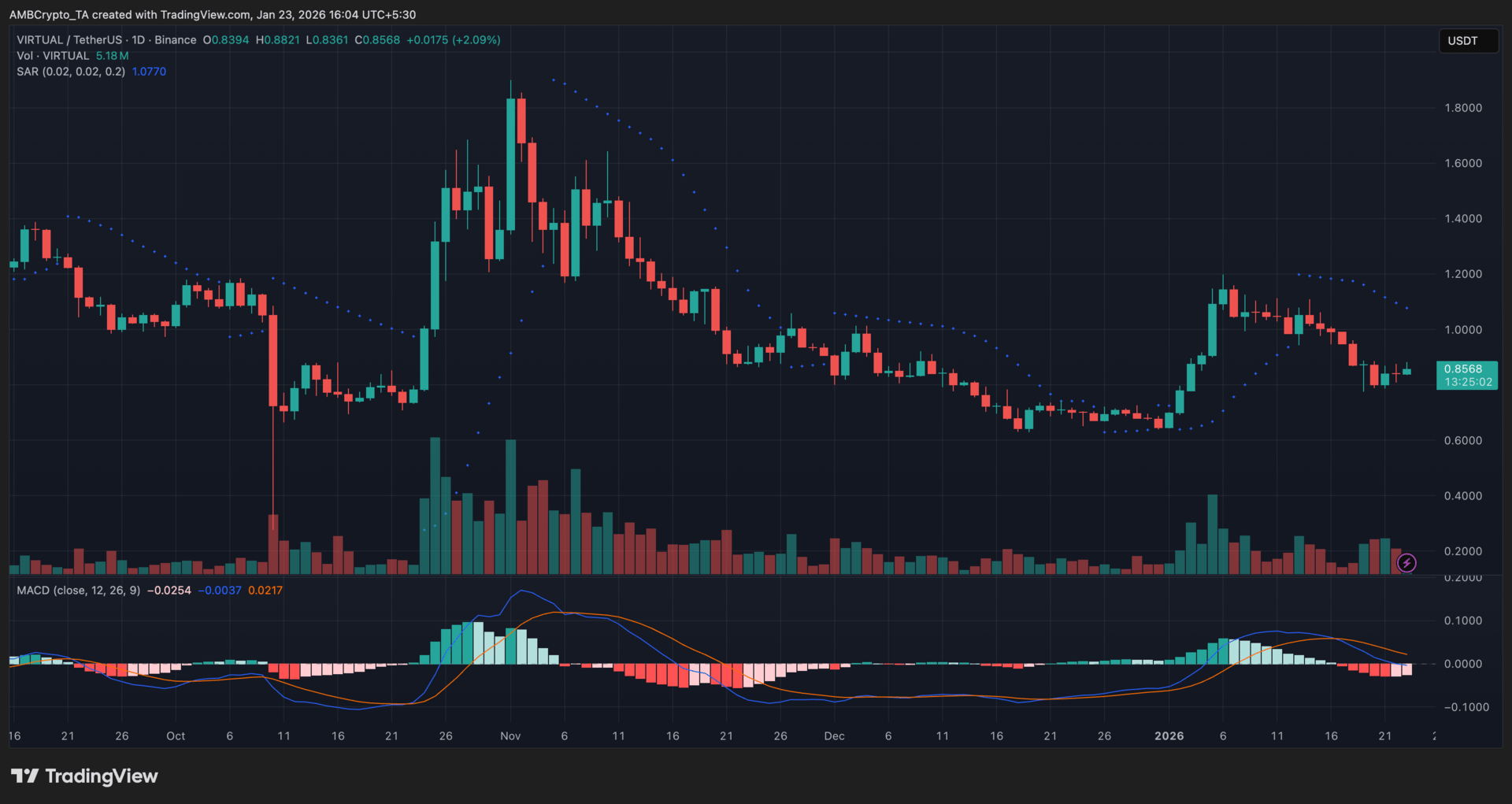

Virtuals Protocol (VIRTUAL)

Key points:

VIRTUAL logged a mild recovery over the past session after defending a key demand zone, even as broader market sentiment remained mixed.

Trend indicators stayed cautious, but easing downside momentum and steady volume helped stabilize price action.

What you should know:

Virtuals Protocol attempted a short-term rebound after price held above the $0.83–$0.84 zone, a level that had previously acted as a base during December’s decline. While the bounce pushed VIRTUAL slightly higher, Parabolic SAR dots remained above the candles, signaling that the broader trend stayed bearish despite the recovery attempt.

Momentum indicators painted a mixed picture. The MACD histogram stayed in negative territory, but selling pressure appeared to ease, suggesting downside momentum had begun to slow rather than accelerate. This aligned with moderate volume inflows, which supported stabilization but fell short of signaling strong accumulation.

From a broader perspective, altcoin rotation trends continued to provide a mild tailwind, with speculative capital rotating into higher-beta tokens. In addition, ongoing AI-sector visibility kept VIRTUAL on traders’ radar, helping cushion declines during market pullbacks.

For now, support sits near $0.83–$0.84, while resistance remains around $0.92–$0.95. A sustained move beyond resistance, paired with a SAR flip, is needed to confirm a trend shift.

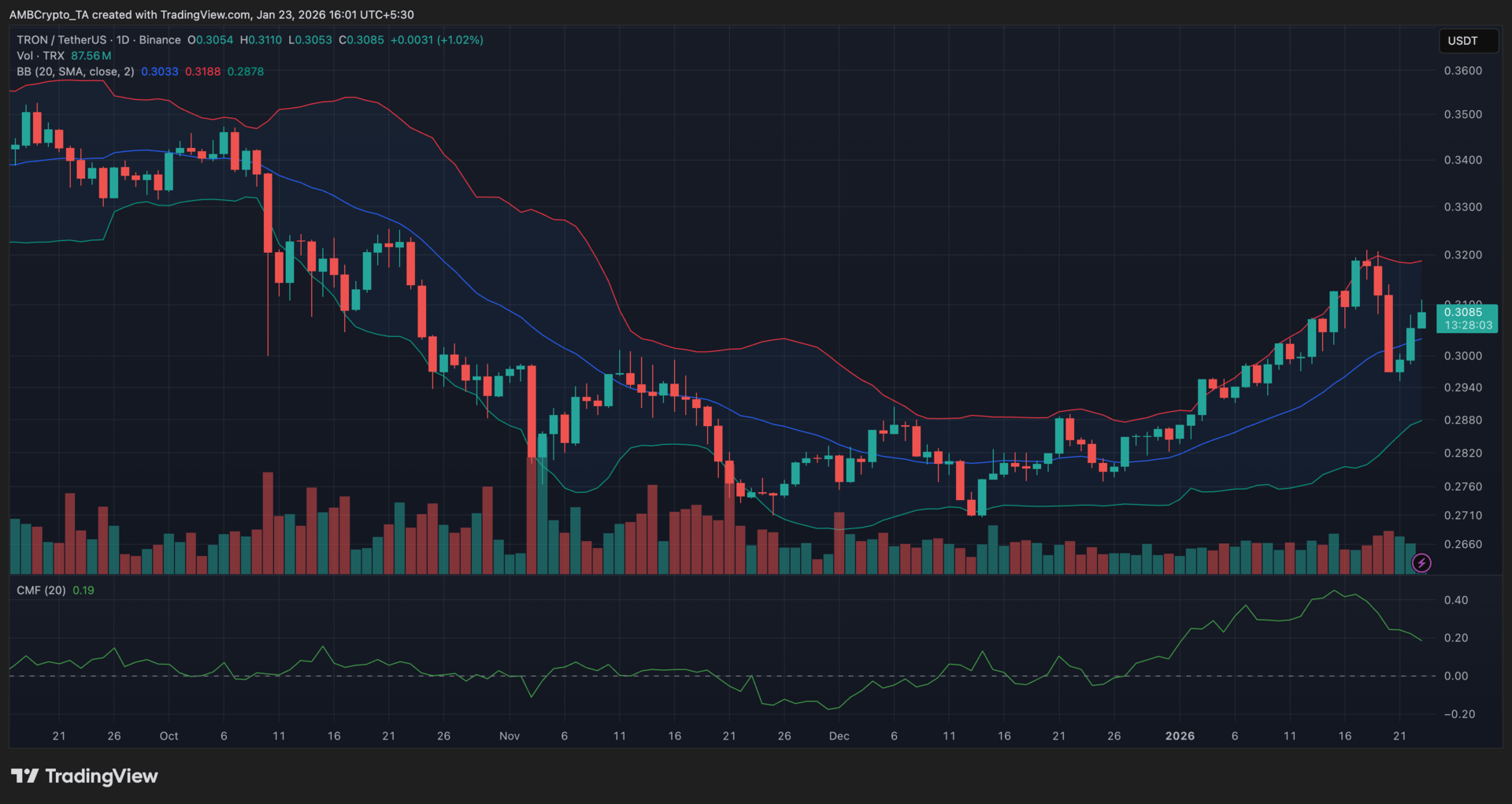

TRON (TRX)

Key points:

TRX hovered around $0.308 after extending its recent climb, maintaining relative strength in a broadly cautious market.

The Bollinger Bands expanded upward while CMF stayed positive, pointing to sustained capital inflows backed by healthy volume.

What you should know:

TRX continued to build on its recent advance, trading close to $0.308 after bouncing from the $0.295–$0.298 zone earlier this week. Bollinger Bands widened during the move, reflecting rising volatility as price briefly approached the upper band near $0.318 before easing. Volume picked up during the push higher, suggesting the move was supported by active participation rather than short-lived spikes.

CMF remained positive around the 0.15–0.20 range, indicating steady buying pressure despite the short-term pullback from local highs. On the catalyst front, sentiment stayed constructive following Justin Sun’s $8 million strategic investment into DeFi project River, reinforcing confidence in TRON’s ecosystem expansion. Regulatory recognition of USDT on TRON by Abu Dhabi’s FSRA also continued to support institutional credibility.

Going forward, support sits near $0.295, while resistance is positioned around $0.318–$0.320, aligned with the upper Bollinger Band.

How was today's newsletter? |